Greenspan Warns On Housing Imbalance, Cracks In US Housing Appear

``The real problem is the

Last week, I opined that the US Federal Reserve could be targeting the

Mr. Greenspan’s speech was practically an implicit admonition on the ballistic price dynamics of the exploding credit mortgage fueled real estate industry in the

Mr. Greenspan says that this phenomenon grew out of complacency due to the perceived ‘long period of economic stability’ which has led to ‘lower risk premiums’ and which market participants view as ‘structural and permanent’.

This warning shadows Sir Greenspan’s “irrational exuberance” call on the stock market mania in 1996. The Nasdaq bubble imploded at the onset of the millennium in 2000.

With Greenspan’s shot across the bow, you have been warned!!

Further, I’d like to point out one recently enacted law that may even trigger the `reversion to the mean’ could be the new federal Bankruptcy Reform Act which is slated to take effect in October 17th of this year.

According to Dana Blankenhorn, in the article Dating the Next Recession, ``Borrowers must begin paying back credit card loans based on a 10-year payback, doubling many minimum balances, and New rules force borrowers to repay those debts, even after filing bankruptcy... Faster write-downs of credits by borrowers means fewer assets for credit card banks. Forcing borrowers to pay back their loans, even after bankruptcy, means those assets can't be written-off, and those bankrupt borrowers can't be extended new credit. It's a squeeze on bank assets, from both sides of the ledger...So two things happen, even in the best of all possible worlds. Assets decline, while new assets become harder to generate.”

The law essentially cuts the 20-year credit terms to only 10 years which translates to a jump in monthly payments. The doubling of the minimum balance monthly payoff will hit consumers who are in debt to the eyeballs starting on November! Notwithstanding, borrowers are required to pay even after bankruptcy. Let me quote at length Dana Blankenhorn very important message (emphasis mine)...

``Millions of people (I have no idea how many, but the number may be in the 10s of millions) are already at their limits, squeaking by and paying the minimum on their credit card balances. To protect themselves, the banks made it the law that rates on balances that fall past-due automatically jump to over 30%. But this is, in fact, no protection at all. The banks' assets are frozen, and while they might be paid back in time, the chances of raising more assets (remember, loans are assets to the banks) declines dramatically once the hammer falls on borrowers...

``People have been encouraged (by subsidies, and the fact that banks can always sell their loans to Fannie Mae and Freddie Mac) to create a mortgage "asset bubble," with interest-only and adjustable-rate loans. People were then encouraged to furnish these palaces through credit cards or second-mortgages.

``This has happened nationwide, not just in the areas where the supply of new housing has been tight.

``So let's say you're stretched and October rolls around. The credit card bill jumps. The natural inclination (the one encouraged by banks) is to tap the home equity. But that may already be tapped. With many tapped people forced to put homes on the market (to stave off bankruptcy) a downward spiral begins. Home equity values fall, and with each turn more over-extended homeowners find themselves with negative equity. Home equity loans must be called, mortgage loans start to default, foreclosures add more assets to the pile. (Those who deal in foreclosures are already cheering.)”

How this would affect Sir Greenspan’s “structure finance” regime of about $3 trillion of Asset Backed Securities (ABS), over $6 trillion of Government Sponsored Enterprises (GSE) exposure and over $220 trillion of derivatives is a wonder if not a spectacle to behold.

Yet there are quite a number of signs that appear to indicate that the real estate sector is rolling over...

- ``Bankruptcy filings to federal courts in the April-to-June quarter totaled 467,333, according to data released Wednesday from the Administrative Office of the U.S. Courts. That marked a record number of filings made in any quarter. Of that total, most -- 458,597 -- were personal bankruptcy filings; the remaining 8,736 were businesses filing for bankruptcy, the data showed.” reports the New York Times.

- According to Dr Steve Sjuggerud of the Investment U, ``New home prices have spiraled downward for three straight months. They're down 14% in that time, from $236,300 in April, to $203,800 today. A drop of more than $30,000!

``The way The Wall Street Journal reported the statistics, it seemed like home prices have been going up. But it was the number of houses sold rising 6.5%. The median price of a home fell in July alone by - get this - 7.2%. Wow!”

Chart courtesy of Investment U

- ``In July of last year, the supply of condos and co-ops on the market nationwide was only enough to cover 3.5 months of sales. Now, NAR estimates that the supply’s enough to cover 5.3 months of sales, a 51.4% jump.” notes analyst Martin Weiss.

- In addition Mr Weiss observed that ``Inventories of homes for sale rose 2.6% to 2.751 million, a 4.6-month supply at the current sales pace. That’s the largest inventory since May 1988. And today, it was announced that the inventory of unsold NEW homes is also at a record (despite an increase in sales).”

- According to BCA Research, ``Real mortgage rates are still low compared to past Fed tightening cycles, but the Affordability Index for first-time buyers has plunged below the average of past cycles because of soaring prices. Any fading in the wealth tailwind from housing could hit consumer spending hard, especially given the escalating drag from energy prices.”

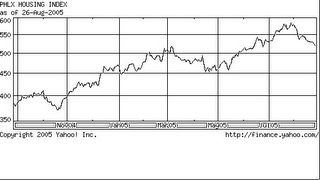

Chart courtesy of yahoo finance

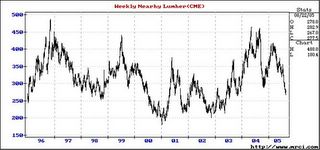

- Finally stocks of homebuilders and subprime mortgage lenders have recently been buffeted, as shown in the chart above, the PHLX HOUSING SECTOR INDEX. Even lumber prices as shown below have collapsed!

Lumber chart courtesy of

Mr. Kiyosaki, today, recommends buying gold and silver, he wrote, ``Also, I am getting rid of my U.S. dollars. As you may know, the U.S. dollar has lost nearly 40% of its value against other currencies in the last four years. That means if you have $10,000 in savings in the year 2000, it is worth about $6,000 in purchasing power. Rather than holding cash in the bank, Kim and I have been holding our excess cash in gold and silver bars. Why? Because you will know that the dollar is falling because the price of gold and especially silver will begin to rise. When silver goes higher than $8.50 an ounce and gold reaches $500 an ounce, you will know the end is near. When the crash comes, the currency of many countries will go down in purchasing power as the price of these two precious metals rise in value.”

In other words, this is no time to lollygag or be complacent. The risk factors today appear to be gaining momentum or accelerating with no less than Sir Alan Greenspan underscoring the imbalances issue coupled with a law that could have serious unintended consequences.

Remember that the Phisix has a correlation of 34% relative to the US S & P 500 benchmark according to Standard & Poor's Global Stock Markets Factbook 2004/Matthews Funds Asia which I wrote about last August 1 to 5 edition, (see Yuan Adjustments Bolsters Emerging Markets, Commodities). In other words, if the