An updated graph of the Big Mac Index is shown by The Economist.

THE Big Mac index, says the Economist, is based on the theory of purchasing-power parity (PPP), according to which exchange rates should adjust to equalise the price of a basket of goods and services around the world.

Again, the above shows that ASEAN and other Asian countries as having the most affordable ‘Big Mac’, while the euro area remains the most expensive.

If we go by the mercantilist perspective where cheap currencies=strong exports then we must deduce that outside China, South East Asia should be today the world’s biggest exporters.

Well unfortunately, again with the exception of China, this isn’t true. The priciest currency, the Euro, according to the table from the CIA, lodges the largest exporting region of the world.

Why is this so?

Because currency values do not solely determine exports or wealth for that matter. There are many factors involved and chief among them are the nation’s capital, production and the market structure, and importantly the desire to compete...

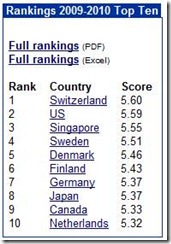

And as part of capital structure, this includes the perception of stability, which as example, the Economist cites the Swiss Franc,

``Investors looking for a safe place to put their money have sought refuge in the Swiss franc. Despite attempts by the Swiss central bank to stem the appreciation, the Swiss franc is overvalued by 68%”

This means that if the intent or priority is to seek a safehaven, then pricing risk from a ‘stable’ currency becomes less sensitive relative to other forms of risks.

Nevertheless, the affordability of ASEAN’s Big Mac in itself doesn’t intuitively posit that her currencies would close or equalize the gap with that of the Euro.

Instead ASEAN’s intent to expand trade with the world (globalization) and undergo more economic integration with the region (regionalization) should be the primary reason why the ASEAN’s currencies should be a buy.

The other way to say it is that the convergence won’t come from currency values, in as much as from lower costs (wages etc.), but from increasing wealth from free trade which would then be reflected on the respective currency.

Of course, the only way to devalue a currency is to print more of it, which essentially gives justification to expand government at the expense of the market or a euphemism for socialism.

No comments:

Post a Comment