I have written about the Canadian bubble in 2012

The independent Canadian research outfit the BCA Research claims that the “weight of evidence is clear” on Canada’s bubbles

The BCA notes (bold mine)

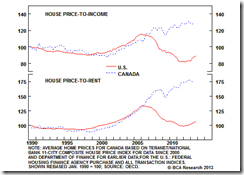

-Price level: The IMF highlighted recently that Canada tops the list of the most expensive homes in the world, based on the house-to-rent ratio.-Broad Based: Real home prices have surged in every major Canadian city since 2000, not just in Toronto and Vancouver.-Over-Investment: Residential investment has risen to 7% of GDP, above the peak in the U.S. and far outpacing population growth.-High Debt: Household debt now stands at nearly 100% of GDP, on par with the U.S. at the peak of its housing boom. The increase in household debt as a percent of GDP since 2006 has been faster in Canada than anywhere else in the world, according to the World Bank.-Excessive Consumption: The readiness of Canadian households to take on new debt by using their homes as collateral has fueled the consumption binge. Outstanding balances on home equity lines of credit amount to about 13% of GDP, eclipsing the U.S. where it peaked at 8% of GDP at the height of the bubble.The IMF and the BoC have argued that the air can be let out of the market slowly. But, as the old cliché goes, bubbles seldom end with a whimper. What could spoil the party? Higher interest rates are a logical candidate for ending the housing boom.

Let me add…

Since Canada’s central bank, the Bank of Canada stepped on the interest rate pedal headed towards zero bound, loans to the private sector exploded. The spike in loans has been reflected on money supply growth over the same period (see red rectangles).

It’s not just about zero bound.

As of January 2013, the Zero Hedge observed that the Bank of Canada has been deploying a stealth ‘QE’ since the second semester of 2011 by vastly expanding her balance sheet with escalating acquisitions of domestic government bonds

The credit bubble from BoC’s zero bound policies complimented by stealth QE has prompted wild yield chasing activities in the property sector. Canada’s housing index has zoomed since 2009

And this has not been limited to the property sector, Canadian stocks as measured by the S&P/TSX composite has also revealed partial signs of a bubble.

Following the correction after the huge rebound from the 2009, the the renewed uptrend in Canadian equity benchmark since late 2011 appears to have mirrored the BoC’s balance sheet expansion but at a more diminished scale.

Finally over the same period where the BoC adapted zero bound rates, Canada’s once positive balance of trade has turned negative. This implies that the once conservative producers have become spendthrifts or that Canadians have likewise indulged in rampant consumerism.

This bubble spending spree has been reflected on the weakening of her currency, the Canadian dollar against the US dollar since September 2012

The BCA asks “What could spoil the party?” Aside from bubbles collapsing from its own weight, I agree, higher interest rates could serve as the proverbial pin.

Yields of Canada’s 10 year bonds seem on the rise anew since the reprieve from the third quarter uptrend.

Should the global bond vigilantes continue to hassle or put pressure on Canada’s growing systemic leverage I would also agree with the BCA where they say “as cliché goes, bubbles seldom end with a whimper”.

No comments:

Post a Comment