The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, September 24, 2014

Humor: Working for the Goverment

Friday, October 04, 2013

Obamacare Adds 10,350 pages to Existing Regulations

When the government passes a law, it must be enforced. The executive branch of the government then makes up the actual enforcement rules. It interprets the law and translates it into actual regulations.The ObamaCare law was 2,000 pages long. That is just the beginning. Now the executive branch is building on its foundations.The specific interpretations are published in the Federal Register, which is published daily by the federal government. It publishes about 80,000 pages of regulations a year. Each page is three columns of rules that can be understood only by very specialized and very expensive lawyers in a particular field.CNS news sent a reporter to interview Democrat Congressman Henry Waxman. He asked Waxman if he had read all 10,535 pages. Waxman refused to answer. He said it was a propaganda question. He refused to answer.You owe it to yourself to see one page in the Federal Register. Few Americans ever have. Go here. You will see a highlighted link: Today’s Issue of the Federal Register. Click it. You will see articles. Click the PDF of any article. Then read just one column. You will not have to read all three to get the picture. Multiply this one column by 240,000. That is one year’s output.

Saturday, May 25, 2013

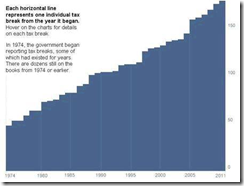

The Economist: Why Americans Love the IRS

WHEN Barack Obama fired the acting head of the Internal Revenue Service (IRS) earlier this month, he doubtless hoped to quell the hullabaloo about its seemingly partial treatment of applications for tax-exempt status from conservative groups. The IRS selected for extra scrutiny groups whose names included conservative buzzwords, such as “tea party”, “9/12” and “patriot”. Republicans accuse the taxmen of persecuting anti-tax groups. The IRS’s defenders insist that a few low-level functionaries simply made a clumsy attempt at an administrative short-cut. But the main reason why Americans dislike dealing with the IRS is not, however, the bureaucrats’ fault. Congress keeps making the tax code more complex. It is now 4m words long, and has been changed over 4,000 times since 2001. Americans spend 6.1 billion hours a year complying with it—enough work to keep over 3m people employed full-time without producing anything. Nearly 90% of filers pay for help with their returns. The cost of all this is equivalent to 15% of the tax raised says the Taxpayer Advocate, an ombudsman. Yet change may be a long time coming. Politicians usually balk at taking on the myriad vested interests which all ferociously defend their favourite tax breaks, says Bill Gale of the Brookings Institution, a think-tank. For that reason, he argues, “tax reform is always the bridesmaid and never the bride”

- It has thieving employees.

- It has incompetent employees.

- It has thuggish employees.

- It has brainless employees.

- It has protectionist employees.

- It has wasteful employees.

- And it has victimizing employees.

The power to tax is the power to destroy.

Friday, November 16, 2012

Are Taxes and Regulations as Primary Business Obstacles a Myth?

Many business leaders will tell you that taxes and regulation are the biggest barriers to starting up and enlarging small businesses. It’s true that some regulations and laws have inhibited the growth of small businesses; the Sarbanes–Oxley Act, for instance, had the unexpected consequence of discouraging some companies from making initial public offerings, a step typically followed by a burst of hiring. But taxes and government oversight are not the primary barriers to stimulating the growth of small businesses. In the latest recession, their owners pointed to a lack of market demand as the primary problem, as well as an inability to obtain financing

The conquest of opinion by Keynesian economics is due mainly to the fact that its argument conformed to the age-old belief of the businessman that his prosperity depended on consumer demand. This plausible but erroneous conclusion was derived from his individual experience in business, namely, that general prosperity could be maintained by keeping general demand high. Economic theory had been rejecting this conclusion for generations, but it was suddenly made respectable by Keynes. And since the 1930s it has been embraced as obvious good sense by a whole generation of economists brought up on the teaching of his school. Thus for a quarter of a century we have systematically employed all available methods of increasing money expenditure, which in the short run creates additional employment but at the same time leads to a misdirection of labor that must ultimately result in extensive unemployment

Thursday, November 08, 2012

Quote of the Day: Business Advise: Get Lawyers and Lobbyists

If you run a business, get a lot of lawyers and lobbysists. He who writes the regulations will make a lot of money. He who does not will lose. Make sure you make the right political contributions and don't say anything critical of those in power. You will need a discretionary waiver of something, and these rules are so huge and so vague, the regulators can do what they want with you. Don't be the one to get "crucified" (EPA). We live in the crony-capitalist system that Luigi Zingales describes so well. Live with it. Political freedom requires economic freedom, taught us Milton Friedman. You don't have the latter, don't expect the former.

