The price paid for each ounce of bullion is composed of the metal’s spot price and the bullion premium.Here’s the price composition of some common rounds:Silver Eagle: 80% spot price / 20% bullion premiumSilver Canadian Maple Leaf: 84% spot price / 16% bullion premiumGold Eagle: 96% spot price / 4% bullion premiumHow are these bullion premiums determined? How can bullion buyers take advantage of the lowest possible premiums?DIFFERENCE BETWEEN SPOT PRICES AND BULLION PREMIUMSSpot Price: The current price per ounce exchanged on global commodity markets.Bullion Premium: The additional price charged for a bullion product over its current spot price.The calculation for bullion premiums depends on five key factors:The current bullion market supply and demand factors.Local, national, and global economic conditions.The volume of bullion offered or bid upon.The type of bullion products being sold.The bullion seller’s objectives.BULLION SUPPLY AND DEMANDThe total amount of supply and demand of bullion is a major influence on bullion product premiums.Bullion dealers are businesses, and they are actively trying to balance product inventory and profitability. Too much inventory means high costs. Too little inventory means angry customers. Fluctuations in the gold and silver markets affect bullion market supply, and this impacts premium prices.For example, in the Western hemisphere during the summer, calmer price patterns mean the bullion supply tends to increase. Sellers mark down their prices to attract market share.During other months, silver and gold prices tend to have more volatility. This leads to increased buying and selling, and bullion sellers react accordingly. Some may mark up prices to prevent running out of inventory, or to capture profits.ECONOMIC CONDITIONSDepending on their size and significance, market events can affect bullion premiums local to global stages.Examples:In a small town with only one brick and mortar coin shop, the dealer may boost their premiums to guard against running out of inventory.In a country like Venezuela, where the local currency is losing value at an extreme rate, locals may opt to buy bullion to preserve their wealth. This means higher premiums.At a global level, in the event of a large crisis (similar to the 2008 Financial Crisis), it is likely premiums would increase significantly as demand spikes and options diminish.VOLUMES BEING SOLDEvery seller incurs costs on each transaction such as time, overhead, or payment processing costs. For a seller, a single transaction for 1 oz of gold may have similar transaction costs as a 1000 oz transaction.Therefore, transactions with higher volumes of bullion have their costs spread out. As a result, premiums tend to be higher on small volume purchases, and lower per oz on high volume buys.FORM OF BULLION FOR SALEAs a general rule, the larger the piece of bullion is, the less the premium costs are per oz.It costs a mint far less to make one 100 oz silver bar, vs. 100 rounds of 1 oz each.There is also typically a significant difference in premiums between government and private mints.For example the most popular bullion coins in the world are American Silver and Gold Eagle coins. The U.S. Mint charges a minimum of $2 oz over spot for each Silver Eagle coin and +3% over spot for each Gold Eagle coin they strike and sell to the world’s bullion dealer network.A private company like Sunshine Minting will sell their silver rounds and bars in bulk for less than ½ the premium most government mints will sell their products for.BULLION SELLER’S OBJECTIVESWhether the seller is a large bullion dealer or a private individual, they will almost always want to yield the highest ask price they can get for the bullion they are selling.That said, just because one wants to receive a large premium on the bullion they are selling, that doesn’t necessarily mean the market’s demand or willing buyers will comply.Dealers must consider these factors when setting premiums:Market share objectivesCompetitor strategiesPrice equilibrium strategyIf a dealer sets its price too high, buyers will likely choose to go to a lower priced competitor.If a dealer sets their price too low, they could end up selling out of inventory without garnering enough profit margin to pay for the company’s overhead costs.Dealers and sellers are both typically trying to find the price equilibrium “sweet spot” where the time required to complete a sale is minimized and the seller’s profit is maximized.This is more difficult than it sounds, as there can be thousands of factors at play when establishing the best possible premium to charge in line with one’s overall objectives.PRICE COMPOSITION FOR BULLION PRODUCTSWhen bullion markets are experiencing normal demand, about 80-95% of silver bullion’s price discovery is comprised of the current spot price.For gold, spot prices approximately comprise of 95-98% of gold bullion’s overall price discovery.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, December 04, 2015

Infographics: How are Silver and Gold Bullion Premiums Calculated?

Wednesday, July 10, 2013

Gold Prices Goes Backwardation, Borrowing Rates Soar to Highest Level Since 2009

NEW YORK: The cost of borrowing gold surged on Tuesday to the highest level since January 2009, reflecting dwindling supplies from bullion banks after heavy liquidation and resilient demand for physical gold products.

The rates for lending out physical gold - mostly offered by bullion banks and central banks to institutional investors and manufacturers - have been near historically low levels over the past four years due to plentiful supplies.

