``When it comes to Wall Street, there ain't no tooth fairy.'' Joel Greenblatt

AS part of my forecast blemish in 2005 (mines to be the year’s winner), an involuntary repercussion naturally would be portfolio underperformance, and in this regard I have been taken to task by those whom mistimed their entry to the market by buying at the “peak” of last year’s cycle and secondly, had been fervidly imbued by the price anomalies (losses) in Lepanto.

Nevertheless, it is understandable that the average investor could be characterized as having the typical shortcomings: a short time horizon in terms of reckoning of returns, are emotionally overwhelmed, expect oversimplified explanations to developments in a vastly complex and dynamic framework, and most importantly, expect flawless, infallible and “pulling rabbits from hats” performances (by anticipating fund managers or analysts to accurately forecasts tops and bottoms of the markets) instead of taking into perspective the overall risk-reward nature of the markets.

In earnest, it is quite a daunting task to rather help investors attain for themselves the appropriate risk-reward expectations management when in most instances they have the faintest idea of why they are in the market in the first place, principally focusing on mark-to-market fluctuations without considering the risks and volatility factors involved. Hence, the investing landscape is littered with countless numbers of spurned investors whose goals today are to simply return to their costs rather than profit after years of horridly watching their portfolio shrivel.

As a battle hardened investor whom has lived off the years from investing and trading the market, let me share to you some of the insights I have gleaned which may hopefully help you to comprehend more the nature of the financial markets and help shape your objectives or goals when investing.

1. Past Performance Does NOT Guarantee Future Outcomes. The market has a life of its own and is simply soooo fluid and dynamic that randomness dominates daily, weekly or yearly or what we might call as ‘short term’ activities. To quote the famed mentor of the world’s most successful stock investor

A reader from the

Since I wrote my piece “The Philippine Mining Index Lags Behind” which was published in two international websites, safehaven.com and goldseek.com in 2003, the domestic mining index has belabored in its sporadic rise and has been preponderated by prolonged bouts of heavy selling as signal of the public’s rabid denial.

As the chart above shows, the Mining Index (blue line) has lagged behind the Phisix (black candlestick) since the inception of the 2003 bull run and has been so until end 2004! After a dismal 2005 some signs of life during the last few weeks!

Gold (and other precious metals) has been in a bullmarket for about 5 years while the local mining industry has been trailing its counterparts abroad and is still struggling to get its feet standing. Will these last perpetually? My answer is no. It will rise, but lag as history shows.

As a matter of randomness, do you know that Lepanto’s surge to a record high (according to my chart 1980s up) was in 1997 just when Gold was into its last phase of the bearmarket (to $252 per oz)? Do you know that Philex Mining soared to its record high in 1987 just as copper prices was in the prime of its decade long descent throes from its peak during the 80’s?

Of course, things do change. Today’s technology enabled connectivity has brought the world into a more intertwined state such that global capital flows are now “real time” or within a click of the mouse.

The combined market capitalization for the world’s mining sector is said to be less than $150 billion a puny compared to an estimated $30 trillion or more in aggregate market cap for the entire world. A panic into gold or the precious metal group could simply send global investors driving mining stocks to the roof! One might argue that this might be a black swan event (low probability event); my response would be; NOT with Gold in a bullmarket, anything is possible.

The same assertion holds true with “supply inelasticity themed” natural resource based stocks as oil, natural gas, coal, water or agriculture. They may be in slumber today, but are we certain that they would remain the same tomorrow?

2. The Financial Markets Operate in Cycles. I have long argued that investment themes take time to develop and they usually come in the forms of cycles, unlike mainstream brokers who keep shifting themes as often to encourage you to trade the market.

Former IBM top honcho Thomas J. Watson, Jr. once said that ``There's a fine line between eccentrics and geniuses. If you're a little ahead of your time, you're an eccentric, and if you're too late, you're a failure, but if you hit it right on the head, you're a genius." In other words, timing is the key for one to be judged as eccentric, failure or genius. One may be right about his/her anticipation of the future market trends, however, being too early could result to unacceptability as the investing public is mostly concerned with faddish issues. Unfortunately market timing is an arduous task.

