I want rising real wage levels, but something about which I get incredibly frustrated is the use of that word “capital”. I have heard economists talk about capital when what they really mean is money, and typically what they mean by money is new bank credit, because 97% of the money supply is bank credit. That is not capital; capital is the means of production… I fear that we have started to label as capital money that has been loaned into existence without any real backing. That might explain why our capital stock has been undermined as we have de-industrialised, and why real wages have dropped. In the end, real wages can rise only if productivity increases, and that means an increase in the real stock of capital.To return to where I wanted to go: where did all the money that was created as debt go? The sectoral lending figures show that while some of it went into commercial property, and some into personal loans, credit cards and so on, the rise of lending into real productive businesses excluding the financial sector was relatively moderate. Overwhelmingly, the new debt went into mortgages and the financial sector. Exchange and the distribution of wealth are part of the same social process. If I buy an apple, the distribution of apples and money will change. Money is used to buy houses, and we should not be at all surprised that an increased supply of money into house-buying will boost the price of those homes…My point is that if a great fountain of new money gushes up into the financial sector, we should not be surprised to find that the banking system is far wealthier than anyone else. We should not be surprised if financing and housing in London and the south-east are far wealthier than anywhere else. Indeed, I remember that when quantitative easing began, house prices started rising in Chiswick and Islington. Money is not neutral. It redistributes real income from later to earlier owners—that is, from the poor to the rich, on the whole. That distribution effect is key to understanding the effect of new money on society. It is the primary cause of almost all conflicts revolving around the production of money and around the relations between creditors and debtors.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, November 22, 2014

Quote of the Day: Understanding the Distribution Effects of New Money (Debt) on Society

Monday, February 24, 2014

Explaining the Recent Sharp Volatility in the Peso

Monday, January 30, 2012

Phisix and the Rotational Dynamics

It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. [I]f the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with 'free banking.' The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.- Former US Federal Reserve chairman Paul Volcker

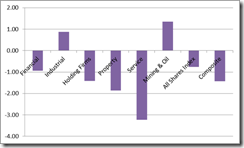

The Phisix fell 1.43% for the first time in four weeks. This comes after a turbocharged advance since the start of the year. Year to date, the local benchmark has been up 7.04% based on nominal Peso returns. But for foreign investors invested in the Phisix, the returns are higher. Since the Philippine Peso has materially gained (over 2%) from the same period, returns from local equity investments in US dollar terms is about 9+%.

Could this week’s decline presage a correction phase?

Rotational Dynamics in the PSE and the Cantillon Effects

The decline of the Phisix has not been reflected over the broad market as exhibited by the positive differentials of the advance-decline spread. This means more issues gained despite the natural corrective profit taking process seen on many of the Phisix component heavyweights.

And leading the market gainers has been the mining index which seems to have reasserted the leadership after a rather slow start. Also defying the profit taking mode has been the industrial sector.

From the start of the year, despite this week’s retrenchment, the property sector remains the best performer followed by the mining and the financial sectors.

This week’s market activities demonstrate what I have always called as the rotational process or dynamic. Sectors that has lagged outperforms the previously hot sectors which currently has been on a profit taking mode. Eventually the overall effect is to raise the price levels of nearly issue.

Here is what I previously wrote[1],

A prominent symptom of inflation is that prices are affected unevenly or relatively.

Eventually prices in general moves higher, but the degree and timing of price actions are not the same.

It’s the same in stock markets, which represents as one of the major absorbers of policy induced inflation.

Prices of some issues tend go up more and earlier than the others. At certain levels, the public’s attention tend to shift to the other issues which has lagged. This brings about a general rise in prices.

These are the spillover effects which I call the rotational process.

The mining sector has been narrowing the gap with the property sector and has surpassed service and financial sectors. The industrial sector which has been the tail end, has shrugged off the current profit taking process.

In the real economy, the effects of inflation has been similar, this known as the Cantillon Effect (named after the Mercantilist era Irish French economist Richard Cantillon) who brought about the concept of relative inflation or the disproportionate rise in prices among different goods in an economy[2]

The great Murray Rothbard dealt with the social and ethical considerations of Cantillon Effect or the relative effects of inflationism to an economy[3]

The new money works its way, step by step, throughout the economic system. As the new money spreads, it bids prices up--as we have seen, new money can only dilute the effectiveness of each dollar. But this dilution takes time and is therefore uneven; in the meantime, some people gain and other people lose. In short, the counterfeiters and their local retailers have found their incomes increased before any rise in the prices of the things they buy. But, on the other hand, people in remote areas of the economy, who have not yet received the new money, find their buying prices rising before their incomes. Retailers at the other end of the country, for example, will suffer losses. The first receivers of the new money gain most, and at the expense of the latest receivers.

