The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, March 27, 2014

More Signs of Canadian Debt Bubble (in Pictures)

Friday, December 13, 2013

Bubbles Everywhere: The Canadian Bubble Redux

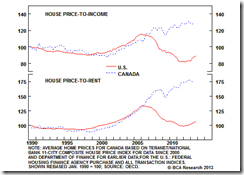

-Price level: The IMF highlighted recently that Canada tops the list of the most expensive homes in the world, based on the house-to-rent ratio.-Broad Based: Real home prices have surged in every major Canadian city since 2000, not just in Toronto and Vancouver.-Over-Investment: Residential investment has risen to 7% of GDP, above the peak in the U.S. and far outpacing population growth.-High Debt: Household debt now stands at nearly 100% of GDP, on par with the U.S. at the peak of its housing boom. The increase in household debt as a percent of GDP since 2006 has been faster in Canada than anywhere else in the world, according to the World Bank.-Excessive Consumption: The readiness of Canadian households to take on new debt by using their homes as collateral has fueled the consumption binge. Outstanding balances on home equity lines of credit amount to about 13% of GDP, eclipsing the U.S. where it peaked at 8% of GDP at the height of the bubble.The IMF and the BoC have argued that the air can be let out of the market slowly. But, as the old cliché goes, bubbles seldom end with a whimper. What could spoil the party? Higher interest rates are a logical candidate for ending the housing boom.

Friday, July 20, 2012

Canadians Have Overtaken Americans in Wealth

From the USNews.com

For the first time in recent history, the average Canadian is richer than the average American, according to a report cited in Toronto's Globe and Mail.

And not just by a little. Currently, the average Canadian household is more than $40,000 richer than the average American household. The net worth of the average Canadian household in 2011 was $363,202, compared to around $320,000 for Americans.

If you're thinking the Canadian advantage must be due to exchange rates, think again. The Canadian dollar has actually caught up to the U.S. dollar in recent years.

"These are not 60-cent dollars, but Canadian dollars more or less at par with the U.S. greenback," Globe and Mail's Michael Adams writes.

To add insult to injury, not only are Canadians comparatively better-off than Americans, they're also more likely to be employed. The unemployment rate is 7.2 percent—and dropping—in Canada, while the U.S. is stuck with a stubbornly high rate of 8.2 percent.

Besides a strengthening currency and a better labor market, experts credit the particularly savage fallout from the financial crisis on the U.S. economy and housing market, which torpedoed home values and gutted household wealth. According to the report, real estate held by Canadians is worth more than $140,000 more on average and they have almost four times as much equity in their real estate investments.

In contrast to most of mainstream reporting, Canada’s strong currency has been imputed as manifestation of a relatively “superior” performing economy than the US.

Of course commodity exports have been partly responsible for the this but has barely been an indication of the resource course: the Dutch Disease.

Canada’s strength, according to the report, has been founded on two aspects: one relatively “better” labor market, and two, America’s boom bust cycles which has “torpedoed home values and gutted household wealth”.

While there are many other factors to consider for comparison, I would focus on three;

One, Canadian banks has outperformed the US. Like in the great depression, the US financial crisis of 2008 barely dinted on Canada’s banking system.

Two, Canada tops the US in Economic Freedom…

Canada ranks 6th in the Heritage Foundation’s world’s country ranking of economic freedom index compared to the US…

The economic freedom in the US has been in a steady descent.

Finally, Canada’s government has been relatively fiscal prudent than her neighbor.

As Cato’s Chris Edwards writes

The spending reforms of the 1990s allowed the Canadian federal government to balance its budget every year between 1998 and 2008. The government's debt plunged from 68 percent of GDP in 1995 to just 34 percent today. In the United States federal debt held by the public fell during the 1990s, reaching a low of 33 percent of GDP in 2001, but debt has soared since then to reach more than 70 percent today.

Bottom line: Economic freedom and fiscal prudence are once again depicted as key to economic prosperity.

Saturday, February 18, 2012

Canada’s Housing Bubble

Central bank policies have been serially blowing bubbles everywhere.

From the Bloomberg’s chart of the day,

Canada may be on the cusp of a “severe” housing correction as real estate investment surges above a tipping point relative to economic output, according to George Athanassakos, professor of finance at the Richard Ivey School of Business.

The CHART OF THE DAY shows Canada’s housing investment as a percentage of gross domestic product, and the declines in inflation-adjusted house prices that follow when this ratio tops 7 percent.

“Eventually, everything boils down to demand and supply,” Athanassakos said in a telephone interview from Western University in London, Ontario. “Whenever this ratio goes over 7 percent, it signifies overinvestment in housing and two or three years later, we have a severe correction.”

Canada’s housing market is booming as historically-low interest rates fuel purchases, driving uphome prices and adding to record household debt. Canada’s ratio of housing investment to GDP has averaged 5.8 percent over the last 50 years and is currently at about 7 percent, based on Statistics Canada figures as of the third quarter of 2011, Athanassakos said. Housing investment includes spending on new homes, renovations and real estate transaction fees.

More from the Economist,

Speculators are pouring into the property markets in Toronto and Vancouver. “We have foreign investors who are purchasing two, three, four, five properties,” says Michael Thompson, who heads Toronto’s economic-development committee. Last month a modest Toronto home put on the market for C$380,000 ($381,500) sold for C$570,000, following a bidding war among 31 prospective buyers. According to Demographia, a consultancy, Vancouver’s ratio of home prices to incomes is the highest in the English-speaking world.

Bankers are becoming alarmed. Mark Carney, the governor of the central bank, has been warning for years that Canadians are consuming beyond their means. The bosses of banks with big mortgage businesses, including CIBC, Royal Bank of Canada and the Bank of Montreal, have all said the housing market is at or near its peak. Canada’s ratio of household debt to disposable income has risen by 40% in the past decade, recently surpassing America’s (see chart). And its ratio of house prices to income is now 30% above its historical average—less than, say, Ireland’s excesses (which reached 70%), but high enough to expect a drop. A recent report from Bank of America said Canada was “showing many of the signs of a classic bubble”.

Like China, Canada’s central bank is in a crossroad; tighten monetary environment which translates to a bust (recession/crisis), or attempt to fine tune the boom bust cycle which only delays the day of reckoning but aggravates the situation.

I am reminded by the admonitions of the preeminent Professor Murray N. Rothbard,

Like the repeated doping of a horse, the boom is kept on its way and ahead of its inevitable comeuppance, by repeated doses of the stimulant of bank credit. It is only when bank credit expansion must finally stop, either because the banks are getting into a shaky condition or because the public begins to balk at the continuing inflation, that retribution finally catches up with the boom. As soon as credit expansion stops, then the piper must be paid, and the inevitable readjustments liquidate the unsound over-investments of the boom, with the reassertion of a greater proportionate emphasis on consumers' goods production.

Central banks are caught in a bind, regulations have been failing to stop boom bust cycles, which they deny have been a product of their constant manipulation of interest rates.