The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, November 26, 2013

Indonesia Crisis Watch: Rupiah Falls to New Lows, JCI drops 2.3%

Saturday, November 23, 2013

Phisix and the Manny Pacquiao Post Hoc

The CHART OF THE DAY shows the Philippine Stock Exchange Index has risen 73 percent of the time in the first trading day after a Pacquiao win, compared with 52 percent for all days since 2007. The gauge climbed an average 0.5 percent the day after fights, versus an average 0.04 percent increase for the entire period.“Pacquiao’s victory in the ring creates a nationwide euphoria that things will get better -- positive sentiment, positive investment,” said Jonathan Ravelas, chief market strategist at BDO Unibank. “A victory by Pacquiao will help lift the Philippine spirit at a time when it’s facing the impact of calamities. The nation definitely needs to hear something positive right now.”

Tuesday, February 12, 2013

Curse of the Laffer Curve: Why Manny Pacquiao Prefers His Next Fight Outside the US

Manny Pacquiao's chief adviser insisted Monday that the Filipino superstar's preference is for his next bout – a fifth fight against Juan Manuel Marquez – to take place away from Las Vegas, with the off-shore Chinese gambling resort of Macau emerging as the "favorite."Michael Koncz told Yahoo! Sports that the 39.6 percent tax rate Pacquiao would face if he were to fight again in the U.S. makes a fall bout in Las Vegas "a no go."Promoter Bob Arum is hopeful of arranging a fifth match between Pacquiao and Marquez in the fall, potentially on Sept. 14. Arum's preference is for the fight to be at the MGM Grand in Las Vegas, which is his company's home base.But Arum and Koncz say Pacquiao is balking at the additional money he'd lose to the government if the fight were held in Las Vegas. Arum said Pacquiao would not have to pay taxes if the fight takes place in casinos in either Singapore or Macau."Manny can go back to Las Vegas and make $25 million, but how much of it will he end up with – $15 million?" Arum said. "If he goes to Macau, perhaps his purse will only be $20 million, but he will get to keep it all, so he will be better off."

Wednesday, December 12, 2012

Manny Pacquiao Didn’t Let Fans Down, Prodded by Media Fans Deluded Themselves

From MSN News

"The low morale, the sadness, I accept that. This is my job.... But the reaction of the Filipinos, the many who cried, especially my family, it really hurts me," he said in an interview on the GMA network.The former eight-division world champion wiped tears from his eyes listening to his wife, Jinkee, make a tearful appeal on camera for her husband, who turns 34 next week, to hang up his gloves.

This is a great example of bubble psychology. The same lessons which will permeate and eventually apply to the Philippine capital markets.

"Journalism is popular, but it is popular mainly as fiction. Life is one world, and life seen in the newspapers is another."

Monday, December 10, 2012

Juan Marquez Shows Manny Pacquiao is Only Human

Of course reality bites, Mr. Pacquiao’s fame, fortune and political career have all been tied up with his boxing career. Once Mr. Pacquiao retires this privilege will erode overtime, as with all of the local celebrity sporting forebears.So he may push his boxing career to the limits or take unnecessary risks in order to struggle to preserve this privilege.

Monday, June 18, 2012

Surprise, Manny Pacquiao is Human

Veteran sport analyst and commentator Ronnie Nathanielsz finally awakens to reality and asked the right question “Is Pacquiao Slowing Down”

Mr. Nathanielsz at yahoo.com

As we cautioned some years ago, the late nights, the drinking and gambling would eventually take its toll on Pacquiao's physical condition and when the effects of abuse of a person's body and the effects of dissipation set in, it often happens abruptly.

A careful review of the fight tape shows Pacquiao has lost a split second in terms of speed, which both Arum and trainer Freddie Roach long pointed to as a key factor in Pacquiao's arsenal which effectively accentuated his power.

"Speed kills" was what Arum pointed to before Pacquiao pulverized De La Hoya that saw him quit on his stool at the end of the seventh round.