Inflation, then, confers no general social benefit; instead, it redistributes the wealth in favor of the first-comers and at the expense of the laggards in the race. And inflation is, in effect, a race--to see who can get the new money earliest. The latecomers--the ones stuck with the loss--are often called the "fixed income groups." Ministers, teachers, people on salaries, lag notoriously behind other groups in acquiring the new money. Particular sufferers will be those depending on fixed money contracts--contracts made in the days before the inflationary rise in prices. Life insurance beneficiaries and annuitants, retired persons living off pensions, landlords with long term leases, bondholders and other creditors, those holding cash, all will bear the brunt of the inflation. They will be the ones who are "taxed."

The distributional impact of an inflation generated boom means the chief beneficiaries of inflation policies are the first recipients of new money who constitutes the political agents (politicians, bureaucrats), the politically privileged (welfare beneficiaries) or politically connected economic agents (war contractors, government suppliers, cronies and etc.). Where they spend their newly acquired money on will then serve as entry points to the diffusion of these new (inflation) monies to the economy.

The impact of current series of inflation policies works the same way too, they are meant to benefit, not the economy, but the insolvent banking and financial system of developed nations and their debt dependent welfare states teetering on the brink of collapse. And such policies have partly been engineered to buoy the financial markets (stock markets, bond markets and derivatives markets) because the balance sheets of their distressed banking system have been stuffed or loaded with an assorted mixture of these paper claims.

In the stock market, a similar pattern occurs, early receivers of circulation credit who invest on stock markets will benefit at the expense of the latecomers, usually the retail participants, where at the end of every boom, retail investors are left holding the proverbial empty bag.

As Austrian economist Fritz Machlup wrote,

the money which flows onto the stock exchange and is tied up in a series of operations, need not come directly from stock exchange credits (brokers' loans) but that any "inflationary” credit, no matter in what form it was created, may find its way onto the stock exchange[4]…

Extensive and lasting stock speculation by the general public thrives only on abundant credit[5].

So for as long as the interest rate environment can accommodate an expansion of inflationary or circulation credit, then stock markets are poised for an upside move.

Rotational Dynamics Abroad

The distributional and rotational dynamic can also be seen in the actions of ASEAN-4 bourses where Thailand’s SET has swiftly been closing on the lead of the Phisix on a year to date basis, while Indonesia and Malaysia has yet to get started.

Not only have the rotational effects been manifested in the region but also seem to be percolating around world.

Of the 71 bourses in my radar list, only about 18% have been in the red. The current environment has been the opposite of what we have seen in 2011.

And importantly, similar to the dynamics dynamics in the Philippine Stock Exchange, last year’s laggards have currently been outperforming.

About two weeks ago, the Philippine Phisix took the second spot[6] after Argentina among world’s top performing bourses. Apparently the relative effects of inflation has prompted for a strong recovery for the previous tailenders—such as the BRICs [Brazil, India, and Russia to the exclusion of China whose bourses have been closed for the week in celebration of the Year of Dragon] and developed economies as Germany and Hong Kong as well as a fusion of other nations from developed as Austria to the frontier markets Peru—to eclipse the gains of the Phisix and Argentina.

Central Banking Fueled Inflationary Boom

Financial markets have only been responding to what seems as synchronized efforts to deluge the world with liquidity in the hope that these efforts would lead to a structural economic recovery.

Unfortunately such short term oriented policies will only mask the problems by delaying the required adjustments and at worst, build or compound upon the current imbalances which would significantly increase systemic fragility which ultimately leads to a bubble bust.

Four central banks cut interest rates this week[7] (Thailand, Israel, Angola and Albania) with India paring down on the reserve requirements—mandated minimum reserves held by commercial banks.

Most of the world’s major central banks have been enforcing an environment of negative real rates, where as I have earlier noted, global interest rates reached the lowest level since 2009[8].

Meanwhile the US Federal Reserve recently announced the extension of the incumbent zero interest policy (ZIRP) rates “at least through late 2014”[9] on economic growth and unemployment concerns.

Also US Federal Reserve Chair Ben Bernanke has again been signaling the prospects of the revival of Fed’s bond buying which he said is “an option that is certainly on the table”[10].

In reality, the Bernanke led US Federal Reserve has been using the economy as cover or as pretext to rationalize the funding of what has been the uncontrollable spending whims by US politicians, aside from providing support to the banking system (both the US and indirectly Europe), which serves as medium for government to access financing.

