The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Showing posts with label graphic. Show all posts

Showing posts with label graphic. Show all posts

Thursday, March 24, 2016

Friday, March 04, 2016

Graphic of the Day: Voting: The Illusion of Free Choice

Friday, February 19, 2016

Headlines of the Day: Nikkei Asia Pushes Back on BoJ's Negative Interest Rates

Well, below seems a curiosity: headlines from one of mainstream media have been pushing back on BoJ policies!

From today's Nikkei Asia Review's Capital Markets

From yesterday's Nikkei Asia Review's Trends

Growing signs of fragmentation or fissures within the establishment?

Tuesday, February 16, 2016

Headlines of the Day: China's Substance Abuse: Credit Growth and Non Performing Loans Zoom to Records as External Trade Crashes!

This critical news has just been in, Chinese credit growth in January 2016 zoomed to a record high...

Read article from Bloomberg

The other day, curiously, economic data reported a shocking collapse in both exports and imports during the same month or in January 2016...

Read article from CNBC

And yesterday, media told us that China's Non Performing Loans (NPL) last December also rocketed to milestone highs

Read article from Bloomberg

So let me ponder on what these headlines seem to say.

Slowing economy means MORE non performing loans.

But to solve the problem of non performing loans brought about by a slowing economy means to gorge on MORE DEBT!

So I get it.

Solve the problem of substance addiction with more substance abuse! And hope that the problem of addiction will just go away!

Monday, February 15, 2016

Headlines of the Day: Hong Kong and Singapore's Hissing Property Bubbles

Saturday, January 16, 2016

Headline of the Day: US Stocks Post Worst 10 Day Start of the Year in History!!!

From Marketwatch

Yes indeed, this time is different!

Bonus headline

From Bloomberg

'2016 feels like the year of the Bear'. Yes indeed.

'Decoupling' anyone?

Labels:

bear market,

global stock markets,

graphic,

US stock markets

Thursday, January 07, 2016

Graphics: 67 Countries which the US Government is Obliged to go to War for

The policeman of the world has defense treaties with 67 countries, which means US government is obliged to go to war to defend them during conflicts.

Writes the Mental Floss (hat tip Lew Rockwell )

The United States has entered a lot of treaties over the years, especially after the complicated network put in place after World War II. The Myth of Entangling Alliances by Michael Beckley sought to figure out a hard number for just how many countries the United States has agreed to defend in war. Thanks to NATO, ANZUS, OAS, and bilateral agreements, the U.S. has promised 67 countries protection. Here's a look at the list included in Beckley's paper:

Some insights from the above. First, there is a big probability for the US to be drawn into (needless) wars. Second, the US government military have been spread too thin. Third, this represents great business for the military industrial complex. Fourth, this also represents expanded US political influence on nations with which the US has defense treaties. Fifth, expanded political influence also translates to monetary and economic influence (US dollar standard)

Labels:

bilateral treaties,

graphic,

imperialism,

NATO,

US foreign policy,

war politics

Friday, December 18, 2015

Graphic of the Day: What's Behind the Colors of Star Wars' Lightsabers

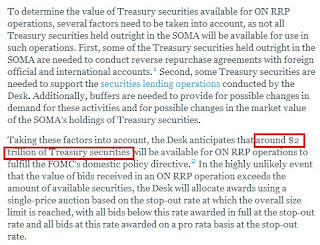

Headline of the Day: What Junk Bonds Derivatives Have Been Signaling, US Fed Siphons $105 billion as Part of Rate Hike

Two charts from the article

Read the Bloomberg article here

Last Sunday I wrote,

And another thing, the US Federal Open Market Committee (FOMC) will be holding its meeting next week (December 15-16), with markets heavily anticipating its first rate hike since June 2006.This comes even as financial markets have shown increased signs of anxieties anew.In the US, its more than just falling stocks but yields of junk bonds have been rocketing!

The other day, the US Federal Reserve spelled out how it would raise rates: (NY FED)

Last night NY Fed siphoned $105 billion

Bullish eh?

Tuesday, November 17, 2015

Headline of the Day: Introducing China’s Sunshine Industry...