Investors have lent out their big stockpiles of metal as prices have soared.

But that came to an abrupt end when supplies started tightening as institutional and speculative investors have unwound those long positions since the mid-April historic sell-off that has seen spot prices plunge 26 percent so far this year.

The implied one-month gold lease rate rose to 0.3 percent on Tuesday, their highest since January 2009 when investors scrambled for physical metal, seen as a safe haven investment, after Lehman Brothers collapsed.

That is up sharply from the 0.1 percent early last week. Rates have increased steadily from a negative 0.2 percent since September last year, but the gains have accelerated since April.

Even so, they are far off record highs of close to 10 percent seen in 1999 after European central banks agreed to curb gold sales and are still near historically low levels.

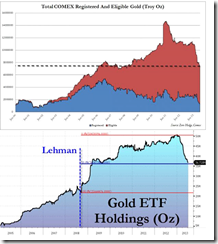

The recent collapse of gold prices came amidst a substantial decline in the inventories of the COMEX and gold ETFs (chart from Zero Hedge).

But in sharp contrast to Wall Street, demand for physical gold continues to be robust: Chinese imports of gold posted the second highest on record last May where gold spot premiums rose almost to "unprecedented levels", according to Mineweb.com. And even as official data on India’s imports may slow to reflect on recently imposed draconian gold trading curbs, gold smuggling has picked up according Mineweb.com. Emerging market central banks continue to substantially amass gold in April and May according to ETFTrends.com

There is another very important related development. Gold prices are reportedly in accelerating backwardation—where future prices are trading below spot prices.

As the Wikipedia.org notes

A backwardation starts when the difference between the forward price and the spot price is less than the cost of carry, or when there can be no delivery arbitrage because the asset is not currently available for purchase

something happened that has not happened since the Lehman collapse: the 1 Month Gold Forward Offered (GOFO) rate turned negative, from 0.015% to -0.065%, for the first time in nearly 5 years, or technically since just after the Lehman bankruptcy precipitated AIG bailout in November 2011. And if one looks at the 3 Month GOFO, which also turned shockingly negative overnight from 0.05% to -0.03%, one has to go back all the way to the 1999 Washington Agreement on gold, to find the last time that particular GOFO rate was negative.

Before we get into the implications of this rather historic inversion, let's review the basics:

What is GOFO (Gold Forward Offered Rates)?

GOFO stands for Gold Forward Offered Rate. These are rates at which contributors are prepared to lend gold on a swap against US dollars. Quotes are made for 1-, 2-, 3-, 6- and 12-month periods.

Who provides the rates?

The contributors are the Market Making Members of the LBMA: The Bank of Nova Scotia–ScotiaMocatta, Barclays Bank Plc, Deutsche Bank AG, HSBC Bank USA London Branch, Goldman Sachs, JP Morgan Chase Bank, Société Générale and UBS AG.

When are the rates quoted?

The means are set at 11 am London time. These are the rates shown on the LBMA website. To show derived gold lease rates, the GOFO means are subtracted from the corresponding values of the LIBOR (London Interbank Offered Rates) US dollar means. These rates are also available on the LBMA website.

How are the GOFO means established?

At 10.30 am London time, the Reuters page is cleared of all rates. Contributors then enter their rates for all time periods. A minimum of six contributors must enter rates in order for the means to be calculated. At 11.00 am, the mean is established for each maturity by discarding the highest and lowest quotations in each period and averaging the remaining rates.

What are some uses for GOFO means in the market?

They provide a basis for some finance and loan agreements as well as for the settlement of gold Interest Rate Swaps.

- An ETF-induced repricing of paper and physical gold

- Ongoing deliverable concerns and/or shortages involving one (JPM) or more Comex gold members.

- Liquidations in the paper gold market

- A shortage of physical gold for a non-bullion bank market participant

- A major fund unwinding a futures pair trade involving at least one gold leasing leg

- An ongoing bullion bank failure with or without an associated allocated gold bank "run"

- All of the above

The answer for now is unknown. What is known is that something very abnormal, and even historic, is afoot at the nexus of the gold fractional reserve lending market.

The payback time for the gold bulls nears.

