Eventually, the naked will be exposed when the tide subsides.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, November 14, 2012

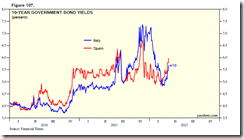

Graphic: A History of Sovereign Defaults

Eventually, the naked will be exposed when the tide subsides.

Tuesday, July 24, 2012

Quote of the Day: Freedom is not Defined by Safety

Freedom is not defined by safety. Freedom is defined by the ability of citizens to live without government interference. Government cannot create a world without risks, nor would we really wish to live in such a fictional place. Only a totalitarian society would even claim absolute safety as a worthy ideal, because it would require total state control over its citizens’ lives. Liberty has meaning only if we still believe in it when terrible things happen and a false government security blanket beckons

This is from Ron Paul’s latest outlook Security and Self Governance

Thursday, July 05, 2012

S&P’s Philippine Upgrade: There's More than Meets the Eye

From Bloomberg,

The Philippines’ debt rating was raised to the highest level since 2003 by Standard & Poor’s, taking President Benigno Aquino nearer his goal of attaining investment grade.

The nation’s long-term foreign currency-denominated debt was raised one level to BB+ from BB, S&P said in a statement yesterday. That’s one step below investment grade and on a par with neighboring Indonesia. The outlook on the rating is stable.

The foreign currency rating upgrade reflects our assessment of gradually easing fiscal vulnerability,” Agost Benard, a Singapore-based analyst at Standard & Poor’s, said in the statement. “The rating action also reflects the country’s strengthening external position, with remittances and an expanding service export sector continuing to drive current- account surpluses.”

Emerging nations from Brazil to Indonesia have won credit- rating upgrades in the past year as governments contained budget deficits. A higher assessment for the Philippines will help Aquino as he moves to boost spending to a record this year and seeks $16 billion of investment in roads, bridges and airports to shield the economy from Europe’s sovereign-debt crisis.

This is exactly the reflexivity theory at work. Here is how I described it earlier

The foundation of this theory seems to be anchored on the confirmation bias, where changes in prices that reinforces the underlying trend, gives confidence or strengthens the convictions of people to undertake action in the direction of the same trend. Such action feeds into the price mechanism and thus the feedback loop.

Applied to the Philippine equity market, many people will interpret the current state of the Phisix, which is at fresh record levels, as positive changes in the real economy. Believers would see this as having raised confidence levels, which that merits further actions through additional investments. Again this eventually feeds into higher prices.

The reality is that whatever appearance of progress the Philippines has been experiencing has been impelled by internal (negative real rates) and external (negative real rates through Zero Interest Rate Policy, QEs and other forms of inflationism) monetary policies rather than real changes in the economy.

It would be a mistake to generalize surging prices asset markets as “economic improvement” when they are veiled symptoms of underlying bubble policies.

The other factor is about perceptions management. This can be called as PR work, or in political vernacular, propaganda.

Campaign to weed out corruption have mostly been superficial as these have not addressed the roots: arbitrary statutes. Unknown to the public, corruption is not about virtuosity but about the tentacles of crooked laws.

The huge informal sector and the reliance on OFW remittance are really NOT signs of progress. They are symptoms of regulatory failure.

The plight of the OFWs have converted into a publicity stunt meant to evince of a positive political light, when they are manifestations of the failure to create domestic jobs through stagnant investments and falling standards of living.

Look at media’s exaltation from the S&P upgrade…“higher assessment for the Philippines will help Aquino as he moves to boost spending to a record this year and seeks $16 billion of investment in roads, bridges and airports”…this is proof of the dearth of investments. Investors have been reluctant to provide capital, therefore jobs.

Yet the implication is that government spending is an elixir to the economy. In reality, this $16 billion of government spending will be taken off from the private sector. And this also means $16 billion money funneled to the cronies or political favorites of this administration. Also that would extrapolate to $16 billion of tax onus to the productive sector

So the S&P upgrade actually rewards cronyism and advocates more burden for the taxpayers.

