The biggest problem I have with the standard analysis of the minimum wage–on either side of the ideological divide–is that it shows a certain lack of imagination. It presumes that market forces work only on quantity and price. So that when legislation artificially raises price, the debate is over the impact on quantity–how many jobs will be lost (or gained if you’re on the other side.)But price and quantity are not the only way market forces work. And they are certainly not the only attributes of a job. There is how hard you have to work, how many breaks you get, how much training or mentoring or kindness. What amenities are in the workplace–snack bar, vending machine, nicely decorated walls and so on. When the government requires that wages be higher than what they would otherwise be, that creates an increase in the number of people who would like to work and reduces the number of opportunities available.Ironically, the minimum wage creates a reserve army of the unemployed. That in turn allows employers to be less thoughtful, helpful, and kind. It destroys the civilizing effect of competition by muting it. That encourages exploitation. It reduces the cost to employers of racism or cruelty. Before the increase, being obnoxious or racist made it much harder to find employees. A minimum wage makes it easier to indulge in bad behavior. The costs are lower. Before the minimum wage, a cruel, selfish employer might have had to mentor his employees or train them or be nice to them despite his nature. Now he won’t have to. He can still get workers to work for him. Even more cruelly, the minimum wage encourages workers to exploit themselves.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, February 20, 2013

Quote of the Day: The Ethics of Minimum Wage

Wednesday, December 05, 2012

Quote of the Day: When We Reify the Model, We Misunderstand the World

We reify the model, and misunderstand the world.People need to understand that this is exactly the *same* insight that dawned upon Ludwig Wittgenstein — mental constructs made of “given givens” which are given to one mind fail to capture the imperfect networks of imperfectly coordinated common patterns of orienting our self in the world via language — and these ‘given given’ entities mislead us about the source of significance or meaning — we go looking for significance in ‘given given’ entities, eg Plato’s essences, Russell’s logical atoms, Frege’s senses, Kripke’s direct references, Lewis’s possible world entities.When we reify the mental construct we’ve built of ‘language’ using logic and meaning entities, we misunderstand the real world of the social phenomena of language.In the economic case, we lose sight of networks of price relations in the world as found social tools already existing in the world for orienting our doings in coordination with other people. Social tools which aren’t always perfect and don’t always guarantee perfect coordination.In the language case, we lose sight of networks of shared practices of going on in the world involving speech and written words as found social tools already existing in the world for orienting our doings in coordination with other people. Social tools with aren’t always perfect and don’t always guarantee perfect coordination.Prices and language are external social network realities with an existence and reality far beyond the closed system of any single individual’s formal mental model of the price system or the language system made of of ‘given givens’ or stipulated ‘meanings’ and their formal relations.The lesson of Mises’ socialist calculation argument and Wittgenstein’s private language argument is that we can’t recreate this social thing that lies outside us in a fully surveyed formal system of “givens”, we can’t recreate it and we can’t replace it, what we do is make use of it coordination our social doings within this larger *socially* given network of relations, which we don’t receive as ‘given given’ entities like a hat in a box, but as networks of significance we are constantly orienting ourselves within and internalizing, in the first instance without any real explicit articulated fixed rules of going on together in a coordinated way. We acquire usefully and commonly coordinated practices via imitation, trial and error, training, absorbing the culture, practice, getting advice from others, etc.

Saturday, April 02, 2011

Correlation Isn't Causation: Food Prices and Global Riots

The IMF says that the string of antigovernment protests worldwide are all about rising food prices.

The Wall Street Journal blog writes, (bold emphasis original)

100%: The increase in antigovernment protests associated with a 10% rise in global food prices

Despotic leaders, entrenched inequality and new forms of communication have all played their roles in the political turmoil now shaking the Middle East. But new research by economists at the International Monetary Fund points to another potential contributor: global food prices.

Looking at food prices and instances of political unrest from 1970 through 2007, the economists — Rabah Arezki and Markus Brueckner — find a significant relationship between the two in low-income countries, a group that includes Tunisia, Egypt, Sudan and Yemen. To be exact, a 10% increase in international food prices corresponds to an added 0.5 antigovernment protests over the following year in the low-income world — a twofold increase from the annual average.

Rising food prices represent a symptom and NOT the cause of these riots.

People aren’t too dumb to protest on food prices alone, they attribute events to politics (e.g. inequality and etc...) to markets (e.g. speculation, hoarding, et.al.) to economy (e.g. emerging market growth) or to other exogenous causes (climate change etc...).

While all of the above have some grain of truths in them, they aren’t reflective of the entire picture or the bigger force driving these.

In other words, rising food prices serves as the trigger to the unrest from long built in domestic imbalances.

But here is the bigger picture...

US Adjusted Monetary Base has been exploding!

Chart from St Louis Federal Reserve

US Federal Reserve balance sheet has also been ballooning!