Monday, October 22, 2012

How the US Government Spends Money

#1 While Barack Obama has been president, the U.S. government has spent about 11 dollars for every 7 dollars of revenue that it has actually brought in.#2 During the fiscal year that just ended, the U.S. government took in 2.449 trillion dollars but it spent 3.538 trillion dollars.#3 During fiscal year 2011, over a trillion dollars of government money was spent on 83 different welfare programs, and those numbers do not even include Social Security or Medicare.#4 Over the past four years, welfare spending has increased by 32 percent. In inflation-adjusted dollars, spending on those programs has risen by 378 percent over the past 30 years. At this point, more than 100 million Americans are enrolled in at least one welfare program run by the federal government. Once again, these figures do not even include Social Security or Medicare.#5 Over the past year, the number of Americans getting a free cell phone from the federal government has grown by 43 percent. Now more than 16 million Americans are enjoying what has come to be known as an "Obamaphone".#6 When Barack Obama first entered the White House, about 32 million Americans were on food stamps. Now, nearly 47 million Americans are on food stamps. And this has happened during what Obama refers to as "an economic recovery".#7 The U.S. government recently spent 27 million dollars on pottery classes in Morocco.#8 The U.S. Department of Agriculture recently spent $300,000 to encourage Americans to eat caviar at a time when more families than ever are having a really hard time just trying to put any food on the table at all….#19 The U.S. government spends more on the military than China, Russia, Japan, India, and the rest of NATO combined. In fact, the United States accounts for 41.0% of all military spending on the planet. China is next with only 8.2%.#20 In a previous article, I noted that close to 500,000 federal employees now make at least $100,000 a year.#21 In 2006, only 12 percent of all federal workers made $100,000 or more per year. Now, approximately 22 percent of all federal workers do….#32 When you combine all federal government spending, all state government spending and all local government spending, it comes to approximately 41 percent of U.S. GDP. But don't worry, all of our politicians insist that this is not socialism.#33 As I have written about previously, less than 30 percent of all Americans lived in a home where at least one person received financial assistance from the federal government back in 1983. Today, that number is sitting at an all-time high of 49 percent.#34 Back in 1990, the federal government accounted for just 32 percent of all health care spending in America. This year, it is being projected that the federal government will account for more than 50 percent of all health care spending in the United States.#35 The number of Americans on Medicaid soared from 34 million in 2000 to 54 million in 2011, and it is being projected that Obamacare will add 16 million more Americans to the Medicaid rolls…#36 In one of my previous articles, I discussed how it is being projected that the number of Americans on Medicare will grow from 50.7 million in 2012 to 73.2 million in 2025.#37 If you can believe it, Medicare is facing unfunded liabilities of more than 38 trillion dollars over the next 75 years. That comes to approximately $328,404 for each and every household in the United States.#38 In the United States today, more than 61 million Americans receive some form of Social Security benefits. By 2035, that number is projected to soar to a whopping91 million.#39 Overall, the Social Security system is facing a 134 trillion dollar shortfall over the next 75 years.#40 When Barack Obama first took office, the U.S. national debt was about 10.6 trillion dollars. Now it is about 16.2 trillion dollars. That is an increase of 5.6 trillion dollars in less than 4 years…#55 Boston University economist Laurence Kotlikoff is warning that the U.S. government is facing a gigantic tsunami of unfunded liabilities in the coming years that we are counting on our children and our grandchildren to pay. Kotlikoff speaks of a "fiscal gap" which he defines as "the present value difference between projected future spending and revenue". His calculations have led him to the conclusion that the federal government is facing a fiscal gap of 222 trillion dollars in the years ahead.

Wednesday, August 29, 2012

Corrupt Indian Politicians Loot $14.5 billion in Food

From Bloomberg,

as much as $14.5 billion in food was looted by corrupt politicians and their criminal syndicates over the past decade in Kishen’s home state of Uttar Pradesh alone, according to data compiled by Bloomberg. The theft blunted the country’s only weapon against widespread starvation -- a five-decade-old public distribution system that has failed to deliver record harvests to the plates of India’s hungriest.

“This is the most mean-spirited, ruthlessly executed corruption because it hits the poorest and most vulnerable in society,” said Naresh Saxena, who, as a commissioner to the nation’s Supreme Court, monitors hunger-based programs across the country. “What I find even more shocking is the lack of willingness in trying to stop it.”

