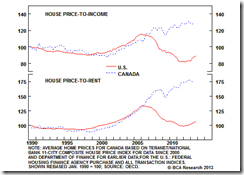

-Price level: The IMF highlighted recently that Canada tops the list of the most expensive homes in the world, based on the house-to-rent ratio.-Broad Based: Real home prices have surged in every major Canadian city since 2000, not just in Toronto and Vancouver.-Over-Investment: Residential investment has risen to 7% of GDP, above the peak in the U.S. and far outpacing population growth.-High Debt: Household debt now stands at nearly 100% of GDP, on par with the U.S. at the peak of its housing boom. The increase in household debt as a percent of GDP since 2006 has been faster in Canada than anywhere else in the world, according to the World Bank.-Excessive Consumption: The readiness of Canadian households to take on new debt by using their homes as collateral has fueled the consumption binge. Outstanding balances on home equity lines of credit amount to about 13% of GDP, eclipsing the U.S. where it peaked at 8% of GDP at the height of the bubble.The IMF and the BoC have argued that the air can be let out of the market slowly. But, as the old cliché goes, bubbles seldom end with a whimper. What could spoil the party? Higher interest rates are a logical candidate for ending the housing boom.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, December 13, 2013

Bubbles Everywhere: The Canadian Bubble Redux

Friday, November 30, 2012

Inflation’s Toll: Canada Goes ‘Penniless’

The federal budget is guaranteed to leave Canadians penniless — literally.Among the victims of cutbacks outlined by Finance Minister Jim Flaherty in the government's 2012 federal budget on Thursday is Canada's one-cent coin.Citing low purchasing power and rising production costs, the government has decided to phase the penny out of existence starting this fall, when the Royal Canadian Mint will stop distributing the one-cent coin to financial institutions.Over time, that will lead to the penny effectively becoming extinct, although the government noted on Thursday that one-cent coins will always be accepted in cash transactions for as long as people still hold on to them.The value of the penny has decreased to about 1/20th of its original purchasing power. Indeed, the lowly penny has fallen so far that Ottawa described it as a "burden to the economy" in a pamphlet explaining the change on Thursday.In part because of rising prices for the metals it's made of, it actually costs 1.6 cents to produce every penny. The government estimates it loses $11 million a year producing and distributing the penny, and that doesn't include the costs and frustrations for businesses and consumers that use them in transactions.

Wednesday, November 30, 2011

Canada Deepens Free Market Policies

It’s time to be bullish Canada. Here is why.

From Reuters (hat tip Mark Perry)

Canadian Finance Minister Jim Flaherty said on Sunday the government would eliminate tariffs on dozens more products used by Canadian manufacturers, aiming to lower their costs and encourage more hiring.

The initiative would scrap custom duties on 70 items used by businesses in sectors such as food processing, furniture and transportation equipment.

Flaherty, who estimated the tariff cuts would save Canadian businesses C$32 million ($30.5 million) a year, said the cuts were part of the Conservative government's overall free trade policy.

"We believe in free trade in Canada," Flaherty said on CTV's "Question Period" program. "Some of these old-fashioned tariffs get in the way. So we're getting rid of them."

As part of its Economic Action Plan to pull Canada through the global slowdown of 2008-09, the government has eliminated more than 1,800 tariff items, providing about C$435 million a year in tariff relief. Its stated goal is to make Canada a tariff-free zone for manufacturers by 2015.

The tariff move comes as Canada and the European Union negotiate a deal to knock down trade barriers on goods and services and boost two-way trade by 20 percent.

Cheers Mr. Flaherty!

Again, free markets seem to be gaining political headway at the margins.

Tuesday, May 03, 2011

Canada’s Politics: It’s Hayek Over Keynes As Harper Conservatives Win Majority

As I earlier noted, Keynesians have been on a losing streak.

Now we seem to be seeing this phenomenon percolate even in the realm of politics, a traditional Keynesian bastion.

This from Bloomberg, (bold highlights mine)

Canadian Prime Minister Stephen Harper won a majority of seats in Parliament for the first time, giving him a mandate to fund corporate and personal income tax cuts with curbs on spending.

Harper’s Conservatives were ahead or leading in 166 districts, according to preliminary results from Elections Canada. Jack Layton’s New Democratic Party was leading in 103 seats and will form the official opposition for the first time, followed by 34 for the Liberal Party led by Michael Ignatieff. The separatist Bloc Quebecois led in four seats with the Green Party ahead in one. The Conservatives held 143 seats in the 308- seat legislature before the vote was called in March.

The victory in the national election yesterday ends seven years of minority governments that have fueled government spending, and may make it easier for Harper to open up industries to foreign investment. Throughout the campaign, Harper said he needed a majority to secure the country’s economic recovery.

Stephan Harper grew up on Hayekian ideals, as this report from Canadianbusiness.com shows...

The government’s sudden embrace of Keynesian economics — the theory that you can spend your way out of a recession — is pretty much the mirror image of everything Harper has fought for over the past two decades. He complained bitterly about big government, high taxes and profligate spending during his time at the Reform Party (1987–1997), NCC (1997–2001), as leader of the Opposition (2002–2006), and even as prime minister, since he was first elected on Feb. 6, 2006. During the latest election campaign, Harper routinely criticized the tax-and-spend policies of his opponents, and as recently as October, he declared matter-of-factly: “I know economists will say we could run a small deficit, but the problem is that once you cross that line, as we see in the United States, nothing stops deficits from getting larger and larger and spiralling out of control.”

Few of Harper’s friends or supporters believe he honestly thinks the massive stimulus spending outlined in his latest budget will rescue Canada’s slowing economy. The measures, they say, are merely an attempt to stave off a non-confidence vote, like the one that loomed after Finance Minister Jim Flaherty threatened to remove the multimillion-dollar subsidy opposition parties have come to depend on in his economic statement in November. “Stephen Harper didn’t suddenly wake up and become a Keynesian,” says Frank Atkins, an economics professor at the University of Calgary who once taught the prime minister. “This is nothing more than a political budget.”...

Returning to the University of Calgary to work on his master’s degree, Harper began reading the works of Austria’s Friedrich Hayek, the influential conservative economist. Hayek vehemently disagreed with the Keynesian notion that government spending could limit economic downturns, and instead warned that intervention in the marketplace would merely prolong suffering and create unintended, and harmful, consequences.

(hat tip Greg Ransom)