Iconic economist John Maynard Keynes once wrote:

If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coalmines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course, by tendering for leases of the note-bearing territory), there need be no more unemployment and, with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is. It would, indeed, be more sensible to build houses and the like; but if there are political and practical difficulties in the way of this, the above would be better than nothing.

I guess the Chinese government found a modern application of this theory…

From en.people.cn:

Having been left unused for too long, the building could not be brought back into use so local government decided to demolish it.It is reported to be the highest building that has ever been demolished in China.

Since "build and they would come" didn't work, so might as well just build THEN demolish as a circular economic growth model. Neat!

Labels:

China Bubble,

china economy,

China politics,

graphic

Friday, October 23, 2015

Belated 'Back to the Future' Day! (October 21, 2015)

Remember the 1985 Scifi comedy movie series Back to the Future?

In one of the series, protagonists Marty McFly (Michael J Fox) tand Dr. Emmett "Doc" Brown (Christopher Lloyd) travel from 1985 to October 21, 2015 (two days ago)

Image from Daily Mail

Marty McFly: Where are we? When are we?Doc: We're descending toward Hill Valley, California, at 4:29 pm, on Wednesday, October 21st, 2015.Marty McFly: 2015? You mean we're in the future?Jennifer: Future? Marty, what do you mean? How can we be in the future?Marty McFly: Uh, Jennifer, um, I don't know how to tell you this, but I... you're in a time machine.Jennifer: And this is the year '2015'? Doc: October 21st, 2015.

Movie excerpt from the IMDB's Back to the Future II

USA Today Headline (Back to the Future Tweet)

Marty McFly and Doc on the Jimmy Kimmel show...

Trivia: 11 Technologies which Back to the Future got right (Business Insider)

Friday, October 16, 2015

Headline (and Tweet) of the Day: Weak Philippine peso NOT Equal to Remittances Growth (August Remittances Shrinks!)

For the mainstream: Shiver me Timbers!!!!

The above headline comes from the Business World.

The August numbers signifies a sequel from July's data (as reported by media and as initially blogged here and explained here last September).

The difference was July was a near zero growth. August was NEGATIVE!

And this seems like a virtual demolition of the mainstream agitprop which sold the weak peso as an elixir to remittances.

The following tweet from Channel News Asia's Haidi Lun

Revenues of both OFWs and BPOs are SOURCED externally. This means OFW remittances depend on the INCOME of foreign employers. BPOs revenues depend on the INCOME of foreign based principals. This likewise means that the economic, social and political CONDITIONS of the nations serving as HOST to foreign employers and foreign principals essentially determine indirectly the REVENUES of OFWs and BPOs.

Reality eventually prevails.

Labels:

graphic,

myths and fallacies,

OFW,

Philippine Peso,

political propaganda

Tuesday, October 06, 2015

Saturday, September 19, 2015

Headline of the Day: Unintended Consequence from US Federal Reserve's Unchanged Policy This September

The US Federal Reserve kept its policy its stance by citing "Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term."

Well, the above headline from Nikkei Asian Review's equity page looks like an unintended consequence from such an outlook.

Anyway, the above table (from stockcharts.com) exhibits the headline's subject.

Wednesday, September 09, 2015

Headline of the Day: Death of the World’s Biggest Stock Market Index Futures Market By Capital Controls

My previous admonition on the likely repercussions of the Chinese government’s massive intrusion on her stock market:

Since markets are about exchanges or buying and selling, if one of the main function is banned, or severely regulated or impaired through the arbitrary interferences by politicians, who determine and impose on the price levels, then markets do not exist at all. Liquidity will practically shrink, if not evaporate. People’s resources will get stuck into assets that have no exit mechanism. So Xi Jinping Put will mutate into a Frankenstein market.Capital controls not only inhibits movements or confiscates people’s properties, they reduce the economy’s access to capital.Yet if the ‘war against sellers’ fails, which will be manifested through sustained downfall of Chinese stocks, then the Chinese government may likely declare a stock market holiday.

Well the segment of evaporating liquidity has now hugged the headlines.