In every instance of corruption, the public’s attention have mechanically been directed at the immorality of the culpable political leaders. Yet media fails to investigate or even attempt to understand the incentives that encourages such nefarious acts. Thus the easy implied solution has always been to seek the appointment of persons of supposed “virtue”. But in reality, politics has never been about virtue but of the preservation of power.

Looking at the symptom than the disease won’t really lead to comprehensive solution.

More from the same article

This scam, like many others involving politicians in India, remains unpunished. A state police force beholden to corrupt lawmakers, an underfunded federal anti-graft agency and a sluggish court system have resulted in five overlapping investigations over seven years -- and zero convictions.

India has run the world’s largest public food distribution system for the poor since the failure of two successive monsoons led to the creation of the Food Corporation of India in 1965. The government last year spent a record $13 billion buying and storing commodities such as wheat and rice, and expects that figure to grow this year.

Yet 21 percent of all adults and almost half of India’s children under 5 years old are still malnourished. About 900 million Indians already eat less than government-recommended minimums. As local food prices climbed more than 70 percent over the past five years, dependence on subsidies has grown.

In reality, political distribution of resources tends to create two classes of people: particularly the powerful politicians—bureaucrats and the helpless public. With God like powers from legal mandates to determine the beneficiaries (winners and losers), many will try to influence or win the favor of the political class through various means, including bribery or through coopting or gaming the system.

On the other hand, the political class will always act in accordance to their self interest, particularly personal values and preferences, ideology, personal networks (family friends and etc..), career, social status and even financial interests. After all, political class are humans too.

As the great Professor Ludwig von Mises wrote in his magnum opus Human Action,

Unfortunately the office-holders and their staffs are not angelic. They learn very soon that their decisions mean for the businessmen either considerable losses or—sometimes—considerable gains. Certainly there are also bureaucrats who do not take bribes; but there are others who are anxious to take advantage of any “safe” opportunity of “sharing” with those whom their decisions favor.

In many fields of the administration of interventionist measures, favoritism simply cannot be avoided. Take, for example, the case of export or import licenses. Such a license has for the licensee a definite cash value. To whom ought the government grant a license and to whom should it be denied? There is no neutral or objective yardstick available to make the decision free from bias and favoritism. Whether or not money changes hands in the affair does not matter. The scandal is the same when the license is given to people who have rendered or are expected to render other kinds of valuable services (e.g., in casting their votes) to the people upon whom the decision depends.

Corruption is a regular effect of interventionism. It may be left to the historians and to the lawyers to deal with the problems involved.

Since interventionism are coursed through laws, laws create corruption and corruption engenders laws.

This striking quote from the same Bloomberg article is very much revealing of the true nature of the state and of the importance or of the superiority of the market: (bold highlights mine)

“If you can buy a Pepsi in every village in India, why can’t the government get us our rations?” asked Vaish, who lives in Satnapur. “The reason we don’t is because the government doesn’t want us to -- they all get a cut.”

Saturday, July 28, 2012

China’s Sovereign Wealth Fund in the Red

Many think that government (central banking) surpluses should be ‘invested’ through loans or through financial markets as sovereign wealth funds. They solely look at the benefits of the supposed ‘investments’ while ignoring both the hidden and the visible costs.

The recent losses of China’s sovereign wealth fund should be an example.

From CNN,

China's sovereign wealth fund suffered its worst year ever in 2011, losing 4.3 per cent on its global investment portfolio.

In an annual report that has become the focal point of its efforts to portray itself as a transparent institution, China Investment Corp also confirmed that it had received a $30bn capital injection from the government at the end of last year, boosting its investment firepower.

CIC was established in 2007 with money carved out from China's foreign exchange reserves and given a mandate to make investments that would generate higher returns. However, it quickly ran into concerns about its government background and so has been at pains to demonstrate that it is a long-term investor focused on profits, not politics.

In its annual report CIC emphasised that point, noting that its board decided in 2011 to make rolling 10-year annualised returns a key measure of performance.

"As a long-term investor, we are well positioned to withstand short-term volatility in markets, to pursue contrarian investments and to build long-term positions that can capture the premium for less liquidity," it said.

There is no guarantee that government ‘investments’ will produce positive returns.

After all, government and central bank bureaucrats are human and suffer from the same knowledge problem, as well as, other human frailties (heuristics, biases, etc..) as with the rest.

The difference is that government actions has externality effects which unduly exposes taxpayers. Yes, central banks as government institutions are underwritten by taxpayers.

The other difference is that actions by government agents or bureaucrats are driven by legal technicalities and political priorities than from the profit and loss incentives.

Besides given the huge distortions of the marketplace financial assets are subject to immense volatility and boom bust cycles, which makes sovereign wealth funds highly susceptible to market risks.