Bank holdings of US government securities have also been exploding. US Banks have been speculating more than lending. (chart from St. Louis Federal Reserve)

Stock Market leverage has also been ramping up (chart from Pragmatic Capitalism)

Unless money printing has no impact at all, then all these won’t matter. But obviously, money isn’t neutral, and all these money printing have been absorbed somewhere in the financial markets or the real economy.

Surprisingly, the Bank of Japan (BoJ) recognizes this government induced phenomenon. They write,

Globally accommodative monetary conditions have become unprecedented. The relative size of global money stock (M1) measured against the real GDP has surpassed its historical trend (Chart 14). This sustained global excess liquidity not only increases physical demand for commodities thereby affecting fundamentals, but also amplifies speculative factors, both of which are contributing to the sharp rise in global commodity prices.

Incidentally they have been big practitioners of inflationism too. This seems to be a case "where right hand doesn't know what the left hand is doing".

And this only proves how the mainstream economic perspective has been utterly wrong.

In other words, monetary policies by the US, as the de facto foreign currency reserve of the world, have been filtering throughout the global financial system and to the global real economy.

And surging food prices has been aggravated by the shared central bank practice of inflationism and artificially suppressed interest rates by OTHER nations, most especially by the OECD economies.

And in terms of supply side, another key factor behind surging food prices has been due to the restricted international trade of agriculture. Agriculture has been the least globalized among other sectors.

In short, protectionism from the political toxin called “self-sufficiency” has been responsible for the aggregate imbalances of food economics globally.

Chart from Guinness Atkinson

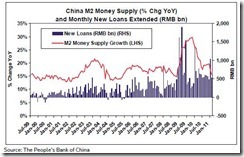

Of course, it is equally nonsense to attribute rising inflation to China as attributed by some observers.

China isn’t the world’s foreign currency reserve. While China is an important driver in the global consumption equation, (in as much as the supply side) China hasn’t been inflating as much as the developed economies. In short, China has only served as an aggravating factor to the main dynamics behind the world’s food price triggered riots. I might add that China has also been plagued by her domestic bubble policies.

Only the politically (and or mathematical formalism) blinded people can’t see anything wrong done by the state. Their knee jerk response is to lay the blame on the doorsteps of either the marketplace or to other nations, for what actually is truly a failure in domestic policies.

To quote Forrest Gump: Stupid is as stupid does.

Wednesday, March 23, 2011

Rising Inflation Expectations: Why Macro Economists Can’t See It Coming

This is an example why macro-models used by mainstream experts don’t get it.

From the Wall Street Journal Blog (bold emphasis mine)

The Federal Reserve expects higher price pressures to be “transitory.” But other economic players aren’t so sure.

A new survey of finance professionals done by J.P. Morgan shows core inflation expectations are rising around the world.

In the U.S. specifically, the mean response is that core inflation, as measured by the consumer price index excluding food and energy, will be running 1.8% a year from now. That is up from 1.4% when the survey was last done in November and up from February’s actual reading of 1.1%. The survey polled about 750 respondents, with about 40% from North America.

The report notes the recent jump in oil prices and the longer-running increase in commodity prices may be skewing responses. But the report notes core inflation rates have already been rising in the U.S. and the U.K.

Duh?!

Core inflation expectations have long been rising around the world! Don’t these experts see that the REVOLTS in the Middle East have partly been triggered by record food prices??!!!

Chart from Business Insider

Next, price pressures are “transitory”???!!!

The IMF even says that people should get used to high food prices for all other reasons except macroeconomic government policies. The IMF is part of mainstream macro.

From the Bloomberg,

Consumers should get used to paying more for food, after prices rose to a record, because farmers will take years to expand production enough to meet demand and drive down costs, the International Monetary Fund said.

People in developing countries are becoming richer and eating more meat and dairy, meaning more grain for livestock feed and land for grazing animals, Thomas Helbling, an adviser for the IMF’s research department, and economist Shaun Roache wrote in an article. Rising demand for biofuels and bad weather also tightened supply, they said.

“Rising food prices may be here to stay,” Helbling and Roache wrote in the article published in the agency’s Finance & Development magazine. “The main reasons for rising demand for food reflect structural changes in the global economy that will not be reversed.”

True, food prices signify a minor component in the household expenditure pie for developed economies. But that doesn’t mean that rising oil, food and commodity prices won’t spillover to the rest of the economy. Eventually they will!

Chart from Northern Trust

When models try to isolate variables from people’s action (like isolating food and energy from inflation index as shown above-right window), then experts tend to underestimate real social activities, like inflation.

People do not act based on one or two or select variables. Our actions are bundled, as I previously wrote

We cannot isolate one variable from the other. People’s actions are responses to an ever dynamic “bundled” environment shaped by laws, markets, culture, environment, etc...

