The US government overtly intervenes in the gold markets when it uses gold as a foreign policy tool.

From the Economic Times:

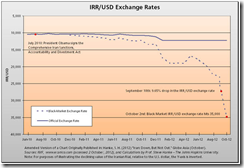

WASHINGTON: The United States is working to block sales of gold to Iranians in order to undermine their currency the rial and to step up pressure on Tehran over its nuclear program, officials said on Wednesday.From July 1, the US will ban sales of gold by anyone to either the Iranian government or to Iranian citizens, a senior US Treasury official said. Washington has warned Iran's neighbors Turkey and the United Arab Emirates, key regional centers of the gold trade, to stop gold sales to Iran, said David Cohen, treasury under-secretary for terrorism and financial intelligence.

Embargoes and trade sanctions are acts of war. The US has been provoking Iran into a war ever since.

Yet the US government’s arbitrary ban gold sales are really an attack on the average Iranians whom has gravitated to gold and to bitcoins due to Iran’s simmering hyperinflation.

This shows how ruthless governments are, in wanting to starve or sacrifice innocent civilians in order to serve the political (neocons) and economic (military industrial complex) interests of the powerful elites.

And I don’t think gold has just been a foreign policy tool but a monetary signaling channel or central bank communications tool as well.

“Wall Street versus the world” attempts to impress upon the main street and the real economy that gold has lost its luster as inflation hedge. The Iranian ban seem to also suggest of the same. The same article quotes the above US official: (bold mine)

The move to block gold sales is part of the effort to further weaken the rial, he explained. "There's a tremendous demand for gold among private Iranian citizens, which in some respects is an indication of the success of our sanctions.""They are dumping their rials to buy gold as a way to try to preserve their wealth. That is I think an indication that they recognize that the value of their currency is declining."

So from the political authority’s perspective, the ban on gold means that Iranians would have to revert to the rapidly diminishing value of the rial and die alongside with the decaying currency.

Nonetheless the average Iranians know better thus the “dumping their rials to buy gold as a way to try to preserve their wealth”.

Gold, not an inflation hedge? Only in Wall Street.

Like all forms of prohibitions they are most likely to fail.