Professor Gary Galles at the Mises Institutes wrote:

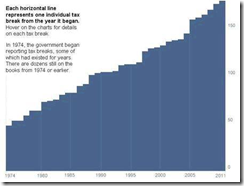

The approach of each year’s April 15 tax deadline reminds us that even if one stretches credulity to believe “taxes are the price we pay for a civilized society,” that doesn’t prove the civilization we get is worth the taxes we are forced to pay. But this issue is far from new. More than two centuries ago, the Antifederalists warned us that the price we would have to pay for government would rise. So as we struggle with our IRS forms, and particularly as we write that check to the Treasury (or file for an extension to delay it), what they said merits recalling.Antifederalists were particularly concerned that the Constitution gave the national government almost unlimited taxing discretion.One of the leading Antifederalists was Robert Yates, writing as Brutus. He described federal taxing power as onethat has such latitude, which reaches every person in the community in every conceivable circumstance, and lays hold of every species of property they possess, and which has no bounds set to it, but the discretion of those who exercise it.In addition,it will lead to the passing a vast number of laws, which may affect the personal rights of the citizens of the states, expose their property to fines and confiscation. ... It opens the door to the appointment of a swarm of revenue and excise officers to prey upon the honest and industrious part of the community [and] eat up their substance.Brutus wrote that federal taxation “will introduce such an infinite number of laws and ordinances, fines and penalties, courts and judges, collectors, and excise men, that when a man can number them, he may enumerate the stars of Heaven.” That sounds a lot like what millions of Americans now struggle with each April.Brutus also predicted how invasive tax collection could become:This power, exercised without limitation, will introduce itself into every corner of the city, and country — it will wait upon the ladies at their toilet, and will not leave them in any of their domestic concerns; it will accompany them to the ball, the play, and assembly; it will go with them when they visit, and will, on all occasions, sit beside them in their carriages, nor will it desert them even at church; it will enter the house of every gentleman, watch over his cellar, wait upon his cook in the kitchen, follow the servants into parlor, preside over the table, and note down all he eats or drinks; it will accompany him to his bedchamber, and watch him while he sleeps; it will take cognizance of the professional man in his office, or study; it will watch the merchant in the counting-house, or in his store; it will follow the mechanic to his shop, and in his work, and will haunt him in his family, and in his bed; it will be a constant companion of the industrious farmer in all his labor, it will be with him in the house, and in the field, observe the toil of his hands, and the sweat of his brow; it will penetrate into the most obscure cottage; and finally, it will light upon the head of every person in the United States. To all these different classes of people, and in all these circumstances, in which it will attend them, the language in which it will address them will be GIVE! GIVE!Brutus described the consequences of expansive federal taxing powers. But he was writing only of direct (e.g., excise) taxes and the small federal government they could finance, long before the 16th Amendment made possible a federal income tax in 1913. In its aftermath, Brutus would conclude that he was far, far too optimistic. He would see why Albert Jay Nock described the income tax as a new American revolution, allowing a Brobdingnagian federal government and burdens beyond even his worst nightmare.