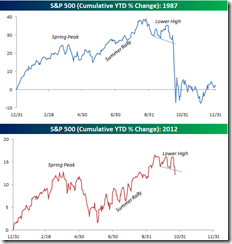

Bespoke Invest has a spooky chart which tries to paint a parallel of the S&P 500 today with the infamous October 19th Black Monday crash in 1987, 25 years ago

To counter or to alleviate the adverse message from such pattern seeking diagram, the Bespoke writes,

While the patterns between 1987 and 2012 are similar, there are two key differences. First, the S&P 500 was up considerably more at its peak in 1987 (+39%) than it was at the 9/14 peak this year (+16.6%). Secondly, in terms of valuation, the S&P 500's P/E ratio is considerably lower now than it was in 1987. In 1987, the S&P 500's P/E ratio at the low after the crash (14.37) was still higher than it is now (14.28).

Well, crashes really don’t happen because of financial ratios or the degree of year-to-date gains. These are symptoms rather than causes.

In the 1987 episode, the equity market crash signified an amalgam of events: inflationism by global governments via the 1985 Plaza Accord and the February 1987 Louvre Accord, Portfolio insurance, the twin deficits, massive speculation brought about by easy money policies in the US…

As Prudent Bear’s Doug Noland narrates

Credit excesses were certainly not limited to government finance. Total Non-Financial Debt expanded 14.8% in 1984, 15.6% in 1985 and 15.6% in 1986. The Credit boom was broad-based, with Federal, State & Local, Household, and Corporate debt all expanding at double-digit rates throughout the period. Financial Sector Credit Market Debt was exploding, with growth of 17.5% in ’84, 19.3% in ’85, and 26.2% in ’86. Importantly, this growth reflected the commencement of a historic expansion of non-bank Credit, led by (Agency/GSE) MBS and ABS, along with finance company and (“captive finance”) corporate borrowings.

And equally the influence of Japan’s domestic bubble on the US stock market, again Mr. Noland

The market and U.S. economic environments troubled Toyota executives back in 1987. They were also plenty worried about Japan. Japanese policymakers were under intense American pressure to stimulate their economy in order to remedy their widening trade surplus with the U.S. After beginning 1986 at about 13,000, Japan’s Nikkei equities index surpassed 26,000 in the autumn of 1987. The Japanese real estate balloon was also rapidly inflating, even as consumer prices remained well contained. Toyota officials were increasingly worried that loose monetary policy and other stimulus measures had fostered a dangerous Bubble in Japan. The 1987 crash proved but a minor setback for the Japanese Bubble, as “terminal phase” excesses in 1988 and 1989 sealed Japan’s fate. The Nikkei ended 1989 at 38,916. The Nikkei closed Friday, some 23 years later, at 9,003.

The point is that crashes (sharp asset deflation) occur because of prior booms (dramatic asset inflation).

Crash dynamics, therefore, represent unintended consequences from the interventionism from political authorities.

Will the pattern repeat itself this year? I can’t say, though the risks have ALWAYS been present given my definition of crash dynamics.

The conspicuous “parallel universe” or the environment where markets seems to have “detached” or "diverged" from economic reality signifies as evidence of such monetary interventions prompted dislocations that has led to the recent asset inflation (boom).

The economic activities has simply been out of touch with the markets as shown above.

Yet the key difference between then 1987 and today has been global central bankers aggressive actions to explicitly support asset prices

In short, crash dynamics will be an offshoot to the action-reaction feedback loop of central bankers to the unfolding events or conditions. The balance sheets of central banks continues to balloon. Recent announcements has been made to add up to this (an estimated $2 trillion from the FED-ECB), and more will be coming as central banking inflationism becomes the only remaining tool in support of the political economic status quo.

Eventually markets will prevail though, (there will massive wave of defaults or super inflation, if not, hyperinflation).

But in the meantime, my bet has been for a non-crash scenario for October or for this year.

No comments:

Post a Comment