The Pragmatic Capitalist quotes a Nomura Study of what seems to be a simmering volcano waiting to explode

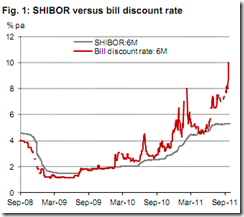

In order to understand better how serious the problem is, we monitor the bill discount rate, which is the financing cost for firms when they sell commercial acceptance bills to banks for cash. A higher bill discount rate is a signal that the imbalance between supply and demand for credit has worsened. The 6-month bill discount rate has worsened at alarming pace since 2011, rising to above 10%.

The gap between the bill discount rate and the interbank rate has widened to 5.7 percentage points, the highest level since the data was made available. China’s credit market is becoming more fragmented. Financing costs for firms without access to bank loans have risen much more than those for large state owned enterprises. The sharp rise in the bill discount rate may be partly driven by property developers who are facing worsening financing conditions given the lackluster sales.”

These indicators: China’s Bill discount rate and the Shanghai Interbank Offered Rate (SHIBOR) should be one very important indicator to watch

No comments:

Post a Comment