Needless to say, cycles are part of the general acceptance of the investing public of the unraveling events or trend formation. Mr. George Soros, a billionaire speculator and now turned philanthropist, once dubbed as “the man who broke the Bank of England” for successfully shorting England’s currency in 1992 enumerates the phases of a boom/bust cycle in his book Alchemy of Finance which is applicable to any asset market, namely,

1. The unrecognized trend

2. The beginning of a self-reinforcing process

3. The successful test

4. The growing conviction, resulting in a widening divergence between reality and expectations

5. The flaw in perceptions

6. The climax

7. A self-reinforcing process in the opposite direction

The Supreme Court’s decision to validate the Mining act of 1995 was obviously the beginning of the self reinforcing process, as mining stocks ephemerally zoomed at its wake. However, after a short stint up, 2005 was dominated by the public’s refusal to accept the industry’s revival until the end of the year where select mining stocks started to gain upside momentum...

After last week’s forecast where once again I made a similar call to that of 2005 that the mines and oil will lead the market in 2006, it appears that destiny could be kinder to me this time around or if not has given me a pivotal headstart; the reformatted MINING and OIL index soared by 11.61% leaving all other indices eating dusts!

Unassuming and unhedged Philex Mining, a star performer in 2005 up 120% (it’s payback time for those who have stood with me in the test of time!!! The dividends of Patience!!), was up 22.34% over the week and 30.68% year to date (While I am still bullish over the present mining celebrity over the long term, I see this stock as having been overextended and requires a short-term correction or profit taking soon). Philex B approaches its major resistance at Php 2.5 per share, touched by about FOUR times in 1994-1997 with one successful encroachment.

Meanwhile, Apex Mining too gave out scintillating returns up 25.77% for the A shares and an astounding 50.48% for the B shares and mining index heavyweight Lepanto finally showed signs of recrudescence with its B shares up 24% over the week.

These signs of mining issues moving higher without corresponding headline news to underpin their rise looks likely a gradation from stage 2 or “the beginning of a self-reinforcing process” to stage 3, the “successful test”. Notice that the psychological influences take investors not a month or a year but YEARS to develop (since 2003)!!!

This also shows why diversification works, spreading your eggs to limit risks while maximizing gains over the broad based issues or over the broader market.

So, as far as the present situation is concerned, it is a mistaken notion to take investing in commodity based stocks over a very short time frame.

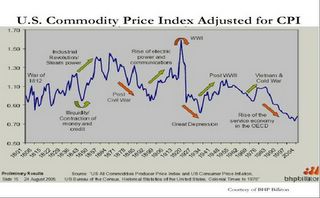

In fact, the entire Commodity Cycle since 1800 shows that it similarly takes awfully LOOONGG years for the overinvestment cycle to shift to underinvestment cycle as limned by the BHP Biliton chart below...

As I have noted before analyst Puru Saxena observed that in ``over the past 200 years, commodities had five secular bull-markets between the following periods –

1st boom - 1823-1838 (15 years)

2nd boom - 1848-1865 (17 years)

3rd boom - 1878-1918 (40 years)

4th boom - 1929-1950 (21 years)

5th boom - 1963-1980 (17 years)

So the likelihood is that commodity cycle may last anywhere from 15 to 40 years which means that if the boom cycle began during the advent of the millennium, the peak of the cycle could last anytime from 2015-2018 (15-18 years)! So essentially, commodity based assets have a looonngg way to go too (caveat there will be interim bumps-as we have seen and will continue to see)....

This also means that whatever transpired in Lepanto’s underperformance last year could be considered as a “price shock” or unexpected price moves or an anomaly. For as long as there is no major fundamental problem concerning management or its operations or most importantly, Lepanto’s ownership of its reserves, then the likelihood that last year’s price digression could simply be a short term move (one year is short term relative to cycles).

To quote DR Barton of Traders U, ``unforeseen transmission problem, the market has a particularly keen knack for hitting us with unexpected price moves... There's an old trader's axiom that every market participant has a disastrous trade out there with our name on it. Our job is to minimize the effect of unexpected price shocks.”

Differentiating between short term moves and long term cycles is a must for investors to ensnare real positive returns, otherwise you’ll be caught chasing prices (ending up in tears~ recall 1997?).

3. Real Returns is all about Risk Taking. This is a timely apothegm from investment maven Mr Paul McCulley from PIMCO (one of the largest bond institutions in the world) who writes his outlook for this month (emphasis mine), ``Risk taking is a risky business. But logic says you gotta take risk to make real returns...In the investment arena, you don’t have to be in it to win it. Rather, you have to be in it or out of it at the right price. It’s called active investment management, taking positions on both the overweight (long) and underweight (short) sides of risks embodied in benchmarks.” In short, in trying to beat the relative returns of the market, one has to take risks to where the highest possible yield would most likely accrue and this is primarily the reason I stuck to the “supply inelasticity theme” given our profuse natural endowments.