What the S&P upgrade does is to SOW the seeds for future downgrades as the current administration goes into a spending binge.

Credit upgrades means only MORE debt acquisition by the Philippine government. This will be financed by the mostly the domestic banking sector and partly by foreign money (foreign banks). So more of local savings will be channeled into unproductive political ventures as public liabilities expand.

In the light of concerns over the growing shortages of global “safe assets”—government bonds, which in reality is a myth, I believe that credit rating agencies have been rushing in aid to the banking system of major economies in order to provide bridge “safe assets”.

Since the banking system of major economies have been in dire straits, they will be in need of “safe assets” to bolster their balance sheets. So emerging market debts, such as the Philippines, could provide temporarily some of the supply of “safe assets”.

Have we forgotten too that credit agencies had been party (or may I say functional stamp pads) to the US property and mortgage bubble which blew up in 2007-2008?

Also government debt spree will likely be accompanied by a private sector debt expansion on the belief of the sustainability of a boom or from capital flight from economies inflating away their debt problems or from “bridge” collateral or a combination of these.

So will likely there be a surge in hot money.

This would seem like a déjà vu of the Asian Crisis of the 90s (Wikipedia.org)

Thailand's economy developed into a bubble fueled by "hot money". More and more was required as the size of the bubble grew. The same type of situation happened in Malaysia, and Indonesia, which had the added complication of what was called "crony capitalism". The short-term capital flow was expensive and often highly conditioned for quick profit. Development money went in a largely uncontrolled manner to certain people only, not particularly the best suited or most efficient, but those closest to the centers of power

Eventually the entire thing collapses.

Only when the tide goes out, to quote Warren Buffett, do you discover who's been swimming naked.

Party on. But be aware that this is a bubble and not about politically driven progress. Politics is about redistribution or a zero sum game--where someone's gains comes at the expense of another.

It is the markets that provide real growth.

Updated to add:

Below is an example of why credit rating agencies cannot be trusted:

From Bloomberg,

Morgan Stanley successfully pushed Standard & Poor’s and Moody’s Investors Service Inc. to give unwarranted investment-grade ratings in 2006 to $23 billion worth of notes backed by subprime mortgages, investors claimed in a lawsuit, citing documents unsealed in federal court.

According to the plaintiffs, the documents reveal that what the ratings companies describe as independent judgments were actually unsupported by evidence and written in collaboration with the bank that was packaging the securities. Morgan Stanley and the ratings companies deny the allegations.

Friday, June 29, 2012

BSP's loan to the IMF: Costs are Not Benefits

The simmering debate over the proposed loan to the IMF by the Bangko Sentral ng Pilipinas (BSP) can be summarized as:

For the anti-camp, the issue is largely one of purse control or where to spend the government (or in particular the BSP’s money) seen from the moral dimensions.

For the pro-camp or the apologists for the BSP and the government, the argument has been made mostly over the opportunity cost of capital or (Wikipedia.org) or the expected rate of return forgone by bypassing of other potential investment activities, e.g. best “riskless” way to earn money, appeal to tradition, e.g. Philippines has been lending money to the IMF for decades, and with some quirk “foreign exchange assets …are not like money held by the treasury” which is meant to dissociate the argument of purse control with central bank policies.

I will be dealing with latter

This assertion “foreign exchange assets …are not like money held by the treasury” is technically true or valid in terms of FORM, but false in terms of SUBSTANCE.

