The big culprit in all of this is short-term debt. There would be no crises if governments had issued long-term debt to match long-term plans to repay that debt. If investors become gloomy about long-term debt, bond prices go down temporarily—but that's it. A crisis happens when there is bad news and governments need to borrow new money to pay off old debts. Only in this way do guesses about a government's solvency many years in the future translate to a crisis today. There are two lessons from this insight. First, given that the Europeans will not let governments default, they must insist on long-term financing of government debt. Debt and deficit limits will not be enough. Second, the way to handle a refinancing crisis is with a big forced swap of maturing short-term debt for long-term debt. This is what "default" or "restructuring" really means, and it is not the end of the world.- Professor John Cochrane 'Contagion' and Other Euro Myths

Since political developments have weighed heavily on the marketplace, it would a mistake to isolate politics or interpret the marketplace outside of the political dimensions. That’s because governments, which are socio-political institutions, are made up of human beings. And as human beings, their actions are driven by incentives and purposeful behaviour premised on their respective operating environments.

Additionally, as regulating bodies or agencies, they likewise interact with participants of the marketplace. Thus, any useful analysis must incorporate the role of the political economy.

Current Government Actions Validate Our Call

I am glad to say that it’s not only in the markets where our outlook appears to get substantial validation but likewise in our predictions of the political economy.

We have repeatedly argued that faced with a crisis, the predisposition or mechanical response or path dependency of today’s global political leaders is to inflate the system (or throw money at the problem). And these actions are primarily channelled through central banks.

As we declared last week[1],

And like the US dollar, the Euro will be used as an instrument to achieve political goals but coursed through the central bank (ECB).

Here are some recent evidences which corroborates on our call.

Central banks appear to surreptitiously encroach on the fiscal aspects of democratic governments in developed economies.

From Bloomberg[2], (bold highlights mine)

``European Central Bank officials tried to force Ireland to seek a bailout earlier this month and European officials are now trying to do the same to Portugal, Irish Justice Minister Dermot Ahern said.

“Clearly there were people from outside this country who were trying to bounce us in as a sovereign state, into making an application, throwing in the towel before we had even considered it as a government,” he told Irish state broadcaster RTE in an interview today. “And if you notice, they are doing the same with Portugal now.”

``Asked about who was pressuring Ireland, he said “quite obviously people from within the ECB.”

Markets do not only make opinion, importantly they affect policymaking.

Yet in a world where the morbid fear of deflation has been instilled by mainstream economics, governments would use to the hilt its inflationary magic wand.

Another news report from Bloomberg[3], (bold emphasis mine)

``The European Central Bank delayed its withdrawal of emergency liquidity measures and bought more government bonds as President Jean-Claude Trichet pledged to fight “acute” financial market tensions.

``Under pressure from investors to lead the charge against the spreading sovereign debt crisis, Trichet said the ECB will keep offering banks as much cash as they want through the first quarter over periods of up to three months at a fixed interest rate. As he spoke, ECB staff embarked upon a new wave of purchases, triggering a surge in Irish and Portuguese bonds.”

And bailouts of the privileged political class will never end until forced by the markets.

From Bloomberg[4],

``Belgian Finance Minister Didier Reynders said the euro region could increase the size of its 750 billion-euro ($1 trillion) bailout fund, breaking ranks with German Chancellor Angela Merkel and France’s Nicolas Sarkozy.

``Reynders told reporters in Brussels yesterday that the current cash pool could be increased if governments decide to create a larger fund as part of a permanent crisis mechanism in 2013. “If we decide this in the next weeks or months, why not apply it immediately to the current facility?”

``European officials are under pressure to find new ways to stop contagion spreading from Greece and Ireland amid concern the bailout package may not be large enough to rescue Spain if needed. While Sarkozy and Merkel rejected expanding the fund on Nov. 25, European Central Bank President Jean-Claude Trichet on Dec. 3 indicated governments should consider just such a move.”