Bottom line: macroeconomics tends to deal with superficial issues that are bottled up in laboratory environment models rather than lay blame on what truly causes CPI inflation—inflationism (low interest rates and money printing) and interventionism (price controls, subsidies and etc..).

Quote of the Day: The Failure of Macro Economic Policies

From Columbia University Professor Joseph Stiglitz writing on the IMF Blog, (bold emphasis his) [hat tip: Greg Ransom]

The most remarkable aspect of the recent conference at the IMF was the broad consensus that the macroeconomic models that had been relied upon in the past and had informed major aspects of monetary and macro-policy had failed. They failed to predict the crisis; standard models even said bubbles couldn’t exist—markets were efficient. Even after the bubble broke, they said the effects would be contained. Even after it was clear that the effects were not “contained,” they provided limited guidance on how the economy should respond. Maintaining low and stable inflation did not ensure real economic stability. The crisis was “man-made.” While in standard models, shocks were exogenous, here, they were endogenous.

In short, math models fail to predict the complexities of human action.

Tuesday, August 03, 2010

Quote Of The Day: No Scientific Understanding Of Human Society

From James Manzi, (hat tip Prof Arnold Kling)

``At the moment, it is certain that we do not have anything remotely approaching a scientific understanding of human society. And the methods of experimental social science are not close to providing one within the foreseeable future. Science may someday allow us to predict human behavior comprehensively and reliably. Until then, we need to keep stumbling forward with trial-and-error learning as best we can.”

My comment: Anyone audaciously claiming that they can use science or math or econometric models to influence changes in society signify no less than a huckster, a false messiah or a fraud.

Wednesday, June 30, 2010

Economics Should Never Be Treated As Science

Saturday, June 26, 2010

The Model Curse Strikes Again!

Here is the Wall Street Journal, (hat tip Russ Roberts)

``BP PLC and other big oil companies based their plans for responding to a big oil spill in the Gulf of Mexico on U.S. government projections that gave very low odds of oil hitting shore, even in the case of a spill much larger than the current one.

``The government models, which oil companies are required to use but have not been updated since 2004, assumed that most of the oil would rapidly evaporate or get broken up by waves or weather. In the weeks since the Deepwater Horizon caught fire and sank, real life has proven these models, prepared by the Interior Department's Mineral Management Service, wrong... (emphasis added)

How true.

Tuesday, June 22, 2010

Does Macro Economics Matter?

``So my advice to anyone about to embark upon Einhorn's path of using macro to "actively manage your long-short exposure." is to think long, hard and honestly about what your sphere of competence actually is." (thanks to my dear friend Mr. Laird Smith)

Put differently, the usefulness of the macro perspective relative to risk-reward tradeoff depends on the expected level or degree of government interventionism or inflationism.

As a caveat, while macro does matter, we shouldn't ignore the micro developments. Importantly, we should NOT depend on mathematical formalism to make macro appraisals.

Saturday, May 29, 2010

Hugh Hendry: 'I would recommend you panic'

The fascinating part is the engagement between Mr. Hendry, supposedly a fan of Austrian economist Jesus Huerta de Soto, and the mainstream camp whose views seem to be represented by academist Mr. Sachs. (hat tip Mises Blog, Jeffrey Tucker)

Some important comments by Mr. Hendry (courtesy of the comments posted at the Mises Blog)

~2:30 “When you bring on a professor and when you bring on a politician, they are unaccountable. If Jeffery’s wrong, he will survive in tenure. If I’m wrong, I go bankrupt. Who do you want to bet with?”

And,

~4:50 “I don’t know, was Jeffrey skiing two months ago? Because I was working and Julian was working. So we can tell you about the real world, because it doesn’t look like two months ago.” To which Sachs responded “please watch your language.”

Again more reasons not to trust presumptuous mainstream (ivory tower) views.

Friday, May 28, 2010

Contracting Money Supply, Deflation Bugaboo And Dubious Statistical Models

``"It’s frightening," said Professor Tim Congdon from International Monetary Research. "The plunge in M3 has no precedent since the Great Depression. The dominant reason for this is that regulators across the world are pressing banks to raise capital asset ratios and to shrink their risk assets. This is why the US is not recovering properly," he said."

Of course these experts have long used contracting money supply to argue for a deflation scare, in order to justify more inflation or money printing as a cure.

Here is a relevant chart of different money supplies from John Williams' Shadow Government Statistics

Here is a relevant chart of different money supplies from John Williams' Shadow Government StatisticsAnd compare them to the movements of asset markets below...

If you look at the money supply chart, although mostly positive, the monthly rate of changes have been on a decline since 2008 (except for M3-now negative)! So given the trend of declining money supply, theory goes that markets ought to be collapsing (!) or at the very least we won't be seeing any material rallies in the markets!!