Thursday, April 18, 2013

Gold Price Crash Spurs Boom in Physical Gold Markets

Shoppers in China lined up for gold this week, while in Hong Kong they rushed to buy bracelets and in India sought jewelry for weddings not set until December. The metal’s biggest price drop in three decades provoked the clamor.From Zaveri Bazaar in Mumbai, India’s largest bullion market, to Australia’s Perth Mint, where sales doubled from last week, consumers headed to shops after the commodity entered into a bear market last week. As gold plunged 13 percent in the two sessions through April 15, retail sales tripled across China on April 15-16, the China Gold Association reported.The frenzy appeared in India and China, the biggest gold- consuming nations, with cultures that traditionally acquire the metal for brides, babies or strongboxes. This year’s 18 percent decline may reignite demand that last year fell for the first time in three years, with Asian investors in particular seeing the drop as a buying opportunity.

Sales of gold and silver coins are soaring despite the sudden plunge in the price of precious metals, benefiting mints around the world and driving the cost of the collector items to well above the value of the metal they are made of.Coins account for about a fifth of all gold purchases for investment and are often favored by retail investors because they are far cheaper than the larger bars bigger investors buy.While traders dumped gold futures earlier this week on signs global inflation is easing and world economies are slowing, coin prices have been cushioned by high demand from gold enthusiasts who say coins hold their value over the long term.The premium on gold coins has risen to about 5% more than the spot price of the metal, and compares with 3% at the start of the year, traders say. For silver, the premium has risen to as much as 18% from about 15% at the start of the year. Comparisons aren't precise because the coins generally contain small amounts of other metals to strengthen them, and there is typically a small premium because of manufacturing costs.

The biggest drop in gold prices since 1983 has divided central banks on whether the metal is cheap enough to increase investment.Sri Lanka’s central bank governor said falling prices are an opportunity for nations to raise gold reserves and that the island will “favorably” examine buying more. The Bank of Korea said the plunge isn’t a “big concern” because holding the metal is part of a long-term strategy for diversifying currency reserves. Reserve Bank of Australia’s assistant governor said bullion has no “intrinsic value.” South Africa’s central bank governor won’t adjust its reserves policy.Central banks own about 19 percent of all gold ever mined, and last year boosted their holdings by the most since 1964, according to the London-based World Gold Council.

Updated to add: The Zero Hedge points out that the US Mint sold a record 63,500 ounces of gold in ONE day.

According to today's data from the US Mint, a record 63,500 ounces, or a whopping 2 tons, of gold were reported sold on April 17th alone, bringing the total sales for the month to a whopping 147,000 ounces or more than the previous two months combined with just half of the month gone.

Tuesday, April 16, 2013

Parallel universe in Gold: Physical versus Paper gold

With gold prices tumbling to a 15-month low today, retailers are witnessing a surge in demand and expect up to 50 per cent spike in sales volume in this marriage season.They are also expecting prices to fall further to around Rs 25,000 per 10 grams in the immediate short-term."Over the weekend, demand has picked up and there is surge in footfalls. As such, demand for jewellery has been up since Holi due to the upcoming wedding season. However, the recent plunge in prices have added to the momentum."We are expecting a whopping 50 per cent growth in sales volume during this season over the same period last year," Vice-Chairman of the Mumbai Jewellers Association Kumar Jain told PTI.Jain, who also owns Umedmal Tilokchand Zaveri retail chain, said jewellers are expecting a good season on the back of expectations that the prices are likely to tumble further to around Rs 25,000 due to global cues.

Gold futures with a value of over 400 tonnes were sold in hours and this is equal to 15% of annual gold mine production. The scale of the selling was massive and again underlines how one or two large banks or hedge funds can completely distort the market by aggressive, concentrated leveraged short positions.It may again be the case that bullion banks with large concentrated short positions are manipulating the price lower as has long been alleged by the Gold Anti Trust Action Committee (GATA). The motive would be both to profit and also to allow them to close out their significant short positions at more advantageous prices and possibly even go long in anticipation of higher prices in the coming weeks.Those with concentrated short positions may also have been concerned about the significant decline in COMEX gold inventories.The plunge in New York Comex’s gold inventories since February is a reflection of increased demand for the physical metal and concerns about counter party risk with some hedge funds and institutions choosing to own gold in less risky allocated accounts.Comex gold bullion inventories have slumped 17% already in 2013, falling to just 286.6 metric tons of actual metal on April 11, the lowest since September 2009.This means that futures speculators on Friday sold a significant amount of more paper gold, in an hour or two, then the entire COMEX physical gold bullion inventories.

Saturday, January 12, 2013

Is the US Federal Reserve Indirectly Putting Down Gold Prices?

Evidence suggest that gold prices may have departed from real world activities. Sales of physical gold have exploded to record highs. Moreover central bank buying has been gathering steam, which seems on path to hit new highs this year (500 tons), along with record ETF gold holdings at 2,627 tons.

