A very important feature that distinguishes the epic 1987 crash from modern equity market meltdowns has been that the cataclysmic ‘1987 moment’ originated overseas than from the US, as the Wikipedia.org describes[1],

The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin. The Dow Jones Industrial Average (DJIA) dropped by 508 points to 1738.74 (22.61%).

Ignoring China’s Woes

Much of the concentration of the public’s attention has been in the developments of Europe or the US functioning as the major drivers of the price actions of global equity markets.

Again, most have been ignoring the developments in China.

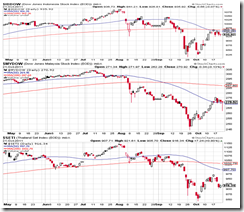

This week, China’s Shanghai index expunged all gains previously acquired from the declared rescue efforts by the Chinese government’s sovereign wealth fund, Central Huijin to buy shares of major Chinese banks to demonstrate support for her banking and financial sector as well as the stock market, aside from the recently announced bailout measures which extended liberal financing to small scale enterprises following deepening signs of economic weakness[2]

The Shanghai index broke down from her immediate support. Importantly, momentum suggests that a meaningful test or even a possible encroachment of the 15-month critical support levels could happen anytime soon.

Again whether the current conditions signify as plain vanilla economic slowdown or have been symptomatic of a bubble bursting phase of China’s puffed up real estate sector, current events ostensibly exhibits a liquidity contraction process at work as consequences to earlier policies to contain inflation via increases in interest rate and reserve requirement channels and through the appreciation of her currency, the yuan.

China’s policies have shown little difference from the policies of the West, Keynesian attempts to perpetuate quasi-booms that are eventually met with busts.

And as previously mentioned, since China has been a major consumer of commodities, a liquidity contraction will likely extrapolate to price declines over a broad spectrum of commodities. At worst, a bursting bubble could mean a price collapse.

Thus far, the commodity sphere appears to be confirming the China liquidity contraction theme as commodities have shown sharp declines almost in conjunction with recent selloffs in the Shanghai Index.

Industrial metals (GYX), Precious Metals (GPX), Energy (DJAEN) and Agriculture (GKX) have all stumbled markedly and have mostly been drifting in bear market territories except for the Precious metals.

Can China Withstand the Financial Storm Unfazed?

For many there has been much optimism over China’s ability to conduct a successful bailout of the affected segments of her economy. Some say that China has been equipped with ‘financial tools’ and or the wherewithal to arrest the current decline.

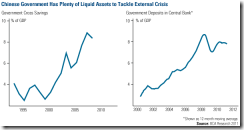

While it may be true that China’s government has a lot of savings, estimated at 8% of the GDP, and similarly holds sizeable deposits, where government savings has been estimated at 8% of the GDP[3], it is not clear if these deposits have remained in the banking system or had been lent out as various forms of loans that could have been exposed as off-balance sheet liabilities that has propped up the property bubble.

Also, my skepticism applies to the alleged large pool of state owned assets estimated at 15 times GDP that could serve as cushion to any ‘systemic meltdown’[4].

In short, I am doubtful of these statistical premised presumptions. Further, I am a cynic to the credibility and reliability of the actual metrics used to calculate accurately the existence of these assets.

And speaking of credibility, China’s accounting system has remained partly abstruse, whose transparency should be reckoned as questionable. China has yet to fully adapt and integrate to the world’s standard of generally accepted accounting principles or International Accounting Standards[5]. Up to February of 2010 China’s accounting standards has still been under Chinese standards.

Moreover, much of China’s foreign exchange surpluses have been representative of monetary or credit expansion and thus vulnerable to any credit contraction-hot money outflows from a bursting of her property bubble.

Foreign reserve surpluses are equally vulnerable as Austrian economist Dr. Anthony P. Mueller explains[6],

The expansion of debt by the issuer of the international reserve medium augments the stock of international reserves and the increase of the reserves works like a growth of the global money supply. Central bank balance sheets show that the circulating domestic money forms a debit item, while foreign reserves are part of the credit side. All other things being equal, an increase in foreign reserves implies money creation. This way, foreign debt accumulation by the issuer of a global reserve currency impacts monetary demand through two channels: in the debtor country by the domestic spending of foreign savings, and in the creditor country by the accumulation of foreign exchange reserves which augment the money supply….

And the engagement of further bailouts would only shift the burden to government which would accumulate more debts that ultimately becomes unsustainable

Again Dr. Mueller,

Governmental debt accumulation and monetary expansions tend to go the extremes until they will collapse. While it has taken many years for the capital structures of the economies involved to adapt to these conditions, the catastrophic event of the debt collapse will abruptly confront the capital structure with a new and very different setting. International capital flows driven by government possess the same general features like a debt cycle caused by monetary expansion that is not funded by savings.

For as long as China’s government will persists on with various interventionist policies, bailouts, bubbles, and an expansion of the welfare system, this should lead to capital consumption activities which would undermine whatever supposed advantages accrued from the foreign reserves.

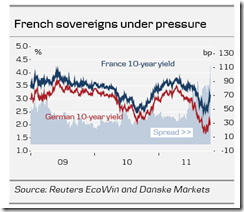

The lingering debt crisis in the Eurozone has only increased the indebtedness of the region, which according to reports has boosted the region’s debt average to 85.4 percent of gross domestic product from 79.8 percent in 2009[7]. The continuing growth of debt has been corollary to the increase of ‘budget deficits’ and of ‘bank-recapitalization costs’.

