“Markets can remain irrational longer than you can remain solvent.” – John Maynard KeynesThe last time we gave a good run down of Canada’s housing market was in May 2015, when we noted that The Economist gave it the dubious title of the most overvalued housing market in the world. Since then, in just 10 months, prices in Vancouver and Toronto have soared to marks that are 14.1% and 8.7% higher respectively.Frothy prices, million-dollar shacks, and buying frenzies have prompted world-class short-sellers to come out of the woodwork. For a speculator such as Marc Cohodes, who advises hedge funds on Wall Street that want to bet against the Canadian housing market, this type of classic bubble behavior is music to his ears.“The cross currents are beyond crazy in Vancouver — it’s a mix of money laundering, speculation, low interest rates,” says Cohodes, who was once profiled as Wall Street’s highest-profile short-seller by the New York Times. “A house is something you live in, but in Vancouver you guys are trading them like the penny stocks on Howe Street.”Mr. Cohodes has recently said that Canadian real estate has reached “peak insanity”, and it’s part of the reason that investors around the world are trying to find a way to bet against the market.Home Capital Group, one of Canada’s largest financial institutions, is now the most-shorted stock on Canadian exchanges. The same alternative mortgage lender recently also came under scrutiny for suspending 45 of its brokers for falsifying borrower income.DOMINOS FALLINGJust as falling oil prices helped to drag the Canadian dollar down, the “lower for longer” price environment for crude has had a similar effect on house prices in the Prairies. Homes in Fort McMurray, the epicenter of the Canadian oil sands, have crashed an average of $117,000 in just a year.Meanwhile, price tags in the once-strong housing market of Calgary have declined from their peak in October 2014 by -5.4%. The city, which is a financial center for Canadian energy, is bracing for a particular tough year ahead as well. Houses are spending more time on the market, and sales volume and prices continue to fall.But it’s not just Canada’s oilpatch that is starting to see the writing on the wall. Toronto, which has helped to buoy the rest of the country’s housing growth for years, has also started to cool down.According to the Teranet – National Bank House Price Index, prices have risen just 0.3% since October in Canada’s largest real estate market. With the prospect of rising interest rates in the future, it’s not expected to heat back up, either. In fact, TD Bank expects that Toronto will have a “moderate” decline in 2017.AND THEN THERE WAS ONE…For investors bullish on near-term gains in Canada’s housing sector, there is one last hope that resides on the West Coast.Vancouver’ housing market sailed again in February, shooting up a record 3.2% in just one month. This is the best month for the market since August 2006. It was so good, in fact, that it single-handedly propped up Canada’s national index for housing.Canada’s market as a whole saw gains of 0.6% in the month, but it would have dropped to a lacklustre -1.1% without the inclusion of Vancouver in the 11-city index.The only problem?The city, which has been a primary beneficiary of rampant foreign buying, is continually cited as the market most ripe for a deep correction, as it continues to defy all common sense.While Keynes is right in that markets can remain irrational for longer than one can stay solvent, it seems that Canadian housing has turned a corner: regional markets in other parts of the country have stumbled, and the last remaining pillar is Vancouver.It may continue to buck the trend for now, but it is a wobbly pillar at best.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, March 19, 2016

Infographics: Canada's Hissing Housing Bubble

Thursday, March 27, 2014

More Signs of Canadian Debt Bubble (in Pictures)