If you look at the money supply chart, although mostly positive, the monthly rate of changes have been on a decline since 2008 (except for M3-now negative)! So given the trend of declining money supply, theory goes that markets ought to be collapsing (!) or at the very least we won't be seeing any material rallies in the markets!!The chart above shows of the 2 year trends of the global stock market index (DJW), the commodities index (CCI), an index of US government securities (USGAX) and an emerging market debt fund (XESDX).

Despite the falling rate of money supplies, all of these asset classes, which competes for everyone's money, have been on the rise in spite of the recent volatility--a scenario in stark contrast to what's being painted.

This only goes to show that there must be some major loopholes or that global dynamics must have changed alot for these statistics not to capture the developments in the asset markets.

Yet the mainstream has been using the same models to anchor their bugaboos and argue for more zombie-fication of the markets.

We earlier dealt with the lack of reliability of models in Beware Of Economists Bearing Predictions From Models, and this seems like a good example.

Thursday, May 27, 2010

Beware Of Economists Bearing Predictions From Models

"So what do all these macroeconomic models have in common?

-They’re rendered either in impenetrable math or with sophisticated computers, requiring a lot of popular (and political) faith.

-Politicians and policy wizards hide behind this impenetrability, both to evade public scrutiny and to secure their status as elites.

-Models vaguely resemble the real-world phenomena they’re meant to explain but often fail to track with reality when the evidence comes in.

-They’re meant to model complex systems, but such systems resist modeling. Complexity makes things inherently hard to predict and forecast.

-They’re used by people who fancy themselves planners—not just predictors or describers—of complex phenomena."

The point is, according to Richard Ebeling, ``The inability of the economics profession to grasp the mainsprings of human action has resulted from the adoption of economic models totally outside of reality. In the models put forth as explanations of market phenomena, equilibrium — that point at which all market activities come to rest and all market participants possess perfect knowledge with unchanging tastes and preferences — has become the cornerstone of most economic theory."

Yet many people stubbornly refuse to learn from the lessons of the last crisis.

The mainstream hardly saw the last crisis from ever occurring:

This is why the Queen of England in 2009 censured the profession's failure to anticipate the crisis.

This also why US investment banks became an extinct species in 2008 as remnant banks were converted into holding companies, as losses strained the industry's balance sheets, which forced these banks into the government's arms.

This also why Ponzi artist Bernard Madoff gypped, not only gullible wealthy individuals but importantly a slew of international financial companies.

And this is also why contrarian John Paulson was able to capitalize on shorting the housing bubble via Goldman Sachs, which became a recent controversy, because the other side of the trade had been 'sophisticated' financial companies.

In retrospect, not only was the mainstream composed of highly specialized institutions, which were not only model oriented, but had an organization composed of an army of experts that have not seen, anticipated, predicted or expected these adverse events.

It is also important to point out that not only are the models unrealistic but those making these models are people with the same frailties whom they attempt to model. These people are also subject to the same biases that helped skew the models, which they try to oversimplify or see constancy in a dynamic world. They are also subject to Groupthink and the influences of Dopamine in their decision making process.

Adds Mr. Borders, (emphasis added)

``What does this mean for economics as a discipline? I think it’s time we admit many economists are just soothsayers. They keep their jobs for a host of reasons that have less to do with accuracy and more to do with politics and obscurantism. Indeed, where do you find them but in bureaucracies—those great shelters from reality’s storms? Governments and universities are places where big brains go to be grand and weave speculative webs for the benefit of the few.

``And yet “ideas have consequences.” Bureaucracies are power centers. So we have a big job ahead of us. We’ve got to do a seemingly contradictory thing and make the very idea of complex systems simple. How best to say it? Economists aren’t oracles? Soothsaying is not science? Ecosystems can’t be designed?

“The very term ‘model’ is a pretentious borrowing of the architect’s or engineer’s replica, down-to-scale of something physical,” says Barron’s economics editor, Gene Epstein. “These are not models at all, but just equations that link various numbers, maybe occasionally shedding light, but often not.”

Bottom line: Incentives and stakeholdings largely determine the mainstream's fixation to models.

Many are driven by ego (desire to be seen as superior to the rest), others are driven by politics (use math models to justify securing the interests of particular groups), some by groupthink (the need to be seen in the comfort of crowds), some because of personal benefits (defense of political or academic career, stakeholdings in institutions or markets or businesses) and possibly others just for the plain obsession to mathematical formalism.

At the end of the day, logic and sound reasoning prevails.

