A principle, then, is the essence of reality. To try to create our own reality is both futile and destructive. You certainly have the right to go on believing whatever you want to believe, but reality doesn’t care about your wants or beliefs. –Robert Ringer

In this issue:

Phisix: Weakening Asian Currencies to Weigh on Region’s Risk Assets

-As Asian Currencies Tumble; Asian Equities Diverge from Risk ON

-Macau’s Casinos: Crashing Revenues Reinforces Bear Markets: PBoC’s Quasi QE

-The Firming US Dollar Pressures Oil Producing Nations

-Has ECB Draghi’s Magic Faded? Will Catalonia Dismember the EU?

-Storm Forming in South Korean Financial Assets?

-Will the Malaysian Ringgit Pop the Credit Bubble?

-Phisix: More Index Massaging; The Peso Should Weaken

Phisix: Weakening Asian Currencies to Weigh on Region’s Risk Assets

Last week, I propounded that the Bank of Japan’s shock and awe will imply for weak Asian currencies, where I asked[1]: Will Friday’s collapse of the yen percolate into ASEAN currencies overtime?

As Asian Currencies Tumble; Asian Equities Diverge from Risk ON

Interestingly, the market’s response seems to affirm my thesis sooner rather than later. Asian currencies crumbled in the wake of the firming US dollar across the region.

And as the Japanese yen took another week of shellacking to plunge by 2%, many Asian currencies took it to the chin, the South Korean won crashed 2.3%, the Malaysian ringgit dived 1.72%, the Indonesian rupiah plummeted .77%, Taiwan dollar tumbled .63% and the Thailand baht foundered by .57%. Even the Australian dollar collapsed 1.8% this week, now seemingly fast approaching the June 2010 lows. Meanwhile the Philippine peso lost only .33%.

Unlike Australian stocks which glossed over the cascading regional currencies where the S&P ASX 500 posted a modest .41% gains this week, Asian stocks have largely been shaky.

The pressure in Asian currencies seems to have been reflected on their respective equity markets (see orange rectangles): the Indonesian JCI fumbled 2.01%, the Malaysian KLCI floundered 1.67%, the South Korea’s KOSPI skidded 1.25%, Taiwan’s TWSE dropped .69%, Thailand’s SET fell .37 while the Philippine Phisix having earlier boosted by almost daily massaging of the index lost .14%.

So record US stocks and soaring Japanese equities have hardly been shared by most of Asia with the exception of New Zealand’s NZ50 and India’s Sensex both at record highs while Australia’s S&P ASX 500 just 1.9% off the record highs.

Despite intermittent rallies, Asian currencies should be expected to weaken further.

First of all, BoJ’s and the ECB’s recent quantitative easing programs are likely to attenuate their respective currencies over the interim. Given the substantial weighting by the euro (57.6%) and the Japanese yen (13.6%) alone, in the basket of the US dollar index (DXY), the euro and the yen combined at 71.2% share would signify as enough force to lift the US dollar index.

I failed to add last week that the Swedish central bank, the Riksbank, added to the atmosphere of central banks flooding the world with stimulus by pushing official interest rates to ZERO[2]. The Swedish Krone (SEK) was down by about 2% this week, the SEK constitutes 4.2% share of the US dollar index.

Why does it seem that the world is in a crisis with global central banks seemingly in a state of panic to flush the system with money?

Macau’s Casinos: Crashing Revenues Reinforces Bear Markets: PBoC’s Quasi QE

In the midst of October, I noted that crashes have become a real-time real dynamic. Well the above chart hasn’t been about a stock market crash, instead the above manifests of Macau’s gambling revenues which have been steeply falling since the highs of February 2014 (red arrow) and where in October, gambling revenues has virtually collapsed!!!