In the third quarter, according to the World Gold Council (WGC), the world's central banks bought a total 97.6 metric tons of gold.In six out of the last seven quarters, central bank demand has been around 100 metric tons, which is a sharp increase from as recently as 2010, the bank said in a statement, adding that through the third quarter of this year, total central bank buying was up 9 percent.

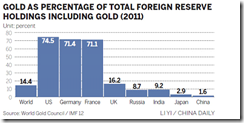

China may decide to increase the percentage of gold holdings in its monetary reserves in the next few years, said the report, an analysis of the world monetary system commissioned by the World Gold Council.Demand for gold is likely to rise amid the uncertainty about the stability of the US dollar and the euro, the main assets held by central banks and sovereign funds, it added.China almost doubled its gold reserves in the last five years. The country had holdings of 1,054metric tons in July 2012 and is now the sixth-largest holder of monetary gold.In 2011, gold accounted for 14.4 percent of the world's total monetary reserves.In a country-by-country comparison, the figure was 1.6 percent in China, while it was 74.5percent in the United States, 71.4 percent in Germany and 71.1 percent in France, according to data from the World Gold Council and the International Monetary Fund.China holds the world's largest foreign exchange reserves, which were worth more than $3.31trillion by the end of 2012, according to figures from the People's Bank of China, the country's central bank.

at 90.8 tons, this was the second highest gross import number of 2012, double the 47 tons imported in October (which many saw,incorrectly, as an indication of China's waning interest in the yellow metal), and brings the Year to Date total to a massive 720 tons of gold through November. If last year is any indication, the December total will be roughly the same amount, and will bring the total 2012 import amount to over 800 tons, double the 392.6 tons imported in 2011.

Exchange traded funds (ETFs), with gold as the underlying asset, have contributed to its prices. Institutional and retail inflows into global gold ETFs are at record levels. ETF holdings have been a key indicator of price movements in the recent years. Reports suggest that at November end last year ETF holdings were at an all-time high of over $150 billion. Till November, holdings in ETFs had risen by 12 per cent to 2,630 tonnes.

Thursday, March 08, 2012

Germany and Switzerland to Review Policy on Gold Reserves

So some central bankers appear to be getting apprehensive over their own set of actions, such that they are now contemplating to secure physical gold ownership—much of which have been stored overseas.

Reports the Resource Investor,

German lawmakers are to review Bundesbank controls of and management of Germany’s gold reserves. Parliament’s budget committee will assess how the central bank manages its inventory of Germany’s gold bullion bars that are believed to be stored in Frankfurt, Paris, London and the Federal Reserve Bank of New York, according to German newspaper Bild.

The German federal audit office has criticised the Bundesbank’s lax auditing and inventory controls regarding Germany’s sizeable gold reserves – 3,396.3 tonnes of gold or some 73.7% of Germany’s national foreign exchange reserves.

There is increasing nervousness amongst the German public, German politicians and indeed the Bundesbank itself regarding the gigantic risk on the balance sheet of Germany's central bank and this is leading some in Germany to voice concerns about the location and exact amount of Germany’s gold reserves.

Writes ZeroHedge,

As it turns out, Germany is not alone: as part of the "Rettet Unser Schweizer Gold", or the “Gold Initiative”: A Swiss Initiative to Secure the Swiss National Bank’s Gold Reserves initiative, launched recently by four members of the Swiss parliament, the Swiss people should have a right to vote on 3 simple things: i) keeping the Swiss gold physically in Switzerland; ii) forbidding the SNB from selling any more of its gold reserves, and iii) the SNB has to hold at least 20% of its assets in gold.

The above account exhibits the growing importance of precious metals even among central bankers.

Interesting times indeed.

Thursday, February 23, 2012

Singapore: The Best Place to Own and Store Gold

The Sovereign Man’s Simon Black says that Singapore is the best place to secure ownership of physical gold

Mr. Black writes,

It’s official. Starting October 1, 2012, Singapore will be the best place in the world to store gold.

As a major international financial center, Singapore is rapidly becoming THE place to invest and do business in Asia. Why? Because it’s just so easy. Regulation is minimal, corruption is among the lowest in the world, and the tax structure is very friendly to businesses and investors. With one exception.

Traditionally, physical gold and silver purchases in Singapore have been taxed at a 7% GST rate (like VAT, or a national sales tax). The only legitimate exception was purchasing (and subsequently storing) at the Freeport facility, adjacent to the main airport.

In just-released budget documents, however, the government of Singapore announced that it will begin waiving GST on purchases of investment grade gold, silver, and other precious metals effective October 1st.

This is huge… and it should really make Singapore the best place in the world to buy and store gold. Prices are already incredibly competitive, with ultra-low premiums and very reasonable storage costs.

Thanks for the tip.