The single most important price in all of capitalism is the money market rate of interest. It sets the cost of carry in all asset markets and on options and futures pricing. It therefore indirectly fuels the bid for all debt, equity and derivative securities in the entire global financial system.—David Stockman

In this issue

Why Interest Rates Will Rise: 1Q Fiscal Deficit Blowout Financed by BSP’s Debt Monetization (QE) and Spiking Public Debt!

-The BSP’s Anti-Disinflation/Deflation Mindset

-Overcapacity Signifies Malinvestments

-1Q 2018’s Deficit Blowout: Exploding Expenditures in the Face of Waning Tax Revenues!

-Excess Supply Plus Crowding Out: Huge Financing Required for NG’s Spend, Spend, Spend Competes with the Private Sector

-Liquidity Strains Hit the Banking System!

-The BSP’s Launches QE to Offset Liquidity Depletion!

-The BSP and the NG Have Been Boxed to a Corner!

Why Interest Rates Will Rise: 1Q Fiscal Deficit Blowout Financed by BSP’s Debt Monetization (QE) and Spiking Public Debt!

The days of easy money are over.

The cumulative sins of the past and the present have converged to plague the Philippine economy

Risk pressures underneath the financial system have been intensifying. And despite official actions to restrain it, such pressures have been partially ventilated through the markets.

Even the establishment experts have succumbed to recognize its presence. With the Bangko Sentral ng Pilipinas (BSP) being “behind the curve”, the risk of “overheating” has risen. So they have pressured the BSP to alter its policy stance.

Naturally, the BSP has vehemently denied this.

“Behind the curve” means that policies have lagged real-time developments for it to have allowed excesses to accrue within the system.

Overheating, on the other hand, is defined as excess demand over productive capacity leading to price pressures.

The reality has been that the establishment experts have been reasoning from price changes or rationalizing the current dynamic. Because pressures have appeared, they have sought explanations for it rather than comprehend the current status.

As iconoclast philosopher and mathematician Nassim Taleb wrote aptly in his newest book Skin in the Game

The curse of modernity is that we are increasingly populated by a class of people who are better at explaining than understanding, or better at explaining than doing.

Yet these developments have not appeared out of a vacuum.

The BSP’s Anti-Disinflation/Deflation Mindset

Here is the backstory.

As I have repeatedly been pointing out here, when money supply growth exploded by 30% for TEN successive months in 2013-2014, that was THE “overheating”.

The partial tightening (e.g. monetary decisions of May 8, June 19, July 31 and September 11) in response to the surge in inflation signified proof that the BSP was “behind the curve”. Remember the Senate investigations on garlic prices? That episode underscored the BSP policy changes inreaction to these.

But the BSP got burned with that decision!

As credit expansion slowed in 2015, prices begun to fall, GDP and earnings declined. Mall vacancies made its inaugural appearance here. Then BSP chief Tetangco introduced the deflation-disinflation spiel in his speech.

Ladies and gentlemen, disinflationary pressures and divergence are just two of the key economic issues that are likely to pose challenges for central bank like the BSP.

Amando M Tetangco, Jr: Keeping the economy on the right track – key challenges for monetary policy February 20, 2015, Bank for International Settlements

So by the end of 2015, the BSP unleashed the nuclear option: Quantitative Easing! A tool reserve for economic and financial emergencies was used to combat disinflation/deflation.

Basically, except for this lowly analyst, such actions were buried from the establishment's communications. Even now.

Overcapacity Signifies Malinvestments

Fast forward today.

Recent price spikes or mainstream’s account of inflation have been in areas with fewer investments (food and energy) and sectors covered by the changes in policies (excise taxes and VAT).

Here is the BSP’s narrative on April CPI which soared past 2014 highs: “Inflation accelerated as most major CPI subcomponents continued to increase during the month. Food inflation remained elevated, driven by higher price increases for rice, corn, and vegetables. Likewise, inflation for non-alcoholic beverages, alcoholic beverages, and tobacco went up due to the excise tax adjustment. Prices of petroleum products also increased during the month, reflecting rising international oil prices, while upward adjustments in electricity rates were driven by higher generation and transmission charges.”

Though real economy and real estate prices have been rising, swelling vacancies of retail specs in malls haven’t been signs of full capacity, but rather escalating saturation (excess capacity).

Rather, these are signs of escalating economic maladjustments brought about by the BSP’s tampering with interest rates and worsened by the incumbent administration’s profligacy.

By establishing a near complete dependence to an easy money regime and by embracing aggressive redistribution fiscal policies, now the lethal mix of artificially boosting the economy has come to a head

1Q 2018’s Deficit Blowout: Exploding Expenditures in the Face of Waning Tax Revenues!