That speed has diminished as Pacquiao nears his 34th birthday on December 17, and as we assess his diminishing assets of speed and devastating power we need to accept the reality that the passing of the summers inevitably takes its toll on even the finest, relentlessly hardworking athlete who walked through the doors of Roach's Wild Card Gym in Los Angeles in the first week of June 2001, eleven long years ago. The innumerable fights, the punches he has taken, the burdens of training and the demands on his time as a congressman, a crossover superstar, a TV personality and a caring human being not to mention his former wild and wooly ways have surely taken their toll and its time we admit it, although such an admission doesn't mitigate the high crime committed in Las Vegas last June 9.

Let us put in a simple way: Contrary to popular expectations, Manny Pacquiao is just human. Yes read my lips, human. Mortal. Not superman. Yes, he susceptible to physiological ageing as anyone else.

Even if Mr. Pacquiao did away with gambling, drinking or late night escapades during his early years, unless technology will save the day, age will function as Manny’s neutralizing factor. This exempts no one, not even priests, monks or other vice free celibates.

You can go to the Boxing Hall of Fame and examine one by one and determine the median, if not the average age, when these former boxing legends had their career inflection point or when they retired.

That’s where the legendary Manny Pacquiao is today.

In the past, most of Pacquiao’s scintillating or brilliant victories came at the expense of OLDER boxers as noted I here. That cycle has turned.

Mr. Pacquiao will now wear the shoes of his former older opponents as most of his contemporaries have hanged up their gloves. So he will be faced with YOUNGER boxers even if he wins against Tim Bradley in a return bout.

The point is the more Pacquiao fights, the lesser the chances of his victory. Of course, this comes in the condition that he duels with younger foes with world class caliber.

And if he insist on staying on the ring, we should expect that after 3-4 more bouts (assuming 2 fights a year), the chances of losing badly (by KO or TKO) will become very significant. And that's when reality will sink in to him (that's if he remains stubborn to pursue more ring engagements)

So while relative age matter, a boxer’s career cycle has even more impact.

In economics, this is merely called the law of diminishing returns.

The law of diminishing returns based on the physiological ageing process has brought upon the twilight of Mr. Pacquiao’s boxing career.

Truth hurts. But that’s how nature works.

Deal with it.

Monday, June 11, 2012

Expect a Continuation of the Risk ON-Risk OFF Environment

Today’s controversial split decision loss by World champion and Filipino boxing legend Manny Pacquiao serves as a vivid example of the self-imposed limits of nature on people.

As I pointed out on my blog[1], about 2 hours prior to the Pacquiao-Bradley match, Pacquiao has almost reached the natural speed limits of boxers, where the law of diminishing returns from ageing will turn the tide against him. Pacquiao’s contemporaries, the greatest boxers of the pasts, essentially sought retirement by mid-30s. Mr. Pacquiao is 33 and turns 34 this December.

And contrary to popular expectations, today’s match reveals that the venerable (in sports, not in politics) Filipino champion Manny Pacquiao is just like everyone else, a mortal. A victory from a rematch will not take away the laws of nature. The Pacquiao-Bradley fight heralds the twilight of the Pacquiao boxing era.

Pacquiao’s experience applies to the markets, the inflationism is a policy that will not and cannot last.

For the past few weeks, I have been emphasizing on this[2].

Like it or not, UNLESS there will be monumental moves from central bankers of major economies in the coming days, the global financial markets including the local Phisix will LIKELY endure more period of intense volatility on both directions but with a downside bias.

I am NOT saying that we are on an inflection phase in transit towards a bear market. Evidences have yet to establish such conditions, although I am NOT DISCOUNTING such eventuality given the current flow of developments.

What I am simply saying is that for as long as UNCERTAINTIES OVER MONETARY POLICIES AND POLITICAL ENVIRONMENTS PREVAIL, global equity markets will be sensitive to dramatic volatilities from an increasingly short term “RISK ON-RISK OFF” environment.

And where the RISK ON environment has been structurally reliant on central banking STEROIDS, ambiguities in political and monetary policy directions tilts the balance towards a RISK OFF environment.

