Amidst a divided FED, this time financial markets chose to focus on US FED chairman Ben Bernanke’s statement as justification for a quasi-RISK ON day.

From the Bloomberg: (bold mine)

Federal Reserve Chairman Ben S. Bernanke called for maintaining accommodation even as the minutes of policy makers’ June meeting showed them debating whether to stop bond buying by the Fed in 2013.“Highly accommodative monetary policy for the foreseeable future is what’s needed in the U.S. economy,” Bernanke said yesterday in response to a question after a speech in Cambridge,Massachusetts.The Fed chairman spoke just three hours after the central bank released minutes of the June 18-19 gathering showing that about half of the 19 participants in the Federal Open Market Committee (TREFTOTL) wanted to halt $85 billion in monthly bond purchases by year end. At the same time, the minutes showed many Fed officials wanted to see more signs employment is improving before backing a trim to bond purchases known as quantitative easing.

Three weeks back financial markets opted for the “taper” perspective which resulted to a market turmoil.

Well, it is not just the FED, speculations floated that the Chinese government may infuse stimulus for what seems as a wobbling economy.

From another Bloomberg report:

China may soften its stance on monetary policy after Premier Li Keqiang said the nation’s economic growth and employment must stay above a certain floor, Nomura Holdings Inc. said.Li said policy should ensure that economic activity moves within a reasonable range, while inflation should be kept below a ceiling, according to a Xinhua News Agency report posted on the government’s website yesterday, without giving precise limits. Citigroup Inc. took a different tack, saying Li’s remarks were in line with its view that the government has no plans for stimulus at the current expansion pace.China’s exports and imports unexpectedly declined in June, underscoring the severity of a slowdown in the world’s second-largest economy as Li’s attempts to rein in credit growth contributed to the worst cash crunch in at least a decade. Gross domestic product may grow 7.5 percent in the second quarter, down from 7.7 percent in the first, according to the median estimate of 40 economists in a Bloomberg survey.

Bad news is good news again.

Markets are groping for any signs of inflation steroids from central banks.

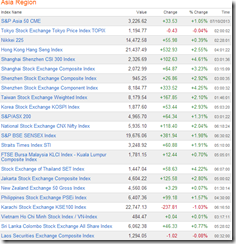

Asia generally traded sharply higher today. Much of the big gains came in the afternoon as rumors of interventions by the Chinese government spread.

China’s Shanghai Composite rocketed 3.23%

Previously battered Thai and Indonesia’s stock markets flew 4.22% and 2.8% respectively.

Korea’s Kospi and Hong Kong’s Hang Seng also traded sharply higher by 2.93% and 2.55%.

Meanwhile the Philippine Phisix also jumped 1.57%

Despite the optimism for more accommodation, US markets closed mixed last night. Although futures suggest of a grand opening in favor of the bulls.

And part of the quasi-RISK ON environment has been a huge rebound in oil prices.

I say “quasi” because bond markets continue to respond negatively to what seems as an ambiguous Fed communications. US 10-year yields moved significantly higher last night.

Interesting evolving contradictions.

No comments:

Post a Comment