Relative return is defined by financial-dictionary.com as ``The return that an asset achieves over a period of time compared to a benchmark. The relative return is the difference between the absolute return achieved by the asset and the return achieved by the benchmark.” For instance the Phisix, since its reversal to the advance phase, in three years has gained 41.63% in 2003, 26.38% in 2004 and 14.99% in 2005. In short, its relative return for the past three years is about 27% per annum. IF, for example, because of investor’s stubbornness to accept our investment themes and assume that for 2003 and 2004 return was ZERO but in 2005 yielded 105% then relative returns would be almost equal to that of the Phisix for the same period. That’s if we aspire to achieve the same performance. We aim for Gold or outperformance with active management!

Stated differently, given the lagging cyclical effects, underperformance could be expected at the onset as these themes gradually work its way to the mindset of mainstream investors. Top notch value investors (characterized by investment in non-popular themes) like Warren Buffett, constantly outperform the market “Beta” at the margins, after positioning earlier on issues largely ignored by the investing mass. For instance his bet against the US dollar has resulted to a losing position by almost $1 billion in 2005, does it make him less effective? Obviously not, because the record shows that Mr. Buffett’s overachievements results from long term holdings delivering positive real returns (relative or absolute). You can take Berkshire Hathaway’s ownership of 129 million ounces since 1997 or a quarter of the world’s silver supply as an example!

Please do not misconstrue me as comparing myself to a legend, I am simply a disciple of the market learning the ropes and conveying to you that ‘investment themes such as contrarian picks or value investing are given time to work and shape, and does not happen overnight’ as alot of investors mistakenly expect. And lastly,...

4. Timing the Market Is At Best Probabilistic. You can simply scour on the list of top 100 or so of the world’s most successful investors and find NO PURE market technicians as part of the roster. Why? Timing is one of the hardest thing to accomplish! As John Bogle founder of Vanguard fund, once said ``After nearly fifty years in the business, I do not know of anybody who has done it successfully and consistently. I do not even know anybody who knows anybody who has done it successfully and consistently."

As to my experience, most of my missed calls have largely been out of purely timing or technical calls. Remember the failed two successive Christmas rallies, the individual chart calls, how about 2005’s last minute whipsaw?

An analyst says that predicting tops and bottoms is a mug’s game. Well while he does it anyway and so do I admittedly. This is not to outrightly dismiss the prospects of market timing because occasionally they do work. However to my experience, they work best when they are either supported by fundamentals and/or sentiment or a combination thereof.

Your prudent investor analyst has had a streak of major forecasts that went favorably for him: promptly forecasted the bottom of the market in 2002 (recall index trading edition), accurately pinpointed the technically guided “capitulation” of PLDT in October 2002, rightly forecasted the market’s reversal in 2003 to even challenge ING Baring’s flat outlook (which eventually was proven right), accurately predicted the rise of telecoms during the said year, while in a derring-do fashion called for the upcoming rise of the mines and the oil extractives industry; was on the spot in 2004 with mines taking the cue from the Supreme Court’s ratification of the Mining Act of 1995 and precisely prognosticating the reversal of the Peso which was realized in 2005. All these took quite sometime to unravel using the mélange of technicals, sentiment and most importantly macro fundamentals as yardstick to these auspicious or “lucky” forecasts. In short hard work, provenance from above, and a tinge of “luck” mattered. NOT astrology or NO crystal ball nor tarot cards, made this happen.

To cap this defense of Real returns, let me quote analyst Chet Currier of Bloomberg (emphasis mine), ``Beating the market is, at best, a misguided goal for most individual investors. When a child's college tuition comes due, it matters not a whit whether you beat the market or not. The only pertinent question is, do you have the money to pay the bill? Real-life investment plans should be geared to such real- life goals, with careful attention to risk as well as reward --- not to an abstraction like beating the market. That's for professionals, and for people who invest as an ego-driven sport.”

My personal objective for the market is based out of survivorship, am definitely NOT part of the ego-driven sporting classes that go for technical abstractions or jingoistic “sophistications” and am definitely a FAILURE when it comes to “pulling rabbits out of your hat” renditions. Besides, there are no shortages of Harry Houdinis and David Copperfields wannabes in the field of investing.

Albeit, as hands on practitioner of the market, I do believe in Absolute returns at minimum, and Relative returns at best, which ALL requires the test of time. As the preeminent and another legendary investor Sir John Templeton once said, ``The best time to invest is when you have money. This is because history suggests it is not timing which matters, it is time.”