Proven True: Sharp Volatility on Both Directions With A Downside Bias

This week, local markets confirmed my assessments.

Today’s dramatic volatilities have been representative of the gross distortion of the financial markets from sustained interventionism in various forms.

Unlike Pacquiao’s predicament, while it may be so that peak inflationism has yet to be reached, I believe that we are nearly there. All it would probably take is a global recession which will likely be met by the fully loaded firepower of central bankers.

Because the Phisix missed the selloff during the previous week as global markets got clobbered which I suspect has been due to some interventions by non-market forces, Monday’s 3.4% quasi-crash seems like a belated ventilation of the downside volatility that I have been concerned with.

Yet bulls remain in the hopeful that stock markets will continue to climb, I am not sure. Again, evidences don’t seem to confirm this and that the conditions I have stated above has yet to be met.

Also the current actions in the Phisix serve as a wonderful example of the tradeoffs between magnitude and frequency, where the frequency of accrued small gains can easily be wiped out by rare short bout/s of huge moves.

One of my favorite radical thinkers Nassim Nicolas Taleb called this the Turkey problem.

I explained in February of 2011[3]

The Turkey is fed from day 1 and so forth, and as a consequence gains weight through the feeding process.

From the Turkey’s point of view such largesse will persist.

However, to the surprise of the Turkey on the 1,001th day or during Thanksgiving Day, the days of glory end: the Turkey ends up on the dinner table. The turkey met the black swan.

The turkey problem is a construct of the folly of reading past performance into the future, and likewise the problem of frequency versus the magnitude, both of which serves as the cornerstone for Black Swan events.

In short, to avoid being the turkey means to understand the risk conditions that could lead to a cataclysmic black swan event (low probability, high impact event).

And this is why it has been IMPERATIVE to establish the underlying risk conditions affecting the marketplace rather than simply guessing on where short term fluctuations are headed for.

Given the current conditions, I wouldn’t want to be the turkey that ends up on the dinner table.

I would rather identify a trend that can provide me the opportunities for measured price moves in the face of established risk conditions given a time window to work on. Luck, to paraphrase the distinguished French chemist and microbiologist Louis Pasteur[4], favors the prepared.

In other words, determining the whereabouts of the stages of the boom bust cycle should be more of the priority than just the price levels.

Volatility has been ubiquitous and not limited to the Phisix. The US S&P 500 has been experiencing the same degree of turbulence.

Under current environment it would be very risky to interpret sporadic moves as sustainable trends.

Even gold has not been spared from drastic pendulum swings.

While I am still exceedingly bullish gold over the long run, I think there will equally be strong vacillations on both directions. Perhaps gold will undergo a consolidation phase first. But a severe downside move cannot be discounted.

Yet going back to the Phisix, the major Philippine bellwether was down only by 1.35% over the week which means 60% of Monday’s losses had been recovered.

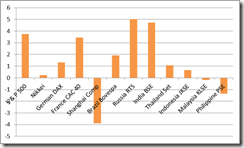

At the world markets, this week’s performance has been in sharp contrast with that of the previous.

Monday’s quasi-crash by the Phisix has partially been offset by intra-week succession of gains whose rebound comes in the light of a global rally founded on multiple reports of rescues.

The markets cheered when ECB’s president Mario Draghi declared that “We monitor all developments closely and we stand ready to act”[5]. Also proposals for a grand rescue mechanism via a regional banking union had been floated[6] to the delight of steroid addicted markets.

Meanwhile, the US Federal Reserve chair Ben Bernanke employed the same I will backup the markets spiel with “As always, the Federal Reserve remains prepared to take action as needed to protect the US financial system and economy in the event that financial stresses escalate”[7] US markets soared.

India’s Prime Minister also chimed in to promise more engagement of fiscal spending on infrastructure projects[8].

Notice that outside Russia’s equity markets, the best gainers had been stock markets which made promises of rescues, particularly the India, US, Germany and France.

Ironically, the reaction has been different for those who actualized easing policies.