Sunday, September 13, 2009

Velocity Of Money: A Flawed Model

``Economics is a social science. Econometric models spit out results that lack the accuracy of chemistry experiments and the precision of mathematical equations. Central bankers are forced to deal in the realm of the touchy-feely all the time. If their work could be reduced to an equation, we wouldn’t a) need them or b) find ourselves in the mess we’re in now.” Caroline Baum Central Banks Can Do Better Than Just Mopping Up

Zero Hedge’s Mr. Tyler Durden comment of ``And instead of this excess money hitting broader aggregates such as M2 or MZM, it is held by the banks, who proceed to buy securities outright on their own, either Treasuries or Equities. Apply the proper "money multiplier" to get the monetary impact on the S&P 500, as a result of the banks not lending these excess reserves, and instead simply speculating with it, and you will likely get the increase in the market cap of the S&P since the launch of QE” provoked my inquisition to mainstream’s allure to use money velocity as benchmark for arguing the case for deflation.

Velocity of money is the turnover (circulation) rate of money in terms of transactions.

It is assumed that a low money velocity, which means lower rate of circulation, can only support lower prices.

Yet if US banks have indeed been directly speculating, and if such activities haven’t been registering in money aggregates, as postulated by Mr. Durden, then the whole premise built around the inefficacy of monetary policies seems tenuous because statistics have not accurately captured such bank speculations in the asset markets.

Besides, Velocity of Money is a statistical measure based on the Keynesian consumption model, where spending equates to income.

The idea is more spending would result to higher prices and higher national income and or higher economic growth.

This is an example from wikipedia.org,

``If, for example, in a very small economy, a farmer and a mechanic, with just $50 between them, buy goods and services from each other in just three transactions over the course of a year

Mechanic buys $40 of corn from farmer.

Farmer spends $50 on tractor repair from mechanic.

Mechanic spends $10 on barn cats from farmer

``then $100 changed hands in course of a year, even though there is only $50 in this little economy. That $100 level is possible because each dollar was spent an average of twice a year, which is to say that the velocity was 2 / yr.”

In short, velocity of money measures transactions only and not of real economic output.

Moreover, it is also implies that money printing or increasing systemic leverage as the key driver to an increased velocity of money.

From the Austrian economic perspective, this concept is pure flimflam.

Henry Hazlitt wrote ``What the mathematical quantity theorists seem to forget is that money is not exchanged against a vacuum, nor against other money (except in bank clearings and foreign exchange), but against goods. Hence the velocity of circulation of money is, so to speak, merely the velocity of circulation of goods and services looked at from the other side. If the volume of trade increases, the velocity of circulation of money, other things being equal, must increase, and vice versa.” (bold emphasis mine)

Similarly Ludwig von Mises scoffs at the concept, ``They introduce instead the spurious notion of velocity of circulation fashioned according to the patterns of mechanics.” (bold emphasis mine)

Figure 5: Hoisington Management: Velocity of Money

Figure 5: Hoisington Management: Velocity of Money

Some deflation exponents say that the two major forces, which drove up the velocity of money, which has characterized the previous boom (see figure 5), particularly financial innovation and leveraging, will be materially less a factor in the post boom era.

The general notion is that the collapse of the shadow banking system and the deleveraging in the US households and its banking system would lead to deflationary pressures from which the government or the central bank inflationary policies won’t be able to offset.

That is from a mathematical standpoint, from which presumes to capture all the variables of human actions. Unfortunately, these macro based math models don’t reflect on reality, because it can’t impute the cause and effect, before and after outcomes of human decisions.

Other reasons why I think velocity of money is a flawed model?

One, such outlook depends on the accuracy of each and every variable that constitutes the equation, such as money supply. If Mr. Durden is correct, then velocity of money model automatically crumbles.

Two, it disregards the impact of pricing dynamics on the marketplace, e.g. how will lower prices impact demand?

Three, it discounts man’s adoptability in acquiring technology [see earlier post, Technology's Early Adoptor Disproves Deflation]

Fourth, such measure focuses entirely on the leveraging of the financial sector and leaves out the contributions from the real economy.

Fifth, it treats the economy as a homogeneous constant (single form of capital, labor and output), from which excludes the evolving phases of the interlinkages of the marketplace, governments and technology.

Lastly, it oversimplistically omits the transmission mechanism from the interactions of the US (policies and economic activities) with the world.

As Professor Arnold Kling observed, ``Structural models do not extract information from data. Instead, they are a method for creating and calibrating simulation models that embody the beliefs of the macroeconomist about how the economy works. Unless one shares those beliefs to begin with, there is no reason for any other economist to take seriously the results that are calculated.” (bold emphasis mine)

Or as Warren Buffett on warned on depending on models, ``Our advice: Beware of geeks bearing formulas.”

Sunday, June 21, 2009

Global Stock Markets: Finally A Reprieve, Ivory Tower Syndrome And Ipse-Dixitism

``Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one” -Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

Finally after 6 weeks consecutive weeks and a dazzling 21.64% of gains, the Philippine benchmark, the Phisix, finally succumbed to a hefty 7.72% “profit taking” streak over the week.

