``Deflationary credit contraction is, necessarily, severely limited. Whereas credit can expand (barring various economic limits to be discussed below) virtually to infinity, circulating credit can contract only as far down as the total amount of specie in circulation. In short, its maximum possible limit is the eradication of all previous credit expansion.” Murray N. Rothbard

Mainstream expert analyses are mostly hinged on heuristics (mental shortcuts), except that they often argue from the context of technical gobbledygook which appeals and overwhelms the naive public to assume such abstraction as universal reality.

For instance, many go at length to argue that low interest levels in US Treasury exhibit signs of deflation. Heck, as if deflation or falling prices in the mainstream definition means the end of world. Well, falling prices also means greater purchasing power, which from the fundamental standpoint of demand and supply, it means more goods that one can acquire. So the end of the world, it is not.

For us, deflation isn’t a one size fits all dynamic. We see this market force as operating from different previous actions; one that deals with productivity growth or one that deals with government property confiscation, or bank credit contraction or cash building. So the social impact won’t be the same. Yet when the mainstream hears or reads of deflation they seem to develop a reflexive revulsion to the word.

What the mainstream actually refers to is of the credit contraction order- which according to them has a feedback mechanism which forces liquidation, reduces collateral values, curbs aggregate demand, which leads to excess supplies and subsequently falling prices which gets exacerbated by expectations of people to hoard cash and back to the loop.

It’s a story long been told even during the days of my Dad, but this has hardly occurred. Not even with Japan, which the mainstream has arrantly mislabelled[1].

Although deflation had an instance of reality in 2008, our rebuttal has been that in a world central banking, governments have the incentive and the tools to temporarily offset credit contraction by serially blowing up new bubbles. How? By keeping interest rates excessively low and by printing an ocean of money.

Yet mainstream insist that this is a demand problem and that government actions won’t have an impact.

On the contrary we persist to argue that this is mostly a supply dilemma—one where banks have been stuffed with questionable assets and that reluctance to lend is a function of some distrust.

And the disruption from the near seizure in the US banking system, which prompted for a short episode of deflation, as consequence to the Lehman bankruptcy is why the US government put to risk some $23.7 Trillion worth of taxpayer money[2], according to a US official.

In short, US officials have been acting on the current financial quandary predicated on a liquidity issue.

It’s funny how many gawk at the actions of the marketplace only to put meaning into them based on their bias or economic religion.

The mainstream refuses to acknowledge that government are people too and are driven by incentives. They see government in a paradox. On one aspect, they believe government operates like supermen whom would act on every single social problem that emerges. Yet on another aspect, particularly on the financial markets, they treat governments as passive onlookers!

From our perspective, the abnormally low yields in the US treasury markets may not be due to the fear of lending or the lack of demand to borrow, but rather from government intervention.

With the US budget deficit expected to hit $1.56 trillion in 2010[3], what better way to attract cheap private financing and create an environment of marketplace confidence (animal spirits) than by manipulating interest rates down!

Since there have been little signs of inflation in the past, then the US government can simply use its covert dealers to conduct interest rate manipulation operations.

And it may not be limited to stealth actions; it may even be reported.

In three weeks since June 30, the Federal Reserve balance sheet has registered consecutive additions to its US treasury positions by $45 billion, according to the data provided by the Federal Reserve Bank of Cleveland[4].

This seems consistent with some signs of unease from select Federal Reserve officials, such as James Bullard, president of the Federal Reserve Bank of St. Louis, who called for renewed buying of treasury securities or the resumption of quantitative easing[5].

Yet these guys seem to be looking at the wrong picture.

First of all, the banking system doesn’t represent the entire US capital markets.

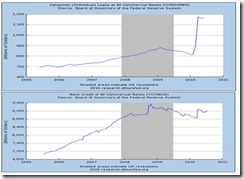

Figure 4: St. Louis Fed: Consumer and Bank Credit at ALL Commercial Banks

But even if we deal with the banking system we are seeing not widespread signs of contraction but signs of credit expansion (see figure 4)!

True business and industrial loans are still down, but nominal lending in US dollars by consumers at all commercial banks have recently skyrocketed (upper window). And we seem to be seeing material improvement in credit activities of bank credit of all commercial banks, perhaps directed at consumers.

Figure 5: Yardeni.com[6]: Flow of Funds

We predicted[7] that the influence of the yield curve lags by about 2-3 year period, which if we are right we could see an acceleration in the activities in the US credit markets by this yearend, could we be seeing the seeds of this turnaround (see figure 5)? Oops....

Now as we earlier said, banks aren’t the sole source of funding for the US economy, which the mainstream loves to fixate on. And I think signs have saying they’re dead wrong.

Why? Because the corporate bond market is likewise booming!

