A geneticist recently claimed that human intelligence has been on a gradual decline due to the extensive use of fluorides in the water supply, pesticides, high fructose corn syrup and processed foods.

I have a different opinion. If true, then I would say that the main culprit has been the public’s worship of state, from which untruths, as conveyed by media, politicians and their apologists, envelops its essence. Blind belief in political falsehood makes people lose their intellectual bearings.

Just recently the Japanese government has been blamed by her counterparts as Russia, South Korea and the Bundesbank for inciting, if not escalating, a “currency war” via open ended bond buying program to devalue the yen. The implication is that Japan’s “currency manipulation” polices signifies as “beggar thy neighbor” policies that have been implicitly designed to hurt other nations.

A “currency war” is another term for competitive devaluation which according to Wikipedia.org represents “a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency” where “states engaging in competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing.”

Yet one would notice that the balance sheets of major central banks, all of which have been skyrocketing, and which allegedly reflects on “direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing”, currency wars in the light of competitive devaluation has been an ongoing event since 2008 as shown in the chart above.

In short, neither has this been an exclusive Japan event nor has been a fresh development.

And this has also not been limited to major central banks but extends all the way to emerging Asia and to China as well, the Philippines included. (chart from the Bank of International Settlements)

In short, global central banks have been in a state of “currency war” or “currency manipulation” since 2008.

This article is not meant to absolve Japan's policies but to expose on what seems as political canard.

In reality “currency war” or “currency manipulation” or competitive devaluation is simply nothing more than inflationism. The great Ludwig von Mises defined inflation as

if the quantity of money is increased, the purchasing power of the monetary unit decreases, and the quantity of goods that can be obtained for one unit of this money decreases also.

While there may be technical difference on what a central bank buys to expand her assets through a corresponding expansion of currency liabilities, the fact is that “quantity of money is increased”.

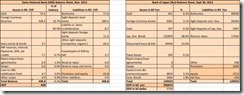

The assets of Swiss National Bank have mostly been in foreign currency reserves (as of November 2012) while the Bank of Japan has mostly been in JGBs (as of September 30, 2012). Table from (SNBCHF.com)

American neo-mercantilists have labeled “currency manipulation” on nations, who allegedly use of accumulation of currency reserves as exchange rate policy, from which they call their government to impose protectionist countermeasures such as China.

As I wrote previously this represents naïve thinking.

While the technical reasons why countries accumulate foreign currency reserves are mainly for self-insurance (for instance Asia reserve accumulation has partly been due to the stigma of the Asian Crisis) and from trade, financial and capital flows (NY FED), the real “behind the curtain” reason has been the US dollar standard system. Such system allows for a “deficit without tears”, or unsustainable free lunch by the use of the US dollar seingorage to acquire global goods and services that results to seemingly perpetual trade deficits.

Deficit without tears, as the late French economist and adviser to the French government Jacques Rueff wrote in the Monetary Sin of the West (p.23), “allowed the countries in possession of a currency benefiting from international prestige to give without taking, to lend without borrowing, and to acquire without paying.”

And this has been the main reason for America’s “financialization” and the recurring policy induced boom bust cycles around the world, which essentially has been transmitted via the Triffin dilemma or “the conflict of interest between short-term domestic and long-term international economic objectives” of an international reserve currency

Thus blaming China or even the Philippines for reserve currency accumulation seems plain preposterous and only represents political lobotomy.

Currency war or currency manipulations serves no less than to “cloak the plea for inflation and credit expansion in the sophisticated terminology of mathematical economics”, to quote anew the great professor Ludwig von Mises from which “to advance plausible arguments in favor of the policy of reckless spending; they simply could not find a case against the economic theorem concerning institutional unemployment.”

And may I add that pretentious public censures account for as ploys to divert public’s attention or serve as smokescreens from homegrown government “inflationist” policy failures.

Since major central bank represented by the G-20 knows that by labeling Japan as instigator of currency wars would be similar to the proverbial pot calling the kettle black, they went about fudging with semantics to exonerate Japan’s political authorities.

From Bloomberg,

Global finance chiefs signaled Japan has scope to keep stimulating its stagnant economy as long as policy makers cease publicly advocating a sliding yen.The message was delivered at weekend talks of finance ministers and central bankers from the Group of 20 in Moscow. While they pledged not “to target our exchange rates for competitive purposes,” Japan wasn’t singled out for allowing the yen to drop and won backing for its push to beat deflation.

This doesn’t look like a “war”, does it?

At the end of the day, currency war, or perhaps, stealth collaborative currency devaluation (perhaps a modern day Plaza-Louvre Accord) maneuvering means that central bank shindig will go on; publicity sensationalism notwithstanding.

No comments:

Post a Comment