``The wild geese do not intend to cast their reflection; The water has no mind to receive their image.” -Zenrin poem, The Way of Zen

This reminds me of the undue harangue by a slew of experts on the alleged “ills” of a strong Peso (“damned if you do and damned if you don’t” situation). In an incisive article, ``Will a unicameral parliament save us?” Honesto C. General business columnist for the Philippine Daily Inquirer enumerates the flawed cumulative economic policies adopted by the past administrations that have led to the country’s present predicament.

In short, his message was that when government assumes to know in behalf of its constituents and adopts policies in what it believes is for the better, in most instances THEY HAVE BEEN WRONG. And it is us who pays for such flawed policies instead of allowing market forces to determine where resources are best allocated for. More interventionism translates to more government bureaucracy, more red tapes, more corruption, and a more distorted economy. Think

Of course, I do share the concern that a precipitate surge in the Peso may lead to the so-called “Dutch Disease” or ``the deindustrialization of a nation's economy that occurs when the discovery of a natural resource raises the value of that nation's currency, making manufactured goods less competitive with other nations, increasing imports and decreasing exports. The term originated in

Are we referring to our neighbors or to our distant relatives at the far side of the globe?

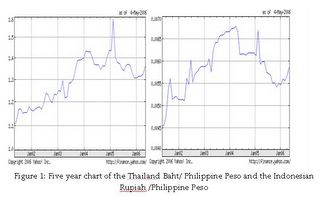

As you can see in three instances above except for

Ergo, the firming of Brazil’s currency as well as by our neighbors’ demonstrates that the Philippine Peso has lagged the marketplace for quite sometime, thereby its present appreciation has not had a substantial material effect, thus far, on the so called “export competitiveness”. If taken at a converse perspective, since the Peso has depreciated largely against its “competitors” over the longer period, then presumably given the single dimensional focus on the “price component” as manifested by the underlying currency, then we should have gained “export” market share, bilaterally or through the world market, at their expense. But have we done so? Nicolas Taleb in his book Fooled by Randomness promptly explains, ``but economics is a narrative discipline and explanations are easy to fit retrospectively”.

Moreover, present world conditions highlights the increased dimensions of globalization as manifested by expanded linkages through trades, economic and financial integration can now be seen through the attempt to integrate the region’s monetary system whose possibility I discussed three years ago (see September 15 to 19, 2003 edition, the Emerging Asian Economic Bloc). According to Shehla Raza Hasan writing for the Asia Times Online notes that ADB plans to revive the adoption in June of the ACU (Asian Currency Unit) or the ``notional unit of exchange based on a "basket" or weighted average of currencies used in the 10 member states of the Association of Southeast Asian Nations plus South Korea, China and Japan”, for purposes of a single common currency to bolster the region’s capital markets, economic integration and cross border transactions. With the region’s growing realization of the need for an alternative form of currency, it is a wonder why too much effort have been spent looking for solutions that ran backwards. Interestingly, have not the G-7 in their latest communiqué, exhorted Asian nations to allow for “greater flexibility of exchange rates”?

No comments:

Post a Comment