It is important to the Federal Reserve’s low interest rate policy to suppress the bullion price. If the prices of gold and silver continue to rise relative to the US dollar, the Fed cannot keep the prices of bonds high and interest rates low. If the dollar is widely perceived to be declining in value in relation to gold, the price of dollar-denominated assets will also decline, including bonds. If the dollar loses value, the Fed loses control over interest rates, and the US financial bubble pops, with hell to pay.To forestall armageddon, the Fed and its dependent banks cap the price of gold.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, March 12, 2013

Quote of the Day: To Forestall Armageddon, Central Banks cap the Price of Gold

Saturday, March 09, 2013

Infographics: War on Gold, A History of Confiscation

Thursday, January 17, 2013

Bundesbank’s Gold Repatriation will Take Seven Years!

The Bundesbank will repatriate 674 metric tons of gold from vaults in Paris and New York by 2020 to restore public confidence in the safety of Germany’s reserves.The phased relocation of the gold, currently worth about 27 billion euros ($36 billion), will begin this year and result in half of Germany’s reserves being stored in Frankfurt by the end of the decade, the Bundesbank said in a statement today. It will bring home all 374 tons of its gold held at the Banque de France and a further 300 tons from the New York Federal Reserve, it said. Holdings at the Bank of England will remain unchanged.

Saturday, January 12, 2013

Is the US Federal Reserve Indirectly Putting Down Gold Prices?

Evidence suggest that gold prices may have departed from real world activities. Sales of physical gold have exploded to record highs. Moreover central bank buying has been gathering steam, which seems on path to hit new highs this year (500 tons), along with record ETF gold holdings at 2,627 tons.

In the third quarter, according to the World Gold Council (WGC), the world's central banks bought a total 97.6 metric tons of gold.In six out of the last seven quarters, central bank demand has been around 100 metric tons, which is a sharp increase from as recently as 2010, the bank said in a statement, adding that through the third quarter of this year, total central bank buying was up 9 percent.

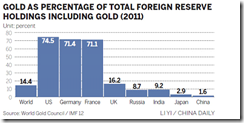

China may decide to increase the percentage of gold holdings in its monetary reserves in the next few years, said the report, an analysis of the world monetary system commissioned by the World Gold Council.Demand for gold is likely to rise amid the uncertainty about the stability of the US dollar and the euro, the main assets held by central banks and sovereign funds, it added.China almost doubled its gold reserves in the last five years. The country had holdings of 1,054metric tons in July 2012 and is now the sixth-largest holder of monetary gold.In 2011, gold accounted for 14.4 percent of the world's total monetary reserves.In a country-by-country comparison, the figure was 1.6 percent in China, while it was 74.5percent in the United States, 71.4 percent in Germany and 71.1 percent in France, according to data from the World Gold Council and the International Monetary Fund.China holds the world's largest foreign exchange reserves, which were worth more than $3.31trillion by the end of 2012, according to figures from the People's Bank of China, the country's central bank.

at 90.8 tons, this was the second highest gross import number of 2012, double the 47 tons imported in October (which many saw,incorrectly, as an indication of China's waning interest in the yellow metal), and brings the Year to Date total to a massive 720 tons of gold through November. If last year is any indication, the December total will be roughly the same amount, and will bring the total 2012 import amount to over 800 tons, double the 392.6 tons imported in 2011.

Exchange traded funds (ETFs), with gold as the underlying asset, have contributed to its prices. Institutional and retail inflows into global gold ETFs are at record levels. ETF holdings have been a key indicator of price movements in the recent years. Reports suggest that at November end last year ETF holdings were at an all-time high of over $150 billion. Till November, holdings in ETFs had risen by 12 per cent to 2,630 tonnes.

Saturday, October 27, 2012

Vietnam’s Banking System Has Been Short on Gold

any time a bank, and especially an entire banking sector, is willing to pay you paper "dividends" for your gold, run, because all this kind of (s)quid pro quo usually ends up as a confiscation ploy. Sure enough, as Dow Jones reports today, the gold, which did not belong to the banks and was merely being warehoused there (or so the fine print said), was promptly sold by these same institutions to generate cash proceeds and to boost liquidity reserves using other people's gold, obtained under false pretenses.And now, it is time for the forced sellers to become forced buyers, as "the State Bank of Vietnam, the country's central bank, may allow local banks to buy up to 20 metric tons of gold over the next two months to improve their liquidity ahead of a ban soon on their use of gold as a means of boosting their operating capital." What they mean is that having been caught engaging in an illegal reserve boosting operating, the banks are now "allowed" to undo their transgressions ahead of a "ban" on what inherently was not a permitted practice. What is left unsaid, of course, is that any gold anywhere in the world, that is not in one's physical possession, and has been handed over to an insolvent bank (virtually all of them) for "safekeeping", is currently being sold, lent out, rehypothecated and otherwise traded with, in a way that any demand for full delivery will generally be met with silence, blank stares and phone calls going straight to voicemail.