A popular analyst misleadingly labelled the Euro a political currency[5] in the assumption that US dollar epitomizes as more of an “economic currency”.

Yet in contrast to such false claim, the recent disclosure by the US Federal Reserve on recipients of bailout money during the 2008 crisis suggests otherwise.

According to the Wall Street Journal Editorial[6],

``We learn, for example, that the cream of Wall Street received even more multibillion-dollar assistance than previously advertised by either the banks or the Fed. Goldman Sachs used the Primary Dealer Credit Facility 85 times to the tune of nearly $600 billion. Even in Washington, that's still a lot of money. Morgan Stanley used the same overnight lending program 212 times from March 2008 to March 2009. This news makes it impossible to argue that either bank would have survived the storm without the Fed's cash.

``The same goes for General Electric, which from late October to late November 2008 tapped the Fed's Commercial Paper Funding Facility 12 times for more than $15 billion. Thanks to the FDIC's debt-guarantee program, GE also sold $60 billion of government-guaranteed debt (with a balance left of $55 billion). The company finished a close second to Citigroup as the heaviest user of that program from November 2008 to July 2009. GE is lucky it was too big to fail, or it might have failed as smaller business lender CIT did.

``The blogosphere was hurling pitchforks yesterday because some foreign banks also took the Fed's money, including such prominent names as UBS, Barclays and BNP Paribas, and even names like Dexia and Natixis that most Americans might confuse with pharmaceuticals marketed on TV. But this was inevitable given the interconnectedness of the global financial system, and the fact that these foreign banks had U.S. subsidiaries. The Fed could not have quelled the panic by offering only U.S. banks access to these loan facilities.”

As seen above, the Fed bailouts were extended heavily to the banking system in the US and abroad, which shows of the immense reach of the political redistribution process, apparently designed to save the system or the status quo.

In effect, the US Federal Reserve can be said to have been transformed as lender of the last resort of the world[7].

Let me further clarify that instead of the whole banking system, the bailouts had been concentrated to the politically connected elite or the “too big to fail” banking behemoths.

This means the US dollar is even more representative of a political currency than the Euro (As a caveat all paper money are political in nature)

Bailouts Equals Crony Capitalism

For Euro bears, it is also a fatal mistake to imply of the political correctness of bailouts when done or executed geographically or within borders. To argue that Germans are unlikely to agree to a bailout of Greece or that Texans are unlikely to agree to a bailout of the Illinois seems like a strawman.

Bailouts, as shown above, hardly represent geographical boundaries. For instance in the case of the Euro, none EU members such as Sweden, United Kingdom and Denmark have even participated in the recent Irish bailout[8] while Norway[9] have offered to join the non-EU consortium. In other words, taxpayers of these non-EU nations have been exposed to credit risks.

Instead, bailouts function as a redistributive process in support of a politically favoured class regardless of territorial boundaries.

Bailouts, in principle, equates to crony capitalism. As Cato’s Gerald P. O'Driscoll Jr. explains[10]

(bold emphasis mine)

Distorted prices and interest rates no longer serve as accurate indicators of the relative importance of goods. Crony capitalism ensures the special access of protected firms and industries to capital. Businesses that stumble in the process of doing what is politically favored are bailed out. That leads to moral hazard and more bailouts in the future. And those losing money may be enabled to hide it by accounting chicanery.

In short, bailouts signify a form of protectionism that only benefits the politically connected or the “insiders” at the expense of the public.

The act itself is condemnable, where boundaries do not mitigate its iniquities.

And apparently, as the Irish bailout and the Fed bailout of 2008 demonstrate, the global banking class has been the privileged insider.

The Endowment Effect And The Euro’s Regional Political Imperatives

Moreover, Euro bears seem to be afflicted by a cognitive bias known as the endowment effect. Such bias, according to wikipeida.org[11], is “where people place a higher value on objects they own than objects that they do not”.

