Bad news on China’s property sector is good news for media and the Chinese equity markets.

From Bloomberg

China’s new home prices rose for the first time in 10 months as the government eased its monetary policies to bolster the economy, according to SouFun Holdings Ltd. (SFUN), the nation’s biggest real estate website owner.

Home prices increased 0.1 percent from May to 8,688 yuan ($1,367) per square meter (10.76 square feet), SouFun said in an e-mailed statement today, based on its survey of 100 cities. Beijing led gains among the nation’s 10 biggest cities, climbing 2.3 percent from May, followed by the southern business hub of Shenzhen, which added 0.8 percent.

China’s Vice Premier Li Keqiang asked for curbs on speculative home demand to be continued and called for more efforts to build affordable housing units, Xinhua News Agency reported yesterday. While the government maintained its housing curbs, it helped ease funding by lenders and vowed to support first-home buyers. The central bank cut the benchmark one-year lending rate last month for the first time since 2008.

“The rate cut played a big role changing the sentiment on the market,” said Jeffrey Gao, a Shanghai-based property analyst for Macquarie Capital Securities. “The government hasn’t changed the overall direction of the property policy, but it probably will be less stringent on the easing in smaller cities.”

Round off .1 percent and you get zero. Ok, give them the benefit of the doubt that zero is better than negative.

What such news attempts to frame to the public’s mind is that low interest rates equals recovery. The implication is that debt is growth. That’s hooey.

As the great Ludwig von Mises warned,

Public opinion is prone to see in interest nothing but a merely institutional obstacle to the expansion of production. It does not realize that the discount of future goods as against present goods is a necessary and eternal category of human action and cannot be abolished by bank manipulation. In the eyes of cranks and demagogues, interest is a product of the sinister machinations of rugged exploiters. The age-old disapprobation of interest has been fully revived by modern interventionism. It clings to the dogma that it is one of the foremost duties of good government to lower the rate of interest as far as possible or to abolish it altogether. All present-day governments are fanatically committed to an easy money policy.

To paraphrase Professor Mises, All present-day governments are fanatically committed to boom bust cycles, erosion of capital for civil society and the transfer of wealth to politicians

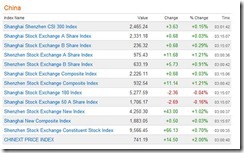

China’s equity markets are modestly up as of this writing.

Could this be in response to zero growth or could this be a carryover from the EU Summit bacchanalia or both?

Yet commodity prices are down.

Nevertheless, One day does not a trend make.

No comments:

Post a Comment