The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, August 02, 2020

The Historic Gold and Bond Bull-Market Tango

Wednesday, February 06, 2013

Video: Milton Friedman: Only Government Create Inflation

(1:37) Any other attribution to growth in inflation is wrong. Consumers don’t produce it. Producers don’t produce it. Trade unions don’t produce it. Foreign sheiks don’t produce it. Oil imports don’t produce it. What produces it is too much government spending and too much creation of money and nothing else.

Tuesday, May 29, 2012

Risk OFF Environment: Surging US Dollar

The Bloomberg reports

The dollar is proving scarce, even after the Federal Reserve flooded the financial system with an extra $2.3 trillion, as the amount of the highest-quality assets available worldwide shrinks.

From last year’s low on July 27, the greenback has risen against all 16 of its major peers. Intercontinental Exchange Inc.’s Dollar Index surged 12 percent, higher now than when the Fed began creating dollars to buy bonds under its extraordinary stimulus measures at the end of 2008.

International investors and financial institutions that are required to own only the highest quality assets to meet investment guidelines or new regulations are finding fewer options beyond dollar-denominated assets. The U.S. is one of only five major economies with credit-default swaps on their debt trading at less than 100 basis points, meaning they are viewed as almost risk free. A year ago, eight Group-of-10 nations fit that category, data compiled by Bloomberg show.

“The pool of high-rated assets has been shrinking, not just in the euro zone but elsewhere as well,” Ian Stannard, Morgan Stanley’s head of Europe currency strategy, said in a May 22 telephone interview. “With the core of Europe shrinking, and the available assets for reserve purposes shrinking, it makes the euro zone less attractive.”

In a world where debt has been the elephant in the room, especially for major economies then it would be obvious that once there will be pressure on the claims to debts then this would mean an increased demand for the US dollar. This is because debts have been denominated in fiat currencies mostly on the US dollar. Some people may have forgotten that the world still operates on a US dollar standard.

For instance, intra-region bank run in the Eurozone will likely extrapolate to higher demand for the ex-euro currencies, mainly the US dollar

From Kyle Bass/Business Insider

This means that anxieties over a shrinking pool of “high-rated assets” has also been misguided, because much of these so-called high-rated assets revolve around the problems which we are seeing today: DEBT!!!

In short, what has been discerned by the mainstream as risk-free or safe assets epitomizes nothing short of a grand myth, founded on the belief that government edicts can defeat or are superior to the laws of economics.

Yet the US dollar has not been immune to debt, except that current instances reveal that the locus of market distresses have mainly been from ex-US dollar assets or economies, particularly the EU and China.

And since current predicament has been about debt deleveraging where central bankers have been fire fighting these with intensive money printing, then the pendulum of volatility swings from either asset deflation to asset inflation—or the boom bust cycles.

As one would note, gold has mostly moved in the opposite direction of the US dollar index. The euro has the largest weighting (about 58%) in the US dollar basket.

This simply debunks the flawed idea that gold is a deflation hedge under a paper currency system.

And as Professor Lawrence H. White aptly points out on an essay over monetary reforms,

We should not expect a spontaneous mass switchover to gold, or to Swiss francs, as long as dollar inflation remains low. The dollar has an incumbency advantage due to the network property of a monetary standard. The greater the number of people who are plugged into the dollar network, ready to buy or sell using dollars, the more useful using dollars is to you.

Where the US dollar continues to surge amidst staggering gold prices, then this only means central banking actions have been momentarily overwhelmed by apprehensions over debt mostly via political stalemates, whether in the EU or in China.

Yet we should not discount that central bankers to likely step on the inflation gas to save the current political institutions based on welfare-warfare state, central banking and the political clients—the banking sector.

Prices of commodities will now serve as crucial indicators as to the conditions of monetary inflation-debt deflation tug of war.

The Risk ON Risk OFF conditions may not last, we may morph into a stagflationary landscape.

Monday, December 06, 2010

QE 3.0: How Does Ben Bernanke Define Change?

News reports say that Federal Reserve Chairman Ben Bernanke is considering the next round of quantitative easing.

From the Bloomberg,

Federal Reserve Chairman Ben S. Bernanke said the economy is barely expanding at a sustainable pace and that it’s possible the Fed may expand bond purchases beyond the $600 billion announced last month to spur growth.

This is really no news for us.

Nevertheless the following looks like the kicker…

From the same article, (bold emphasis mine)

The Fed’s policy of purchasing Treasury securities shouldn’t be considered simply printing money, Bernanke said.