Friday, July 27, 2012

Graphic of the Day: Red Tape and Small Business

In the mainstream, hardly has there been any meaningful discussions about how red tape, costs of regulatory compliance and the costs of leviathan bureaucracy contributes to unemployment or how politicization of the economy via the bureaucracy and arbitrary rules (regime uncertainty) takes its toll on the economy, particularly on small business, which have been the major source of the employment in the US (and elsewhere).

The chart from the Joint Economic Committee Republicans exhibits the astounding maze of regulations.

So when the politicians deceivingly assert that the success of entrepreneurs has been due to the government, in truth this relationship has been in reverse: many business failures, stillborn and or unrealized businesses have been products of government interference in various forms.

Cato’s Dan Mitchell (where the chart above has been sourced) gives us some numbers on the onus of the bureaucracy to the US economy:

Americans spend 8.8 billion hours every year filling out government forms.

The economy-wide cost of regulation is now $1.75 trillion.

For every bureaucrat at a regulatory agency, one study estimated that100 jobs are destroyed in the economy’s productive sector.

As the great Ludwig von Mises pointed out,

The trend toward bureaucratic rigidity is not inherent in the evolution of business. It is an outcome of government meddling with business. It is a result of the policies designed to eliminate the profit motive from its role in the framework of society’s economic organization.

Elimination of the profit motive means a declining trend in a society’s standard of living.

The Economist has an article about “The parable of the four-engined planes” which nicely demonstrates of the failure of bureaucratic rigidity.

Updated to add:

Another worthwhile example is this article about a 13 year old aspiring entrepreneur whose business got shut down by local regulators. (pointer to Professor Gary North)

Saturday, July 14, 2012

Warren Buffett Sees Rising Municipal Bankruptcies

Obama crony Warren Buffett predicts that municipal bankruptcies will increase

From Bloomberg,

Warren Buffett, the billionaire chairman of Berkshire Hathaway Inc. (BRK/A), said municipal bankruptcies are set to rise as there’s less stigma attached after three California cities opted to seek protection just weeks apart.

The City Council of San Bernardino, California, a community of about 210,000 east of Los Angeles, decided July 10 to seek court protection from its creditors. The move came just weeks after Stockton, a community of 292,000 east of San Francisco, became the biggest U.S. city to enter bankruptcy. Mammoth Lakes, California, also sought the shelter this month.

“The stigma has probably been reduced when you get very sizeable cities like Stockton or San Bernardino to do it,” Buffett, 81, said in an interview today on “In the Loop with Betty Liu” on Bloomberg Television. “The very fact they do it makes it more likely.”

Cities and towns across the U.S. have been strained by rising costs for labor, including pensions and retiree health benefits, while the longest recession since the 1930s crimped sales- and property-tax revenue.

I don’t think “stigma” has anything to do with the real issue of the unsustainable financial and economic conditions of the excessively (welfare and bureaucracy) bloated public sector, driven by Keynesian policies. As per Herb Stein’s Law, if something cannot go on forever, it will stop.

So goes with Munis.

Wednesday, June 27, 2012

Italy’s Regulation Choked Labor Markets

Here is another example of the normative way of how politicians deal with problems: They treat the symptoms rather than the disease.

From the Wall Street Journal,

Prime Minister Mario Monti has issued a new "growth decree" to revive Italy's moribund economy. Among other initiatives, the 185-page plan proposes discount loans for corporate R&D, tax credits for businesses that hire employees with advanced degrees, and reduced headcount at select government ministries.

Will any of this solve Italy's economic problems? Only in the sense that one could theoretically drain Lake Como with a ladle and straw. Allow us, then, to illustrate why Italy's economy stagnates.

Imagine you're an ambitious Italian entrepreneur, trying to make a go of a new business. You know you will have to pay at least two-thirds of your employees' social security costs. You also know you're going to run into problems once you hire your 16th employee, since that will trigger provisions making it either impossible or very expensive to dismiss a staffer.

But there's so much more. Once you hire employee 11, you must submit an annual self-assessment to the national authorities outlining every possible health and safety hazard to which your employees might be subject. These include stress that is work-related or caused by age, gender and racial differences. You must also note all precautionary and individual measures to prevent risks, procedures to carry them out, the names of employees in charge of safety, as well as the physician whose presence is required for the assessment.

Now say you decide to scale up. Beware again: Once you hire your 16th employee, national unions can set up shop. As your company grows, so does the number of required employee representatives, each of whom is entitled to eight hours of paid leave monthly to fulfill union or works-council duties. Management must consult these worker reps on everything from gender equality to the introduction of new technology.