Foreign exchange assets are in reality products of Central Banking monetary or foreign exchange policies of buying and selling of official international reserves (Wikipedia.org)

This means that foreign exchange assets and reserves are acquired and sold by the BSP with local currency units, or the Philippine Peso, prices of which are set by the marketplace

It is important to address the fact that the local currency the Peso has been mandated as legal tender by The New Central Bank Act or REPUBLIC ACT No. 7653 which says

Section 52. Legal Tender Power. -

All notes and coins issued by the Bangko Sentral shall be fully guaranteed by the Government of the Republic of the Philippines and shall be legal tender in the Philippines for all debts, both public and private

This means that ALL transactions made by the BSP based on the Peso are guaranteed by the Philippine government. This also further implies that foreign exchange assets held by the BSP, which were bought with the Peso, are underwritten by the local taxpayers. Therefore claims that taxpayer money as not being exposed to the proposed BSP $1 billion loan to the IMF are unfounded, if not downright silly. We don’t need to drill down on the content of the balance sheet and the definition of International Reserves for the BSP to further prove this point.

The more important point here: whether foreign exchange or treasury or private sector assets, we are dealing with money.

And money, as the great Austrian professor Ludwig von Mises pointed out, must necessarily be an economic good, the notion of a money that would not be scarce is absurd.

As a scarce good, money held by the National government or by the BSP is NOT money held by the private sector.

Therefore the government or the BSP’s “earnings” translates to lost “earnings” for the private sector.

Costs are not benefits. To paraphrase Professor Don Boudreaux, that the benefit the BSP gets from investing in the asset markets might make sacrificing some unseen private sector industries worthwhile does not mean such sacrifices are a benefit in and of itself.

The public sees what has only been made to be seen by politics. Yet the public does not see the opportunities lost from such actions. Therefore, the cost-benefit tradeoff cannot be fully established.

Besides, any idea that loans to the IMF is risk free is a myth. There is no such thing as risk free. The laws of economics cannot be made to disappear, or cannot become subservient, to mere government edicts as today’s crisis has shown. Remember the IMF depends on contributions from taxpayers of member nations. And for many reasons where taxpayers of these nations might resist to contribute further, and or where the loan exposures by the IMF does not get paid, then the IMF will be in a deep hole.

As I pointed previous out the risk to IMF’s loan to crisis nation are real. There hardly has been anything to enforce loan covenants or deals made with EU's crisis restricted nations.

Also, it is naïve to believe that just because the Philippines has had a track record of lending to the IMF, that such actions makes it automatically financially viable or moral. This heuristics (mental short cut) wishes away the nitty gritty realities of the distinctive risks-return tradeoffs, as well as the moral issues, attendant to every transaction. Here the Wall Street saw applies: Past performance does not guarantee future outcomes.

It is further misguided to believe that the government (in particular the BSP) behaves like any other private enterprises.

As a side note, I find it funny how apologists use logical verbal sleight of hand in attempting to distinguish central bank operations from treasury operations but ironically and spuriously attempts to synthesize the functionality of government and private enterprises.

Two reasons:

1. Central banks are political institutions with political goals.

As the great dean of Austrian School of economics, Murray N. Rothbard pointed out,

The Central Bank has always had two major roles: (1) to help finance the government's deficit; and (2) to cartelize the private commercial banks in the country, so as to help remove the two great market limits on their expansion of credit, on their propensity to counterfeit: a possible loss of confidence leading to bank runs; and the loss of reserves should any one bank expand its own credit. For cartels on the market, even if they are to each firm's advantage, are very difficult to sustain unless government enforces the cartel. In the area of fractional-reserve banking, the Central Bank can assist cartelization by removing or alleviating these two basic free-market limits on banks' inflationary expansion credit.

2. The guiding incentives and structure of operations for government agencies (not limited to the BSP) is totally different from profit-loss driven private enterprises.

