And it would be serious mistake to simply gloss over the motives of politicians and presume that, along with their allies, they would docilely submit to market forces. The political class along with their economic clients have benefited immensely from the incumbent political institutions, organized along the 20th century vertical top-bottom framework, will likely continue to fight to maintain their entitlements through the preservation of the system.

And such transition would be surrounded by intense volatilities in the marketplace and in the political realm as evidenced today.

It’s not a question of simply reading past performance (current economic figures) and projecting them into the future as the mainstream does. Many who see the world as operating in a prism of the 2008 paradigm or the Japan stagnation or the Great Depression of the 1930s will most likely be mistaken, as consistently proven in the recent past.

Instead, it is the question of how politicians along with their respective bureaucratic leaders will react in the face of the continuing unfolding crisis and the possible ramifications thereof that would matter most in forecasting the path of price trends in financial markets.

Divergences as Emerging Theme

Divergence seems to be an emerging theme.

One would need just to see how equity markets have been reflecting on the emerging signs of divergences, instead of a contemporaneous convergence during periods of market stresses such as in the crisis of 2008.

Below is the weekly performance of the select major equity markets.

While reflecting signs of weakness, Asian equity markets have not been as buffeted in the scale of her Western counterparts.

To consider, globalization has been increasing the correlations of equity markets.

Asian equity markets (ex-Japan) since 1995 has been exhibiting growing interdependence with global markets[1].

Given today’s deepening of globalization trend, Asian equity markets have become more sensitive to developments of the world. And this is why the argument for a decoupling may not be persuasive.

However my thesis has been that—market divergences or relative asset pricing may likely persists for as long as the world doesn’t succumb to a vortex of liquidity contraction or from a global recession which may also manifest the same symptom.

Yet signs of seminal diversity in equity market performance seem even more apparent from a wider timeframe.

The year-to-date performance of select global benchmarks as seen below.

While the European debt crisis has substantially battered the region’s equity markets where the current bear markets—shown by Germany and France could exhibit signs of forthcoming recession, the expected ripple or ‘contagion’ effects from this crisis seems to have been limited, thus far.

Again the ASEAN-4 and the US S&P 500 appear to sizably deviate from the Eurozone. Japan’s gloomy performance may partly be attributed to dour global sentiment but mostly to the first quarter triple whammy natural disaster. Meanwhile, the weak state of China’s equity markets could be a manifestation of either a cyclical slowdown or a bubble bust, which so far has yet to be established.

It is important to note that we cannot discount a shock from happening given the current circumstances. However as I have repeatedly been pointing out, the fundamental difference of the market’s outcome (from that of 2008 or from Japan’s lost decade) will be determined by prospective policy actions.

Monetization and Debt Profiling

Part of the aberration in market pricing can be attributed to the market’s differentiation of credit risks by specific nations.

The fascinating table above from Bespoke Invest[2] signifies an updated tale of the tape of credit risks, where the cost to insure debt of 44 nations via credit default swaps (CDS) has materially surged in the Eurozone led by Greece and Portugal (see bottom portion of the table) whom has surpassed the former laggard socialist Venezuela.

The Eurozone’s crisis has even dragged AAA credit rating France whose costs of insurance have skyrocketed by 142% year-to-date and which has even topped the ASEAN-4. France has now been ‘riskier’ than the Philippines and the ASEAN.

Meanwhile the US continues to exhibit strength or outperformance amidst rising concerns over global credit risks, which has hardly dented on her CDS premiums. This comes in spite of the recent S&P downgrade.

But the above table doesn’t tell the entire story though.

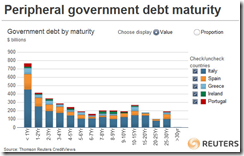

The reason for the current Euro crisis and the relative ‘safe US credit standing’ has largely been due to the debt maturity profile.

Much of the refinancing needs of Italy and the rest of the crisis affected PIIGS have been current or due in near term (top chart[3]).

Meanwhile US debt maturity profile has been farther out of the curve[4].

Nevertheless, sovereign liabilities of the US continue to balloon.

This November, US debts have soared passed 100% of GDP[5] which adds the US in the company[6] of prospective deadbeats.

The major reason why US the hasn’t suffered the same fate as that of the European PIIGS is that the US Federal Reserve has been monetizing her US debts, something which the Keynesians and the Chartalists have been raving about. The implication is that the US, as the world’s premier foreign currency reserve, is virtually immune to laws of economics. For them, money printing allows the US government to spend at will, which hardly will stoke any risks of inflation. Thus, the aversion to discuss any hyperinflation parallels of Weimar Germany or of Zimbabwe.

Yet the seeds towards the destruction of the US dollar have already been sown, the US Federal Reserve has reportedly outpaced China as the largest owner of US debt[7]. This means that the US has principally been relying on money printing by the Fed to finance her present liabilities.