Hire No. 16 also means that your next recruit must qualify as disabled. By the time your firm hires its 51st worker, 7% of the payroll must be handicapped in some way, or else your company owes fees in-kind. During hard times, your company may apply for exemptions from these quotas—though as with everything in Italy, it's a toss-up whether it's worth it after the necessary paperwork.

Once you hire your 101st employee, you must submit a report every two years on the gender dynamics within the company. This must include a tabulation of the men and women employed in each production unit, their functions and level within the company, details of compensation and benefits, and dates and reasons for recruitments, promotions and transfers, as well as the estimated revenue impact.

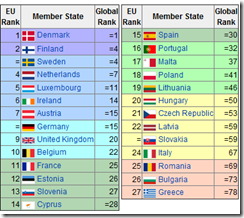

I earlier posted the labor markets of France and Germany compared to Spain.

Such astounding maze of regulations has been one of the major dynamics for today’s crisis. This has produced a huge bureaucracy that has been draining productive resources from entrepreneurs. This has also increased the costs of doing business. Reduced the incentives of entrepreneurs to expand. Shifted many activities to the informal or shadow economy.

Italy has one of the largest informal economies relative to the OECD nations

As well as encouraged corruption. Italy ranks as one of the most corrupt in Eurozone. Overall, such regulations has reduced Italy’s competitiveness.

So reduced competitiveness leads to diminshed output (income) – ballooning government (expense)= crisis (deficits)

And how does the Italian government intend to fix the problem?

Among other initiatives, the 185-page plan proposes discount loans for corporate R&D, tax credits for businesses that hire employees with advanced degrees, and reduced headcount at select government ministries

Gosh, 185 pages of more regulations and more bureaucracy.

Note: reduced headcount at “select” government ministries looks more symbolical and seems like a loophole.

Yet the mainstream advice of solving this problem by inflation will only worsen the situation, as this does not address the root: asphyxiation from big government.

Doing it over and over again and expecting different results only reinforces the worsening of this crisis.

Friday, June 15, 2012

Chart of the Day: Greece’s ‘Macaroni’ Bureaucracy

From Bloomberg, (bold emphasis mine) [hat tip P. Ella]

Panagiotis Karkatsoulis, who works in the Greek Ministry of Administrative Reform and e-Governance and teaches at the National School of Public Administration, has some well founded theories about where Greece went wrong. One long-standing habit of government that helped the country become almost unmanageable, according to Karkatsoulis, is its disdain for parliament: new rules and regulations in Greece have long been created by ministerial order and presidential decree rather than through parliamentary process.

About 70 percent of regulations were approved directly by ministers between 1975 and 2005, and just 2 percent were the result of parliamentary actions, Karkatsoulis says in this OECD presentation. Regions, prefectures and the president account for the remaining rule changes. More than 30 years of scant coordination has resulted in a morass of contradictory rules and a lack of legal clarity.

A profile of Karkatsoulis in Le Monde explains how the first government of George Papandreou in 2009 had 15 ministers, 9 vice-ministers and 21 adjunct ministers, along with 78 general or special secretaries, 1,200 counselors, 149 directorate generals and 886 directorates — this for a population of just over 11 million, or the same number of people as those living in Cuba. The resulting mesh of interdependencies for decision making has made governing Greece increasingly difficult.

The chart above from Mr. Karkatsoulis has been labeled as the ‘Macaroni’ chart.

This serves as a great example of how the Gordian Knot of arbitrary rules and regulations, which has been emblematic of a political economy built on an unsustainable parasitical relationship, ultimately ends up in a crisis.

Printing money via devaluation, as prescribed by the mainstream, will not solve the issue of excessive regulations, red tape and bureaucratic barnacles, as well as property rights, free markets and the rule of law.

Friday, January 20, 2012

Quote of the Day: Inconsistencies of Public Policies

Bureaucracies typically resist working with other bureaucracies for fear that their own power and budget might decline as a result. If high-ranking politicians wanted to, they could insist on coordinated policymaking. But they don’t, because coordinating does not matter to them. The ultimate goal for a politician running for office is to get elected. From that vantage point, politicians tend to consistently push for policies that will bring them votes, funds or both.

That’s from Chidem Kurdas at the ThinkMarkets, giving us a public choice perspective on the reasons why bureaucracies has the tendency to remain obstinately inefficient and inconsistent. The answer, in short, is all about the incentives guiding the actions of bureaucrats and politicians.