Thursday, October 25, 2012

Germany’s Bundesbank Consolidates Gold Holdings

Roughly 66pc is held at the New York Federal Reserve, 21pc at the Bank of England, and 8pc at the Bank of France. The German Court of Auditors told legislators in a redacted report that the gold had "never been verified physically" and ordered the Bundesbank to secure access to the storage sites.It called for repatriation of 150 tons over the next three years to test the quality and weight of the gold bars. It said Frankfurt has no register of numbered gold bars.The report also claimed that the Bundesbank had slashed its holdings in London from 1,440 tons to 500 tons in 2000 and 2001, allegedly because storage costs were too high. The metal was flown to Frankfurt by air freight.

Saturday, October 06, 2012

Charles Goyette: Are the Central Bank Vaults Empty of Gold?

New mine supply of gold this year is estimated to be just under 2,700 tons. But gold demand, growing rapidly over the last 12 years, amounts to an additional 2,268 tons of new gold demand a year today that didn’t exist in 2000.That number was derived from the buying of just five sources: non-western central banks (Russia, Turkey, Kazakhstan, Ukraine and the Philippines), the mints of the U.S. and Canada, ETFs, and Chinese and Indian consumption.This increase in gold demand seems to actually understate the matter, since it doesn’t include huge private investment purchases of physical gold from around the world. For example, Sprott cites China’s Hong Kong gold imports, expected to reach 785 tons this year, as just one additional source of net investment that sees real total demand exceeding new mine supply.But the private investment demand amounts to much more than the Hong Kong gold imports he cites.Other substantial purchases of physical bullion include those by hedge funds and other institutions (the University of Texas endowment fund alone purchased and took delivery of $1 billion of physical gold in 2011), as well as purchases by Russian plutocrats and Persian Gulf petrocrats.The bull market in gold has, after all, been a global event.In short, Sprott concludes there is a big discrepancy between real physical gold demand (own any gold bars yourself? If so, they don’t show up in the demand numbers!) and the purported supply.Where Is All the Gold Coming from?Who is selling the gold that fills the gap between supply and fast-growing demand? Who is releasing physical gold to the market without it being reported, Sprott asks?"There is only one possible candidate: the Western central banks. It may very well be that a large portion of physical gold currently flowing to new buyers is actually coming from the Western central banks themselves. They are the only holders of physical gold who are capable of supplying gold in a quantity and manner that cannot be readily tracked …"Under current reporting guidelines, therefore, central banks are permitted to continue carrying the entry of physical gold on their balance sheet even if they’ve swapped it or lent it out entirely. You can see this in the way Western central banks refer to their gold reserves."The UK government, for example, refers to its gold allocation as, ‘Gold (including gold swapped or on loan).’ That’s the verbatim phrase they use in their official statement."Same goes for the U.S. Treasury and the ECB, which report their gold holdings as ‘Gold (including gold deposits and, if appropriate, gold swapped)’ and ‘Gold (including gold deposits and gold swapped),’ respectively."Unfortunately, that’s as far as their description goes, as each institution does not break down what percentage of their stated gold reserves are held in physical, versus what percentage has been loaned out or swapped for something else."The fact that they do not differentiate between the two is astounding."Loans? Swaps? Repurchase agreements? A house of cards by any other name would topple as fast.It is impossible to know exactly what shenanigans are afoot at the Federal Reserve. Have the gold reserves held by the Fed, the property of the American people, been loaned out? Have the banksters and other Fed cronies borrowed U.S. gold, sold it to China, and left an IOU in the Fed’s vaults?In an age rich with banking and other institutional, credit, and counterparty failures and frauds, such transactions are anything but prudent. Especially since whatever gold the Fed holds is not its property.In a one-time partial audit that the Federal Reserve resisted mightily, the Government Accounting Office found that from Dec. 1, 2007, through July 21, 2010, the Federal Reserve provided more than $16 trillion – a sum equal to America’s entire visible national debt – in secret loans to some of the world’s most politically powerful banks and companies.Among the major recipients of the windfall were Citigroup, Morgan Stanley, Merrill Lynch, Bank of America, Bear Stearns and Goldman Sachs. But the beneficiaries weren’t just American financial institutions.Central Banker to the World?At one point (in October 2008), 70% of Fed loans were to foreign banks. Foreign recipients of the windfall included powerful European banks: Barclays, Royal Bank of Scotland, Deutsche Bank, UBS, Credit Suisse and others.Among the disclosures the Fed was forced to make is that it extended 73 separate loans for an aggregate $35 billion to Arab Bank Corp., owned in substantial part by the Central Bank of Libya.The Fed is a hot bed of cronyism: The discount window, bond purchasing, its primary dealer system and pricing structure, currency and gold swaps and repurchase agreements, Open Market Committee operations, and so on.The light of a full and thorough audit is likely to find all kinds of cronies lurking in these dark corners of the Fed.And with the new, third round of quantitative easing under way, it may not be long before the money-printing game collapses entirely. At that point the calamity will compound if Americans turn to the vaults where the gold was purported to be, and find that the gold has long since been loaned out or otherwise cleaned out.