However it would seem that access to financing windows has been closing.

The US debt ceiling, without fanfare, had been raised anew[11], which accounts for the relentless increase in the spending appetite of the incumbent administration.

Next foreign financing of US debts are likely to shrink, perhaps not because of geopolitical issues but because economic developments could alter the current financing dynamics. For instance, Japan’s trade balance posted a deficit for the first time in 31 years[12] and that China’s trade surpluses have been steadily narrowing[13]. China has already been reducing its holding of US treasuries.

If the trade balance of the key traditional financers of the US turns into extended deficits, this would put a cap on funds from Japan and China. Unless other emerging markets will fill in their shoes, and with low domestic savings rate, the US government will be left with the US Federal Reserve as financier of last resort. Of course, the Fed may possibly work in cahoots with other central banks through the banking system to accomplish this.

This only translates to a growing dependency on the printing press for an increasingly debt reliant welfare-warfare based political economic system.

And importantly, monetization of debts would have to be supported by zero bound rates to keep the US treasury’s interest expenditures in check.

So the current debt and debt financing dynamics will imply for a deeper role of the US Federal Reserve. All of which will have implications to markets and the production aspects.

Yet Bernanke’s nuclear option (helicopter drop approach) has palpably become the conventional central bank policy doctrine for global central bankers, specifically for most of developed economies.

There is no better way to show of the unprecedented direction in central bank policymaking than from the aggregate expansion of, in terms of US dollar, the balance sheets of 8 nations (US, UK, ECB, Japan, Germany, France, China and Switzerland) in order to keep the current system afloat.

By such nonpareil actions, there would no meaningful comparisons in modern history (definitely not Japan circa 90s or the Great Depression)

Deflation as Political Agenda and the Fallacy of Money Neutrality

It is important to stress that the mainstream’s obsession with so-called deleveraging process, although part of this is true, operates in an analytical vacuum. For their analysis forgoes the political incentives of the central banks to forestall the markets from clearing. For allowing the markets to clear will translate to a collapse in the current redistribution based political system. Deflation, a market clearing process, is a natural consequence to the distortions brought upon by prior inflationary policies or the boom bust cycle.

The irony is that those who benefit from inflation (government and banks), will be the ones who will suffer from deflation.

As Professor Jörg Guido Hülsmann explains[14],

the true crux of deflation is that it does not hide the redistribution going hand in hand with changes in the quantity of money. It entails visible misery for many people, to the benefit of equally visible winners. This starkly contrasts with inflation, which creates anonymous winners at the expense of anonymous losers. Both deflation and inflation are, from the point of view we have so far espoused, zero-sum games. But inflation is a secret rip-off and thus the perfect vehicle for the exploitation of a population through its (false) elites, whereas deflation means open redistribution through bankruptcy according to the law.

Thus the shrill cry over deflation amounts to nothing more than a front for vested interest groups who insists on pushing forward the inflationism agenda. Yet despite years of ceaseless incantations about deflation, asset markets and economic activities have behaved far far far away from the scenarios deflationists have long been fretting about. To contrary the risks has been tilted towards higher rates of consumer inflation.

I would further add that another mental lapse afflicting mainstream analysts, who embrace the “we inhabit a deflation, deleveraging reality”[15] mentality is that their aggregatism based economic analysis sugar-coats what in reality signifies as largely heuristics or mental short cuts predicated on political beliefs or appeal to acquire readership or catering to the mainstream to get social acceptance.

They believe that money printing by central banks has neutral effects—which means changes in money supply would lead to a proportional and permanent increase in prices that has little bearing on real economic activity as signified by output, investment and employment.

In reality, prices are determined by subjective valuations of those conducting exchanges, given the particular money at hand, the goods or services being traded for and the specific timeframe from which trade is being consummated, thus changes in the supply of money will not affect prices proportionally.

Money is never neutral. Professor Thorsten Polleit explains[16],

What is more, money is a good like any other. It is subject to the law of diminishing marginal utility. This, in turn, implies that an increase in the stock of money will necessarily be accompanied by a drop in money's exchange value vis-à-vis other goods and services.

Against this backdrop it becomes obvious that a rise or fall of the money supply does not confer a social benefit: it merely lowers or raises the exchange value of the money unit. And a change in the money supply also implies redistributive effects; that is, a change in money stock is not, and can never be, neutral.

So even as central banks continue with their onslaught of adding bank reserves at a pace that has never happened in modern history, they believe that such actions will be engulfed by “deleveraging”.

