The Hong Kong’s monetary board, the Hong Kong Monetary Authority (HKMA) seems in a conundrum over what appears to be shifting of credit bubble from real estate to private sector loans.

From the Wall Street Journal Real Economics Blog (bold mine)

Demand for residential real estate has gone flat, so it appears banks are lending to the corporate sector instead.The ability of Hong Kong companies to pay their debts has “showed a marked deterioration” according to the Hong Kong Monetary Authority’s latest monetary and financial stability report. “There are some initial signs that the credit risk of banks’ corporate exposures may be building up.”The HKMA calculates that interest coverage ratios, or the ability of companies to pay debt service with the revenues they generate, have gotten worse the past three years. That’s because of a combination of more and more debt, and business performance not keeping pace. Company’s leverage ratios, or the value of a company’s assets on their balance sheet to their debt has also eroded.Lending to corporations jumped 13.2% in the first half, from 3% growth in the second half of last year. Loans to companies make up 70% of Hong Kong banking loans, whereas mortgage lending is 21.5%. Meanwhile, mortgage lending grew just 3.1% in the first half of 2013, a slowdown from 5% in the second half of last year.The HKMA figures the banks it regulates have enough capital to weather a storm. But the HKMA is worried as the Fed eventually does cut back on its monetary stimulus, Hong Kong will feel it.

Hong Kong’s credit bubble continues to inflate.

Loans to the private sector rose by 12% over two years.

But Hong Kong’s housing index has been plateauing. This should compound on the system’s credit risks as property developers who took on leverage for their projects are now faced with declining demand for housing.

Yet the banking sector’s loan exposure accounts for over 211% of Hong Kong GDP or Domestic Credit Provided By Banking Sector in 2011 and 200% in 2012 (World Bank)

Yield chasing by the banks in luring more companies to take on more credit comes in the face of rising yields. Hong Kong’s 10 year yields have likewise been affected by the bond vigilantes.

Rising yields have likewise been a factor in the deteriorating quality of corporate loans, aside from growing use of ponzi finance via a "combination of more and more debt, and business performance not keeping pace"

While Hong Kong has still huge forex reserves (US $303 billion) in spite of the recent decline, and previously a trend of current account surpluses (which has now turned slightly negative), the HKMA acknowledges that a FED taper will affect Hong Kong, unlike those institutions bearing delusions of decoupling.

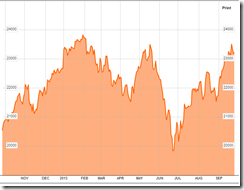

Nonetheless, Hong Kong’s stock markets as benchmarked by the Hang Seng has ignored on such risks and has almost recovered the losses from the supposed FED taper scare last May-June.

The don't worry be happy manic crowd seem to embrace the idea that willful ignorance is bliss.

No comments:

Post a Comment