Let us hear it from mainstream news how Macau’s casino stocks responded to the news of the earnings collapse, from Marketwatch[3]: Gambling revenue in the Chinese territory fell 23% in October from the same month last year to 28 billion patacas ($3.51 billion), government data showed Tuesday. It was the worst monthly decline ever recorded, eclipsing a 17% year-over-year drop in January 2009. The sharp fall was no surprise. Analysts had expected revenue to fall by at least 20%, and industry executives have been blunt about the grim state of affairs. Still, stocks didn't react well to the news. Shares of Las Vegas Sands Corp. unit Sands China Ltd., trading higher before the data was released, fell into negative territory to close with a 3.3% loss. Galaxy Entertainment Group Ltd. slumped 2.8%, and Wynn Macau Ltd. fell 3.4% compared with the benchmark Hang Seng Index's 0.3% drop.

It’s not just the monthly earnings, but accumulated gross earnings have also been rapidly deteriorating.

While I have pointed out[4] in the past of the reasons to Macau’s casino dilemma—1) Chinese government crackdown on illegal fund transfers and potential restrictions on the mobility of Chinese gamblers 2) Overcapacity 3) Chinese government clampdown on corruption 4) Overvalued stocks. 5) Slowing Chinese economic growth—I believe that the next focal point will be credit risks from the earnings collapse.

The focus will swing to how these expansions have been financed. If they have been financed by debt then falling revenues in the wake of large debt burden will amplify the profit margin squeeze. Such would likely to raise their respective credit risks.

Stocks of Singapore’s Casino Genting (G.13 SI) have hardly improved since I wrote about the Macau contagion[6]. Meanwhile stocks of US gambling industry, as benchmarked by the Dow Jones Gambling Index, have been in consolidation and seem to have entirely missed the record run of her peers.

Meanwhile, Philippine equity markets have been euphoric about the outperformance of Macau’s domestic competitor for having to register a “massive” earnings “turnaround” during the 9 months this year[7].

Yet should the domestic banking system’s credit growth materially slow, which should reflect on G-R-O-W-T-H that should be compounded by the “massive” slowdown in demand for casinos in Asia, then the supposed massive earnings turnaround will most likely experience a volte face.

As one can see from Macau’s recent experience—40% growth can morph into a 23.2% crash in a flash or in just EIGHT months!

As I warned back in 2013 of the credit fueled supply side expansion of domestic casino industry[8]:

Aside from overcapacity, the writing on the wall for plunging Macau revenues has been the sharply slowing Chinese economy, despite what the Chinese government statistics suggests.

Car sales have also been notably weakening which has led to downgrades on sales forecasts by several auto manufacturers. From the Economist[9]: Several major auto manufacturers, including Honda and Nissan, are downgrading their Chinese sales growth forecasts for this year, while General Motors (GM) recently posted its slowest monthly pace of sales growth in China for over a year and a half…During 2014, growth rates have slowed again, however. During the first nine months of this year, China's total vehicle sales rose by just 7% year on year, with September's growth at just 2.5%. With the commercial vehicle market already in decline, passenger car sales were slightly stronger, with nine-month growth at 10.4%. But September's growth in car sales was just 6.4%, according to the China Association of Automobile Manufacturers (CAAM).

The deepening property slump in China has been spilling over to the broader economy.

Thus a significant economic slowdown in China would transmit into a meaningful downturn in external trade and investments given Asia’s deep economic and financial linkages with China[10].

Subsequently this implies that an Asian economic decline would hardly be favorable for Asian currencies.

It is interesting to note that China’s central bank the People’s bank of China (PBoC) has announced last week that they have embarked on selective easing measures by injecting 769.5 billion yuan (US $126 billion) to the banking system over the last two months: 500 billion yuan in September and 269.5 billion in October

Notes the Taipei Times[11]: The facility is the latest unconventional liquidity tool as the Chinese central bank joins the European Central Bank on a path of easing, even as the US begins the shift to a more normal monetary policy.

Again in the face of record stocks, why does it seem that the world is in a crisis with global central banks seemingly in a state of panic to inundate the system with money?

