``Fear not for the future, weep not for the past." - Percy Bysshe Shelley (1792-1822), English Poet

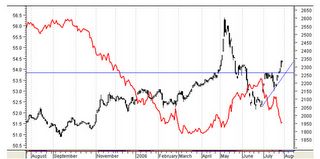

As mentioned during the last edition, the Philippine benchmark composite Index has basically shadowed the movements of the US equity benchmarks. This has not been an isolated motion but rather a global dynamic as shown in Figure 4.

Figure 4: Stockcharts.com MSCI Emerging Free (red line) and MSCI World Index (black line)

Both the MSCI World Index and MSCI emerging market Index had moved almost in lockstep over the past quarter.

With a significant rebound in global bond prices or a meaningful decline in yields, a rally in broad based commodities, lower oil prices and a broadmarket decline of the US dollar Index, it appears that the global financial markets have thus far, reflected for the US Federal Reserve to go on a pause this coming August 8th, following evidences of a marked slowdown. The reappearance of stimulative conditions has temporarily provided global investors ammo to load up on diversified assets.

Figure 5: The Phisix (black candle) and the US/Philippine Peso (red line)

As shown in Figure 5, like clockwork, each time the Peso vis-à-vis the US dollar advances, the Phisix has been likewise buoyed. For the week, the Phisix stormed to a 3.94% advance following sizeable gains from Wall Street (Dow, Nasdaq and S&P 500 up over 3% a piece) to take the second spot behind India (+5.89%) as the best performing bourse for the week.

While foreign buying turned positive from last week, what bemuses your analyst is the extent of the exceptional signs of local bullishness as revealed by sentiment indicators, i.e. the wide gap between advancers and decliners (263 to 85) and the hefty jump in the number of issues traded over the week.

Meanwhile, alongside its ASEAN neighbors, the Peso climbed 1.16% to Php 51.56 against the US dollar in the backstop of the successful issuance of government debt instruments in the global financial bond markets last week. Financeasia.com brands the issuance as ``one of the largest order books ever seen in Asia.” Why? Because ``the final book closed massively oversubscribed, the 10-year tranche closed at 5.7 billion on 228 accounts, an over subscription of 19 times (emphasis mine), while the 25-year tranche closed at 6.5 million with 248 accounts, an oversubscription ratio of 15-times.” Very opportune indeed.

Again I find it truly bizarre for the financial markets to climb amidst the expected economic “moderation” in the US, except for the notion that these could have been so due to liquidity leakages within the financial system.

One of my favorite analyst Mr. Doug Noland in his Credit Bubble Bulletin rightly observes, ``second quarter financial sector earnings reports offer scant evidence of any significant slowing of system Credit growth. The major “banks” maintain an aggressive business posture, with robust growth in lending and capital market activities. The push to satisfy Wall Street earnings growth demands is intense, and the ongoing huge stock buybacks are as well indicative of more aggressive lending and market activities to come. Financial conditions remain extraordinarily loose; Credit Availability remains easy and marketplace liquidity abundant.”

So in spite of the Fed raising interest rates the liquidity backdrop remains essentially loose.

Still, a growth slowdown basically translates to weaker demand, limited pricing power and prospective declines in profit margins. Canadian Independent Research outfit BCA, sees an inflection point or a peak in global earnings power as shown in Figure 5. Quoting the widely followed BCA (emphasis mine),

Figure 6: BCA Research: Global Earnings Revised Down

`` The path of least resistance for global earnings estimates is down until economic growth prospects turn-up anew.

The path of least resistance for global earnings estimates is down until economic growth prospects turn-up anew.

``Analysts continue to rein-in earnings expectations after an impressive three year run of positive revisions. The de-rating will continue until signs emerge that global economic momentum is set improve. On this note, our proprietary Global Leading Economic indicator is still falling, and further weakness is likely as a cooling U.S. economy weighs on global growth. The offset for global stocks is that fund managers are already very bearish on both U.S. economic growth and earnings prospects over the next 12-months, as gauged by the latest Merrill Lynch fund manager survey. Accordingly, a weaker growth environment appears to have already been partially discounted. Bottom line: expect directional uncertainty in equities until yearend based on Q3 earnings results before prospects improve next year.”

BCA suggests that extensive bearishness could have been factored into the markets, or possibly, dominant negative sentiment could have fueled the recent rebound in the markets despite the lingering uncertainties. In short, investor sentiment swings and technical “chart” factors could have boosted equity prices abetted by liquidity leakages.

Furthermore, it is also important to mention that PIMCO’s Mr. William Gross, the “Warren Buffett” of Bonds, one of the most successful bond fund managers, if not the top-rated, in the investing world, have audaciously declared in his latest outlook that the bond bull market has began and would be the last, in his words, ``that this bond bull market will be the last; that history, as almost all active bond managers have known it since 1981, will come to an end a few years hence.” Mr. Gross attributes the rebound of bond prices to a significant slowdown in the US economy driven by an intense decline in the housing industry to be followed by possible money easing steps by the Fed.

Mr. Gross’ outlook is similar to my view that the bond markets are treading over to the bear territory over the long-term. The foundation to this outlook, according to Mr. Gross (emphasis mine), ``The important idea is that such a forecast speaks to eventual reflation, inflation, and declining bond prices sometime out there in 2009 and far beyond as the U.S. seeks to address its enormous future liabilities concentrated in social security, healthcare, and foreign holdings of U.S. bonds.” He also thinks the Dow Jones could possibly hit 5,000 in the distant future! My, my, my.

In contrast to the US markets which had undergone a bullrun from 1982 to the onset of the millennium, the Philippine market has basically risen from its nadir in 2002. Yes, today’s marketplace has been “globalized” in a sense that the activities have been running in almost parallel motions. But seen over the long run, both markets are coming from starkly divergent reference points and would, in high probability, remain divergent. In short, the cycles underpinning these markets are structurally dissimilar.

In a recent talkshow at Channel 27’s ANC channel, Rep. Joey Salceda of Albay raised as the “biggest risk” to the planned implementation of the grandiose projects enlisted by the PGMA at her SONA as a US slowdown. If I heard him right, he noted that for every 1% decline in US GDP, the Philippine growth clip would taper by an equivalent of 1.5%. That’s pretty significant. If the markets are all about economic growth then we should expect the domestic markets to consolidate or move rangebound as the US goes into a (hard or soft?) landing. I don’t expect our markets to fall off the cliff as a high probability event, even if the US goes into a recession.

If liquidity propulsion would still be the driver of world financial markets, then as the US Federal goes on a cyclical peak for its money policies, the domestic financial markets may in essence part ways from the directional path of the US markets. My bet is for this eventuality.

While I remain confident that the Philippine cycle remains on the upside over the longer period, the financial markets could be frayed by considerable headwinds caused by exogenous factors over the immediate term. One can take advantage of present swings or volatilities in the market to trade or to accumulate on dips.

![]() The path of least resistance for global earnings estimates is down until economic growth prospects turn-up anew.

The path of least resistance for global earnings estimates is down until economic growth prospects turn-up anew.

No comments:

Post a Comment