Thursday, March 24, 2011

Video: Understanding The Difference Between Private and Public Enterprises

Tuesday, December 14, 2010

One Source of Wealth Inequality: Government Owned Or Controlled Corporations (GOCCs)

Those promoting class schism by presenting misleading arguments on wealth-tax inequalities deal with superficial analysis, instead they should rant about is this:

GOVERNMENT WASTAGE AND INEFFICIENCY THAT LEADS TO HIGHER TAXES.

Today’s news headlines provides a magnificent example.

This example from the Inquirer,

Another government-owned and -controlled corporation (GOCC) has been found to have granted its officers and employees millions of pesos in unauthorized allowances, bonuses and other benefits.

Despite owing the government over P7 billion in concession fees and other liabilities, Philippine National Construction Corp. (PNCC) last year gave its board of directors, officers and employees over P57 million in allowances that lacked legal basis, according to the Commission on Audit (COA).

PNCC whose president is Theresa Defensor also gave some P261.33 million in unauthorized cash advances to its employees, the audit agency said in its latest report on the GOCC.

The COA said the corporation should have first settled its obligations with the national government before improperly providing “huge” allowances to its personnel.

On Sept. 8, President Benigno Aquino III ordered the suspension until Dec. 31 of all allowances, bonuses and incentives of board members of GOCCs and government financial institutions (GFIs).

Here, media’s framing of government’s wastage seem to be angled only from the morality aspects.

Yet one noteworthy statement from the same article…

The COA said these disbursements had no authority from the DBM or the Office of the President.

My comments:

1. Legality seems to be determined according to the unilateral political discretion of the incumbent leadership, where arbitrary rules equate to subjective actions by the regulators or administrators.

As Ludwig von Mises pointed on the inherent weaknesses of bureaucratic organizations… (bold emphasis mine)

There are, of course, in every country’s public administration manifest shortcomings which strike the eye of every observer. People are sometimes shocked by the degree of maladministration. But if one tries to go to their roots, one often learns that they are not simply the result of culpable negligence or lack of competence. They sometimes turn out to be the result of special political and institutional conditions or of an attempt to come to an arrangement with a problem for which a more satisfactory solution could not be found. A detailed scrutiny of all the difficulties involved may convince an honest investigator that, given the general state of political forces, he himself would not have known how to deal with the matter in a less objectionable way.

This also means that since the administration of these organizations are mainly politically determined, management actions may be directed at the rewarding or dispensing of favors to political allies or adherents, or trying to attain high approval ratings by projecting control, or other non-market based actions.

2. Spending someone else’s money has always been the easiest thing to do. And that’s what bureaucracies essentially stand for.

This from GMA TV,

Government-owned and –controlled corporations (GOCCs) got P15.95 billion in subsidies in the 10 months to October, up by 54 percent from P10.36 billion a year earlier, the Bureau of Treasury (BTr) reported Wednesday

3. Bureaucracy isn’t concerned with profitability, but with fulfilling regulatory, or as stated above, specific political goals for the benefit of the political leadership.

This from ABS CBN

Goverment owned and controlled corporations (GOCCS) are bracing for a major shakeup as the state plans to abolish some of these agencies.

Budget Secretary Florencio Abad said on Monday that some of the 14 GOCCs being monitored by the goverment, may have to be folded up.

The abolishment of losing and redundant GOCCs is part of the government's overall strategy to trim the bureacracy and stop the bleeding of its coffers through huge subsidies to these agencies.

There seem to be little concerns, except for paying lip service, on the trimming the leviathan. Also there seems hardly any discussions on the justifications for the continued existence of these political enterprises, aside from looking at financial conditions.

In addition, there also seems hardly any reckoning on the adverse impact on the economy by, not only misallocation of resources, but as privileged competitor at the expense of the private sector (yes, some GOCCs are profitable. That’s because they are monopolies of strategic sectors, e.g. Bangko Sentral ng Pilipinas, Government Service Insurance System, Social Security System, Philippine Deposit Insurance and many more).

Yet these enterprises represent anti market or totalitarian tendencies by the state.

Again from the great Professor von Mises (bold emphasis mine)

Those who criticize bureaucracy make the mistake of directing their attacks against a symptom only and not against the seat of the evil. It makes no difference whether the innumerable decrees regimenting every aspect of the citizen’s economic activities are issued directly by a law, duly passed by Congress, or by a commission or government agency to which power has been given by a law and by the allocation of money. What people are really complaining about is the fact that the government has embarked upon such totalitarian policies, not the technical procedures applied in their establishment.