The Firming US Dollar Pressures Oil Producing Nations

The downturn in Chinese-emerging market growth story has likewise been manifested in the collapse of commodity prices.

Apparently we are witnessing what I have postulated as the periphery to the core dynamics where EM growth should impact developed market growth from which will develop a feedback loop, thereby both EM and DM having to drag each other until the world enters a recession.

As I wrote last February[12],

Even when the exposure would seem negligible, if the adverse impact of emerging markets to the US and developed economies won’t be offset by growth (exports, bank assets and corporate profits) in developed nations or in frontier nations, then there will be a drag on the growth of developed economies, which would hardly be inconsequential. Why? Because the feedback loop from the sizeable developed economies will magnify on the downside trajectory of emerging market growth which again will ricochet back to developed economies and so forth. Such feedback mechanism is the essence of periphery-to-core dynamics which shows how economic and financial pathologies, like biological contemporaries, operate at the margins or by stages.

The reason for this contagion dynamic has been based on the unraveling of similar bubble policies.

Well crashing stock markets appear to be back into limelight.

The soaring US dollar in the face of crashing oil prices has apparently incited Nigeria’s stock market to tailspin as the nation’s central bank reportedly[13] intervened frantically to cushion the currency, the naira, from a meltdown. The Nigerian Stock Exchange swiftly entered into a bear market following last week’s harrowing 11.03% crash (left window)!!!

The meltdown in Nigerian currency and stocks has reportedly diffused into Kenya, where both currency, the shilling, and equity markets (Nairobi-20) came under selling strain. The Nigerian naira has been under pressure concomitant to rallying US dollar index last July, whereas the Kenyan shilling has been on a decline from the start of the year. The strengthening US dollar appears to be gnawing at the foundations of the real economy.

It’s also interesting to observe of the fantastic volatility being encountered by stock markets of the major OPEC oil producers, the Gulf Cooperation Council (GCC).

Financial tremors in the DM violently shook the equity markets of Saudi Arabia, United Arab Emirates, Oman and Qatar in mid-October. But the ECB’s intervention sparked a rally to reduce the early stock market carnage.

With the ECB QE’s being two weeks old, it appears that the soothing effect may have faded, so RISK OFF seems to have reappeared in GCC stocks. Saudi’s Tadawul plunged 3.84% this week. Misery loves company, the UAEs DFM general sank 3.06% while Kuwait’s SE dropped 3.08%.

During the selloff I questioned[14] on the reported underpricing ‘predatory’ strategy adapted by the political leadership Saudi Arabia designed to gain market share or suppress competitors:

Saudi Arabia has lately stated that they will protect their oil market share. What if those affected oil welfare deficit governments resist? What if Russia or any of Saudi’s chief adversaries, say Iran, for instance finance rogue groups within Saudi to sabotage the latter’s pipelines?

Media reported last week that an oil pipeline in Saudi Arabia caught fire, where Saudi Aramco authorities denied of the involvement of terrorist. Curiously Saudi Authorities swooped down on militants based on “security raids across the Kingdom”[15]. Yesterday Saudi authorities nabbed 26. This has reportedly expanded to 33 as of this writing.

Has ECB Draghi’s Magic Faded? Will Catalonia Dismember the EU?

So Mr. Draghi publicly announced that “We will also soon start to purchase asset-backed securities. The programs will last for at least two years”[17]. Mr. Draghi also squashed rumors of a division among the ECB’s governing council stating that he has “secured unanimous support” for ECBs programs[18]. Mr. Draghi assurances fired up the markets.

But despite the verbal support, European stocks as indicated above eventually succumbed to a quasi-Risk OFF to close the week mostly in the red.

What makes this interesting is that ECB’s QE and verbal stimulus’ appears to be fading after only two weeks.

Has Draghi’s magic may been losing ground?

And to add to Mr. Draghi’s woes is that Catalonians, as of this writing, are voting to determine if they will secede from Spain. The independence referendum is being held outside the approval of the Spanish authorities[19].