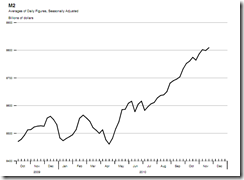

“The amount of currency in circulation is not changing,” he said. “The money supply is not changing in any significant way. What we’re doing is lowering interest rates by buying Treasury securities.”

Given the above graphs, the question that intuitively pops into my mind is how does Mr. Bernanke quantify change?

Like this?

That’s “change” in terms of the exponential growth in currency during the Germany’s Weimar Hyperinflation (chart from nowandfutures.com).

For bureaucrats, change seems like an abstraction. (this applies to politicians as well).

Monday, November 29, 2010

Ireland’s Financial Crisis Equals The Euro End Game?

There have been many commentaries suggesting that the Irish financial crisis represents as the Euro Endgame.

Well, not so fast.

This from Bloomberg, (bold emphasis mine)

Ireland’s banks will get as much as 35 billion euros ($46 billion) of aid while senior bondholders will escape the cost of the bailout led by the European Union and International Monetary Fund, the government said.

Banks will get an immediate 8 billion euros to bolster capital, and will raise a further 2 billion euros by shedding assets, the central bank said in a statement yesterday. Lenders will be able to draw on a further 25 billion euros depending on how they fare in a round of stress tests in the first half of next year, the government said in a statement…

The banks are getting the money after rising loan losses and shrinking deposits forced the government to seek the rescue. The state pledged to back all deposits in Irish banks two years ago, requiring the government to inject 33 billion euros into the lenders. The estimated cost of rescuing the banks rose to as much as 50 billion euros in September after losses from the collapse of the country’s decade-long real estate boom jumped, fueling concern Ireland couldn’t fund a rescue itself.

Ireland will in total receive 67.5 billion euros from the EU and IMF, Prime Minister Brian Cowen told reporters in Dublin yesterday after EU finance ministers backed the plan at a meeting in Brussels. The country will pay average interest of about 5.8 percent. The government will meet about half the cost of the 35 billion-euro banking bailout from its own resources, including the National Pension Reserve Fund, Cowen said.

Lenders will use the money to boost their core capital ratios, which gauge financial strength, to at least 12 percent. Bank of Ireland Plc and Allied Irish Banks Plc, the country’s two biggest lenders, will also be able to transfer all their remaining “vulnerable” commercial real estate loans to the National Asset Management Agency, the so-called bad bank set up to take over lenders’ riskiest loans, by the end of March.

As we earlier said, one of the primary role of central banks is to finance government directly or indirectly. And such redistribution process means ‘rescuing’ political privileged interest groups. Apparently this has been the case with Ireland.

Alternatively this means much of the bailouts will be coursed through stealth monetary inflation. Yes, this means you won’t read them on the papers.

To say that the Euro would disintegrate because of the populist upheaval predicated on ‘lack of aggregate demand’ or the rejection of the proposed reduction in social spending programs is pure hooey. While part of the adjustments (reductions) will reflect on the fiscal side, the offsetting (expansionary) part will be the support for the banking system which benefits from such bailouts.

And we should expect to see more of this.

Central banks will use to its hilt their ‘magic wand’. The power to control money signifies an immense privilege, political and economic. It’s not a privilege that would be easily sacrificed by the bureaucracy.

Nonetheless the degree of monetary inflation will always be relative.

Besides, throughout history people flee their currency not because of fiscal austerity or discipline or bankruptcy, but because of rampant debasement or from war.

Russia’s Putin even suggests that Russia may join the Eurozone.

This from the Bloomberg

Russian Prime Minister Vladimir Putin said Friday he was confident in the euro despite Europe's debt crisis and said his country might even join the currency block itself one day.

Putin also sharply criticized the dollar's dominance as a world reserve currency.

Despite the problems in some heavily indebted eurozone countries, the euro has proven itself "a stable world currency," Putin said.

"We have to get away from the overwhelming dollar monopoly. It makes the world economy vulnerable," he told a gathering of business leaders in Berlin through a translator.

In short, like earlier said, Euro bears will be proven wrong again.

And as we earlier wrote, hardline stance by policymakers will crumble in the face of market pressures. Again current developments appear to be validating my view.

This from Bloomberg,

European finance leaders backed a Franco-German compromise on post-2013 sovereign bailouts that waters down calls by German Chancellor Angela Merkal for investors to assume losses and share the costs with taxpayers.

The paper money system is fundamentally deeply flawed. But one system is more flawed than the other. Eventually, like in all historical accounts, the whole system collapses and reverts to the commodity system or a replica of it.

This time won’t be different.