From Bloomberg: (bold mine)

Add the world’s biggest stock-index futures market to the list of casualties from China’s interventionist campaign to stop a $5 trillion equity rout.Volumes in the country’s CSI 300 Index and CSI 500 Index futures sank to record lows on Tuesday after falling 99 percent from their June highs. Ranked by the World Federation of Exchanges as the most active market for index futures as recently as July, liquidity in China has dried up as authorities raised margin requirements, tightened position limits and started a police probe into bearish wagers.While trading in Chinese equities has also slumped amid curbs on short sales and an investigation into computer-driven orders, the tumble in futures volumes may cause even greater damage because of their central role in the investment strategies of domestic hedge funds and other institutional money managers. A failure to revive the market would undercut the government’s own efforts to attract professional investors to local stock exchanges, where individuals still account for more than 80 percent of trades.“It is further evidence that the Chinese authorities are not yet ready to commit to freely trading markets,” said Tony Hann, a London-based money manager at Blackfriars Asset Management, which oversees about $350 million. “Fully functioning developed financial markets in China will take many years.”Popular ToolChinese policy makers, intent on ending a selloff that has eroded confidence in their management of the economy, are targeting the futures market because selling the contracts is one of the easiest ways for investors to make large wagers against stocks. It’s also a favored product for short-term speculators because the exchange allows participants to buy and sell the same contract in a single day. In the cash equities market, there’s a ban on same-day trading.Yet futures are also a popular tool among sophisticated investors with longer-term horizons. For hedge funds, they provide an easy way to adjust exposure to market swings. And large institutions use them to make cost-effective asset-allocation changes. As an example, selling index futures might be cheaper than unloading a large block of shares -- an order that could put downward pressure on prices.A sustained slump in liquidity may spur some institutional investors to “give up hedging in futures, unwind futures positions and reduce their stock positions,” said Dai Shenshen, a trader at SWS Futures Co. in Shanghai.China, which has been investigating evidence of “malicious” short selling since July, stepped up curbs on the futures markets on Monday. The China Financial Futures Exchange now labels a position of more than 10 contracts on a single index future as “abnormal trading.” While the bourse said the restriction won’t apply to futures used for hedging purposes, it didn’t detail how it will identify such trades. Before last month, investors could have as many as 600 contracts.The bourse also raised fees for settling positions opened on the same day to 0.23 percent from 0.0115 percent. Margin requirements on stock-index futures contracts were lifted to 40 percent from 30 percent. For those with hedging demand, the levels climbed to 20 percent from 10 percent. Exchange officials didn’t respond to e-mailed questions from Bloomberg News on Tuesday.Futures trading on the CSI 300 Index, a gauge of the nation’s biggest companies, shrank to just 34,085 contracts on Tuesday. That’s down from 3.2 million at the end of June and compares with the 30-day average of 1.7 million. For the CSI 500 Index of small-cap shares, futures volumes have dropped to 13,167 from about 144,000 a month ago.

A slomo death of the stock market it has been for China!

So the way for the Chinese government to the “stabilize” the market has been to disable sellers.

Sellers have been castrated to the extent that people can only sell based on the prices that is considered politically allowable.

Yet all these massive interventions, i.e. capital controls, restrictions, intimidation, harassment, which includes the arrests of politically incorrect media personalities and industry participants, humongous credit financed mandated frantic bidding up by state owned enterprises haven’t been as smooth sailing as desired for by the authorities.

China’s major equity bellwether the Shanghai Composite remains under severe pressure in spite of the raft of financial repression measures imposed. The SCOMP trades at the December 2014 to February 2015 levels as shown by the stockcharts.com

So throw “everything but the Kitchen sink” to manage the headlines!

Like the Philippine counterparts, the Chinese government has been obsessed with showbiz everything—economy, domestic politics, international relations or geopolitics, financial markets and more…

Touted reforms? Well the only reform that has become so evident has been of the deepening centralization or the reversal of market liberalizations to an anachronistic command and control economy instituted through political, economic, and financial market repression.

Yet while the Chinese government may succeed in pushing the stock markets up, the impairment of the foundations of stock markets, as already envisaged by liquidity drought, ensures that this would not be lasting.

Moreover, such would have grave adverse repercussions down the road.