Unlike the failed Scottish vote for independence where Scotland has mostly been a tax consumption economy[20], so in the fear of the loss of the welfare privileges, the elderly stampeded to cast a NO vote to independence[21], Catalonia has been the main contributor to the Spanish economy with nearly 19% of Spain’s GDP where her GDP per capita is higher than the European Union average (EU-27) according to the OECD[22].

In short Catalonians may be fighting to keep their share of production rather than satisfy Madrid’s political interests by redistributing the former’s resources to the latter’s welfare dependent supporters.

Thus should Catalonia’s independence become a reality, this will likely signify a big setback to the already struggling Spanish political economy.

I am not aware of the political agenda of the leaders of Catalonia, whether they will elect to join the EU and adapt the euro or join the EU and decide to have their own currency or operate independently from the EU.

So should the independence vote prevail, there will likely be huge political uncertainties that will dangle over the political economic domain of EU and of Mr. Draghi’s ECB.

Having said so, ECB’s magic will hardly work when political forces are becoming increasingly fragmented.

As one would note either from Africa-GCC to the Eurozone, there are not only substantial economic problems that has been surfacing, but political uncertainties and risks too.

The same political and economic uncertainties in the oil producing Emerging Markets and the EU will likely be transmitted to the world. And with greater prospects of uncertainty, King Dollar will likely attain temporary supremacy.

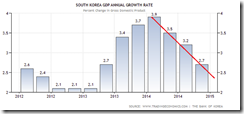

Storm Forming in South Korean Financial Assets?

With the global economy looking gloomier, Asian markets will become dependent on domestic developments. Unfortunately, external weakness will only magnify the vulnerabilities from Asia’s credit fueled economic growth model.

Take the meltdown in South Korea’s won.

The plight of the won began only in the first week of September. Based on Google Finance’s chart, the won has declined by a whopping 7.3% as of Friday’s close since early September.

Koreans have been heavily encumbered by debt. South Korea’s total debt to GDP based on 2011 has been at 314%. This is broken down 81% households, 107% non-financial corporations, 93% financial corporations and 33% government based on McKinsey Global Institute. As of Q4 2013 household debt has ballooned to 85.63% of GDP based on St. Louis Federal Reserve. Latest Bloomberg data shows household debt (excluding mortgage loans) at 501.3 won or a 4.3% increase from December 2013. Given the 3 quarter economic growth average at 3.53% this would imply household debt at now over 86% of GDP.

South Korea’s central bank, the Bank of Korea (BoK), cut interest rates twice in a span of three months this year. In July accompanied by the first interest rate cut, the South Korean government eased property rules in the face of record debt[23].

In apparent recognition of the risks from greater incidence of default, the South Korea government hopes to accommodate the very risky debt levels by easing property rules and by lowering debt to lower debt servicing burdens.

And when October’s global stock market convulsion occurred, this prompted the BoK for the second rate cut to 2%, the same record low rate when the BoK slashed rates as the global financial crisis unraveled in 2008. The second rate cut in the face of an asset turmoil simply exposes how South Korean authorities have become so sensitive to price changes of financial assets.

The actions of South Korean government reaffirm my theory of the politics of monetary easing policies: I recognize the problem of addiction but a withdrawal syndrome would even be more cataclysmic.

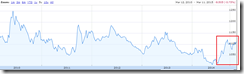

From the highs of late July, South Korea’s equity benchmark the KOSPI tumbled to lose 8.74% to the mid October lows, and since the Risk ON moment, the Korean benchmark has rallied by only 1.89% to reduce the October loss to a still 6.85%. This implies that should the next wave of downside volatility occur, Korean stocks may be headed for ‘lower lows’.

And since the BoK’s action has been ahead of the BoJ, this means that the South Korean government has not been after ‘export share’ of the global markets but about preventing an outburst of internal credit woes.