And going back to the “policy trap” or path dependency of policymaking that has been tilted towards inflationism, as said above, the balance sheets of crisis affected financial and banking institutions greatly depends on artificially bloated price levels. And in order to maintain these levels would require continuous commitment to inflationary policies, which means compounding or pyramiding inflation on top of existing inflation. Inflation thus begets inflation.

Again Professor Machlup[17],

An inflated rate of investment can probably be maintained only with a steady or increasing rate of credit expansion. A set-back is likely to occur when credit expansion stops.

And anytime central banks’ desist or even slow the rate of these expansions, this would entail or usher in violent downside volatilities in the marketplace (including the Phisix). Thus “exit strategies” signify no less than political agitprops.

A noteworthy and relevant quote from James Bianco[18], (which includes the chart above)

Until a worldwide exit strategy can be articulated and understood, risk markets will rise and fall based on the perceptions and realities of central bank balance sheets. As long as this is perceived to be a good thing, like perpetually rising home prices were perceived to be a good thing, risk markets will rise.

When/If these central banks go too far, as was eventually the case with home prices, expanding balance sheets will no longer be looked upon in a positive light. Instead they will be viewed in the same light as CDOs backed by sub-prime mortgages were when home prices were falling. The heads of these central banks will no longer be put on a pedestal but looked upon as eight Alan Greenspans that caused a financial crisis.

So how does one know that “expanding balance sheets will no longer be looked upon in a positive light” considering that central banks can elude accounting rules? My reply would be to watch the interest rate price actions, currency movements and prices of precious metals along with oil and natural gas.

No Decoupling, a Redux

Any belief that the Phisix operates separately from the world would be utterly misguided.

2011 should be a noteworthy example.

The Phisix ended the year marginally up while the US S&P 500 was unchanged. Except for the first quarter where the S&P 500 and the Phisix diverged (green oval, where ironically the US moved higher as the Phisix retrenched), the rest of the year exhibits what seems as synchronized actions. Or that based on trend undulations, the motion of the Phisix appears to have been highly correlated with that of the S&P.

While correlation does not translate to causation, what has made the US and the Phisix surprisingly resilent relative to the world has been the loose money policies adapted by the US Federal Reserve. Money supply growth in the US has sharply accelerated during the latter half of the year despite the technical conclusion of QE 2.0.

Not only has such central bank actions partly offset and deferred on the potential adverse impact from the unfolding crisis in the Eurozone, aside from exposing internal weaknesses, monetary inflation has buoyed the US financial markets.

The deferment of recession risks magnified the negative real rates environment in the Philippines and the ASEAN financial markets which has prompted for the seemingly symmetrical moves and the outperformance relative to the world.

My point is that the notion where Philippine financial markets will or can decouple or behave independently from that of the US, or will not be affected by developments abroad, has been baseless, unfounded, in denial of reality and constitutes as wishful and reckless thinking that would be suicidal for any portfolio manager.

Final Thoughts and Some Prediction Confirmations

Bottom line:

Given the added empirical indications of an ongiong an inflationary boom, here and abroad, the current correction phase seen in the Phisix will likely represent a temporary event

The seemingly synchronized actions by global central bankers to lower rates allegedly to combat recession risks will magnify the negative real rate environment that should be supportive of the bullish trend in both the Phisix and the Philippine Peso and also for global markets.

The hunt for yield environment will be concatenated by the debasing policies of central banks of major economies which will likely spur international arbitrages or carry trades.

Before I conclude, I would like to show you some confirmations of my predictions

An inevitable confirmation of my assertion that the actions of central bankers represent as the main drivers of price trends and not chart patterns[19] can be seen in the above chart from stockcharts.com.

The price actions of the US S&P 500 segues from the bearish death cross, which now officially represents a failed chart pattern, that gives way to the bullish golden cross.

Above is another vital confirmation of my thesis against gold bears who claimed that December’s fall marked the end of the bull market[20]. Gold has broken out of the resistance level which most possibly heralds a continuation of the momentum that would affirm the bullmarket trend.

[1] See Phisix: Why I Expect A Rotation Out of The Mining Sector, May 15, 2011

[2] Wikipedia.org Richard Cantillon Monetary theory

[3] Rothbard, Murray N. 2. The Economic Effects of Inflation III. Government Meddling With Money What Has Government Done to Our Money?