This also shows the absurdity of the idea that the US Federal Reserve won’t commit to additional quantitative easing (QE) measures, as argued by some.

The US is faced with extremely challenging circumstances of pronounced weakness in many parts of the global economy that could intensify the risks of another recession, in an environment where national (US) saving rates has on a deepening slump[8], the worsening insolvency crisis at the Eurozone area that will extrapolate to reduced access to private financing and a possible contagion from a distressed banking sector[9].

True, US bond yields have been drifting in near record lows. However this hasn’t been a sign of systemic deflation (yes oil prices is just under $100, gold at under $1,700), instead low yields have been representative of policies targeted at manipulating the yield curve and of the temporal haven currency reserve status of the US dollar[10].

To add US CPI inflation has been climbing which in October was at the 3.5% rate and has been above the 1914-2010 average at 3.38%[11]. To consider, US CPI construct has vastly been skewed towards housing[12] which doesn’t accurately signal the real rates.

Yet the shortfall of financing US debts will be reinforced by the ongoing ‘slowdown’ in China whom has been resorting to her own whack-a-mole or piecemeal approach in applying bailouts[13]. And this also should apply to other emerging markets as well.

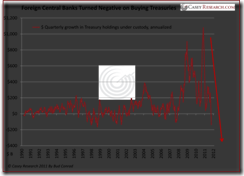

So far, the appetite to finance US debts by foreign central banks has been drying up[14].

Also the current crisis in the Euro area will postulate an environment of an even tighter competition with the US, the EU and other governments, as well as, other private entities wanting to access to savings from private sector.

Of course a no QE scenario for the FED will only happen if Bernanke and the rest of the FOMC will experience the epiphany of letting the markets clear.

But I would say that the odds for such an event to happen will proximate ZERO.

Central Bank Activism

For as long as the rates of inflation remains suppressed, politicians and their bureaucrats will use the current opportunities to test the limits of controlling and manipulating of the markets.

Thus any proclamations to impose self-discipline should be seen with cynicism.

For instance, the once defiant Germans, who have strongly been opposing the European Central Bank’s (ECB) role as ‘lender of last resort’, appear to be gradually acceding to pressures[15] for the ECB to aggressively backstop the Euro in the name of fiscal integration or union.

In reality, today’s signs of divergences seem to be driven by idiosyncratic liquidity conditions of each nation—where asset prices appear to be priced depending on relative systemic exposure on debt combined with the prospective impact of loose monetary conditions to their respective markets and the economy. These, aside from the transmission effects from policies set by the US Federal Reserve.

Thus in considering the above, the low leverage of ASEAN 4 makes them more receptive to the present boom bust policies.

Yet what sets the today’s markets apart from the 2008, Japan’s stagnation and or the Great Depression has been the central bank activism which as I have been reiterating has been navigating on uncharted treacherous waters.

Artificially manipulated interest rate together with money printing results to relative pricing of assets, which all comprises the inflation cycle.

Bottom line: I think the boom phase for the Phisix ASEAN markets, despite the turbulence in the EU, remains intact, barring any unforeseen events.

[1] Worldbank.org Navigating Turbulence, Sustaining Growth WORLD BANK EAST ASIA AND PACIFIC ECONOMIC UPDATE 2011, VOLUME 2

[2] Bespokeinvest.com Global Sovereign Credit Default Swap Prices, November 25, 2011

[3] Macleod Alasdair Watch out for maturing debt, November 19, 2011

[4] Merk Axel, Operation Twist a Primer for QE3? , Merk Funds, October 4, 2011

[5] See US Debt Passes $15 Trillion or Over 100% of GDP, November 17, 2011

[6] Galland David Monetary Madness – Is the US Monetary System on the Verge of Collapse? , October 18, 2011, Daily Reckoning

[7] CNSNews.com Fed Now Largest Owner of U.S. Gov’t Debt—Surpassing China, November 16, 2011

[8] Bloomberg.com U.S. Economy Grew Less Than Forecast on Inventories, November 22, 2011 SFGate.com

[9] See The US Banking Sector’s Dependence on Bernanke’s QEs, October 5, 2011

[10] See Market Crash Confirms Some of My Thesis on Gold and Decoupling, October 2, 2011

[11] Tradingeconomics.com United States Inflation Rate

[12] See US CPI Inflation’s Smoke and Mirror Statistics May 18, 2011

[13] See China Expands Bailout Measures, Reduces Reserve Requirements for Select Financial Firms, November 24, 2011

[14] Vuk, Vedran Are Foreign Banks Losing Confidence in US Treasuries? October 17, 2011 Casey Research

[15] See Will the European Central Bank Relent to Political Pressures to Increase Debt Monetization? November 26, 2011

No comments:

Post a Comment