Those booming stock markets appear to be increasingly masking surfacing signs of troubles in ASEAN’s real economy

The Bank of Thailand (BoT) projects a mild recovery in her sluggish economy predicting a 1.5% growth this year and 4.8% next year banking on recently announced stimulus. The Thai government announced a 364 billion baht (US $11 billion stimulus last October.

The Thai economy has recently endured a significant downshift aggravated by the tumultuous politics which culminated with a coup last May.

2Q GDP of a marginal +.4 growth in GDP spared the Thai economy from a technical recession (chart from tradingeconomics.com)

Given the stagnant 1H, it would take about 3% growth for the 2H in order to meet the BoT’s 1.5% target this year. Yet the BoT admits that debt burdened consumers have been marginally improving.

From Bernama.com.my(bold added) Demand in the private sector play a greater role in driving the economy but low prices of farm products and high household debt are limiting consumption. In addition, slow government spending is limiting investment in the private sector, said Roong…However, spending on durable goods, especially automobiles, has not recovered due to high household debt and strict lending controls by financial institutions.

As a side note to the biased report, slow government spending isn't an obstacle to private sector investment. It is those immense debt levels spent on bubble projects that has impeded investments. Importantly all government spending are anchored on forcible transfers from the private sector money/resources which means growth in government spending stymies private sector investments. This is an economic concept called crowding out.

To add, exports have reportedly fallen too, from the same article: According to Roong, the value of Thai exports fell by 1.7 per cent in the third quarter although it rose in September by 2.2 per cent.

So banking on government spending to spike the economy to meet the 1.5% target is like promising the moon. Of course there is such a thing called statistical massaging for the Thai government to meet their targets.

But the optimistic growth by the Thai government seems faced with a major headwind: ballooning non performing loans (NPL)

From Nikkei Asia: (bold mine)

Loan growth at Thailand's four major banks slowed in the third quarter through September, reflecting the slow recovery in the country's business and consumer confidence since the political turmoil deepened in the country earlier this year. Nonperforming loans increased, on the other hand, as household debt continued to grow.According to the banks' recently released third quarter results, nonperforming loans rose at all four banks. The combined amount was 190 billion baht ($5.8 billion) as of the end of September, up more than 10% from the end of December 2013. High household debt level is one factor for the bad loans. The ratio of household debts to gross domestic product was 83.5% as of the end of June, a 4 percentage point increase on the year.

Despite the marked slowdown in the Thai economy, and the reported recent slowdown in bank lending, it is still surprising to see lofty levels in credit expansion in the private sector in 1H of 2014 (left), but money supply seems to have plateaued for the year.

The leveling of money supply in the face of sustained credit expansion gives a clue that part of the money being borrowed may be used to pay off existing liabilities: Debt IN Debt OUT. Such dynamics would seem as consistent with the NPL growth being experienced by major Thai banks as some entities may not have been able to sustain maintaining onerous debt levels. Debt payments and defaults destroys money.

As I pointed out last May, a material slowdown in the Thai economy will expose on her banking system’s huge debt problem.

And given the substantial debt exposure by the Thai economy, such stimulus won’t seem enough to shield her economy from any intensification of debt problems which has likewise been amplified by the deceleration of Thailand’s property bubble.

The Global Property Guide on Thailand’s housing prices: housing prices rose by 2.28% during the year to Q2 2014, down from 3.76% the previous year. Housing prices dropped by 0.25% q-o-q in Q2 2014.

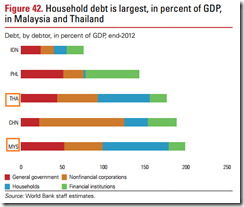

Aside from Thailand, the Malaysian economy seems faced with same predicament. Malaysia like Thailand has the highest household debt exposure among the ASEAN majors, chart from the World Bank.

Perhaps worried about a runaway property bubble Malaysia’s government has embarked policies to rein property prices, the effects have now become apparent

From Nikkei Asia (bold mine)

Uncertainty is growing about the future of Malaysia's housing market because of government measures to curb speculation and excessive competition in urban areas.In Kuala Lumpur, high-rise condominiums are being built everywhere, even though many new apartment blocks are half-empty. Malaysia's leading property developer, Gamuda, says the country's real estate market is losing steam. Another major developer, UEM Sunrise, has cut its 2014 sales target from 3.2 billion ringgit ($962 million) to 2 billion ringgit.A survey by the Real Estate and Housing Developers' Association Malaysia paints a grim picture. Between January and June this year, 10,189 new condos went on sale, up 9% from the July to December period last year. However, the ratio of purchases fell in the first half of 2014 by 4 percentage points to 49%.The survey found 35% of respondents are pessimistic about prospects for Malaysia's housing market for the second half of this year, while 46% are pessimistic about the first half of next year. Despite this, developers plan to sell 15,820 condos in the July to December period, a nearly 70% increase from the same period last year. Analysts see this as optimistic.Bank Negara Malaysia, the country's central bank, last July implemented a more stringent housing loan policy to cool the overheating real estate market. And the government will in April introduce a 6% consumption tax, which is expected to include property transactions. While it is hoped these measures will help prevent a property bubble, concern is growing they could also quickly dampen investors' enthusiasm for real estate.There is also the problem of a supply glut. High-rise condos continue popping up in big cities, but their prices are declining in some areas.

Aside from taxes and increased stringent lending guidelines, the Malaysian government has increased official interest rates last July by 25 basis points.

Nonetheless despite government actions, loans to the private sector continues to skyrocket even as money supply levels appears to be inflecting—signs of debt in debt out.

NPLs growth should eventually follow while the Malaysian economy should start to downshift. It’s when the slowdown has been magnified when bad debts become pronounced. And both economic slowdown and bad debts will function as a feedback mechanism.

At the end of the day, ASEAN has been revealing increasing signs of credit strains. As I pointed out at the start of the year, ASEAN is a candidate for a global black swan event. All it takes is for a trigger to expose on all the accrued unsustainable imbalances.

Don’t worry be happy, stocks will rise forever. As of the close of October 31, year to date gains of Thailand’s equity bellwether the SET has been at a phenomenal 21.98%! In today’s world the more the risks, the higher returns. Whereas Malaysia’s KLSE has been down –.63%.

No comments:

Post a Comment