Again Professor Rothbard,

Proponents of government enterprise may retort that the government could simply tell its bureau to act as if it were a profit-making enterprise and to establish itself in the same way as a private business. There are two flaws in this theory. First, it is impossible to play enterprise. Enterprise means risking one's own money in investment. Bureaucratic managers and politicians have no real incentive to develop entrepreneurial skill, to really adjust to consumer demands. They do not risk loss of their money in the enterprise. Secondly, aside from the question of incentives, even the most eager managers could not function as a business. Regardless of the treatment accorded the operation after it is established, the initial launching of the firm is made with government money, and therefore by coercive levy. An arbitrary element has been "built into" the very vitals of the enterprise. Further, any future expenditures may be made out of tax funds, and therefore the decisions of the managers will be subject to the same flaw. The ease of obtaining money will inherently distort the operations of the government enterprise. Moreover, suppose the government "invests" in an enterprise, E. Either the free market, left alone, would also have invested the same amount in the selfsame enterprise, or it would not. If it would have, then the economy suffers at least from the "take" going to the intermediary bureaucracy. If not, and this is almost certain, then it follows immediately that the expenditure on E is a distortion of private utility on the market — that some other expenditure would have greater monetary returns. It follows once again that a government enterprise cannot duplicate the conditions of private business.

In addition, the establishment of government enterprise creates an inherent competitive advantage over private firms, for at least part of its capital was gained by coercion rather than service. It is clear that government, with its subsidization, if it wishes can drive private business out of the field. Private investment in the same industry will be greatly restricted, since future investors will anticipate losses at the hands of the privileged governmental competitors. Moreover, since all services compete for the consumer's dollar, all private firms and all private investment will to some degree be affected and hampered. And when a government enterprise opens, it generates fears in other industries that they will be next, and that they will be either confiscated or forced to compete with government-subsidized enterprises. This fear tends to repress productive investment further and thus lower the general standard of living still more.

From here we derive the third view that distinguishes from the two mainstream camps:

Government is NOT supposed to “earn” money. Government should leave the private sector to earn from productive undertakings. Whatever “surpluses” or “earnings” should be given back to the taxpayers. How? By reducing taxes, by cutting down government spending and or by paying down public debt.

The “returns” from these actions will surely outweigh gains made from political speculations. Unfortunately this has been unseen.

As the great Frederic Bastiat once remarked

Between a good and a bad economist this constitutes the whole difference - the one takes account of the visible effect; the other takes account both of the effects which are seen, and also of those which it is necessary to foresee. Now this difference is enormous, for it almost always happens that when the immediate consequence is favourable, the ultimate consequences are fatal, and the converse. Hence it follows that the bad economist pursues a small present good, which will be followed by a great evil to come, while the true economist pursues a great good to come, - at the risk of a small present evil.

Tuesday, May 29, 2012

Risk OFF Environment: Surging US Dollar

The Bloomberg reports

The dollar is proving scarce, even after the Federal Reserve flooded the financial system with an extra $2.3 trillion, as the amount of the highest-quality assets available worldwide shrinks.

From last year’s low on July 27, the greenback has risen against all 16 of its major peers. Intercontinental Exchange Inc.’s Dollar Index surged 12 percent, higher now than when the Fed began creating dollars to buy bonds under its extraordinary stimulus measures at the end of 2008.

International investors and financial institutions that are required to own only the highest quality assets to meet investment guidelines or new regulations are finding fewer options beyond dollar-denominated assets. The U.S. is one of only five major economies with credit-default swaps on their debt trading at less than 100 basis points, meaning they are viewed as almost risk free. A year ago, eight Group-of-10 nations fit that category, data compiled by Bloomberg show.

“The pool of high-rated assets has been shrinking, not just in the euro zone but elsewhere as well,” Ian Stannard, Morgan Stanley’s head of Europe currency strategy, said in a May 22 telephone interview. “With the core of Europe shrinking, and the available assets for reserve purposes shrinking, it makes the euro zone less attractive.”

In a world where debt has been the elephant in the room, especially for major economies then it would be obvious that once there will be pressure on the claims to debts then this would mean an increased demand for the US dollar. This is because debts have been denominated in fiat currencies mostly on the US dollar. Some people may have forgotten that the world still operates on a US dollar standard.

