I have long been suspecting that the Chinese government has been implementing a stealth stimulus.

For example here is what I wrote last May

The reality is that the Chinese government has already launched a stealth stimulus since last year.This can be seen in the continuing credit growth in the Chinese banking sector as seen from ‘the chart from Dr. Ed Yardeni.Most of the pick up in credit growth I believe has been directed to State Owned Enterprises (SOE). One must realize that Chinese economy remains heavily politicized where many firms are wards of the government. So Chinese policies can be coursed through them without official admission.

Forbes columnist Gordon Chang fills in the blanks

Beijing is funneling the “silent stimulus” through two state banks. CDB, as China Development Bank is known, will make large infrastructure loans to three provinces, Hebei, Jiangsu, and Qinghai.Hebei will use loan proceeds for slum renewal and an airport zone, and Jiangsu’s funds will go to urban infrastructure and the province’s regional transport network. The money for Qinghai is for roads, railways, and waterways. Hong Kong’s South China Morning Post called the agreements“the latest sign of an effort by Beijing to prop up growth with targeted bursts of lending.”The lender, which directly reports to the State Council, entered into memoranda of understanding with the three provinces. The agreement with Hebei was signed on the 9th of this month, and it appears the other two were inked at about the same time.Moreover, Agricultural Bank of China , one of the country’s Big Four, signed a loan agreement with the Shanghai city government on the 6th of this month. The 250 billion yuan proceeds will be used to establish the first “Hong Kong-like free-trade zone” in China and build Shanghai Disneyland. Analysts were surprised by the size of the loan—12.5% of the city’s GDP for 2012—and by the fact that the municipality, ranked a province, itself borrowed the money. Premier Li is said to have been personally involved in the making of the loan to what is often called China’s largest city.

More on the bank channeled stimulus:

Yet on-the-ground observers report that the central government has been flooding the economy with money, at least since early July. J Capital Research’s Anne Stevenson-Yang notes that Beijing has been injecting stimulus through China’s five largest commercial banks. “I don’t think the debate is even about whether or not to stimulate: it’s all about what type of spending to engage in,” writes Yang, who often spots Chinese economic trends first. “There is a genuine acceleration in infrastructure spending and many announcements about how the government will accelerate ‘slum renovation,’ water projects, and roads.” She points out there has also been an obvious increase in some of the riskiest loans, those to local government financing vehicles, the notorious LGFVs.The stimulus-on-the-quiet program is already having an effect. For example, the amount of steel for infrastructure overtook steel used in housing recently, an indication that government stimulus—not property construction—is now driving growth.

Like all politicians, the current administration seems focused on the approval generating short term measures aimed at attaining statistical growth goals. It’s all about preservation and expansion of political power and their attendant privileges. In short, political self-interests.

The difference in the stimulus has been in the constituents implementing such programs and the beneficiaries

Yet whatever gains from the stealth or ‘silent’ stimulus will be temporary.

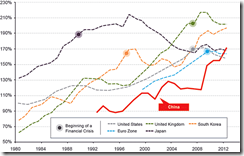

The side effect will be the continued ballooning of systemic debt (charts from WSJ-Zero Hedge) that has been channeled through a massive property bubble. This bubble continues to inflate today in the face of rising interest rates

Politicians have made the world increasingly fragile and vulnerable to black swans.

No comments:

Post a Comment