There are more billionaires now in Indonesia than in Japan

From Wall Street Journal

Forbes Indonesia’s latest list of the country’s richest people, released this week, sets its billionaire tally at a record 32 people and families, edging out Japan, which Forbes says is home to 28 billionaires. Last year Indonesia had 26 billionaires, according to Forbes’ calculations.While the archipelago’s crowd of coal magnates was hit hard by a plunge in coal prices, the commodities collapse was more than offset by the growing wealth of the people behind the country’s top retail, media, banking, food and tobacco companies.

Many may read this as signs of relative prosperity in favor of Indonesia. Perhaps.

But the important question to ask is what has served main foundation for the ballooning wealth class? Has it been economic freedom, cronyism or monetary induced bubbles?

From the same article,

While a lack of public disclosure can make it difficult to estimate exact wealth, Indonesia’s bulging batch of billionaires shows that family fortunes have been largely protected across the archipelago even as most of the world struggles with a slowdown.And though Indonesia’s billionaires club is still smaller than the ranks in China (more than 100 billionaires) and India (more than 50 billionaires), with less.

It is not clear what “family fortunes have been largely protected across the archipelago” really means. Cronyism perhaps?

Although, the Indonesian government appears to have adapted more business friendly policies, economic freedom has been substantially been improving since 2008 (Heritage Foundation)

Also, Indonesia has embarked on genuine fiscal reforms since the Asian crisis.

Indonesia’s government debt to GDP ratio has been pared to only 25% from 67.8% in 2008.

On the other hand, Indonesia’s economy has likewise been experiencing a credit boom from easy money policies.

Domestic loans have picked up substantially over the recent years, but still have been significantly below the levels of the Asian crisis (both charts above from tradingeconomics.com)

Nevertheless, the methodology used to arrive at the respective wealth estimates are from stakes held by these billionaires of publicly listed companies and for non-publicly listed private firms, indirectly through comparisons with publicly listed contemporaries.

And from such perspective, we can see from the charts below why Indonesia has overtaken Japan.

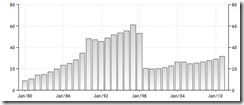

Indonesia’s JKSE has been skyward compared to Japan’s seemingly perpetual stagnation post bubble bust of the early 90s

The jury is out on whether Indonesia’s recent gains has emanated mostly from either increased productivity due to a freer economy or from monetary policy induced bubbles.

Admittedly, economies are complex such that three factors (market economy, cronyism and monetary bubbles) may simultaneously be in operation, the point is which among them is likely the bigger force or influence.

No comments:

Post a Comment