Bottom line: Finger pointing on the rich is one wrong way to address equality issues. Instead we should deal with the system that promotes on such inequality. The system where politics has been empowered at the expense of the markets, and a system that encourages waste, inefficiency, corruption and wealth redistribution from the economic-productive class to the power hungry political class.

Saturday, December 04, 2010

Paper Money Is Political Money

Populist blogger John Mauldin writes,

The euro never was an economic currency. It is a political currency, and for it to remain a currency or at some point in the future become an economic currency, it will take massive political resolve on the part of the members of the EU.

Unless the US dollar operates on a genuine gold standard or a monetary system based on free banking, then this statement or implied comparison or categorization is patently false.

Although to give credit to Mr. Mauldin for admitting that he has been a “Euro skeptic”, his opinions has apparently been shaped by biases rather than from facts.

So why is the above statement false? Because paper money has always been political money.

ALL paper money, whether the US dollar, Euro, the Yen, the Yuan or the Peso, operates on a platform which is not determined by the market forces but by the judgments of unelected bureaucracy whom are appointed by their respective governments.

Thus, from the organizational structure to the operating “technical” procedures to the underlying incentives of the bureaucracy in conducting administration of these instituted statutes or policies, which are all outside the profit and loss dimensions and whose operations are underwritten by taxpayers, all these represent the political nature of the system.

Importantly, the paper money system is founded from legal tender laws, which according to Wikipedia.org, is “a medium of payment allowed by law or recognized by a legal system to be valid for meeting a financial obligation”.

In other words, a monetary system imposed by the government (by fiat or decree), which has largely been operated by central banks, has always been political.

Yet to speak of an “economic currency” extrapolates to a market based currency from which the legal tender-paper money system is not required.

According to the great Friedrich August von Hayek,

We owe it to governments that within given national territories today in general only one kind of money is universally accepted. But whether this is desirable, or whether people could not, if they understood the advantage, get a much better kind of money without all the to-do about legal tender, is an open question. Moreover, a "legal means of payment" (gesetzliches Zahlungsmittel) need not be specifically designated by a law. It is sufficient if the law enables the judge to decide in what sort of money a particular debt can be discharged.”

Thus, to besmirch a currency without the appropriate consideration of the overall framework of the system would seem misguided if not a flimflam.

Caveat Emptor.

Friday, November 19, 2010

On India’s Lost Government Revenues From ‘Corruption’

Columnist Megha Bahree of Forbes reports that a huge amount ($213 billion) of tax revenues had been lost to bribes, tax evasion and mispricing in India during 1948-2008.

These estimates were supposedly conservative because it may have excluded different forms of smuggling and missing data, aside from foregone interest charges.

Ms. Bahree writes, (bold highlights mine)

The flight of capital from the legal system accelerated once the Indian government eased its tight control with economic reforms that started in 1991, the report says. Part of the problem was that Indian’s economic liberalization wasn’t accompanied by better governance or more accountability in the system. So while this period started liberalization of trade, lowering of trade barriers, less control and less oversight, it also led to an increase in bribes (to get your goods out of customs more quickly, for instance) and higher tax evasion.

India’s underground economy has been estimated at 50% of the GDP, making it about $650 billion at the end of 2008. Of this, 72% is held abroad, estimates Dev Kar, the author of the report and a former senior economist at the International Monetary Fund.

My comments:

1. Bribes occur only when there are legal proscriptions.

Bribes are symptoms or representative of societal response to the existing maze of arbitrary regulations.

Absent these restrictions or obstacles, then there won’t be any incentive to bribe, or much less, commit to an act that would circumvent any laws.

In short, the economic liberalization isn’t to blame for the institutional inefficiencies but on the partiality or the tepidness of liberalization reforms.

The strength of any social institutions emanate from the respect for the rule of law.

2. Tax evasions, like bribes, are symptoms of circumvention to onerous statutes.

They represent as cost saving measures resorted to by many enterprises in the face of the high costs of doing business largely due to obstructive taxes and the cumbersome compliance costs from the incumbent regulatory regime.

In other words, in most instances, a regime of high taxes is likely to incentivize tax evasion. Thus, it would be inaccurate to link economic liberalization with tax evasion because the cause and effect does not square. Economic liberalization should translate to lower taxes predicated on less dependence on the government.

3. The 50% share of India’s underground economy is emblematic, not of economic liberalization, but of the bureaucratic morass and the oppressive regulatory structures that discourages half of the economy to participate in the legal framework.

Again they are symptoms of people shunning government regulations, which is tantamount to government failure.

Like any process there always will be a transition. This means that the current reforms made by India hasn’t been enough (but should be on path), and that people and the existing institutions, coming from a long rule of statism, has yet to fully assimilate on the benefits of economic freedom premised on the respect for private property and the adherence to the rule of law.

