One of the popular mainstream deceptions or mendacity employed by the apologists or lackeys of the state has been to repeatedly claim that there has been “no visible signs of inflation”.

Really?

Then how come even the OECD acknowledges that price inflation exists?

From AFP,

Higher energy prices forced annual inflation in advanced economies to rise to 2.0 percent in August from 1.9 percent in July, the OECD said Tuesday."Energy price inflation accelerated sharply to 3.5 percent in August, up from 0.7 percent in July, while food price inflation slowed to 2.1 percent in August, compared with 2.3 percent in July," said the Organisation for Economic Cooperation and Development in a statement.Excluding food and energy, the annual inflation rate slowed to 1.6 percent in August compared with 1.8 percent in July, according to the data for the 34-member OECD.By individual countries, inflation gained pace in Germany, reaching 2.1 percent in August from 1.7 percent in July, while in the United States it advanced to 1.7 percent from 1.4 percent.In Japan, however, consumer prices dipped 0.4 percent in August.Outside the OECD area, annual inflation accelerated in India to 10.3 percent in August from 9.8 percent in July.Inflation also rose in Russia to 5.9 percent from 5.6 percent and in China to 2.0 percent from 1.8 percent, the organisation said.Annual inflation was stable in Brazil from July to August at 5.2 percent and Indonesia at 4.6 percent.

Let us put this way, if central banks were to acknowledge that price inflation exists then what justifies their current policies of inflationism?

Here is an example. The Bloomberg Businessweek quotes Fed Chairman Ben Bernanke

Five years of low interest-rate policies “have not led to increased inflation,” and the public’s expectations for price gains “remain quite stable,” Bernanke told the Economic Club of Indiana.

In reality, the policy of inflationism has been justified based on the supposed non-existence or non-threat of price inflation. Should inflation become a menace, central banks might be forced to resort to tighten or to exit from the current accommodation phase which will spoil Bernanke-global central banks support for their cronies.

And may I also reiterate that Ben Bernanke’s explicit goal has been to support the asset markets.

I quoted Mr. Bernanke in my last stock market outlook

The tools we have involve affecting financial asset prices. Those are the tools of monetary policy. There are a number of different channels. Mortgage rates, other rates, I mentioned corporate bond rates. Also the prices of various assets. For example, the prices of homes. To the extent that the prices of homes begin to rise, consumers will feel wealthier, they’ll begin to feel more disposed to spend. If home prices are rising they may feel more may be more willing to buy home because they think they’ll make a better return on that purchase. So house prices is one vehicle. Stock prices – many people own stocks directly or indirectly. The issue here is whether improving asset prices will make people more willing to spend. One of the main concerns that firms have is that there is not enough demand…if people feel their financial position is better they’ll be more likely to spend….

So are we not seeing asset price inflation?

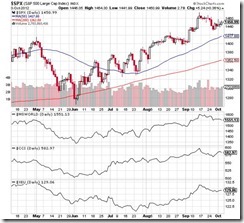

The post Bernanke’s QE forever or infinity has brought back the Risk ON environment as I earlier noted

This has been back led by US Stocks (SPX).

Risk ON means that world equities (MSWORLD), commodities (CCI) and even the euro (XEU) have risen in tandem.

Junk bonds have been booming too.

Inflationism does not necessarily translate to price inflation but to boom-bust cycles. But given the concerted efforts by all major central bankers to reflate (manipulate) the system, not only just boom bust cycles, but price inflation poses as clear and present danger.

Yet like incantation, the political pious repeatedly mumbles of the supposed NO price inflation environment.

Go figure.

The following charts are all from tradingeconomics.com.

Euroland

United States

United Kingdom

Japan (the only exception)

China

Brazil

Russia

India

And all these considers the accuracy of the respective statistics. As stated above, governments are likely to under declare inflation rates for political reasons.

One thing the above suggests is that the world is headed initially for stagflation.

Updated to add:

Ironically, the New York Fed's economic model predicts of "explosive inflation"

From Zero Hedge:

Updated to add:

Ironically, the New York Fed's economic model predicts of "explosive inflation"

From Zero Hedge:

Carlstrom et al. show that the Smets and Wouters model would predict an explosive inflation and output if the short-term interest rate were pegged at the ZLB (Zero Lower Bound) between eight and nine quarters. This is an unsettling fi nding given that the current horizon of forward guidance by the FOMC is of at least eight quarters

No comments:

Post a Comment