Since everything is connected, ramifications will not be straightforward but will likely be manifested through various economic-financial pores: debt levels, interest rates, CPI, capital flows, currency or the property markets among many other possible rivulets.

The Chinese version of the tainted King Canute has yet to learn humility from their ‘fatal conceit’.

They have yet to understand that as the great Ludwig Mises warned (Human Action, p 552)…

The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. The boom comes to an end as soon as additional quantities of fiduciary media are no longer thrown upon the loan market. But it could not last forever even if inflation and credit expansion were to go on endlessly. It would then encounter the barriers which prevent the boundless expansion of circulation credit. It would lead to the crack-up boom and the breakdown of the whole monetary system.

So if all fails what’s next? The closure or a public holiday of the stock market?

Labels:

China Bubble,

China crisis,

graphic,

Shanghai composite

Thursday, September 03, 2015

Headline of the Day: Global Markets Cheer the Absence of China's Stock Markets

Thursday, March 26, 2015

Graphic of the Day: The Fundamental Difference between the Private Sector and the Government

Friday, June 27, 2014

Graphic of the Day: Inflation as seen by consumers and economists

This poll result by Robert Shiller is from the Federal Reserve of Atlanta.

What a striking difference between how ivory tower experts see the world vis-à-vis the general public or the consumers!

Yet incumbent policies represents the perspective of experts rather than the consumers. With such variance, it would be natural to see trouble ahead when consumers feel the pain from the miscalculations of experts.

Friday, June 20, 2014

Graphics of the Day: The 5 things they don't tell you about economics

Tuesday, June 10, 2014

Graphic of the Day: The Militarization of the US Local Police

From the New York Times: (bold mine)

During the Obama administration, according to Pentagon data, police departments have received tens of thousands of machine guns; nearly 200,000 ammunition magazines; thousands of pieces of camouflage and night-vision equipment; and hundreds of silencers, armored cars and aircraft.The equipment has been added to the armories of police departments that already look and act like military units. Police SWAT teams are now deployed tens of thousands of times each year, increasingly for routine jobs.Masked, heavily armed police officers in Louisiana raided a nightclub in 2006 as part of a liquor inspection. In Florida in 2010, officers in SWAT gear and with guns drawn carried out raids on barbershops that mostly led only to charges of “barbering without a license.”

(from Mark Perry)

Why are the local police massively arming?

Congress created the military-transfer program in the early 1990s, when violent crime plagued America’s cities and the police felt outgunned by drug gangs. Today, crime has fallen to its lowest levels in a generation, the wars have wound down, and despite current fears, the number of domestic terrorist attacks has declined sharply from the 1960s and 1970s.Police departments, though, are adding more firepower and military gear than ever. Some, especially in larger cities, have used federal grant money to buy armored cars and other tactical gear. And the free surplus program remains a favorite of many police chiefs who say they could otherwise not afford such equipment. Chief Wilkinson said he expects the police to use the new truck rarely, when the department’s SWAT team faces an armed standoff or serves a warrant on someone believed to be dangerous…Pentagon data suggest how the police are arming themselves for such worst-case scenarios. Since 2006, the police in six states have received magazines that carry 100 rounds of M-16 ammunition, allowing officers to fire continuously for three times longer than normal. Twenty-two states obtained equipment to detect buried land mines.

Worst case scenarios? Hmmm. If incidences of crime and terrorist attack has been falling, then what possible worst scenarios can there be?

Or could they be expecting an invasion from Martians ala Mars Attacks (1996) or from other aliens like the War of the Worlds (2005)?

Or has the US government merely embraced Paul Krugman's prescription to fix the economy through fiscal spending based on an imaginary "alien invasion"?

Or has local police authorities been preparing for war against the citizenry?

Or could all these be part of a gradualist scheme to impose a police state?

Don’t worry be happy, stock markets are at record highs!

Interesting…

Labels:

dictatorship,

graphic,

keynesian myths,

police state,

Road To Serfdom,

US politics

Subscribe to:

Comments (Atom)

/cdn0.vox-cdn.com/uploads/chorus_asset/file/3742634/lightsabers_rev.0.png)

.bmp)