Figure 6: Euro Zone Members as U.S. States[12] (Wall Street Journal Blog)

In other words, Euro bears could possibly be underestimating the deficiencies of the US dollar, while on the other hand, overestimating on the omissions of the Euro simply because many of these Euro bears are domiciled in the US.

Another way to vet such behaviour is to see such bias in the light of nationalism.

Yet in measuring the relative scale of problems (as shown in Figure 6), one would note that the problematic states of the US today[13], according to their pecking order: Illinois, California, New York and New Jersey, which ranks in terms of US GDP[14] 5th, 1st, 3rd, and 8th respectively, would dwarf the PIIGS of the Eurozone.

Seen in a different light, when ranked according to world GDP[15], Illinois is 21st, California 8th, New York 15th and New Jersey 25th compared to Portugal (58th), Ireland (47th), Italy (7th), Greece (40th) and Spain (8th).

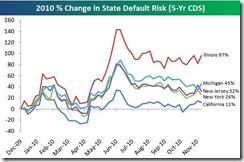

Figure 7: US Troubled States: Calm Before The Storm? (chart from Bespoke Invest[16])

Fortunately, the focus of credit quality concerns has yet shifted to the PIIGS rather than to these problematic states. Otherwise, whatever disintegration blarney that has been bruited by the Euro bears should also apply to the US.

Lastly, Euro bears seem to forget that the Euro or the EU was NOT forged overnight. The Euro was founded on the premise of the avoidance to indulge in repeated wars which has tormented her for last centuries as earlier discussed[17]. Thus, a free trading zone operating under a hybrid[18] of supranationalism and intergovernmentalism, was established to reduce tensions from nationalistic tendencies.

While we don’t see the Euro as an ideal currency, as she falls into the same “power inducing” trap that intrinsically haunts paper based currencies, the Euro ultimately will share the same fate of their forbears as with the US dollar.

However, at present the Euro has been less inflationary than the US, which serves as the main bullish argument for the Euro.

Moreover, these regional politics imperatives postulate that domestic politics will be subordinated, as reflected even by the actions of the non-EU members in facilitating for the Irish bailout.

Bottom line: Aggregate demand, deflation (whatever this means, that’s because for Euro bears deflation has many definitions which makes the term amorphous) and the inability to devalue a currency don’t make a strong case for the disintegration of EU.

[1] See Ireland’s Bailout Will Be Financed By Monetary Inflation, November 28, 2010

[2] Bloomberg.com ECB Tried to Force Ireland Into Bailout, Minister Says, November 30, 2010

[3] Bloomberg.com ECB Delays Exit, Buys Bonds to Fight ‘Acute’ Tensions, December 2, 2010

[4] Bloomberg.com, Reynders Says Bailout Fund May Be Boosted in Break With Merkel, December 5, 2010

[5] See Paper Money Is Political Money, December 4, 2010

[6] Wall Street Journal Editorial, The Fed's Bailout Files, December 2, 2010

[7] Bloomberg.com Fed May Be ‘Central Bank of the World’ After UBS, Barclays Aid, December 2, 2010

[8] Guardian.co.uk, Ireland bailout: full Irish government statement, November 28, 2010

[9] Reuters.com Oil-rich Norway may lend direct to Ireland, November 29, 2010

[10] O'Driscoll Gerald P. Jr. An Economy of Liars, Cato Institute, April 20, 2010

[11] Wikipedia.org Endowment effect

[12] Wall Street Journal Blog, Euro Zone Members as U.S. States, December 1, 2010

[13] See Global Debt Concerns Overwhelmed by Liquidity, October 15, 2010

[14] Wikepedia.org List of U.S. states by GDP

[15] Wikepedia.org Comparison between U.S. states and countries nominal GDP

[16] Bespoke Invest, State Default Risk Levels, December 2, 2010

[17] See Inflationism And The Bailout Of Greece, May 02, 2010

[18] Wikipedia.org European Union

No comments:

Post a Comment