I believe the market is topping. The stock market predicted seven out of the last three recessions; I predicted seven out of the last three bear markets. I started in a bear market, so I have a bearish bias. Where I am on the market is if you gave me a stock I really like, I will buy it. If you give me a stock I really hate, I’ll short it. In terms of having some big position, long or show index, or some exposure to the stock market right now, I am lost. I don’t play when I am lost. I know in the future I won’t be lost. Stanley Druckenmiller, billionaire investor in a Bloomberg Interview

In a snap of a finger, global equity markets dramatically transformed from Risk OFF to Risk ON.

Some equity markets have even reached or are nearly at new highs.

The Boy Who Cried Wolf; The Mania in US Markets

The consensus have come to treat equity markets as “the boy who cried wolf”, ever dismissive of the risks of the emergence of the market’s equivalent of the “wolf” in Aesop’s parable[1]. Each time the market sold off, the consensus sees this as a ‘false positive error’[2] or a false alarm and thus has been interpreted as buying opportunities.

The consensus have been conditioned or programmed to believe markets operate only in one direction: the quasi-permanent boom. Fundamentals both good and bad have been seen as positive for equity markets. Bad news is even better, because the flow of central bank steroids is assumed as assured[3].

Wall Street’s schadenfreude mentality seems to have become the norm. Such appears to have been shaped by repeated guarantees by central banks in support of the financial markets through the Greenspan-Bernanke Put of the zero bound negative real rates policy (ZIRP)

Wall Street and their global counterparts furtively desires to see tepid or stagnant real economic growth to justify central bank policies that transfers resources from the main street to them while paradoxically promoting such policies as “pro-growth”.

In the Philippines where only 21 of every 100 households have access to the formal banking system[4], zero bound rates, which has generated a credit driven statistical boom, means that less than 21% of the every 100 households has benefited from central bank subsidies/transfers stealthily financed and channeled through the loss of purchasing power of the Peso. The other major beneficiary has been the Philippine government whose artificially suppressed or low interest payments have signified as an implicit subsidy from taxpayers and from the peso holders: the financial repression

Last week’s powerful stock market rally in the US (Dow Jones 3.04%, S&P 500 1.98%) has partly been fueled by faltering economic data that has been viewed as potential restraint to the US Federal Reserve purported “tapering”. Much of these optimism stems from this week’s September 17-18th meeting by the Federal Open Market Committee (FOMC).

In the US, equity market Pollyanna have become so certain or overconfident about the sustainability of the current bullmarket such that they have begun to patently mock or heckle at cynics, e.g. “Every Year Since The Financial Crisis Has Looked Like '1987 All Over Again'[5], “Is doomsaying out of fashion?” and “consumers are interested in shopping and not politics”.

Such cockiness has even been captured by magazine covers. For example, Time’s September issue features “How Wall Street Won” or even Barron’s latest “The Bull’s in charge” or Barron’s in last April’s “Dow, 16,000!”[6]

Ironically there is such a thing called the “magazine cover indicators” where excessive sentiments or the “crowded trade” phenomenon embodied by faddish themed magazine covers herald a significant turnaround or an inflection point as the above example shows[7].

Time Magazine’s “death of the euro” in November of 2011 foreshadowed the eventual recovery of the Euro in 2012 and Time Magazine’s Super Abenomics last May had been followed by the crash of the Nikkei, the latter which despite the current rally remains distant from the May 2013 highs[8].

For the consensus, risks have been shelved for good. The stock market has reached “a permanently high plateau” to quote the late American economist Irving Fisher[9] prior to the 1929 stock market crash, who like all the others thought that “this time is different”—a central demarcation of pre-crisis episodes.

Finally it’s nice to know that the current US bullmarket has been revealing of a vital shift in the character of investors. As one would note from the US Equity flow of funds[10], the household sector have become Net buyers of US equities for the first time since 2009 (top most pane) as institutional investors (second to the last box) have been reducing their scale of purchases and as foreign investors have turned NET sellers (lowest pane).

This seems to validate actions of Warren Buffett, John Paulson and George Soros whom all have been raising cash by substantially reducing equity exposures on the equity market[11].

Meanwhile equity mutual funds appear to be neutral while Equity ETFs continue to register substantial but slightly less buying activities. Both mutual funds and equity ETFs are most likely proxies of retail or household investors.

In other words, Smart money have been on a defensive while HOUSEHOLD or RETAIL momentum/punters have increasingly become the driving force for the current bull run. Said differently, what SMART money sells RETAIL money buys.

In Aesop’s Fable, the big bad wolf eventually does appear.

ASEAN Rally and Indonesia’s Fuel Subsidy Dilemma

Asia and many emerging markets resonated with the global equity market melt-up.