Sunday, August 23, 2009

Gold As Our Seasonal Barometer

``If our present inflation, as seems likely, continues and accelerates, and if the future purchasing power of the paper dollar becomes less and less predictable, it also seems probable that gold will be more and more widely used as a medium of exchange. If this happens, there will then arise a dual system of prices — prices expressed in paper dollars and prices expressed in a weight of gold. And the latter may finally supplant the former. This will be all the more likely if private individuals or banks are legally allowed to mint gold coins and to issue gold certificates.” Henry Hazlitt (1894–1993) Gold versus Fractional Reserves

I wouldn’t be in denial that seasonal factors could weigh on asset pricing as we mentioned last week.

This Ain’t 2008

But many analysts seem to have taken a rear view mirror (anchoring) of the seasonal factors on the possible performances of the global stock markets.

Given the fresh traumatic experience from the 2008 meltdown, it is understandable that many have written words of caution about navigating the turbulent periods of September and October.

But unless we are going to see another seizure in the banking system, the 2008 episode seems unlikely to be the appropriate model.

True, we could see some heightened volatility, as a result of the variable fluxes in inflation (as in the recent case of China).

But for us, the focus should be on how the US dollar index would be responding to the stickiness of inflation on the financial markets in the current environment, instead of one dimensionally looking at the stock markets vis-à-vis the seasonal forces.

In my view, gold’s strong performance during this period could be a fitting a precursor see figure 3.

Figure 3: Uncommon Wisdom/Sean Brodrick: Entering Gold’s Seasonal Strengths

Figure 3: Uncommon Wisdom/Sean Brodrick: Entering Gold’s Seasonal Strengths

If gold functions its traditional role as the archrival or nemesis to paper money, then simplistically a weaker dollar should translate to higher gold prices.

In Four Reasons Why ‘Fear’ In Gold Prices Is A Fallacy we pointed out that one of the major reasons why the mainstream has been wrong in attributing “fear” in gold prices was because of the massive distortions by governments in almost every market.

Hence, gold or the oil markets, which represents as the major benchmarks to commodity indices, hasn’t been on free markets to reflect on pricing efficiency enough to attribute fear.

Instead, over the short term, government interventions working through different channels such as the signaling, an example would be the previous announcements of IMF gold sales [which eventually got discounted], or other forms of direct or indirect manipulation, has been used as a stick to control gold prices.

This, plus the seasonal weakness has indeed brought gold prices to a tight trading range, instead of collapse as predicted by the mainstream, thereby validating our thesis and utterly disproving the “fear” thesis.

Nevertheless, governments appear to have retreated from selling their reserves under the Central Bank Gold agreement which expires on September. Central Bank’s selling during the first 6 months of the year are down 73% at 39 tonnes (commodityonline). Although as the calendar year closes, central bank selling could step up, but this would likely be met by the seasonal strength and won’

Investment Taking Over Traditional Demand

Also, as we also pointed out in February’s Do Governments View Rising Gold Prices As An Ally Against Deflation?, the dynamics of gold pricing has rightly been changing.

