The boom produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration. The individual is always ready to ascribe his good luck to his own efficiency and to take it as a well-deserved reward for his talent, application, and probity. But reverses of fortune he always charges to other people, and most of all to the absurdity of social and political institutions. He does not blame the authorities for having fostered the boom. He reviles them for the inevitable collapse. In the opinion of the public, more inflation and more credit expansion are the only remedy against the evils which inflation and credit expansion have brought about.-Ludwig von Mises

Last week I noted that a broad based strengthening Philippine Peso against major currencies could likely fuel carry trades and arbitrage opportunities ahead that may push the Phisix towards the 10,000 levels.

I wrote[1],

What this means is that the Philippines (and our ASEAN contemporaries) is likely to lure spread arbitrages or carry trades from US, Japanese, Swiss and European investors or punters that is likely to kick start a foreign stimulated boom in the local assets including those listed on the Philippine Stock Exchange.

It has barely been a week since I penned this observation. However today’s news headlines seem to provide clues in the direction which may confirm my long held thesis.

The headline says that Japanese investors are bullish the Philippines and would likely commit more investments[2].

In a survey, JETRO, the Japanese government’s trade and investment outfit, said that the Philippines has the ‘the least problematic’ factors for investments among ASEAN neighbors. And this would serve as the impetus for Japanese investments.

Rationalization Process of the Reflexivity Theory

First of all, I would say that this represents the rationalization phase of the current bullmarket.

By rationalization, I mean that price signaling channel exerts influence to the real world (or economic) developments, which at present, are being extrapolated with rose colored glasses. And developments in the real world eventually reinforces the thrust to further bid up of stock market prices paving way to a reflexive feedback loop or the reflexivity theory at work.

Writes the Billionaire (and crony) George Soros[3],

The underlying trend influences the participants' perceptions through the cognitive function; the resulting change in perceptions affects the situation through the participating function. In the case of the stock market, the primary impact is on stock prices. The change in stock prices may, in turn, affect both the participants' bias and the underlying trend.

The essence of the reflexivity theory is the dynamics of the bubble psychology as reflected on people’s expectations and their consequent actions expressed through the price mechanism and through real world actions.

Going back to the politically colored Pollyannaish article, it has been rightly pointed out that the wide scale dislocation or disruption from Japan’s total shutdown of the entire nuclear power industry (except for the two remaining plants)[4], which has been prompted for by last year’s catastrophic earthquake-tsunami disaster, has served as one of the primary reasons for their proposed investments here.

Japan’s nuclear industry previously contributed to about 30% of the nation’s energy requirements. Now the Japanese has to import 84% of their energy requirements[5]; this has partly led to the recent record trade deficits.

Also note the phrase ‘least problematic’ instead of ‘best potential returns’ as basis for attracting Japanese investments from which several criterion has been enumerated supposedly to the advantage of the Philippines, particularly “increasing financial costs”, “rising prices or shortage of land or office”, “skyrocketing payroll costs”, aside from labor conditons of “recruiting general staff”, “recruiting executives”, “low rate of employment retention”, “problems in workers competency”, “difficulty in quality control” and the “the least problems in salary base rate”.

So in a shade of schadenfreude, the Philippines may benefit from the adverse developments in Japan. With seemingly limited options, least problematic becomes a significant variable and has been equated with competitiveness in attracting Japanese investments.

Déjà vu, Asian Crisis 2.0? Phisix 10,000

Yet the article’s projections have been based on Jetro’s survey. Surveys or polls are predicated only from opinions which may or may not reflect on the real motivations or values of surveyed actors. And because there are no stakeholdings involved in surveys, they are fluid, ambiguous, and volatile, ergo, unreliable.

Whereas demonstrated preferences or the actual choice taken by the economic agents represents the more important of the two, since this signifies actual voting or expression of preferences or values.

As the great Professor Murray N. Rothbard wrote[6],

The concept of demonstrated preference is simply this: that actual choice reveals, or demonstrates, a man's preferences; that is, that his preferences are deducible from what he has chosen in action

Since Japan’s calamity struck last year, it should be of note that Indonesia has been the largest recipient, in terms of percentage, of Japan’s outward Foreign Direct Investment (FDI) flow[7].