[4] Machlup Fritz The Stock Market, Credit And Capital Formation p.94 William Hodge And Company, Limited

[5] Ibid p. 289

[6] See Global Equity Markets: Philippine Phisix Grabs Second Spot, January 14, 2012

[7] centralbanknews.info, Monetary Policy Week in Review - 28 January 2012, Bank of Albania Cuts Interest Rate 25bps to 4.50%

[8] See Global Central Banks Ease the Most Since 2009, November 28, 2011

[9] Bloomberg.com Fed: Benchmark Rate Will Stay Low Until ’14, January 26, 2012

[10] Bloomberg.com Bernanke Makes Case for More Bond Buying, January 26, 2012

[11] See US Senate Approves Debt Ceiling Increase, January 27, 2012

[12] AFP Japan posts first annual trade deficit in 31 years, January 25, 2012, google.com

[13] Bloomberg.com Shrinking China Trade Surplus May Buttress Wen Rebuff of Pressure on Yuan, January 9, 2012

[14] Hülsmann Jörg Guido Deflation And Liberty, p.27

[15] Mauldin John, The Transparency Trap, January 29, 2012 Goldseek.com

[16] Polleit Thorsten The Fallacy of the (Super)Neutrality of Money, October 23, 2009 Mises.org

[17] Machlup Fritz op. cit, p 291

[18] Bianco James, Living In A QE World January 27, 2012 ritholz.com

[19] See How Reliable is the S&P’s ‘Death Cross’ Pattern? August 14, 2011

[20] See Is this the End of the Gold Bull Market? December 15, 2011

Tuesday, August 17, 2010

Austerity Equals Deflation? Not In The Eurozone

If you read mainstream analysis, their mantra seems to be ‘austerity equates to deflation’. (Because B follows A, B is the cause of A-post hoc analysis)

Yet when applied to the Eurozone, this seems NOT to be happening.

This from the New York Times, (bold highlights mine)

Higher energy prices drove inflation in the euro area to an annual rate of 1.7 percent in July, the highest level in 20 months but still within the range considered acceptable by the European Central Bank.

Excluding energy prices, inflation increased by 1.1 percent in July when compared with the previous year. That was up from 0.9 percent in June, Eurostat, the European Union’s statistics office, said Monday.

The rise in overall prices, from a rate of 1.4 percent in June, was not considered alarming by economists, who generally expect price pressures to remain in check as growth slows in most of Europe.

“We need to see convincing signs of an upturn in domestic demand, and we’re not seeing that just yet,” said Nick Matthews, an economist at Royal Bank of Scotland. “Underlying domestic price pressures are still quite contained.”

But the European Central Bank could have problems finding a monetary policy that is right for all 16 euro area members if prices continued to rise in some countries while holding stable or even falling in others.

This chart from Tradingeconomics.com

Additional observations:

1. The above development goes to show that inflation is always relative. Some areas experience more and some experience less. In short, money is never neutral.

2. If inflation has been rising in spite of weak domestic demand as alleged by the expert quoted, then obviously it isn’t domestic demand that is the root of inflation. So the expert failing to account for the recent rise likewise fails to look at genuine drivers or the bigger picture.

3. One should note that the inflation dynamics in the Eurozone doesn’t suggest that this is a one time event or random walk, but seemingly a momentum trend on an upswing.

4. This also shows why listening to the ideas of the mainstream seems to be like placing a noose around one’s neck.

Thursday, August 05, 2010

Breakfast Inflation

We’ve been repeatedly told by experts that inflation has been non-existent and is less of a threat compared to deflation which is seen as the major scourge.

This from the Economist,

SEVERE drought and wildfires in Russia, the world’s fourth largest wheat producer, have destroyed a fifth of the country’s crop and sent prices soaring. Since the end of June wheat prices have more than doubled. On Wednesday August 4th, the UN’s Food and Agriculture Organization cut its forecast for 2010 global wheat production by 5m tonnes, to 651m tonnes. Kazakhstan and Ukraine, both big wheat producers, have also been hit with dry weather. In Canada the problem is the reverse: unusually wet weather has prevented seeding and destroyed crops. But wheat is not alone. The price of orange juice has also risen recently, probably thanks to bets placed on the likelihood of tropical storms. Coffee prices, which hit a 13-year high, are a result of poor harvests. Taken together, the raw ingredients for breakfast in much of the rich world have increased in price by 25% since the beginning of June.

Some observations:

Inflation on your breakfast table poses only as short term quirk.

Inflation is beginning to pick up and your breakfast is first among the many diffusing signs.

Let me guess, mainstream analysis which see money has having a neutral effect is wrong.

Sunday, November 15, 2009

Following The Money Trail: Inflation A Key Theme For 2010

WAY past the self imposed $300 billion and October deadline, the US Federal Reserve continues to load up on long dated US treasuries this week.