Then we said, ``The implication of which is a shift in the public’s outlook of gold as merely a “commodity” (jewelry, and industrial usage) towards gold’s restitution as “store of value” function or as “money”. The greater the investment demand, the stronger the bullmarket for gold.” (see Figure 4)

Figure 4: World Gold Council: Investment Leads Gold Demand

Figure 4: World Gold Council: Investment Leads Gold Demand

It would seem like another vindication for us, this from the Financial Times, (bold emphasis ours)

``Total identifiable gold demand, at 719.5 tonnes in the second quarter, was down 8.6 per cent compared with same period in 2008, with jewellery consumption down 22 per cent to 404.1 tonnes.

``Investment demand, which includes buying of bars and coins as well as inflows into exchange-traded funds, reached 222.4 tonnes in the second quarter, a rise of 46.4 per cent from the same period a year ago.

``However, the second quarter was the weakest three-month period for investment demand since before the implosion of Lehman Brothers in September 2008…

``Mr Shishmanian [Aram Shishmanian, chief executive of the World Gold Council-my comment] said that although total demand had failed to match the exceptional levels seen when the economic and financial crisis was at its peak, investment demand had enjoyed a strong quarter, underlining a growing recognition of gold as an important and independent asset class.”

In short, yes, investment demand has materially been taking over the dominant role in gold demand over jewelry and industry and will continue to do so as global central banks inflate the system.

China’s Role And The Reservation Price Model

Moreover, China’s government recently loosened up on its investment rules for gold and silver and even encourages the public to participate [see China Opens Silver Bullion For Investment To Public].

On a gold [in ounces] per capita basis, China has only .028 ounces of gold for every citizen, against the US which has .9436 ounces of gold in its reserves for every Americans (Gold World). That’s alot of gold for the Chinese with its huge savings and humongous foreign currency reserves to buy. And that’s equally alot of room for gold prices to move up.

This means that if the inflation process will continue to be reflected on the financial asset prices, then the likelihood is that gold will pick up much steam going to the yearend on deepening investment demand from global investors, perhaps more from Asia and augmented by the seasonal strength.

Moreover, gold will likely serve as a better barometer for the liquidity driven stock markets, in spite intermittent volatility, than from traditional seasonal forces.

Finally, Mises Institute’s Robert Blumen gives a good account of why evaluating the price dynamics of gold shouldn’t be from the conventional consumption model but from reservation prices model.

Since gold prices are not consumed by destruction and where above ground supply remains after being processed or used, the ``owners of the existing stocks own much more of the commodity than the producers bring to market.”

Hence to quote Mr. Blumen, ``The offered price of each ounce is distinct from that of each other ounce, because each gold owner has a minimum selling price, or "reservation price," for each one of their ounces. The demand for gold comes from holders of fiat money who demand gold by offering some quantity of money for it. In the same way that every ounce of gold is for sale at some price, every dollar would be sold if a sufficient volume of goods were offered in exchange.”

Read the rest here.

Thursday, March 12, 2009

GATA: Gold Suppression Scheme Nears End

Watch the video and read parts of the transcript here

Some noteworthy excerpts from the interview,

``The whole mechanism for this has been described in a paper by Lawrence Summers, who was ex-Secretary of the Treasury, but when he was professor of the economics of Harvard University he wrote a paper called "The Gibson paradox and the gold standard". In that research he explains how in a freely traded gold market the real interest rates and the gold price should move in inverse relationship to each other. In other words, if trust rates are low, the gold price should be high and visa versa.

``What we've seen through the 90s and most of this decade is that we've had a low gold price and low interest rates. So, the conclusion we made was that the gold market is not freely traded and it has been suppressed..

``Yes, the Western central banks, with the leaders of federal reserves and governments, have investigated this scheme of suppressing the gold price. And this is what is at the core of the strong dollar policy. If you can suppress the gold price and not make it a free market then you can have low interest rates and a low gold price.

``The low gold price essentially switches off the alarm in the financial system. What the purpose of the strong dollar was so that the US Government could issue lots of dollars without the alarm bells going off. The benefit for the US has been to live beyond their means. They managed to import goods from foreign countries and they have paid for them essentially with overvalued treasure debt. And they have even been so successful they have convinced other central banks that US treasure debt is a reserve asset. Now central banks around the world are sitting on trillions of dollars of treasure debt as a reserve asset which has a huge counterparty risk now of the American government – they will not repay it."