Australia pursued policy easing by chopping policy interest rates by 25 basis points for mortgages and business loans[9]. However, Australia’s stock market seems to have ignored the monetary stimulus by closing almost unchanged for this week.

More dramatically, China also did respond by cutting of interest rates for the first time since 2008, coupled with the further loosening of controls over lending and deposit rates[10]. Yet instead of recovering, China’s major equity bellwether, the Shanghai index slumped by 3.88% this week.

Again the Shanghai index also manifested the same volatility symptoms as with the rest. The difference is that the downside of China’s equity markets has been more elaborate and possibly signifies the admission of the severity or depth of China’s economic junctures and possibly too of the manifestations (or say protests) of the inadequacy of policy responses.

The point to emphasize is that financial markets has been vastly distorted and importantly, have been held hostage by politics.

As the illustrious Ayn Rand rightly explained[11],

When you see that trading is done, not by consent, but by compulsion - when you see that in order to produce, you need to obtain permission from men who produce nothing – when you see money flowing to those who deal, not in goods, but in favors – when you see that men get richer by graft and pull than by work, and your laws don't protect you against them, but protect them against you – when you see corruption being rewarded and honesty becoming a self-sacrifice – you may know that your society is doomed.

Risk ON-Risk OFF: Capital Flight, Bursting Bubbles and Political Gridlock

If the solution to the current crisis is about having more “stimulus”, then it would be ironic to have seen trillions upon trillions of dollars of “stimulus” thrown into the system, since 2008, and yet see the crisis linger, if not intensify.

Mainstream thinkers have been utterly lost or confused with the current situation for the simple reason that the commonsensical approach of keeping one’s house in order has been eschewed and substituted for the philosopher’s stone of bailouts and money printing. In a world based on aggregates, commonsense is a scarcity while fantasies are in abundance.

Where the problem has been about the lack of competitiveness and economic opportunities from too much regulation, bureaucracy and welfare spending, the propounded solution has been to “tax”, “spend”, “inflate”, “regulate” or “centralize” as if government can increase productivity by edict or by throwing money from helicopters.

Common sense also tells us that if these things worked we don’t need to work at all.

Yet when the law of diminishing returns for these interventionist measures becomes apparent, they ask for more of the same set of actions. The problem of debt requires to be solved by more debt (see above [12]). It’s like if your problem has been about alcohol then you should take more alcohol!

For the mainstream, money is wealth. Print money and everything gets solved. These have been the same prescription that has been complicating today’s crisis scenario with “exit” and “drachmaisation” therapy.

Yet instead of people willing to accept sacrifices for the “common good” as so expected by omniscient mainstream experts, reality reveals the opposite, people run and hide for cover.

There has been accelerating exodus of foreign money from Spain’s banking and financial system as shown above.

Dr Ed Yardeni notes[13],

According to data compiled by Spain’s central bank, foreigners reduced their deposits at Spanish credit institutions by 102.3 billion euros from a record high of 547.1 billion euros during June 2011 to 444.7 billion euros during March. In March alone, the outflow was 30.9 billion euros, and it probably accelerated during April and May…

The TARGET2 balances are more or less consistent with the trends in M2 money supply measures over the past year showing that they are falling in Spain and Greece while rising in Germany. On balance, M2 in the euro zone was up 2.8% y/y during April. This suggests that while the area's depositors are moving their funds from the periphery to the core countries, they aren’t fleeing the euro. However, the recent plunge in the euro suggests that they may be starting to shift funds into the US dollar.

Such exodus or capital flight out of the crisis affected EU nations has been destabilizing money supply conditions around the world.

Residents of these economies obviously don’t like to get robbed of their savings through the loss of purchasing power or through policies of devaluation. Devaluation theory is getting hit right smack on the faces of statist experts.

I pointed out last week that Swiss bonds have turned negative.

The same with Denmark’s 2 year bonds[14] as resident and foreign money flees Greece, Italy, Portugal or Spain. People from these nations would rather pay Swiss and Denmark’s central banks for safekeeping of their money than risk real losses from devaluation and the real risk of a collapse of the banking system.