Unfortunately, the falling won exposes Korea’s externally based leverage. At an estimated $430.9 billion (2013) this would be about only 33% of the statistical GDP. But numbers can be deceiving. Any externally based debt problems may be transmitted internally through the chain links of debt especially today when South Korean finances looks highly fragile. One can simply read through the BoK’s action.

Additionally, the falling won should eventually extrapolate to higher inflation rates which may be reflected on higher rates. And won’s weakening last September appears to reflect on the two month reduction of South Korea’s record foreign exchange reserves.

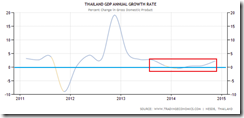

Will the Malaysian Ringgit Pop the Credit Bubble?

The same dynamic can be said of the pronounced weakness of Malaysian currency the ringgit.

Curiously as noted before, Malaysia’s stocks has been one of outlier for having to escape the May-June 2013 Taper Tantrum unscathed, but not so with the ringgit.

Meanwhile, the ringgit has lost 6.34% from the late August lows.

As a side note, I am no fan of debt to GDP ratio. Relying on such ratio can mislead. That’s because in the era of zero bound, statistical GDP has become dependent on debt. So in effect, the denominator (GDP), which depends on the numerator (numerator), may sterilize whatever risks there are from acquiring too much for as long as the cumulative debt produces G-R-O-W-T-H. Debt in statistics is seen in the quantitative aspect, but risks are qualitative.

Because households have been indulging in speculative buying of properties, the Malaysian government instituted curbs in November 2013[25]. I believe that Malaysia’s central bank, the Bank Negara Malaysia increased interest rates last July to compliment the property credit reins.

Recent reports suggest that Malaysia’s housing prices has begun to materially slow. There have also been reports of supply gluts which can be seen as half empty apartments. Aside from slowing sales, developers have been paring down sales forecasts[26].

So the once sizzling hot Malaysian housing has been cooling off. Since 2008, Malaysia’s housing prices has been rising at steadily until the Q3 2013. The slowdown in the housing market should eventually reflect on her statistical GDP. Additionally the decelerating sales and subsequently economic growth should extrapolate to higher credit risks especially for the marginal leveraged developers and households whose livelihoods have been dependent on Malaysia’s bubble industries.

With the housing downshift threatening ‘domestic demand’, the once hawkish BNM has seems to have gotten a cold feet by turning into a dove. The BNM reportedly dropped warnings of further rate hikes[27] (I expect the same reaction by the Philippine BSP)

Yet a sustained weakening of the ringgit is likely to expose on Malaysia’s external debt fragility which is likely to be transmitted to domestic financial system. I have no updated data now for the private sector exposure overseas. But even from Malaysian government external debt position, there has been a notable ballooning of liabilities.

In addition, entities like the 1Malaysia Development Berhad (1MDB) which is a hybrid of a sovereign wealth fund and a private investment vehicle has acquired leveraged from which their operations can hardly cover interest payments. And as I noted last June[28], the Malaysian government has been borrowing based on contingent liabilities and off balance sheet budget, like the (1MDB), in order to circumvent or skirt government imposed debt cap. In short, overleveraging by both the private and public sectors renders Malaysia vulnerable to both external and internal triggers that could implode the system.

Meanwhile Malaysia’s equity bellwether the KLCI has reached a peak last July. From the record highs the KLSE fell by 6.6% during the October turmoil. The latest risk ON has reduced KLSE’s losses to only 3.6% which means more than half of the losses has been erased. The KLCI has been the first to hit record highs. Will the KLCI lead the ASEAN majors?

It’s interesting to see the developing interplay between external developments and internal structural frailties.

Nonetheless internal or domestic fragilities renders Asia vulnerable to capital flight which may either trigger or aggravate on the unwinding of domestic bubbles.

Phisix: More Index Massaging; The Peso Should Weaken

Despite closing with week with losses, the Phisix and the Peso has so far outperformed her peers.

The strength of the Phisix continues to derive from what I call the massaging of the index.

