Mercantilist policymaking in South Korea may be exhibiting some signs of fissures.

Michael Han at Matthews Asia writes,

South Korea has long been an export-oriented economy; more than half its economy is still dependent on export-heavy industries such as shipbuilding, automotives and information technology. The government’s supportive political sentiment toward exports is understandable since these industries have been South Korea’s “bread and butter” ever since it began its transformation in the 1960s from one of Asia’s poorest countries. But Korea now needs to take a deeper look domestically, particularly in terms of its social welfare system.

Recently, the government’s ruling party members, including its president, have lost major elections and seen their approval ratings plummet to all-time lows as issues surrounding currency movements, inflation and overall monetary policy have plagued the country. Many domestic consumer companies and consumers feel policies primarily benefit exporters at their expense. And while the general sentiment, “What is good for Korea’s major global corporations is also good for the country,” was once widely held, that mentality is shifting.

If true, then reality must be sinking into the public’s outlook.

Over the years, Korea’s exports have reached 50% of the GDP, but at what price? (chart from Google Public Data explorer)

Foreign currency reserve of South Korea has been exploding.(chart from Bloomberg)

The acquisition of US dollars by the Bank of Korea, by printing and issuing won, have been reflected on inflation rates (chart from tradingeconomics.com).

Each policy that politically promotes certain industries always comes at the expense of another. The imbalances of which, especially in manipulating or suppressing currencies for export promotion, will eventually get ventilated on the economy via inflation.

And such imbalances has supposedly begun to permeate into the political realm.

The won has been higher since 2009, but would be a lot higher if not for repeated interventions.

The other proposed solution of welfare spending will simply add to the predicament as resources will be transferred from productive to non-productive uses (politicos and welfare parasites).

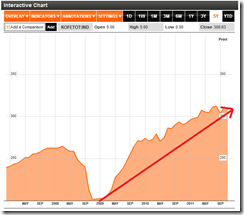

Nevertheless, the Korea’s Kospi has been showing similar trend manifestations or seeming tight correlations as with all of the above (won, inflation rate, foreign currency reserves and even mortgage growth-as shown below).

While there maybe some signs of a seminal property bubble brewing, the Korean cycle has yet to culminate. So far annual change has not risen to alarming levels (charts from global property guide)

Bottom line: Interventionists policies end up spawning bubble or boom bust cycles which eventually percolates into the political sphere. And South Korea has not been exempted from such process.

No comments:

Post a Comment