Here is my open letter to broadcasters Paolo Bediones and Cherry Mercado

Dear Paolo Bediones and Cherry Mercado,

Last night, I overheard your supposed cerebral discussion about the US debt downgrade crisis on your radio program while on the way home, on a cab with my family.

I would like to make significant corrections on the litany of false information that had been disseminated on air.

First you claim that after with America’s downgrade, only New Zealand is left with AAA ratings.

This in patently incorrect as shown by the chart from the New York Times

There are 13 countries still with AAA ratings.

Next, you alleged that the Philippine economy mostly depends on the remittances. This is again far from truth. (The downgrade of which you deduce would hurt the OFWs.)

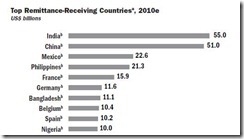

While the Philippines ranks 4th among the largest remittance recipients in the world (US $21 billion in 2010)…

…the share of remittances to our economy is only 12% (see below). This means there are 88% more of non-OFW sectors to consider. Mathematically speaking, 88 should be greater than 12, or am I missing something?

Charts from World Bank’s Migration and Remittance Factbook 2011

True, the multiplier for remittance contribution could mean a lot more share of the economic pie, but this is certainly far from the exaggerated claim that the Philippines entirely or mostly depend on remittances.

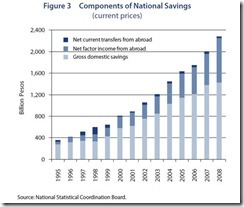

The above chart from ADB shows that while the growth of net factor income from abroad (NFIA) has indeed been substantial, remittances has only been part of this. NFIA also includes contributions from exports and investment inflows. Importantly, gross domestic savings still accounts for the largest share.

So you seem to be pandering to the OFW voting class/audience by overestimating their contributions and underestimating the role of the local economy.

You further moralize on the problem of the 'debt crisis' to Americans as one of having spent too much on things which they didn’t “need”, in as much as they ate in “excess”.

Again both of you seem to be missing out the root of the problem.

Today’s US debt crisis has been mostly about skyrocketing US government spending emanating from promises to her citizenry from which the US government won't be able to finance (chart from Wall Street Journal)

(chart from Heritage Foundation)

If you think that McMansions and SUV’s are “not” needed by Americans, then that would represent fait accompli thinking.

And yet how do you determine what is needed and what is not? And similarly by what measure would you know what or which levels signify as “enough” for each person? If I value beer most and you value coffee most, should my preferences be forced to conform to you or should I sacrifice my beer for your coffee? On what grounds-because most of the people will agree with you?

You see, the fundamental problem has mainly been about the addiction to acquire debt (not only by the American public but MOSTLY by the government).

Moreover while I applaud you for saying that Filipinos should stay clear from incurring debt, I reject your prescription that 'safety nets' should be provided for by the Philippine government to the OFWs in the face of this crisis.

Such safety nets has exactly been the (borrow and spend) formula which has caused the downgrade of the US

Proof?

This is the press release from the Credit rating agency S & P, whom downgraded the US, (bold highlights mine)

The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics.

More broadly, the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges to a degree more than we envisioned when we assigned a negative outlook to the rating on April 18, 2011.

Since then, we have changed our view of the difficulties in bridging the gulf between the political parties over fiscal policy, which makes us pessimistic about the capacity of Congress and the Administration to be able to leverage their agreement this week into a broader fiscal consolidation plan that stabilizes the government’s debt dynamics any time soon.

None in the above says that this has about excess consumption of food and the needless expenditures on material personal needs. Instead, the above shows that this crisis has been representative of the overdependence on government.

Finally, both of you only see the negative side of the downgrade. The bright side is that these events could mean more investment funds for countries willing to embrace investors.

As a saying goes, money flows to where it is treated best. If the US government can’t treat their resident investors adequately, then the Philippines can offer them an alternative venue.

This will happen only if we make the right policy reforms of embracing greater economic freedom.

Ideas have consequences, especially the bad ones. Spreading half-truths could mislead people into doing something that they shouldn’t have politically.

I hope to see public personalities engage in responsible expositions of our society’s problems than just utter rubbish and unfounded statements, especially directed to gullible audiences who mostly don’t understand the situation and who would easily fall prey to demagoguery which they may assimilate as “truth”.

In short, I hope that that both of you practice responsible journalism.

Hope this helps,

Benson

No comments:

Post a Comment