Let us begin with fiscal policies.

At Php 110.7 billion, March fiscal deficit even beat December 2017’s Php 107.15 billion which marked the highest monthly spending since December 2016. Because of the end of the year concerns, public spending is usually the largest during December.

Despite the imposition of RA 10963 or the TRAIN (Tax Reform for Acceleration and Inclusion) law, the growth rate of March revenues slowed to 12.27% from 17.58% in February and 19.26% in January. Expenditure growth has been in high octane for two successive months clocking in 29.52% in March and 36.86% in February.

Because of the March data, 1Q deficit zoomed to a blow-out Php 162.236 billion, a record high, and accounts for 46.27% of 2017’s full-year number! (chart in upper pane)

Annualized, the Php 649 billion deficit will account for 3.8% of the projected GDP which is way past the government target.

The National Government has targeted a deficit-to-GDP ratio of 3% which should run anywhere between Php 480 billion to Php 520 billion.

And if bank credit will grow by 17% this year (marginally slower than the previous 2 years), such deficit, financed through treasury issuance, will gorge on 54.88% of the banking sector’s liquidity! Total bank credit (production + consumer) grew by 18.39% in 2017 and 17.4% in 2016.

Total tax revenue growth has mirrored bank credit growth running at 18.19% in March, 18.68% in February and 18.21% in January 2018.

Both of these trends appear to be slowing down! (middle and lower charts)

Why the slowdown??? Shouldn’t TRAIN boost tax revenues even in the immediate term?

More than 70% of domestic liquidity comes from the banking sector.

Excess Supply Plus Crowding Out: Huge Financing Required for NG’s Spend, Spend, Spend Competes with the Private Sector

The above provides two very precious insights: Tax Revenues and Liquidity conditions.

Bank credit growth has been correlated heavily to tax revenues. (middle window) Needless to say, bank credit expansion has contributed substantially to tax revenues. Therefore, should BSP raise policy interest rates, a SLOWDOWN in bank credit growth would lead to REDUCED tax revenues!

And a slowdown in revenues would rattle the credit dependent GDP and political boondoggle of spend, spend and spend.

And do you not see why the BSP has been dithering from tightening???

And that’s not all.

If the first factor is about taxes, the second is about LIQUIDITY.

How March’s staggering deficit was financed.

The financing of deficit spending is through either debt or inflation or a combination of both.

For the first quarter, the NG and the BSP used both!

The Bureau of Treasury’s total debt stock (domestic + foreign) jumped by 11.14% (year-on-year) in March signifying the highest pace of growth since the start of my record in 2012. Domestic debt spiked by 12.55% or by Php 35.9 billion, the fastest rate since July 2013. Foreign debt also vaulted by 8.61% or by Php 22.32 billion. About 47% of the increase in foreign debt originated from the depreciation of the peso. For the year and the quarter, total debt rose by Php 58.23 billion, which accounted for 36% of the period’s deficit. (upper window)

In March, the stock of National Government’s debt has reached Php 6.88 trillion or 43.5% of 2017’s nominal NGDP. Domestic debt accounted for the lion’s share of NG debt at 64.92% while local debt had a share of 35.08%

An increase in the supply of government debt will lower prices (elevate or raise yields, thus interest rates).

Additionally, massive government debt issuance will compete with the private sector for access to savings, which means even more supply of debt.

The intensification of competitive bids to access savings will, thereby, require much higher yields.

In March, total production and consumer loans soared by 18.19% to Php 7.058 trillion or 44.68% of the NGDP.

To repeat, the increase in Treasury supply, aggravated by competition with the private sector for access to savings, should drive yields substantially higher (prices lower).

Liquidity Strains Hit the Banking System!

Since the BSP reported US $2.5 billion in foreign inflows to Philippine assets in March with about half channeled to Philippine Treasuries (ROP),rising yields have emanated from actions of domestic banks, investment houses and contractual savings institutions such as private and government pension funds (GSIS, SSS)

Yes, banks and financial institutions have been selling bonds to raise liquidity!

And emerging liquidity constraints has been manifested through the gush of Stock Rights Offering (SROs) and the barrage of Long-termnegotiable certificate of time deposit issuance by the banking system.

[Coming up changes in the banking system’s investment portfolio]

And competition for savings will also extrapolate into a crowding out dynamic. The crowding out effect means that through higher interest rates, government spending will displace or reduce private sector spending.

And a fundamental thing to remember is that the relationship between inflation and government debt supply is causal: Government expenditures influence real economy prices while the financing of such (deficit) spending influence the pricing of debt.