For instance, intra-region bank run in the Eurozone will likely extrapolate to higher demand for the ex-euro currencies, mainly the US dollar

From Kyle Bass/Business Insider

This means that anxieties over a shrinking pool of “high-rated assets” has also been misguided, because much of these so-called high-rated assets revolve around the problems which we are seeing today: DEBT!!!

In short, what has been discerned by the mainstream as risk-free or safe assets epitomizes nothing short of a grand myth, founded on the belief that government edicts can defeat or are superior to the laws of economics.

Yet the US dollar has not been immune to debt, except that current instances reveal that the locus of market distresses have mainly been from ex-US dollar assets or economies, particularly the EU and China.

And since current predicament has been about debt deleveraging where central bankers have been fire fighting these with intensive money printing, then the pendulum of volatility swings from either asset deflation to asset inflation—or the boom bust cycles.

As one would note, gold has mostly moved in the opposite direction of the US dollar index. The euro has the largest weighting (about 58%) in the US dollar basket.

This simply debunks the flawed idea that gold is a deflation hedge under a paper currency system.

And as Professor Lawrence H. White aptly points out on an essay over monetary reforms,

We should not expect a spontaneous mass switchover to gold, or to Swiss francs, as long as dollar inflation remains low. The dollar has an incumbency advantage due to the network property of a monetary standard. The greater the number of people who are plugged into the dollar network, ready to buy or sell using dollars, the more useful using dollars is to you.

Where the US dollar continues to surge amidst staggering gold prices, then this only means central banking actions have been momentarily overwhelmed by apprehensions over debt mostly via political stalemates, whether in the EU or in China.

Yet we should not discount that central bankers to likely step on the inflation gas to save the current political institutions based on welfare-warfare state, central banking and the political clients—the banking sector.

Prices of commodities will now serve as crucial indicators as to the conditions of monetary inflation-debt deflation tug of war.

The Risk ON Risk OFF conditions may not last, we may morph into a stagflationary landscape.

Thursday, April 12, 2012

The Myth of ‘Safe Assets’

The IMF is concerned about the potential shortage of supply of “safe assets”

Writes the Wall Street Journal Blog

Worries about nations’ fiscal health could cut the world’s supply of “safe” government debt by 16% in the next four years, the International Monetary Fund said Wednesday.

The diminishing supply comes even as demand rises for safe assets such as high-quality corporate bonds and sovereign debt, which many banks and investors need amid market uncertainty and regulatory changes.

The shrinking pool of safe assets could create more worries about financial stability, the IMF said.

“Safe asset scarcity will increase the price of safety and compel investors to move down the safety scale as they scramble to obtain scarce assets,” the fund said in its Global Financial Stability Report. “It could also lead to more short-term spikes in volatility, and shortages of liquid, stable collateral that acts as the ‘lubricant’ or substitute of trust in financial transactions.”

The notion of ‘safe assets’, which rest on the assumption of ‘intrinsic value’, is really an illusion. It has been a myth repeatedly peddled, inculcated and propagandized for the public to accept the falsehood of the necessity of the welfare-warfare state. The power to tax does not guarantee economic and financial feasibility and consequently ‘security’.

Safety does not emerge out of government decree, as the recent crisis or as history shown whether applied to government bonds or to money.

Instead, valuations are subjectively determined by acting man or by individuals.

The great Professor Ludwig von Mises explained

Value is the importance that acting man attaches to ultimate ends. Only to ultimate ends is primary and original value assigned. Means are valued derivatively according to their serviceableness in contributing to the attainment of ultimate ends. Their valuation is derived from the valuation of the respective ends. They are important for man only as far as they make it possible for him to attain some ends.

Value is not intrinsic, it is not in things. It is within us; it is the way in which man reacts to the conditions of his environment.

Neither is value in words and doctrines. It is reflected in human conduct. It is not what a man or groups of men say about value that counts, but how they act. The oratory of moralists and the pompousness of party programs are significant as such. But they influence the course of human events only as far as they really determine the actions of men.