The attendant strains from the transference of scarce resources from productive sectors to unproductive or politically privileged sectors as banks eventually weighs on the creditworthiness standings of foreign reserve surplus nations such as Germany and France as shown in the above chart by Danske Bank[8].

In addition, I am dubious of any implied sophistication of China’s central banking, whose supposed financial tools like any conventional modern central banks have been merely about printing of money. Transferring liabilities from one pocket and to another only to be camouflaged by fiat money from the PBOC will eventually will get exposed when the proverbial tide subsides.

Inflation is a policy that will not last.

Questioning China’s Crisis Management Experience

Furthermore, China’s experience with handling a major banking crisis should be viewed with skepticism. The last time China had a major banking crisis was in the late 90s where China rescued her major state owned banks that had been complimented by recapitalizations through the Hong Kong Stock Exchange[9].

Also China has only had a major recession over the past two decade. The last recession seem to have coincided with the banking crisis in 1998-99, where real growth fell to 5% while reported growth dipped only slightly below 8% according to the Economist[10].

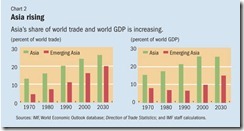

The point that needs to be stressed here is that given the dramatic changes in the scale, the scope and the complexity of the global economy which includes China’s economy which has in the recent years catapulted to the 2nd largest in the world[11], I would have sincere doubts about her ability to conduct an orderly rescue outside the scope of massive reflating the system.

By the same token, it would signify as reckless assumptions to believe that the developed world will be insulated from the risks of a further deterioration of China’s economy.

If the world has supposedly been lifted out of the recession in 2009, led mainly by China and India with the help of the rest of Asia[12], where the region’s share of the economic pie has been rapidly expanding, then we would likely have a reverse contagion effect where a slowdown in China and Asia will exacerbate on the protracted economic pressures being endured by the fragile economies of the crisis affected Western nations.

The degree of contamination will most likely depend on the strength of the internal dynamics of the respective local economies. Thus, it remains to be seen if the massive growth in money supply in the US can offset the liquidity contraction being experienced by China.

China’s Crisis will likely Impact ASEAN Bourses

It would equally be foolish to presume that the ASEAN 4, whom has been outperforming the world in terms of equity markets, would remain unsullied by a China liquidity contraction.

The transmission mechanism from a China crisis postulates that the rapid growth of ASEAN exports to China which has been driven mainly by commodities, information technology and regional supply chain integration[13] would be confronted with tremendous pressures that would have real untoward economic effects.

And despite my bullish bias it would be hard to argue against empirical evidence.

Although the ASEAN majors have not yet violated the 20% threshold level or the technical demarcation for a bear market, chart patterns appear to corroborate such anxious global market sentiments where Indonesia (IDDOW), Malaysia (MYDOW) and Thailand (SETI) bellwethers have transitioned into a bearish ‘death cross’.

People’s actions shape chart trends, this only implies that current market climate has been imbued with too much uncertainty whose present state seems opaquely identifiable. In other words, I am uncertain if we are in a consolidation phase or in a transition to bear market or a pause from a bull market.

Thus, the global equity markets, inclusive of the ASEAN bourses, appear to be much in limbo.

Conclusion

Market signals today appear to be reflective of the rampant uncertainties brought about by the amorphous political environment which has held global financial markets hostage.

Again, the state of extreme fluidity of the events implies that anything may happen in the transition. Equity markets will likely remain sharply volatile in both directions.

And this will remain so until we see major ‘concrete’ actions from global policymakers, including the political stewards of China, the Eurozone, and importantly, from the US Federal Reserve Chief Ben Bernanke, who bizarrely keeps incessantly dangling on variations of his preferred policy action—quantitative easing[14].

The October 1987 crash signified a low probability high impact event or a Black Swan where such event transpired unanticipated by the mainstream.

Such an event risk may seem partly applicable today and could be magnified if the current impasse in policymaking or the stalemate in the political domain remains in place.

On the other hand, for the global financial market greatly dependent on government steroids, concrete or specific actions by policymakers will likely turn the tide that would recalibrate the bubble cycle.

[1] Wikipedia.org Black Monday (1987)

[2] See More Evidence of China’s Unraveling Bubble?, October 16, 2011

[3] US Global Investors Investor Alert - Do Bullish Investors Have an Ace in the Hole?, October 21, 2011

[4] Huang YiPing, Is China's Economy Headed for Trouble? October 12, 2011, Wall Street Journal

[5] Wikipedia.org Chinese accounting standards

[6] Mueller Antony P. Do Current Account Deficits Matter? Mises.org Journals

[7] Bloomberg.com Euro-Area Debt Reaches Record 85.4% of GDP as Turmoil Deepens, October 21, 2011

[8] Danske Bank Preview EU summit: The moment of truth, Strategy October 20, 2011

[9] Xie Andy Here We Go Again, September 10, 2009 China International Business

[10] The Economist, Reflating the dragon, November 13, 2008

[11] The Telegraph China is the world's second largest economy, February 14, 2011

[12] Singh Anoop, Asia Leading the Way IMF Finance and Development June 2010

[13] IMF.org Navigating an Uncertain Global Environment While Building Inclusive Growth, Regional Economic Outlook, October 2011

[14] See Bernanke’s Doctrine: Fed Mulls Purchases of Mortgage Backed Securities, October 22, 2011

No comments:

Post a Comment