Meanwhile, Thailand and Vietnam has substantially bested the Philippines. The Philippines only ranked 6th in Asia.

A better perspective of Japan’s OUTWARD FDI long term trend in ASEAN can be seen above. The trumpeted competitiveness framed by media hardly reveals on the reality.

Of course, these charts represent ex post actions and that ex ante could translate to vital changes as proposed. But I doubt so.

Yet there are several very important things of note from here.

One, as pointed above, the Philippines has not been grabbing the biggest pie of Japanese FDI. There have been little signs of any radical changes into the direction as broached by the headlines.

So far, Thailand has been the biggest magnet in attracting Japanese FDIs. Thailand has the largest nominal dollar based flows at $7.1 billion, signifying 54% share of Japan’s outward FDI flows into ASEAN in 2011.

The Philippines, despite recent material gains, has the smallest inflows.

Two, the growth trend of nominal US dollar based investment flows exhibits that even Vietnam ($1.8 billion) has far outclassed the Philippines ($1.0 billion).

Three, ALL of the ASEAN majors have registered substantial Japan based FDI gains. ASEAN has basically surpassed their regional Newly Industrial Country (NIC) contemporaries in attracting Japanese money.

In short, Japan’s investments in ASEAN do not seem to be country specific, but more of a regional dynamic. Or that the Japanese probably hedge their ASEAN exposure by spreading their investments throughout the region.

Well the past, according to Mark Twain, does not repeat itself, but it rhymes.

Today’s FDI flows eerily resonates or resembles on the time window[8] of the 1985 Plaza Accord to the post Japan bubble in 1990s until the climax, the 1997 Asian Crisis.

The Business Insider quotes author and former Deputy Chief of the Hong Kong Monetary Authority Andrew Sheng[9] in the latter’s book From Asian to Global Financial Crisis

… shift production to countries that not only welcomes Japanese FDI but also had cheap land and labour… By the late 1980s, Japan had become the single largest source of FDI for the fast-growing emerging Asian economies. This trend was particularly clear when another surge of Japanese FDI into Asia took place between 1993 and 1997, with Japanese FDI rising nearly twofold from US$6.5 billion to US$ 11.1 billion during this period…

… banks followed their manufacturing customers into non-Japan Asia in earnest… From 1985 to 1997 Japanese banks supplied over 40 percent of the total outstanding international bank lending to Asia in general… The massive expansion in Japanese bank lending, in both yen and foreign currency, created huge capital flows globally.”

So could we be experiencing a déjà vu, Asian Crisis 2.0?

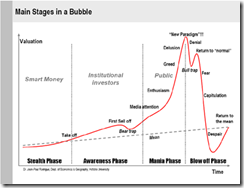

Let me be clear: bubbles or business cycles account for as policy induced processes, fuelled by monetary injections, marked by transitional stages.

FDI’s are by itself not the source of the disease but are symptoms or the ramifications of manifold political actions.

This is NOT to say that ASEAN faces the risks of an imminent bust soon. Instead this is to say that if these flows continue at a pace similar to 1985 to the mid-1990s then they could evolve into a full pledge bubble.

Yet there are many other indicators which will converge to give evidence to the maturing phase or the climax of a domestic business cycle. These may include the current account balances, state of banking credit, the yield curve, financial innovation, currency values and the state of the stock market.

And speaking of the stock market in the 1986-1997, Japan’s investment flows pumped up the region’s stock markets including the Phisix.

The 11 year bull market phase (green circle) of the local benchmark had two interruptions marked by two botched coup d'état attempts in 1987 and 1989, but nonetheless went to climax at 3,300+ levels. Remember, in 1986 the Phisix was at about only 150.

Put differently, if a similar Japan based investment flow dynamic should swamp into the region, then the Phisix is likely to put to realization my 10,000 level target first, before the structural implosion would occur. Again, trends don’t go in a straight line, and there can be substantial medium term obstacles or counter cycles or bear markets, like 2007-2008, before my targets could be fulfilled.

I would like to repeat, money flows won’t likely be limited to a Japan dynamic but from major western economies as well. This is the wealth convergence in motion.

Capital Flight Camouflaged as FDIs and Portfolio Flows

The recent surge in Japan’s FDI could just be the beginning.