Friday, December 13, 2013

Bubbles Everywhere: The Canadian Bubble Redux

-Price level: The IMF highlighted recently that Canada tops the list of the most expensive homes in the world, based on the house-to-rent ratio.-Broad Based: Real home prices have surged in every major Canadian city since 2000, not just in Toronto and Vancouver.-Over-Investment: Residential investment has risen to 7% of GDP, above the peak in the U.S. and far outpacing population growth.-High Debt: Household debt now stands at nearly 100% of GDP, on par with the U.S. at the peak of its housing boom. The increase in household debt as a percent of GDP since 2006 has been faster in Canada than anywhere else in the world, according to the World Bank.-Excessive Consumption: The readiness of Canadian households to take on new debt by using their homes as collateral has fueled the consumption binge. Outstanding balances on home equity lines of credit amount to about 13% of GDP, eclipsing the U.S. where it peaked at 8% of GDP at the height of the bubble.The IMF and the BoC have argued that the air can be let out of the market slowly. But, as the old cliché goes, bubbles seldom end with a whimper. What could spoil the party? Higher interest rates are a logical candidate for ending the housing boom.

Saturday, February 18, 2012

Canada’s Housing Bubble

Central bank policies have been serially blowing bubbles everywhere.

From the Bloomberg’s chart of the day,

Canada may be on the cusp of a “severe” housing correction as real estate investment surges above a tipping point relative to economic output, according to George Athanassakos, professor of finance at the Richard Ivey School of Business.

The CHART OF THE DAY shows Canada’s housing investment as a percentage of gross domestic product, and the declines in inflation-adjusted house prices that follow when this ratio tops 7 percent.

“Eventually, everything boils down to demand and supply,” Athanassakos said in a telephone interview from Western University in London, Ontario. “Whenever this ratio goes over 7 percent, it signifies overinvestment in housing and two or three years later, we have a severe correction.”

Canada’s housing market is booming as historically-low interest rates fuel purchases, driving uphome prices and adding to record household debt. Canada’s ratio of housing investment to GDP has averaged 5.8 percent over the last 50 years and is currently at about 7 percent, based on Statistics Canada figures as of the third quarter of 2011, Athanassakos said. Housing investment includes spending on new homes, renovations and real estate transaction fees.

More from the Economist,

Speculators are pouring into the property markets in Toronto and Vancouver. “We have foreign investors who are purchasing two, three, four, five properties,” says Michael Thompson, who heads Toronto’s economic-development committee. Last month a modest Toronto home put on the market for C$380,000 ($381,500) sold for C$570,000, following a bidding war among 31 prospective buyers. According to Demographia, a consultancy, Vancouver’s ratio of home prices to incomes is the highest in the English-speaking world.

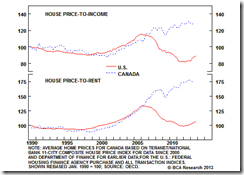

Bankers are becoming alarmed. Mark Carney, the governor of the central bank, has been warning for years that Canadians are consuming beyond their means. The bosses of banks with big mortgage businesses, including CIBC, Royal Bank of Canada and the Bank of Montreal, have all said the housing market is at or near its peak. Canada’s ratio of household debt to disposable income has risen by 40% in the past decade, recently surpassing America’s (see chart). And its ratio of house prices to income is now 30% above its historical average—less than, say, Ireland’s excesses (which reached 70%), but high enough to expect a drop. A recent report from Bank of America said Canada was “showing many of the signs of a classic bubble”.

Like China, Canada’s central bank is in a crossroad; tighten monetary environment which translates to a bust (recession/crisis), or attempt to fine tune the boom bust cycle which only delays the day of reckoning but aggravates the situation.

I am reminded by the admonitions of the preeminent Professor Murray N. Rothbard,

Like the repeated doping of a horse, the boom is kept on its way and ahead of its inevitable comeuppance, by repeated doses of the stimulant of bank credit. It is only when bank credit expansion must finally stop, either because the banks are getting into a shaky condition or because the public begins to balk at the continuing inflation, that retribution finally catches up with the boom. As soon as credit expansion stops, then the piper must be paid, and the inevitable readjustments liquidate the unsound over-investments of the boom, with the reassertion of a greater proportionate emphasis on consumers' goods production.

Central banks are caught in a bind, regulations have been failing to stop boom bust cycles, which they deny have been a product of their constant manipulation of interest rates.