Figure 1 Cleveland Federal Reserve: Credit Easing Policy Tools

Figure 1 Cleveland Federal Reserve: Credit Easing Policy Tools

Notably the amount of purchases has doubled to $ 7 billion from last week’s $2.8 billion. These Quantitative Easing activities have coincided with a new watermark high among global equity benchmarks (see figure 2).

Importantly, US Treasury purchases by the US Federal Reserve which commenced in the week of March 18th of this year, has nearly been concomitant with the March 6th lows of the US stock market.

This posits that after the US markets set a floor in March of this year (vertical blue line left window), the subsequent long dated Treasury purchases (light green arrow left window) by the US central bank combined with the earlier and larger purchases of agency debts have been tightly correlated with the revitalized actions in global stock markets which has likewise been reflected on the inverse price movement of the US dollar Index! (see figure 2)

Evidence and logical argument tells us that this has been more than just a tight correlation but one of causational influence.

So while the “desperately looking for normal” camp continues to pattern their analytics to the conventional economic sphere to predict for a “normalization”, the movements in the markets have increasingly been detached from the underlying motions in the real economy. And the evolving events have repeatedly and derisively contravened such expectations.

For instance, unemployment rates have soared to 10.2% in October (yahoo Finance) with the growling bear camp predicting unemployment rates to reach 12-13% (WSJ Blog) yet US markets continue to crescendo.

And such blatant disparity between surging stocks and improving but tepid economic growth activities has left the mainstream deeply discombobulated.

US Government’s Primary Political Goal: Save The Banking System

Two principal reasons for such confusion:

One, imprisoned by walls of conventionalism, this camp obstinately refuses to acknowledge and or reckon with the political objectives of the incumbent political leadership and their respective bureaucratic authorities, and their consequent actions or measures thereof.

This camp also refuses to digest or internalize on the reality that political objectives have NOT been primarily directed at rehabilitating unemployment, output gaps (excess capacity), idle resources or economic growth, which appears to be secondary, but on the PRESERVATION of the banking system!

The morbid fear out of a massive wave of near simultaneous banking closures or banking collapse (ala the Great Depression) that would lead an eventual systemic deflation has prompted the US Federal Reserve to engage in a massive and unprecedented scale of operations to buttress its banking system.

And it is for this reason that the Federal Reserve has reconfigured bank earnings from its traditional “deposit and lend” operating model, in the face of a disinclined market hobbled by over indebtedness, to a “bank as trader” model.

The Fed has engaged in a massive manipulation of market conditions to the benefit of the “Too Big To Fail” Banks in order to attain such goals [see our expanded explanation in 5 Reasons Why The Recent Market Slump Is Not What Mainstream Expects].

A recovery in earnings is sine qua non to ensure the industry’s survivability and so far the financial sector appears to have positively responded to the Fed’s programs in terms of ameliorating the industry’s balance sheets via earnings growth (See figure 3)

The bank as trader model has singlehandedly turbocharged the earnings of the S & P 500 despite a broad based sectoral decline in the third quarter on a year on year basis (left column). This is a concrete evidence of the outcome of state capitalism, where political officialdom selects the beneficiaries of its actions.

Meanwhile elevated stock prices appear to have somewhat reanimated the animal spirits that seem to have filtered into the earnings expectations of some sectors as the Technology and Materials in the 4th quarter.

To quote Bespoke Investment, ``The Financial sector is currently expected to see growth of 133.8% in Q4 '09 versus Q4 '08. This high estimate in the Financial sector helps put estimates for the entire S&P 500 at +65.2% in the fourth quarter. Ex-Financials, the S&P 500 is expected to see Q4 earnings actually decline by 7.6%. Technology is expected to see growth of 21.5% in Q4, while estimates for the Materials sector are currently at 97.5%.”

As you can see stock prices have been on an overdrive while earnings have only gradually begun to recover, except for the Financial sector. This unique market-real economy divergence has long been prompting bears to call for a reversion to the mean. Unfortunately for them the market continues to scathingly defy their convictions.

Following The Money Trail Analytics

Moreover, the “desperately seeking normal camp” which mainly sees current policies as a “one size fits all” remedial approach to both the banking sector and the US economy is a highly misguided diagnostic.

The fact that the US has spent more and provided gargantuan guarantees for its banking system than for the economy conspicuously reveals of its political priorities.

As we previously quoted a Bloomberg report, `` The U.S. has lent, spent or guaranteed $11.6 trillion to bolster banks and fight the longest recession in 70 years, according to data compiled by Bloomberg. That’s a 9.4 percent decline since March 31, when Bloomberg last calculated the total at $12.8 trillion.”