The far more important or the major driver of Japan’s coming FDI and portfolio flows into ASEAN has already been manifested in the region’s currency markets.

Since the advent of 2012, the long term price appreciation of the Japanese Yen relative to ASEAN markets (Peso, Rupiah, Baht and Ringgit, the order from the top left to bottom right) seems to have been reversed.

Under pressure from politicians[10], the Bank of Japan (BoJ) has aggressively been ramping up its balance sheet[11] to allegedly support the economy by making ‘exports’ competitive.

Thus ASEAN-4 currencies along with the US dollar relative to the Yen have recently spiked!

If Japan’s basic problems today have primarily been due to a dysfunctional nuclear energy sector, then it would represent a logical error to see money printing as replacing the idled nuclear energy sector. Money is just a medium of exchange. Money doesn’t produce energy.

In reality, Japan’s banking system has been stuffed with loans to electric utility companies, many of them nuclear based. The industry’s risk profile has previously been viewed as almost at par with government debt, thus has been part of the banking system’s portfolio. Syndicated loans to the electric power companies had reportedly tripled to 1.16 trillion yen in 2011 from 448.8 billion in 2010[12]. Thus, with a crippled energy sector, Japan’s banking system, which has still been nursing from the scars of the last bubble bust, is once again confronted with heightened risks of defaults. Thus the BoJ rides to the rescue!

The foremost reason why many Japanese may invest in the Philippines under the cover of “the least problematic” technically represents euphemism for capital fleeing Japan because of devaluation policies—capital flight!

As the great Ludwig von Mises wrote[13],

The holders of ready cash try as far as possible to avoid the dangers of devaluation which today threaten in every country. They keep large bank balances in those countries in which there is the least probability of devaluation in the immediate future. If conditions change and they fear for these funds, they transfer such balances to other countries which for the moment seem to offer greater security. These balances which are always ready to flee-so-called “hot money”—have fundamentally influenced the data and the workings of the international money market. They present a serious problem in the operation of the modern banking system.

The bottom line is that YES we should expect Japanese FDI and portfolio investments into the Philippines and the region to swell.

But since (inward) capital flows into ASEAN will reflect on global central bank activities, this dynamic would not be limited to Japan but would likely include western economies as well.

And under the political climate that induces yield chasing dynamics, YES we should expect these flows to translate to a vastly higher Phisix and ASEAN bourses overtime, largely depending on the degree of inflows. This will be further augmented by the response of local investors to such dynamic as well as to local policies.

Although NO the Philippines will not decouple from events abroad and the pace of FDIs and investment flows will largely be grounded on the general liquidity environment.

And finally NO, the incumbent political leadership has a smidgen of responsibility for today’s dynamic. The current global negative real rate environment has mainly been driven by collective central bank actions. Profit from folly.

[1] See Phisix: The Journey Of A Thousand Miles Begins With A Single Step, March 12, 2012

[2] Inquirer.net Japan to pour more investments in PH, March 18, 2012

[3] Soros George The Alchemy of Finance p.53 John Wiley & Sons

[4] New York Times, Japan’s Nuclear Energy Industry Nears Shutdown, at Least for Now, March 8, 2012

[5] World Nuclear Energy Nuclear Power in Japan, Updated March 2012

[6] Rothbard Murray N. Toward a Reconstruction of Utility and Welfare Economics, July 6, 2008

[7] Jetro.go.jp FDI flow (Based on Balance of Payments, net), Japan's Outward and Inward Foreign Direct Investment Japanese Trade and Investment Statistics

[8] Thomsen Stephen SOUTHEAST ASIA: THE ROLE OF FOREIGN DIRECT INVESTMENT POLICIES IN DEVELOPMEN 1999 OECD.org

[9] Sheng Andrew From Asian to Global Financial Crisis Japan's Role In Asian Financial Crisis 1997, March 17, 2011 Business Insider

[10] See Bank of Japan Yields to Political Pressure, Adds $128 billion to QE, February 14, 2012

[11] Danske Bank No real easing from Bank of Japan this time Flash Comment March 13, 2012

[12] Reuters.com Japan utilities may return to bonds as $19 bln debt matures, January 25, 2012

[13] Mises, Ludwig von 4. The Flight of Capital and the Problem of “Hot Money” III. INFLATION