Two of the three ASEAN’s bellwethers which recently entered bear market territory posted the best gains. Indonesia’s JCI and Thailand’s SET soared by 7.45% and 4.85% respectively.

The Philippine Phisix (the third ASEAN market to have touched the bear market zone) and Singapore’s STI had unimpressive 2.65% and 2.36% gains. Meanwhile Malaysia’s KLCI, which had been the least affected during the recent turmoil, has also been sharply up 2.73%.

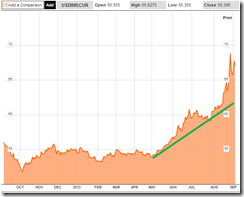

Whatever positive reaction seen last week by ASEAN markets[12] [Philippine Phisix- PCOMP red-orange, Singapore’s STI- FSSTI green, Indonesia’s JCI orange, Thailand’s SET- red] has hardly eradicated the earlier steep losses. Instead last week’s rally appear to resemble the violent upside response to the June lows.

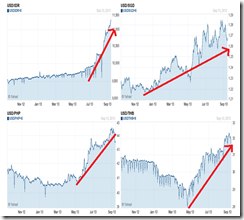

The sharp rally in ASEAN equity markets has partly been reflected on ASEAN currencies. I say “partly” because the degree of rebound in the currency market has not been commensurate with those of the stock markets.

The Singapore dollar (upper right pane) and the Philippine Peso (lower left pane) posted the best gains. The Thai baht (lower right window) recovered only marginally.

Importantly, one of the ‘tinderboxes’ or candidates for a crisis among Emerging economies, Indonesia via her currency the rupiah barely budged from the elevated levels (upper left pane). This despite the monster stock market rally and in spite of the Indonesian central bank, Bank Indonesia’s fourth interest rate increase this year, implemented last Thursday[13].

And so with Credit Default Swaps (CDS) where Indonesia’s 5-year premium are at the highest level of the year[14]

My interpretation to this is that the currency market and the CDS market, as well as the Indonesian bond markets which modestly rallied have largely been unconvinced by the actions of Bank Indonesia.

Such market response has been understandable.

Aside from homegrown bubbles, one of the biggest problems facing the Indonesian government has been fuel subsidies. Fuel subsidies poses as the same major obstacle to India.

The Indonesian government cut fuel subsidies last June. This effectively raised gas and diesel prices by 44% and 22% respectively which also signified as the first fuel increase since 2008. Despite the sharp increases in fuel prices, Indonesia has still one of the lowest fuel prices in the world. Attempts at further reducing subsidies by the Indonesian government have been stalled due to the violent public protests. Subsidies still cost the Indonesian government some $20 billion per year or 3% of GDP, according to the Asian Investor[15].

Meanwhile, India’s fuel subsidies have been estimated by the IMF as accounting for 1.9% of the GDP. Fuel subsidies in India according to an IMF study benefits the wealthy more the poor.

Rallying stocks will hardly eradicate on what has been a structural political economic problem for nations providing significant fuel subsidies as Indonesia and India in the face of a transitioning environment.

Should oil prices continue to rise or should real economic growth slow (meaning lesser taxes) or a combination of both, these factors are likely to compound on the already strained fiscal conditions of Indonesia and India. And rising rates amidst slowing economic growth and high debt levels would not only put a crimp on the economy but likewise raise the risks of credit defaults that may impact both the banking system and their respective governments that also increase the risk of a sovereign crisis.

The ill effects of these subsidies had been camouflaged by credit driven economic growth from the previous easy money regime. Such unsustainable imbalances have been exposed by the bond vigilantes and by rising oil prices. And a return to the salad days brought about by easy money policies is unlikely anytime soon.

Yet unless these governments undertake the unpopular reforms of dismantling fuel subsidies, the risks to a credit event remain significant.

Sure, yield chasing may lead to higher stock markets in Indonesia or India, but unless such reforms are implemented or unless oil prices fall substantially from current levels and or unless economic growth surprises materially to the upside given the current milieu of rising interest rates amidst relative high debt levels, then equity markets may be confronted with heightened risks of a market shock.

And with a high degree of market volatility which aggravates on the uncertainty from the current economic environment, and equally, from the opacity of government responses, market participants seem to have been reduced to scalpers or to short term punters.

Some institutional analysts appear to be lost or confounded with what to do or what to recommend to the public with regards to investing under the present Emerging Market dilemma. Here is a noteworthy quote from Societe Generale’s Benoit Anne[16]

To those EM investors that captured the full risk-on move in EM, hats off and well done. To those that have missed the rally and are now thinking of jumping on, please don’t.

Reading this gave me a vicarious feeling that I was in conversation with fellow bettors in a horse racing Off Track Betting (OTB) station.