For the real economy only $132.5 billion or roughly 17% of the $787 US fiscal stimulus have been spent as of November 10th (recovery.gov)

Yet what seems obvious based on evidence hasn’t been given an appropriate weighting. Instead, experts have opted to selectively choose or data mine facts based on a preferred conclusion.

On our part analysis based on “follow the money trail” has been more effective.

And the money trail tells us that political reality translates to inflation as having been the chosen recourse to salvage the US dollar standard system pillared by the US banking system. The economy, despite the official pronouncements, is a secondary concern.

For as long as economic strains poses as threat to the survival of its banking system, the US political leadership will err on the side of an inflation risk and public sector credit risk than with the risk posed by deflation from a banking collapse. Hence, the sustained QE purchases on long dated treasuries, in spite of the self declared deadline and equally the sustained guarantees on the market mechanism conditioned by the US Federal Reserves that would allow the earnings of the banking system to recover.

This renders talks of “exit strategies” as mainly some sort of communication signaling ruse-meaning central bankers feign interest aimed at controlling the surge in asset prices. As we have been repeatedly saying, economic ideology and recent policy triumphalism has boosted the confidence of policymakers to undertake policies in the same direction. Any proposed “tightening” changes will likely be conservative.

Yet, in contrast to mainstream expectations, QE or “money printed from thin air” buying of US treasuries and US agency debt instruments from private institutions, have been flowing into commodities and equity markets and has likewise exerted pressure on the US dollar-giving a semblance of a US dollar carry.

Nonetheless misreading effects as a cause would seem like a sign of incomprehension or outright denial as a result of either economic ideological zealotry or blind spot biases.

The Folly Of Money’s Neutrality

The second reason for such confusion is the widespread or popular fallacious wisdom of the neutrality of money.

Conventionalism treats money has having a minor impact on its purchasing power or in the economy as transmitted by such inflationist policies. This is the reason why the mainstream can’t seem to reconcile on the dynamics behind rising asset prices and the divergence seen in the real economy.

Professor Mr. Ludwig von Mises explains the flaw in populist wisdom (bold emphasis mine), ``It is a popular fallacy to believe that perfect money should be neutral and endowed with unchanging purchasing power, and that the goal of monetary policy should be to realize this perfect money. It is easy to understand this idea as a reaction against the still-more-popular postulates of the inflationists. But it is an excessive reaction, it is in itself confused and contradictory, and it has worked havoc because it was strengthened by an inveterate error inherent in the thought of many philosophers and economists.”

``These thinkers are misled by the widespread belief that a state of rest is more perfect than one of movement. Their idea of perfection implies that no more perfect state can be thought of and consequently that every change would impair it. The best that can be said of a motion is that it is directed toward the attainment of a state of perfection in which there is rest because every further movement would lead into a less perfect state.”

In short, economic activity is seen as fundamentally independent from money supply growth.

Furthermore, asset prices have been deemed to operate on the premise of ‘efficient’ market price signaling brought about by disparate entrepreneurial assessments, estimates and evaluation. This is hardly true today.

And such perceptions of market efficiency will unlikely reflect on the same performances of yesteryears, as global governments have taken to the center stage in the propping up of financial markets.

The Periphery As Global Economic Locomotive

A recent rundown on the performance of global stock markets can be seen in Global Stock Market Performance Update: BRICs Firmly In Command. What seems obvious is the relativity or the variability of performances from the collective pace of global reflationary activities.

Major emerging markets have monstrously been outperforming developed economies equities for several crucial reasons: a largely unimpaired banking system, low systemic leverage and high savings, from which monetary and fiscal policies seem to have generated a visible efficacy-read my lips-seminal bubbles.

This also means that the transmission mechanism of inflation has been segueing from the core (developed economies) to the periphery (emerging markets) -where the periphery is now expected to lift the economic conditions of the core.

Figure 4: World Bank Asia Pacific Update: China’s Powerlifting The Developed Economies

Figure 4: World Bank Asia Pacific Update: China’s Powerlifting The Developed Economies

The recent crisis has triggered the reshuffling economic might. China’s economy offset the economic losses from developed economies as shown in figure 4.

