The Wall Street Journal Wealth Blog writes,

To dig itself out of recession, Britain hiked its income-tax rate to 50% for those making £150,000 or more. Proponents said the tax was needed to bring fairness to an economy, in which the rich were getting richer and not contributing enough to the cause. Critics said the tax would chase out the job creators.

As it turned out, the real impact was in tax avoidance. According to the Chancellor of the Exchequer’s budget announced today, the income-tax hike caused “massive distortions” that cost the government.

A study found that £16 billion of income was deliberately shifted into the previous tax year. As a result, the tax raised only £1 billion – a third of the amount forecast.

This is another concrete example of a blowback of simplistic knee jerk policies embraced by the left.

In desperate attempts to raise revenues, the stereotyped recommendation by left leaning experts, which has often been adapted by politicians, has been to raise taxes.

They assume that people are like robots who will blindly comply with the regulations. They fail to understand that policies create incentives for people to act, particularly to circumvent on regulations whom they view as either undeserving or excessive.

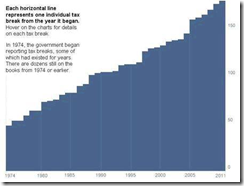

And higher taxes, observes Cato’s Dan Mitchell, lower incentives to earn and report income, and lower tax rates increase incentives to earn and report income.

That’s exactly what transpired in UK. The response of the rich from higher taxes had been to use tax avoidance measures to withhold from paying more taxes. Common sense.

Unfortunately common sense is uncommon to people blinded by political self-righteousness