Put differently, to paraphrase a popular axiom, safe assets are in the eyes of the beholder.

Take for instance gold.

Gold was essentially an ignored asset at the start of the new millennium, however following 11 consecutive years of price increases, the public’s perception has substantially changed. Now gold has been incorporated as part of the safe asset list of the IMF.

Through history, gold’s perceived safety arises from the money attributes it possesses compared with, or relative to, fiat currencies.

As I previously wrote,

paper currencies are basically IOUs issued and stamped by governments as “legal tender” and backed by nothing but FAITH in the issuer. Because paper money is an IOU, it bears counterparty risks.

Where money as a medium of exchange requires these characteristics: durability, divisibility, scarcity, portability, uniformity and acceptability, unlimited issuance of paper money essentially diminishes the moneyness quality of paper currencies. As we cited earlier given the massive and full scale deployment of the printing press globally, such the raises the risk of a potential of disintegration of the present financial architecture.

However gold may not permanently be a refuge asset either. A serendipitous discovery of a process that enables gold to be produced abundantly would lead to a loss of the current attributes and thereby the subsequent loss of gold’s moneyness. And in the world of rapid advances in technology this is something we cannot discount.

To quote Dr. Frank Shostak

If the increase in the supply of gold were to persist, people would likely abandon gold as the medium of exchange and adopt another commodity.

Bottom line: Safety is matter of subjective individual valuations and definitely not decreed by politicians and or the bureaucracy.

Chart from Dr. Ed Yardeni

To the contrary, what government declares as “safe” are likely to be the riskiest assets. A good example is the ongoing crisis in the Eurozone where toxicity has surfaced out of supposed “safe” debt instruments.

It has been the nature of the state to abuse on their powers, by plundering their citizenry through arbitrary laws, or policies of financial repression (includes inflationism), that ultimately undermines the quality of government issued papers.

In short, self-destructive actions cannot be reckoned as ‘risk free’ which serves as a paradoxical, or must I add absurd, proposition.

Saturday, February 18, 2012

$6 Trillion worth of Fake US bonds Seized by Italian Police

From Reuters

Italian police said on Friday they had seized about $6 trillion worth of fake U.S. Treasury bonds and other securities in Switzerland, and arrested eight Italians accused of international fraud and other financial crimes.

The operation, co-ordinated by prosecutors from the southern Italian city of Potenza, was carried out by Italian, Swiss and U.S. authorities after a year-long investigation, an Italian police source said.

It began as a investigation into mafia loan-sharking, but gradually expanded as prosecutors used telephone and computer intercepts to unearth evidence of illegal activity surrounding Treasury bonds.

The fake securities, worth more than a third of U.S. national debt, were seized in January from a Swiss trust company where they were held in three large trunks.

The U.S. Embassy in Rome thanked the Italian authorities and said the forgeries were "an attempt to defraud several Swiss banks". It said U.S. experts had helped to identify the bonds as fakes.

Eventually these alleged 'genuine' government or treasury bonds will be exposed for what they are. They will be defaulted upon either directly or indirectly through massive inflation. In addition, “risk free” by edict (Basel Accord) is a myth.

Saturday, August 06, 2011

NO Such Thing as Risk Free: S&P Downgrades US

The United States has lost its coveted top AAA credit rating.

Credit rating agency Standard & Poor's on Friday downgraded the nation's rating for the first time since the U.S. won the top ranking in 1917. The move came after Congress haggled over budget cuts and the nation's borrowing limit — and failed to cut enough government spending to satisfy S&P. The issue has contributed to convulsions in financial markets.

The drop in the rating by one notch to AA-plus was expected. The three main credit agencies, which also include Moody's Investor Service and Fitch, had warned during the budget fight that if Congress did not cut spending far enough, the country faced a downgrade. S&P said that it is making the move because the deficit reduction plan passed by Congress on Tuesday did not go far enough to stabilize the country's debt situation. Moody's said Friday it was keeping its AAA rating on the nation's debt, but that it might still lower it.