According to the World Bank, ``Thanks to China, East Asia remains the fastest growing developing region in the world. Although China’s economy accounts for less than a tenth of the global economy, the increase in China’s GDP in 2009 will offset three-fourths of the decline in G3’s GDP. This number underlies China’s markedly increased global role, but also reveals the limits to what China alone can do, because this year’s outcome was achieved through a huge monetary and fiscal stimulus that the authorities will find neither prudent nor necessary to sustain for an extended period of time. Take China out of the equation, however, and the remainder of the region is set to expand at a slower pace than the Middle East and North Africa, South Asia, and only modestly faster than Sub-Saharan Africa (Table 4). This reflects the openness of East Asia and the fast transmission of shocks through production networks serving the U.S., Japan and other global markets.” (bold highlights mine)

In short, conventionalism continues to embrace myopically a US centric world, even as global growth dynamics appears to be shifting to a very important theme: the periphery as the world’s economic growth locomotive.

In addition, conventionalism can’t seem to grasp the encompassing dynamics where government has practically been THE market. The US Government has been the market because the political authorities deem the “Too Big To Fail” segment of its banking system as indispensable to the economy or for unspecified purposes (known only to the authorities-saving friends perhaps?).

This means that when government as policy, prints money to buy assets from private institutions that owns these securities to shore up its financial sector; money from the proceeds of the sale of assets circulates in the economy or is imbued by the financial market.

Why? Because according to Professor Mises, ``Money is an element of action and consequently of change. Changes in the money relation, i.e., in the relation of the demand for and the supply of money, affect the exchange ratio between money on the one hand and the vendible commodities on the other hand. These changes do not affect at the same time and to the same extent the prices of the various commodities and services. They consequently affect the wealth of the various members of society in different ways.”

In short, inflationism is fundamentally a redistribution of wealth.

From the US perspective, since the advent of the crisis, US taxpayers have been funneling wealth into its financial sector, which is being precariously upheld by the government policies.

On a global scale, the ongoing QE process by the US government has been facilitating for capital outflows from the US. Conversely, such outflows have translated to influx into emerging markets channeled via a vastly weakening US dollar-ergo, the immense disparity in the equity performances between emerging markets and developed economies.

So while we may not have seen generalized inflation yet, what we are seeing today has been a colossal flow of money into assets or “asset inflation” mostly in terms of rising prices of stock markets and possibly in real estate markets of some emerging economies aside from commodity inflation.

Myths and Fallacies, Inflation A Predominant Theme For 2010

Figure 5: Danske Bank: Euroland Loans Picking Up

Figure 5: Danske Bank: Euroland Loans Picking Up

In addition the vast excess reserves held by the banking system in the developed economies, given today’s buoyant sentiment, is NOT a guarantee that the reserves won’t be converted into private sector loans (see figure 5)

Even as money supply year on year change on the Euroland has been on a decline (right window) since 2007, the loans to non-financial institutions and households have been resurgent (left window). Given the fractional reserve nature of our banking system, sustained loan growths would eventually translate to a surge in money supply growth.

Essentially, more of the continued central bank money printing activities and circulation credit from global zero interest rate regime will transpose to even more systemic inflation.

Remember, it would be a fallacious argument to read ‘deflation’ as contracting money supply in debt plagued economies and apply a different definition to emerging markets (mostly in terms of surplus capacity).

Such inconsistency makes the global deflation theme highly vulnerable or flawed.

Figure 6: World Bank: Different Structures, Different Impact

Figure 6: World Bank: Different Structures, Different Impact

As seen in figure 6, credit growth has been relatively nuanced among Asian economies and has impacted the region’s economies distinctly.

Therefore, oversimplifying inflation or deflation without fully understanding the fundamental individual political economic constructs of each nation would seem nebulous.

Moreover, it is likewise another fallacious argument to predicate the “containment” of inflation on lofty bond prices alone. As earlier discussed, applied to the US, US treasuries have been one of the key markets supported and manipulated by the US government aimed at bolstering its banking system.

Where price controls can create temporary conditions favorable to policymakers, imbalances from market distortions are fostered from within that would eventually unravel once the system can’t absorb more of these at the margins.

Yet, to assume that current market conditions accurately paint today’s economic environment would be a monumental folly. To be sure, this view critically fails to contrast on the political dynamics from economic metrics.

Moreover, this view seems like a perilous miscomprehension on the operating dynamics of inflation. Inflation does not just randomly pop up where central banks can do a whack-a-mole. Inflation is a political process that operates and is manifested on the markets in stages. [see What Global Financial Markets Seem To Be Telling Us]

Hence, market action is conditional on the direction of global government policies where so far political authorities have been predisposed towards the global reflation context.

This, in essence, also suggests that inflation, as expressed in mainstream definition as higher consumer prices, will likely surprise to the upside and will be a key theme for 2010.