Yeah, cower in fear because the big bad bear is back in picture! But is it?

Anyone looking for a simplified answer should get this…we aren’t alone. See Figure 1

While the domestic losses may have the biggest in Asia, perhaps exacerbated by the uncertainties over the political front or just plain momentum-sentiment based panic, the carnage in the region had been nearly equally as steep. For instance, Vietnam, Thailand, Indonesia, Hong Kong and India suffered losses anywhere in the range of 5%-7%. That has been the rule.

The chart shows how the Dow Jones World, Asia Ex-Japan and Emerging Markets simultaneously turning down.

And again, China has again been the exception with both indices (Shanghai and Shenzhen) gaining nearly an astounding 5%.

But it isn’t China alone this time, the recently concluded longstanding Tamil insurgency problem in Sri Lanka appears to have brought about a stockmarket honeymoon.

The Colombo Index has spiked by nearly 9% this week, and is the first of among Asian markets to have reached the pre-crisis levels and is just off by about 20% from the 2007 high see Figure 2.

And I am predisposed to think that Asian bourses will follow suit.

Additionally, I’d like to point out that the Sri Lankan Colombo index has defied the tide because of an extraordinary development.

Going further, the scale of the recent losses has extended throughout most of Europe and to the Americas. Nevertheless, it has been a mixed showing for the Middle East and African region.

G-8 Communiqué As Catalyst?

So what has spurred this so-called global profit taking?

Technically speaking, under normal circumstances, no trend goes in a straight line.

Empirically, we have been witnessing excess volatility from a massive liquidity driven environment.

Fundamentally, I am predisposed to view this event, the G-8 meeting in Italy last weekend where leaders spoke about plans (actually blarneys) to unwind rescue program-as having been the main catalyst.

This from the Wall Street Journal (bold highlights mine), ``World financial leaders are starting to examine how they will unwind their emergency spending packages and bank rescues as signs emerge that the economic crisis may have hit bottom.

``Finance ministers from the Group of Eight leading countries on Saturday asked the International Monetary Fund to research strategies to slim budget deficits and reduce government presence in the financial sector, but in a way that wouldn't reignite the crisis.”

Three observations from these meaty statements:

One, governments have engaged in massive scale of emergency programs without the benefit of studying the possible unintended effects of such programs.

Two, along with this is the NO contingent or NO exit plans.

Gadzooks! Governments have been operating on mere BLIND FAITH on the feasibility of mainstream economic models!

And lastly, asking the IMF to “research strategies to slim budget deficits” is downright and strikingly preposterous! It resonates of the addiction by governments on boondoggles (spending binges) without considering the financing or all other aspects for that matter.

Commonsense says that you either need to cut spending or raise revenues! How complex or difficult could that be? And you don’t need the IMF for that. Qué Horror! Maybe the G8 leaders need to bankroll me for a lot cheaper price.

Markets, acting apparently on cue, shuddered from the thought of such exit plans! This goes to show how increasingly dependent our financial markets have become to money printing dynamics.

The Ivory Tower Syndrome?

Yet for some, commonsensical thinking or basic economic reasoning isn’t the preferred view.

Ironically commonsensical thinking has been perceived as tantamount to the Ivory Tower Syndrome.

The comments of Professor James K. Galbraith of the Lyndon B. Johnson School of Public Affairs at the University of Texas relates to its definition, ``I don’t detect any change at all. [Academic economists are] like an ostrich with its head in the sand.”

Experts afflicted with the Ivory Tower Syndrome simply means losing touch with reality.

It’s because these experts mostly live in a theoretical world filled with quant or econometric models, with virtually no hands-on exposure at risking their own money. Nonetheless they survive under the stipend of institutions and by NOT getting their hands dirty. In other words, perspectives of Ivory Tower analysts are most likely to be unrealizable, if not delusional and unworthy to be heeded.

As the global financial markets endured from a meltdown during the last quarter of 2008, we pointed out that some significant signs, such as the emergence of barter trade (which signified as an impasse on trade finance more than an economic problem) and an appearance of a bottoming market in China, defied the “realistic” consensus view that the world would fall apart.

At the heat of the panic we even declared a buy! [see October 12, 2008 The Bullish Case: It’s Blood On The Streets!].

Then, except for a few experts as Warren Buffett, Jeremy Grantham and John Hussman whose outlook we explicitly covered, other prominent value investors joined the contrarian bandwagon as Steve Leuthold, Anthony Bolton, Vanguard’s John Bogle and Rob Arnott we mentioned in The Rise of Value Investors Amidst A Prevailing Fear and Loss Environment. All of these elite savants, along with my humble perspective, challenged the interpretation of reality by the consensus as the imminence of deflationary depression!!!