I defined the working mechanism previously as[29]

Nonetheless, the common trait in the massaging the index, either via intraday “pump” or “marking the close” have been to massively push up prices of at least 3 issues with combined market cap weighting of 15-20%. In panic buying episodes, (September 24 and October 16), the kernel of these activities transpire after lunch break.

Well Monday November 3 proceeded exactly as defined: afternoon delight which climaxed with a marking the close with relatively low volume.

Wednesday’s November 7 marking the close came without momentum. The entire day saw the Phisix in the red, however by the close, 65% of the losses had been erased during the last minute. This is a shining example of index massaging via marking the close.

Thursday initially shared the same pattern with major afternoon delight push. Except that the scheme of stock market operators seems to have been frustrated by some parties who sold with volume. The Phisix still managed close higher but failed to achieve the 50 or 100 points target.

On Friday, Thursday’s end session selling momentum carried over. Stock market operators were largely silent during the day.

Thanks to the stock operators, the Phisix closed marginally lower for the week and thus outperformed the region.

The latest selloff was largely due to the disappointing performance by the biggest market cap: PLDT.

Reporting lower than expected earnings growth, PLDT got severely punished and was hammered 5.83% for the week.

The reaction has been understandable. Too much expectations have been built in to the company’s overvalued shares. As I recently wrote

The public has been buying into the promise for more “g-r-o-w-t-h”. Yet history suggests that PLDT’s EPS growth rate has been consistently within less than 5% rate (or less than statistical GDP). Over the past 3 years (2011-13), PLDTs EPS CAGR has been at 3.77%. If 2010 will be included, the 4 year CAGR drops to a negative (-9.83%)!

PLDT’s prices have become disconnected with reality.

Yet the punishment has hardly been a scratch on its scale of overvaluations.

Looking at the sectoral performance gives an idea that this has been a single issue drag on the index for the week. But this wouldn’t be right: advancing issues led declining issues in only 1 of the five trading days. In addition, declining issues dominated advancing issues in nominal term at 123 this week.

What the apparent discrepancy reveals is that while the broader market had been sold, stock operators had been pushing up select heavyweight issues, thus buoying the sectoral performance and cushioning the fall in the Phisix.

Additionally operators were also making sure that they momentum will be on their side in spite of the reappearance of sellers. How? By selectively pumping key heavyweights to ‘new’ highs.

As I noted last week[30],

I would guess that given BDO’s ‘breakout’ the strategy for the stock operators now may shift to focus on a one-by-one push for a breakout for major caps for them to succeed a crossover beyond the 7,400. This banks on no bad news that will impede their desperate actions.

Essentially by engineering breakouts of severely mispriced securities, they are hoping that by crafting charts, chart followers acting as greater fools will push the markets higher and buy from them.

I have been saying that the obverse side of every mania (and market manipulation) is a crash.

Historian Charles Kindleberger observed of the same thing in his classic Manias, Panics and Crashes[31]: (bold mine)

What matters to us is the revelation of the swindle, fraud, or defalcation. This makes known to the world that things have not been as they should have been, that it is time to stop and see how they truly are. The making known of malfeasance, whether by the arrest or surrender of the miscreant, or by one of those other forms of confession, flight or suicide, is important as a signal that the euphoria has been overdone. The stage of overtrading may well come to an end. The curtain rises on revulsion, and perhaps discredit.

Gains in foreign investments offset loss in foreign exchange. However it is the gold valuations that marked the difference. The BSP attributes this to “revaluation adjustments”. While gold fell 2.94% month on month, the BSP’s gold holdings was down 3.4%.

So the difference may have been about accounting numbers or perhaps the BSP may have liquidated some gold. Nonetheless, forex inflows (from remittances by OFWs, BPOs, dividends, loans) that didn’t make into “stocks” that should have increased forex reserve, means that the BSP may have used these to support the peso.

Since I expect that the peso should continue to weaken, the BSP will likely use expend more of their forex reserves to massage the peso level.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)