That’s from the Associated Press.

Governments have painted bonds to be sacramental, which the public has worshipped for all these years. Now that the tide has began to ebb, this illusion has been exposed.

As the great Frank Chodorov wrote

The use of the word investment in connection with a bond issued by the State is a treacherous euphemism. When you buy an industrial bond you lend your money to a corporation so that it can buy a machine with which to increase its output of things wanted by the market. The interest paid you is part of the increased production made possible by your loan. That is an investment. The State, however, does not put your money into production. The State spends it — that is all the State is capable of doing — and your savings disappear. The interest you get comes out of the tax fund, to which you contribute your share, and your share is increased by the cost of servicing your bond. In effect, you are paying yourself. Is that an investment?

Government bonds represent as key instruments of financial repression. They signify as redistribution mechanism of scarce and economically valuable resources from the taxpayers (productive sector of society) to the benefit of the politicians, bureaucrats and vested interest groups (unproductive sectors). Yet this arrangement has limits. Apparently we have reached it.

Now even the politically connected major credit rating agencies have obviously bowed to the forces of the marketplace. Risk-free cannot be attained by fiat or legislation (such as the Basel Accords on the banking system).

Thursday, March 03, 2011

How To Reform The Global Debt Biased Economic System

Harvard economist Kenneth Rogoff argues that the world’s problem has been “rooted in excessive concentrations of debt” and that the fix should focus on rebalancing debt into equity. I agree.

Mr. Rogoff writes,

But policy-induced distortions also play an enormous role. Many countries’ tax systems hugely favor debt over equity. The housing boom in the United States might never have reached the proportions that it did if homeowners had been unable to treat interest payments on home loans as a tax deduction. Corporations are allowed to deduct interest payments on bonds, but stock dividends are effectively taxed at the both the corporate and the individual level.

Central banks and finance ministries are also complicit, since debt gets bailed out far more aggressively than equity does.

I’d like to add that this is exactly why central banks exist: they have been designed to finance and bailout the government and or her agencies (mostly by inflation), aside from promoting “consumption” debt as path to economic growth. As for the latter, don’t you see the excessive focus by the mainstream on “employment” based on “consumer spending”?

And these composite policies, all this time, has favored or privileged the central bank supported banking industry cartel.

Since the political leadership (governments) has also benefited from these arrangements, then obviously even administrative or tax policies had been molded into a “debt” bias—which incidentally becomes a feedback loop mechanism (more government spending more inflationism by central banks).

And that’s how boom bust cycles have been playing out.

And as earlier discussed in The Myth Of Risk Free Government Bonds even bank capital regulatory requirements have been tilted towards incentivizing these institutions to hold on to “less risky” government debts.

That’s because institutional holdings on “short term” government securities, under Basel Accord, which were considered as “risk free”, were not required of capital in contrast to holdings of corporate bonds. So major institutions were incentivized to fund governments, from which politicians capitalized on, and which only bloated their nation’s respective fiscal balance sheets.

But the recent crisis has only been exposing the “nudity” of the fabled risk free “emperor”.

I would say that this systemic debt bias has been intrinsic for the paper money system build around the welfare-redistributive state.

And parallel to this been the unseen incentives that drives governments and their respective central banks to gain political capital (via extended tenure and via expanded government control over the political economy) by selling “something out of nothing” to voters via the welfare state—and to reemphasize, all of which have been propped up and funded by the debt based central banking system.

In other words, for the world economic-financial framework—estimated at some $200 trillion, and which have been configured or evolved around these embedded incentives—to be able to shift from a debt to equity bias, would require an overhaul of the monetary system first and the political systems next.

Otherwise, the markets, like it or not, will do the radical debt-to-equity makeover for us.

Wednesday, June 09, 2010

The Myth Of Risk Free Government Bonds

.bmp)

As Cato's Mark Calabria explains,

.png)