Further, we even found evidences of a bottom in commodities last November 2, 2008, see More Compelling Evidence For An Inflection Point in Commodities!.

Moreover, as signs of improvements got reinforced, we repeatedly pounded on the table that stock markets and commodity markets will eventually be driven by government printing presses around the world, which has collectively been operating on 24/7 basis.

And instead of getting tied with economic gobbledygook, we focused on the inflation dynamics which in our view should give us a better glimpse of the market’s direction [see November 30, 2008, Stock Market Investing: Will Reading Political Tea Leaves Be A Better Gauge?]

This means that, in contrast again to the consensus, whom has opted to fixate on mainly the economic template, our fundamental area of concern has been to scrutinize on the actions of global political leaders and central bankers with its possible ramifications or impact on the markets and the economy.

Simply stated, we DIDN’T DEAL with esoteric mathematical models or flamboyant statistical artifacts seemingly aimed to mostly impress gullible audiences as employed by most mainstream analysts with their highly flawed models, we simply dealt with plain vanilla economic reasoning.

As Gerard Jackson in Economic commentators still clueless about the recession so aptly put, ``Unfortunately there are no mathematical relationships in economics. This means that economics is qualitative and not quantitive, despite the obvious importance of statistics.”

The point of this rant is not to accept or deny the pejorative imputation of Ivory Tower analyst, since that would be subjective. People can just say anything about anybody, true or untrue. It’s all a matter of consistency or inconsistency between the allegation and the performance.

Importantly, the perception of reality has always been a preconception out of individual biases. Alternatively, this means ``People believe what they need to believe, when they need to believe it”, a favorite quote of mine excerpted from Bill Bonner of the Daily Reckoning fame. Otherwise, this is also known as the confirmation bias-or the proclivity to look for or interpret data which confirms to inherent beliefs.

Ipse Dixit: Fundamental Driven Markets

In the present circumstances what seems to be the predilection of the mainstream?

Since the markets have shown signs of “life”, many have extrapolated current price levels as an attribution to “fundamental” driven market-economy dynamics.

In other words, the George Soros’ reflexivity theory seems to be getting even more entrenched- many now insist that fundamentals matter more than liquidity. Why? Because prices say so!!!

Funny, but 9 months ago or even at the start of the year, we haven’t heard arguments of such genre. Now market actions appear to calcify on the biases of many market observers.

Let us put it this way, since we believe that this episode has been tightly driven by the interlinkages of global liquidity channels, then it is likely that stock market and commodity market performance will be reflective of the state of inflation absorption as well as the degree of monetary inflation across the global economic and financial system.

In other words, inflation is always relative. As Henry Hazlitt in What You Should Know About Inflation [p.130] wrote, ``Inflation never affects everybody simultaneously and equally. It begins at a specific point, with a specific group. When the government puts more money into circulation, it may do so by paying defense contractors, or by increasing subsidies to farmers or social security benefits to special groups. The incomes of those who receive this money go up first. Those who begin spending the money first buy at the old level of prices. But their additional buying begins to force up prices. Those whose money incomes have not been raised are forced to pay higher prices than before; the purchasing power of their incomes has been reduced. Eventually, through the play of economic forces, their own money-incomes may be increased. But if these incomes are increased either less or later than the average prices of what they buy, they will never fully make up the loss they suffered from the inflation.”

Applied to the current setting, I would deduce that that the stock market and commodity markets have been the secondary recipients of global government spending, central bank lending, direct grants and US Federal Reserve purchases of US sovereigns and mortgage bonds. This has prompted some corners to baptize a moniker for this phenomenon as the bailout bubble, as earlier discussed in Monetary Forces Gaining The Upper Hand Equals The "Bailout Bubble"?.

Whereas circulation credit or bank lending from emerging markets or in Asia or in parts of the US (such as federally insured mortgages) or elsewhere could account for as primary or also secondary channels. The Wall Street Journal gives as this clue, ``Because businesses can't put trillions of new dollars to work in such a short time, the money is finding its way into financial markets.” (bold emphasis mine)

Since markets always operate on the basis of expectations, then a synchronic decline in global markets suggest of four possible causes, outside the technical and sentiment based considerations:

One, markets could probably be discounting a peak in government sponsored programs. Given the addiction of governments as shown by the G-8 news, this isn’t the likely route. Governments have been relishing both the spending spree and the apparent initial favorable effects on the markets.

Two, markets could also be factoring in a culmination in bank lending thru policy induced tightening or a by an aggregate private institutional policy curbs.

This isn’t likely so too. Since the US Federal Reserve has been providing leadership and guidance to global central bankers’ action, then its policy rates could serve as bellwether to the interest rate policy direction of other major central banks see figure 3.