Sunday, February 22, 2009

Do Governments View Rising Gold Prices As An Ally Against Deflation?

As gold nears its all time high see figure 7, public awareness in gold seems to be snowballing.

There are only two major currencies wherein gold trades below its record high; one is the US dollar and the other is the Japanese Yen.

The chart above courtesy of the World Gold Council was last updated February 13th. But as of last Friday’s close, Gold in US dollar terms was seen nearly leveling on its previous high at 1,004.

When gold rises across all currencies, this is symptomatic of a systemic monetary disorder than just mere inflation. There appears to be an accelerating realization that paper currencies issued and guaranteed by the global governments are becoming less sacrosanct, or people have been exhibiting diminished “faith” on the present financial architecture or this has been reflective of paper money’s “race to the bottom” or the effect of the collective efforts by governments to debauch or even destroy their currencies.

Nonetheless, a recent article at the Financial Times had this unusual observation; it noted that rising gold prices seem to be operating under the auspices of governments.

This from Mr. Steve Ellis of RAB Gold Strategy at the FT.com,

``Speaking to central bankers, this is the first time I can recall them actually favouring a high gold price. Normally they see high gold prices as a lack of trust in the financial system (not to mention their ability as central bankers). Alan Greenspan, the former Fed chairman, for example used to target a gold price of around $400 to $500 an ounce.

``Recently, the central bankers have become more enamoured of higher gold prices as it would suggest that their attempts to stave off deflation were starting to work.

``Central bankers in favour of higher gold prices? Things really have changed.”

Gold’s moniker, the “barbaric metal” had been contrived by interventionists because it functioned as rabid nemesis to elastic currency or the ability of authorities to inflate the system to appease the political gods.

Thus, could central bankers truly see gold as an ally against their campaign deflation?

Three reasons why we think this is possible.

Inflation Expectations Needs To Be Reshaped

One, for central bankers, it’s all about signaling channels. This is usually known as the managing of inflation expectations, where the central bank communicates to the markets their policy intentions as to project stability.

In a recent speech, US Federal Reserve chair Ben Bernanke said, ``increased clarity about the FOMC’s views regarding longer-term inflation should help to better stabilize the public’s inflation expectations, thus contributing to keeping actual inflation from rising too high or falling too low.”

You see central bankers believe that inflation can function like a light switch that can be turned on or off, or like a genie that be called in and out of his lamp.

Unfortunately, this is an academic and bureaucratic delusion. In as much as authorities failed to predict the catastrophic consequences of a bursting bubble, they’ve nonetheless equally botched any attempt to rein its deflationary reaction. So they are now hoping that by unduly taking on the inflation risk, they can manage to steer it successfully once the crisis pasts. But like the recent activities, the inflation genie will most likely elude them, until the next crisis surfaces.

Yet by pushing and maintaining interest rates at near zero levels, and the policy shift to adopt the tactical measures of “quantitative easing”, most major central banks (US, Swiss, UK, Japan) appear to be communicating their desire to reignite inflation as means to restore the credit flow.

However, this hasn’t been the entire truth, as we have repeatedly pointed out- the colossal debt structures of the bursting bubble economies require governments to inflate away the real debt levels.

In addition, government’s use of the fiscal medicine to deal with national or domestic economic malaise serves as a parallel approach to stoke inflation in the economy regardless of how ineffectual such efforts are.

Nevertheless, we have almost every government in the world today rehabilitating their domestic economies by instituting inflationary policies. Thus, if gold’s rise should signify as resurgent “inflation” then governments are likely to reticently “cheer” on it.

Enhancement of the Balance Sheet of the US Federal Reserve

Two, if the aim of the US Federal Reserve is to enhance its balance sheet, a revaluation of gold reserves might be necessary.

Using the “backing theory”, which means that the currency’s worth is determined by the underlying assets and liabilities of the issuing agency (wikipedia.org), the Federal Reserve’s attempt to debase its currency is done by absorbing more toxic assets to its balance sheet.