The NG has finally acknowledged and admitted to the excess supply and crowding out syndrome. In response to the plea for the doubling of the public sector’s teacher’s salary, this AWESOME quote from the from GMA (bold mine)

Doubling the salaries of public school teachers will require an additional P343.7 billion, equivalent to 2 percent of the country's gross domestic product, according to the Department of Budget and Management, which warned of a credit rating downgrade as a result of an unmanageable deficit.

“This means we will have higher interest rates in the near future and greater debt service payments when borrowing from international institutions. In other words, such policy will endanger our prudent and carefully crafted medium-term fiscal program,” Budget Secretary Benjamin Diokno said in January.

As a result, the government may resort to imposing new taxes or cut other items in the budget.

Nevertheless, such dynamic will impact domestic rates more than international rates

As a side note, should the Duterte administration fulfill this promise, the crowding out syndrome will not just affect financing but impact the real resources and labor as well. If the private schools fail to outbid the NG, they will lose out the supply of teachers to the public schools. And by raising rates of private school teachers, tuition fees will rocket to compensate for this intensified competition. And should higher tuition fees dampen demand and or should the dearth of private school teachers emerge to impact the industry's balance sheets, the supply of private sector education will diminish. And that’s just part of it. Real resources will be drawn from other areas of the economy to subsidize this. This lopsided competition ensures that as the role of the government bulges, the private sector shrinks! Politics will become the driver of the economy at the expense of market forces: The Neo-socialist state. [This is tied with the free college; SeeHistoric Moment Unfolding in the Philippine Financial System; More Free Lunch Policies August 5, 2017]

This brings us back to the issue of liquidity.

Considering that the government will have finance their aggressive spending with DEBT, a deluge of Treasury issuance will serve to DRAIN liquidity from the system. A back of the envelop calculation should help. If bank credit would grow at 17-18% in 2018 and if fiscal deficit hits the annual rate of Php 648 billion, then about half of the liquidity generated by banking system would have been siphoned off! Taking off half of the system’s liquidity would thus serve as an indirect but sharp tightening!

And depletion of liquidity would entail higher costs of money, shrink taxes, earnings and GDP which should incite a meltdown in asset markets and amplify credit risks.

This morbid fear of deflation/disinflation has, thus, encapsulated the raison d'être of the BSP’s dillydallying!

Hardly any of the above reasoning has been considered or absorbed by the mainstream.

By the way, I have not dealt with maturity transformation and currency mismatches in the financial system.

The BSP’s recalcitrant stance to keep rates at HISTORIC lows have hardly been about inflation but about ballooning risks to subsidies to the bubble political economy, in particular, the Neo-socialist state’s spending binges and the bubble sectors of shopping malls, real estate, and hotels!

The BSP’s Launches QE to Offset Liquidity Depletion!

Well, the BSP has only been confirming my theory.

Not just debt, the blowout March fiscal deficit has been financed by the BSP’s debt monetization program (net claim on Central Government)!

From the BSP: “Likewise, net claims on the central government rose by 6.5 percent from 3.7 percent as a result of increased borrowings by the National Government.”

The BSP financed the NG to the tune of a whopping Php 98.324 billion or 60.6% of March’s deficit! (upper left window)

Over the quarter/year, the BSP’s emergency debt monetization has ramped up to Php 138.13 billion or 85.14% of the Php 162.24 billion deficit! (middle window)

The March monetization marks a breakaway run from 2017’s consolidation. The BSP acquired only Php 31.941 billion of NG debt in 2017.

Bank credit expansion has mostly determined the liquidity conditions and the CPI. That relationship has been diminishing since 2015. (upper right)

The rate of total bank credit has been falling since peaking out in September 2017, but CPI (base 2012) continues to rage. (lowest chart)

And the direction of the USD-peso has been determined largely by the BSP's QE (upper right and middle red trend lines)

In fact, mainly from BSP’s QE and Bond Yield control measures, negative real rates have only deepened. (lower window) That’s free money for the government and for private sector borrowers, which favors mainly the elite.

An anecdotal proof of the BSP’s yield control, from the Inquirer (April 25, 2018) [bold added]: “Espenilla said that while the term deposit facility, in which banks can deposit their unused cash for 7, 14 or 28 days, is not a proxy for the closely followed overnight rates, it is one of the instruments available to the BSP in its arsenal. “And we have allowed interest rates to move up in line with market condition,” he said, noting that average yields on the three instruments have risen by about 50 basis points in recent weeks. Similarly, he pointed out that the yield on the government’s benchmark 91-day treasury bill has risen by more than 100 basis points since the start of the year. “At the end of the day, we want to influence economic activity, expectations and the exchange rate,” Espenilla said, parrying criticism about the central bank’s supposed inaction on inflation. “And all of these are susceptible to the movement of interest rates by different magnitudes.”