Figure 3: St. Louis Fed: Fed Fund Rates futures

We note that while the Fed rates futures have indeed seen a marginal increase to the upper band of the official Fed Rates, it hasn’t succeeded in breaking out yet.

Three, a combination of both.

Fourth, false negative or also a trial balloon. Here the market may have misread the government actions or communications on the threats to unwind or reverse emergency programs, where the official G-8 communiqué may have been unintentional or intentional, possibly targeted at testing markets response.

While I am not certain on the true state of the markets now, the G-8 pronouncements most probably embodies the fourth variable.

Governments given their ideological underpinnings and the present conditions are unlikely to further discomfit the markets. So any further weaknesses by the stock markets are likely to prompt for “dovish” or market friendly communications from the officialdom.

This brings us back to the revitalized arguments of the ‘fundamentalist’, if markets have been moving based on fundamental factors and not from liquidity transmission channels, then why is it then that global markets continue to act almost uniformly? Why are correlations high among regional markets (except for China and Sri Lanka) or even relative to global markets?

The reaction seen in the global markets hasn’t been seen only on Phisix component issues but also in the internal market actions as seen in the market breadth and in the sectoral performance, of the Philippine Stock Exchange (PSE) see figure 4.

Figure 4: PSE: Sectoral Performance, Fundamentals, Where?

The Banking index (black candle), Service (Gray), Commercial Industrial (pink), Holdings (red), property (blue), All index (maroon) and mining (green) have all been down.

The most recent carnage has almost been in the scale of the climax of the October-November 2008 rout, where advance-decline balance has almost been 1:4 ratio!

Further deterioration of market internals at the same rate as last week would translate to the same tsunami that would sink all ships afloat!

So fundamentals, where?

Focus On Issues That Matter

People are unarguably entitled to their perception of reality. If anybody wants to believe in the “reality” of Santa Claus or Peter Pan and tinkerbell or Superman or a living Elvis, no one will stop them.

Although we are open to exchanges of ideas in the same way markets operate on the exchanges of goods or services based on voluntarism and the availability and expected informational changes, my preference for cerebral stimuli are based on merits and show proofs or evidences and not on Ipse-dixitism or an unsupported assertion.

That’s because to operate on hunches or base intuition is likely to be a very risky endeavor where cognitive biases can function as fatal traps. And this applies not only to the investment sphere but to real life non-investment decision making.

A misdiagnosis that leads to a wrong cure risks worsening of the conditions of a patient possibly by complications. In investments, the same misdiagnosis could translate to heavy losses.

And that’s why we try to avoid dealing with gossip or trivia based market actions. Sensationalism, which connects to the majority, only reinforces cognitive biases. And what usually are deemed as popular issues or causes are frequently flawed or even illusory. For instance, politicians sell free stuffs-health, education, jobs, including bailouts and etc. especially during election seasons. In a world of scarcity, there is no such thing as free lunch. Another, some people equate stocks to horse racing, hence, they get what they deserve.

And by the omission of the sensational, it doesn’t matter if our viewpoints aren’t popular. What matters for us is survivability and feasibility.

Conclusion

Despite the harrowing performance of the Phisix or of global stock markets, which may have been prompted for by market’s realization that the good party days may be cut short perhaps based on the conveyed communication by the G-8 meeting or possibly due to overextended or overheated winning streak, it is highly likely that these setbacks could be temporary.

Governments sensing the latest streak of triumphs aren’t likely to upset the present gains, in spite of pressures applied by certain quarters. The present environment has been ideal for the governments as they benefit from both their spendthrift ways and an ephemeral favorable market condition which illuminates on the vainglories of the fictitious centrally based solutions to national economic problems. Maybe Murphy’s Law applies here: If it ain’t broken, don’t fix it.

If today’s markets have been responding to the expectations of culminating inflationary actions then governments will most likely change tones and revert to dovish themes while simultaneously re-inflating the system. That’s our bet.

Besides mainstream experts adhering to the predominant ideology would constantly use technical jingoism of “output gaps” and “idle resources” to rationalize or justify further money printing activities through-quantitative easing, deficit spending, Zero bound policies, negative real interest rates and etc.

So I’d go against the technical outlook which is in present emitting signals in conflict with the probable effects from government policies. Stock markets could go lower or consolidate but won’t probably retest the old lows.

Finally, what appeals to people is what they like or want to hear, read or see premised on their underlying biases.

Biases are inherent to human nature, as it had been hardwired to us by our ancestors. It has been programmed into our genes. Although, the best way to manage bias is by keeping an open mind.

After all, in the markets, it isn’t about being “right” in terms of convictions, it is essentially about being profitable by adopting the “right” flexible mindset and discipline.

So from our end, if the Ivory Tower syndrome equates to survivability, feasibility and performance, then it’s no shame to be labeled as one.

Unfortunately, the idiom, which means to lose touch with reality, would lose its relevance.