According to Philipp Bagus and Markus H. Schiml, ``Since the crisis broke out, the Fed has continuously weakened the quality of the dollar by weakening its balance sheet. In fact, the assets the Federal Reserve holds have deteriorated tremendously. These assets back the liability side of the balance sheet, which mainly represents the monetary base of the dollar. The assets of the Fed, thereby, hold up the value of the dollar. At the end of the day, it is these assets that the Fed can use to defend the dollar's value externally and internally. Thus, for example, it could sell its foreign exchange reserves to buy back dollars, reducing the amount of dollars outstanding. From the point of view of the buyer of the foreign exchange reserves, this transaction is a de facto redemption.” (bold highlight mine)

Hence, under the backing theory, it isn’t just quantitative easing (printing of money) that determines the currency value but also the qualitative aspects (or what it buys for the asset side of its balance sheet).

Again from Mssrs Bagus and Schiml, ``Despite of all these efforts, credit markets still have not returned to normal. What will the Fed do next? Interest rates are already practically at zero. However, the dollar still has value that can be exploited to keep the experiment going. Bernanke's new tool is the so-called quantitative easing. Quantitative easing is when a central bank with interest rates already near zero continues to buy assets, thus injecting reserves into the banking system. In fact, quantitative easing is a subsection of qualitative easing. Qualitative easing can be defined as the sum of the policies that weaken the quality of a currency.”

Simply said, as the Federal Reserve increasingly digests poor quality of assets into its balance sheet, this effectively reduces its equity ratio from which would eventually translate to its insolvency.

Hence, this would leave the US Federal Reserve with only two options, according to Mssrs Bagus and Schiml, ``Only two things can save the Fed at this point. One is a bailout by the federal government. This recapitalization could be financed by taxes or by monetizing government debt in another blow to the value of the currency.”

``The other possibility is concealed in the hidden reserves of the Fed's gold position, which is only valued at $42.44 per troy ounce on the balance sheet. A revaluation of the gold reserves would boost the equity ratio of the Fed.”

High gold prices would eventually be required for gold to be revalued to enhance the balance sheet of the US Federal Reserve.

End To Gold Manipulation?

Lastly, the surging gold prices suggest an end to possible gold manipulation.

It has been long contended by groups like the GATA that central bank gold reserves has been unofficially “sold”, through lease, swaps and derivatives to the markets, hence gold stashed in the central bank books have simply been accounting entries.

Mr. Robert Blumen of Mises.org cites a report from where a broker endorsed the suspicion of gold manipulation; says Mr. Blumen, ``The major conclusion of the report is that the western central banks have sold a larger fraction of their gold reserves than they acknowledge in their official statements. The gold has entered the market through derivatives such as leases, swaps, the writing of call options against the gold. The sale of the gold is obscured in the central banks books through the representation of leased, swapped, and otherwise encumbered, aggregated together with actual physical gold held in vaults as a single asset on their books. An estimated 10,000-15,000 tons of gold has entered the market since 1996 (compared to an official number of 2,000-3,000) through these mechanisms, according to the report. The purpose of these covert gold sales is part of a larger effort to disable the functioning of inflation indicators, which operate to limit central bank credit expansion.”

Gold’s recent rise has been primarily investment demand driven, see figure 8.

The implication of which is a shift in the public’s outlook of gold as merely a “commodity” (jewelry, and industrial usage) towards gold’s restitution as “store of value” function or as “money”.

The greater the investment demand, the stronger the bullmarket for gold.

If the estimated number of 10,000 to 15,000 tons, is anywhere close to being accurate, then this translates to 40-50% of world central bank gold reserves of 29,697.1 tonnes (gold.org as of December 2008) as having been “shorted”.

Therefore, “short” positions in a rampaging gold bullmarket will extrapolate to additional national balance sheet losses. This implies that world governments, whom are net short positions, will likely be net buyers in the near future.

Although I haven’t been totally convinced about the “gold manipulation theory”, I am, however, open to it, in the understanding of the political nature of central banking. Central bankers don’t want competition or interference from gold, thus, the odds that price controls may have attempted in the past.

The implication is that the bullmarket in gold will possibly be accelerating once governments’ covers open short positions. And if we see $100 dollar a day moves, perhaps this theory might be validated.

And since the gold market is an iota or about 6% or $5 trillion (165,000 tonnes of above ground gold) relative to the overall financial markets, this suggests that a bullmarket market will likewise spillover to important key commodities as silver, copper and oil.

Moreover, any panic into gold will likewise see a panic to own producers, which functions as proxy to gold by virtue of reserves.

For now, central bankers would likely to be “sleeping with the enemy”.