I define yield control as policy measures undertaken by the BSP to manage or manipulate bond yields/prices

The claim that interest rates have been allowed to move up in line with market conditions is patently inaccurate because the logic flowsbackward. If the BSP had complete control over the market, rates would go to zero.

Since 2016, the Overnight Reverse Repurchase Rate (O/N RRP) has been pegged at a landmark, or at an all-time low rate of 3%.

Because the BSP operates a corridor system, the Overnight Lending Facility (OLF) at 3.5% represents the ceiling and the Overnight Deposit Rate (ODF) at 2.5% the floor. Yet T-bills, which usually serve as collateral for interbank lending, have rates zoom past the OLF. As of May 4, 1-month, 3-month and 6-month yields were quoted last at 3.63%, 3.41%, and 3.85% respectively.

What this exhibits is that instead of the BSP in control, interest rates have moved sharply against policy targets and have rendered their policies out of touch with reality.

In that regard, in order not to look silly and present the image that they are on top of the situation, they intervene in the marketplace through the use of highly inflationary policy tool called debt monetization.

The BSP will eventually be forced to align its policies with the market!

The BSP and the NG Have Been Boxed to a Corner!

So the BSP PRINTED $98 billion in fresh pesos to finance NG’s deficit spending of Php 110.73 billion last March!

The NG and the BSP believe in free lunches. Their policies redound to the proverbial “the left-hand doesn’t know what the right hand is doing”.

The effects of NG’s massive deficit spending financed by debt issuance have been countered by the BSP’s highly inflationary QE. They don’t seem to realize that the feedback mechanism from such action will aggravate current conditions over time.

The BSP has been faced with a predicament to accommodate not only the private sector bubble but also the NG bubble using tools to subvert basic economics.

The leadership’s mentality reflects on the NG and BSP’s assault on economics

From the Inquirer (May 1, 2018): “I took up diplomatic practice and procedure, geopolitics, international law. And I am [intelligent] because I like these subjects,” he said. The President said, however, that he disliked economics. “I get dizzy with your subject,” he said, recounting a conversation with his economics professor.

Take a look at the NG and the BSP’s possible options.

1) If the NG uses the capital markets, rates will have to reflect the avalanche of supply. Moreover, NG spending will increase pressures on real economy prices.

2) If the NG will use the BSP option, the peso will fall steeply and inflation will rise, which again will ricochet or boomerang on bond yields.

3) If the government stops from its current undertaking, it will severely slow the GDP, prompt for a fall in tax revenues which should spike deficit as well. Credit risk will surface and subsequently impact the banking system. Markets will demand more collateral or increases in credit risk premium (higher yields!).

And there is the Boracay factor which will sap liquidity in the system at the margins. With commerce having been substantially curtailed, there will be substantial dislocations in the flows of credit. Bad loans will rise in the region.

Though Region 6 will be the most affected by liquidity disruptions, this will likely spread to the nation. And liquidity conditions are also anchored on demand and supply chains. Other forms of interventions — such ENDO, TRAIN, mammoth fiscal deficits and more — will also reduce trade and diminish liquidity in the system.

And there’s more.

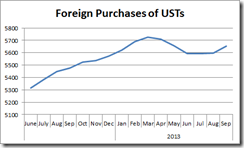

4) If the government should use or depend on external sources for its financing, they should see the same dilemma: rates have been rising too!

US Treasury yields have also been going up, almost along with ROP. UST 10-year yields recently hit 3%! Yields of ASEAN 10 year bonds have also begun to rise as well.

5) The last option would be for the NG and BSP to manipulate markets and statistics in the hope that the markets will conform and comply with their political targets.

But since there is no free lunch, and that there will be costs for such manipulations, the ramifications would be to exacerbate imbalances in the real economy which eventually will get reflected on interest rates and market prices.

The era of easy money is over!

As the great Ludwig von Mises presciently wrote

The popularity of inflation and credit expansion, the ultimate source of the repeated attempts to render people prosperous by credit expansion, and thus the cause of the cyclical fluctuations of business, manifests itself clearly in the customary terminology. The boom is called good business, prosperity, and upswing. Its unavoidable aftermath, the readjustment of conditions to the real data of the market, is called crisis, slump, bad business, depression. People rebel against the insight that the disturbing element is to be seen in the malinvestment and the overconsumption of the boom period and that such an artificially induced boom is doomed. They are looking for the philosophers' stone to make it last.