This from Businessweek/Bloomberg[8],

``U.S. corporate bond sales soared 31 percent to $85.7 billion this month, the busiest July on record, as yields fell to the lowest in more than six years on growing investor confidence in the economic recovery. The London interbank offered rate, or Libor, which banks say they can borrow at for three months in dollars, fell the most today in almost 11 months, dropping to the least since May 14.”

And the boom in the bond markets aren’t restricted to the US markets but around the world!

According to the Wall Street Journal[9], (bold emphasis mine)

``The global corporate-bond boom is gathering steam as companies rush to take advantage of some of the lowest borrowing costs in history....

``This month has been the busiest July on record for sales by U.S. companies with junk-credit ratings. Asia's debt market is on pace for a record year, and European companies are also raising money apace.

``The low borrowing costs are the culmination of an unprecedented bond-market rally that began in the depths of the credit crisis in late 2008 and early 2009 and has defied every prediction that it would soon run out of steam. But individual and professional investors continue to plow money into the bond market, giving companies a constant source of funds to tap.”

Defied every prediction? Not for us, as we have been predicting this all along!

And in terms of bank lending guess where the gist of the activities has been? (see figure 6)

Figure 6: Yardeni.com Lending by International Banks

If you guessed the Emerging Markets and Asia, then you are absolutely correct!

Now if we examine the contribution of economic growth in the US by sector, the mainstream seems caught somewhat surprised. Growth expectations didn’t come from the sectors they’d expected them to be (see figure 7).

Figure 7: Northern Trust: Sectoral Contribution To Growth Rates

According to Asha Banglore of Northern Trust[10], (bold highlights mine)

``In the second quarter of 2010, equipment and software spending (+1.36%) made the largest positive contribution to real GDP, followed by exports (1.22%), consumer spending (1.15%), inventories (1.1%), and residential investment expenditures (0.6%).

``In terms of growth rates, equipment and software spending posted a hefty increase of 21.9% after an upwardly revised 20.4% gain in the first quarter. Consumer spending moved up 1.6% in the second quarter after a downwardly revised 1.9% gain in the first quarter.

So technology and the world economy appear to be heavy lifting the growth momentum of the US economy.

As per the technology sector, here is what I wrote last February[11],

``What I am trying to say is that the contribution of the technology sector to the real economy could perhaps be more accurately reflected on the performance of S&P, however, such contribution may have been underrepresented by conventional statistical metrics.”

Not anymore.

For us, the current developments postulates to the following:

-US economic growth dynamics seem to be shifting from the housing to the technology and export sector.

-Investment in the US and the job growth will likely gravitate into these sectors.

-The pattern of growth in the US seem to confirm the boom in the global bond markets and the bank lending patterns of international banks

-Since technology is partly tied to exports, wealth accumulation in emerging markets is likely to fuel increasing demand for tech savvy products

-the global economy should be expected to sustain momentum as globalization deepens, and this will be in stark contrast to the prediction of deglobalization advocated by PIMCO’s Bill Gross.

-Of course, this is another bubble cycle. The next bubble will likely emanate from the emerging markets or the US technology industry[12], or the US treasury. But the risk of bubble implosion would only surface as inflation accelerates and hamstrings government efforts to intervene.

Speaking of which, where inflation is thought to be non-existent, here is a little surprise (see figure 8)...

Figure 8: stockcharts.com: Commodity Laggards

Oops, even the commodity laggards seem to be generating some reanimated activities!

We seem to seeing resurgence in agricultural products (DBA-Powershares DB Multisector Commodity Trust Agricultural Fund), as well as in Natural gas (NATGAS), the Industrial metals (Dow Jones UBS Industrial Metals-DJAIN) and the broad based commodity index (Reuters-CRB).

So far, pieces of the grand jigsaw puzzle seem to be falling in their rightful place, as we have seen it.

[1] See Japan’s Lost Decade Wasn’t Due To Deflation But Stagnation From Massive Interventionism, July 6, 2010

[2] See $23.7 Trillion Worth Of Bailouts?

[3] CNN Money U.S. deficit streak at 20 months, June 20 2010

[4] Federal Reserve Bank of Cleveland, Credit Easing Policy Tools

[5] New York Times, Fed Member’s Deflation Warning Hints at Policy Shift, July 29, 2010

[6] Yardeni.com: Flow of Funds, July 7, 2010

[7] See Influences Of The Yield Curve On The Equity And Commodity Markets, March 22, 2010

[8] Businessweek, Bloomberg: U.S. 10-Year Swap Negative for Fourth Day as Debt Sales Rise, July 30, 2010

[9] Wall Street Journal, Bonds Soar to Rare Heights, July 29, 2010

[10] Northern Trust, U.S. Economy – Q2 GDP Contained a Few Surprises Although Headline Was Close to Forecast, July 30, 2010

[11] See Statistics Don't Reveal Extent Of The Evolution To The Information Age, February 15, 2010

[12] See ASEAN Markets Surge, Where will The Next Bubble Emerge?, July 11, 2010

No comments:

Post a Comment