The US Federal Reserve has partly countered the surges of capital flows by contracting their balance sheet.

This is perhaps comes along with the culmination of Operation Twist[15]—or the selling bonds with maturities of 3 years and below, which should lead to a decline of money supply and which eventually implies of negative effects on the markets. I would suspect that the gold markets have been sensing this thus the current volatility

Of course, once the episode of today’s capital flight from the Eurozone diminishes (which should amplify the money contraction), the FED will likely try to neutralize this by replacing or buy back of the assets which they earlier sold. Unfortunately the FED does not know beforehand when this will be happening, thus will only resort to reactive measures.

The uncertainty in the monetary actions should lead to heightened volatility that would be transmitted into the markets.

Hence, we should EXPECT very volatile markets ahead.

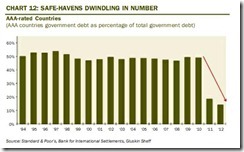

There could be another problem for further monetization of debts. Even if central bankers decide to print more money as another temporary patch to the current turmoil, the availability of their preferred asset[16], government bonds, has accounted for a steep decline. This implies that any future central bank purchases will likely be centered on mortgages and or privately issued securities (equities?).

The bottom line is that the combined effects of interventionism through price controls and bailouts which had prevented markets from clearing malinvestments or misallocated overpriced resources ALONG WITH sharp vacillations of capital flows as consequence of capital flight AND indecisive central bankers in the face of steroid dependent markets have been prompting for the recent market stresses.

This hasn’t been about imaginary ‘liquidity traps’ but of people’s subjective responses to perceived to political risks and policy uncertainties.

Yet as of this writing Spain has asked for $125 billion of rescue fund[17] as firewall from a potential fallout from the elections in Greece.

Does this imply a smooth sailing for the markets? We will see.

And as ramifications to the current dislocations in the monetary sphere out of policy indecisions and of political standoffs, it’s really hard to be unrealistically sanguine when forward indicators of factory activities have shown a synchronized decline[18]. The UK and Eurozone are in a recessionary mode, China is on the borderline while the US seems to be rolling over.

One offsetting factor has been today’s reported surge in China’s external trade[19]. Again this should be monitored rather than taken at face value given all of the above.

Yet we should ask; what if today’s (Pavlovian) stimulus conditioned markets become blasé to further promises from policy procrastination? How would the markets respond?

Again we need to seek clarity in all these than just recklessly plunging into markets centered on the belief that rescues would inherently come along and ride like a white knight to save the proverbial damsel in distress. The reality is that money does not grow on trees.

Thus we should expect the continuation of the Risk ON Risk OFF environment until concrete actions would have been taken.

It is only from here where we can have a sense of direction. And where we can assess and decide as to what position to take.

It is unfortunate that Pacquiao had to lose, but reality has long been staring at him which he denied, and may continue to deny. Many thought he was impervious and invincible too. They were all wrong.

The same with popular expectations for sustained bailouts, reality stares at our faces which we continue to deny. Yet the mounting intensity of crisis upon crisis has been admonishing us of the increasingly tenuous system. Public opinion will be proven wrong too.

Yet I am not saying that we should all be 100% cash. I am saying is that we should get less exposed to equities and overweight cash until conditions change. If the ECB and the FED collaborate on a maximum overdrive to stuff their balance sheets in exchange for green pieces of papers marked by Benjamin Franklins to the public, then we should make a swift move back into commodity based insurance positions. I suspect that come the next phase of interventions, it won’t be a risk ON risk OFF landscape but possibly one of STAGFLATION.

In the meantime be very careful out there.

