Tight money may have begun to take its toll on Indonesia's economy

From Bloomberg

Indonesia’s economy grew less than 6 percent last quarter, adding to risks for the Southeast Asian nation as investments ease, inflation accelerates and the currency slumps.Gross domestic product increased 5.81 percent in the three months ended June 30 from a year earlier, the Central Bureau of Statistics said in Jakarta today. That compares with a 6.02 percent pace reported previously for the first quarter and the median estimate of 5.9 percent in a Bloomberg News survey of 19 economists.Indonesian policy makers are contending with easing growth at a time when higher fuel costs spurred the fastest price gains in more than four years and the rupiah trades near the weakest since the global financial crisis. The central bank has raised interest rates at the past two meetings in an effort to temper prices and reduce capital outflows, actions that may hurt domestic spending and compound the slowdown in Southeast Asia’s largest economy.

As I previously noted, Indonesia has her own credit boom fueled stock market-property bubble.

And monetary tightening expressed via the bond vigilantes may have commenced to negatively impact on the accumulated imbalances on the real economy.

Indonesia’s bubble conditions has led to the deterioration of her trade balance since 2012.

Sustained government budget deficits has also compounded on her weakening external conditions. (charts from tradingeconomics.com)

Indonesia's vulnerable external conditions has been reflected by the accelerating decline of her currency, the rupiah, or the rise of the US-IDR as shown in the chart from xe.com. These dynamics has prompted their government to cut fuel subsidies which sparked riots.

Yet these deficits will need to be funded by more borrowing or higher taxes or by covert inflation. This also means a prospective cut on government expenditures.

So far the recourse has been via debt.

While Indonesia’s external debt level has been low relative to the past (30+% against 60+% in the pre-Asian crisis), it has been rising at an accelerating pace.

In July, Indonesia successfully raised US$ 1 billion from the debt markets but at significantly higher rates.

But these deficits have also been addressed via the monetary inflation route, hence the depreciation of the currency.

Indonesia’s 10 year bond spiked just a few months back when the Fed’s 'taper' talk became a fashion (chart from investing,.com).

With Indonesia's financial markets tightening by its own, the Indonesian central bank, the Bank Indonesia, raised interest twice in a span of a few days last July or just a month back.

Since, the Indonesia’s major stock market benchmark, the JCI, hasn’t been as buoyant as the past (chart from Bloomberg).

While the JCI has not touched the bear market levels during the market tapering incited spasm in the late May-June, the JCI appears to be weakening as evidenced by a series of lower highs.

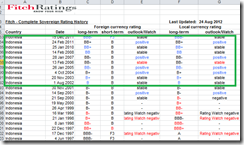

Don’t forget that Indonesia used to be the darling of the credit rating agencies.

For instance the Fitch Ratings has had a series of upgrades on Indonesia’s credit standing since 2002.

Tightening monetary conditions will put Indonesia’s economy to a critical test. The jury is out whether the Indonesian economy will be able to sustain growth or if tightening conditions will expose on the fragility of Indonesia’s systemic leverage that might bring the largest ASEAN nation into a recession--should the bond vigilantes continue to impose their presence around the world.

If Indonesia caves in to the latter, will the rest of the region follow?

And so far, the bond vigilantes have been disproving the outlook of credit rating agencies as in the past.

No comments:

Post a Comment