4. Lost government revenues can be seen both ways.

If it is pocketed by government officials then it is likely to be devoted to consumption activities thereby would be considered unproductive and thus have negative implications.

Whereas if lost government revenues gives private enterprises room to expand production or services then it could be seen as having positive effects. Yes, this is the positive aspect of corruption.

Of course one could argue that lost revenues deprives the government to spend for social projects.

But most of social spending itself is questionable.

Aside from the issues of wastage and corruption, most of these so called public goods can be handled better and more efficiently by the private sector.

More importantly, high dependence on social spending is likely to foster a culture of entitlement or parasitism that is unlikely to prompt people to engage in productive activities but in acrimonious partisan politics between political insiders and the outsiders, promote patron-client relations (or crony capitalism) and even nurture criminal or underground activities.

India’s corruption problems isn’t one that hails from economic liberalization but from the vestiges of statism.

Wednesday, September 29, 2010

The Mentality of A Government Expert

An interesting quote by the Wall Street Journal Blog on Professor Adam Posen, a Harvard PhD economist, who sits on the Bank of England’s Monetary Policy Committee, revealingly illustrates the mentality of government experts.

(bold emphasis mine)

Along the way, he adds a few new metaphors to the debate over central banking: “Fear of looking ineffective should not be a deterrent to doing the right thing, he said. “When facing a worsening situation, you work with the tools you have, whether you’re a central bank in the aftermath of a financial crisis, or someone stranded on the road with a car problem when night is falling. And you try to get help.”

First, the quote simply reveals what we have pointed out in many occasions—bureaucrats and their academic cohorts are NOT there simply to make things “work”. Rather, they need to be seen first, as having a hand in “doing something”, a form of signaling to get accepted by the public, regardless whether their actions put to risk the general welfare.

In addition, the quote also exposes how so-called experts are willing to gamble with public treasury. That’s because at the end of the day, these entities are not held accountable or subjected the consequences of their actions.

Third, the analogy about someone stranded on the road with a car problem and getting some help is blatantly misleading. The car problem is mostly about voluntary assistance or public service to some of the afflicted and not everybody else.

Central banking policies are about putting a gun on our head and forcibly demanding us to act in accordance to the whims of the politically unelected leaders. It affects everyone else albeit in different degrees.

This effectively differentiates government experts from that of the private sector.

As Professor Arnold Kling aptly writes in the Era of the Expert Failures,

The power of government experts is concentrated and unchecked (or at best checked very poorly), whereas the power of experts in the private sector is constrained by competition and checked by choice. Private organizations have to satisfy the needs of their constituents in order to survive. Ultimately, private experts have to respect the dignity of the individual, because the individual has the freedom to ignore the expert.

Lastly, the quote also reveals on the hubris or what Friedrich von Hayek would call as the ‘Fatal Conceit’ of those in the political echelons.

The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.

They who cannot foretell of where the markets are headed for, seem to be consumed by the belief that social problems can be solved with presumptive models.

Monday, March 29, 2010

Example of Political Priorities: Politics First, You Later

From Mary Anastasia O' Grady of the Wall Street Journal, (bold highlights mine) [hat tip: Cafe Hayek's Don Boudreaux]

``Just ask Honduras.

``Last year, the U.S. tried to force the reinstatement of deposed president Manuel Zelaya. When that failed and Team Obama was looking like the Keystone Cops, it sent a delegation to Tegucigalpa to negotiate a compromise.

``Participants in those talks say Dan Restrepo, senior director for Western Hemisphere affairs at the National Security Council, let slip that the U.S. interest had to do with American politics. The Republicans, he said, were using the administration's support for Mr. Zelaya, an ally of Venezuelan Hugo Chávez, against the Democrats. It's not going to work, Mr. Restrepo is said to have informed the other negotiators, because "we have the power" and would be keeping it for a long time.

``It can't have been comforting for Hondurans to learn that while their country was living a monumental crisis, fueled by U.S. policy, Mr. Restrepo's concern was his party's power. For the record, an NSC spokesman says "Mr. Restrepo didn't say that." But my sources are more plausible considering what has transpired since."

Bottom line, according to Ms. O' Grady: ``It's hard to imagine what the U.S. thinks it achieves with a policy that divides Hondurans while strengthening the hand of a chavista. Revenge and power come to mind. Whatever it is, it can't be good for U.S. national security interests."

Ludwig von Mises on politics: "Political realism, that hodgepodge of cynicism, lack of conscience, and unvarnished selfishness."