[1] See On Manny Pacquiao’s Boxing Career, June 10, 2012

[2] See The RISK OFF Environment Has NOT Abated, May 27, 2012

[3] See Dealing With Financial Market Information February 27, 2012

[4] Wikipedia.org Louis Pasteur

[5] Bloomberg.com Draghi Says ECB Is Ready To Act As Growth Outlook Worsens, June 6, 2012

[6] See Eurozone’s Proposes Grand Bailout: Regional Banking Union, June 7, 2012

[7] Telegraph.co.uk Ben Bernanke says Fed ready to act if crisis intensifies, June 7, 2012

[8] See HOT: India Joins Pledge for Stimulus June 7, 2012

[9] Reuters.com ANZ cuts variable mortgage rates by 25 basis points June 8, 2012

[10] See HOT: China Cuts Lending Rates and Deposit Rates, June 7, 2012

[11] Rand, Ayn Atlas Shrugged Money padworny.com p. 387

[12] Price Tim Fixed Cobden Center March 12, 2012

[13] Yardeni, Ed Europe June 4, 2012 yardeni.com

[14] Bloomberg.com Denmark Government Bonds 2 Year Note Generic Bid Yield

[15] Wikipedia.org History of Federal Open Market Committee actions

[16] Zero Hedge, Presenting Dave Rosenberg's Complete Chartporn June 1, 2012

[17] Bloomberg.com Spain Seeks $125 Billion Bailout As Bank Crisis Worsens, June 10, 2012

[18] Yardeni Ed, Global Manufacturing June 5, 2012 yardeni.com

[19] Bloomberg.com China May Export Growth Tops Estimates As U.S. Demand Rises, June 10, 2012

Sunday, June 10, 2012

On Manny Pacquiao’s Boxing Career

This morning, much of the Philippines will be in a standstill as World Boxing champion local idol Manny Pacquiao goes back into the ring.

As a former boxing enthusiast (during my teenage days), I’d say that Manny Pacquiao is past his prime and will likely succumb to a younger player than he is, perhaps as days go by.

I’m not predicting that he will lose this or today’s match. But I am saying that the chances of continued victories will likely diminish if he persists to fight. This will be pronounced especially when he gets to fight younger boxers. It’s simply called the law of diminishing returns brought about by ageing.(unless technology comes to Mr. Pacquiao's rescue)

As a physical contact sport, age and mental condition are what fundamentally matters. Others like physical conditioning, ring technique and tactics are subordinate to this.

Unknown to many, most of Manny Pacquiao’s great victories came against pugilists older than he is (Marco Antonio Barrera, Juan Manuel Marquez, Oscar de La Hoya, Joshua Clottey, Shane Mosley) or at his age level (Ricky Hatton and Antonio Margarito). Only Miguel Cotto has proven to be the younger player whom Pacquiao recently beat.

In addition, the typical retirement age of many boxing legends is at the mid-30s.

The unbeaten Rocky Marciano made a comeback and retired by age 36. The great Muhammad Ali, my favorite hang up his gloves by age 39, but this came amidst back-to-back losses and the emergence of his Parkinson’s disease.

In short, based on the track record of great boxing legends, Pacquiao’s window of boxing greatness has been narrowing.

And there is always the psychological factor. Mike Tyson has been a great of example of a champion consumed by psychology particularly of hubris.

Mr. Pacquiao’s record as politician has not been smooth either. Corruption has been attributed to him, a recent dispute with the local tax agency the BIR shows that he is not an ally of the incumbent administration, and lastly, “God told me to retire”, for me, is a sign of admission of the actual state of his physical condition and of mental stress, where religion becomes his escape mechanism, or as means to endear himself with voters.

In reality, contrary to the popular opinion, it would not be Floyd Mayweather Jr., who will likely beat him, who again is older than Pacquiao and who is more mentality stressed than he is and will likely lose to Pacquiao, but some younger foe.

Of course reality bites, Mr. Pacquiao’s fame, fortune and political career have all been tied up with his boxing career. Once Mr. Pacquiao retires this privilege will erode overtime, as with all of the local celebrity sporting forebears.

So he may push his boxing career to the limits or take unnecessary risks in order to struggle to preserve this privilege.

[UPDATED to ADD: 28 years old Tim Bradley split decisions 33 years old Manny Pacquiao]