The Chinese government and the private sector bought record amounts of US treasuries last October.

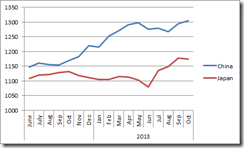

China scooped up more Treasury debt in October than any other foreign investor, a sign recent U.S. fiscal troubles haven’t tainted the Treasury bond market’s status as a global safe harbor.China boosted its Treasury debt holdings by $10.7 billion in October to $1.3045 trillion, according to the latest monthly capital flows data released by the Treasury Department on Monday. Foreign investors overall added $24.4 billion in Treasury debt holdings in October. China primarily bought T-bills due in one year or less, known as T-bills with $8.4 billion added in October.China’s overall holdings of Treasurys at the end of October marks the second highest level following a record high of $1.3149 trillion set in July 2011, according to Ian Lyngen, senior government bond strategist at CRT Capital Group LLC. China is the largest foreign owner of Treasury debt.

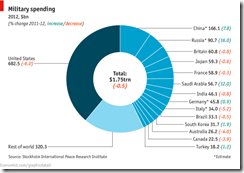

The US government has earmarked $633 billion for her defense budget in 2014. This can be as interpreted as the Chinese government partially financing the US military.

Here is the 2012 global budget on military spending

Question is why does the Chinese government continue to finance America’s budget (or military spending) if both countries have been really at odds with each other?

Of course, the report is as of October, which is prior to the PBoC’s announcement last November that their accumulation of USTs may be put on hold.

Could the PBoC’s threat to decrease funding of the US debt be reason behind the recent political brinkmanship by the US on China’s declared Air Zone?

Chinese buying of USTs has also helped in keeping the bond vigilantes at bay last October. Yields of 10 year UST notes fell in October.

So the American government significantly depends on the foreign buying, particularly from China and Japan, to keep her debt musical chairs ongoing, yet media and politicians try to camouflage on these.

This becomes even more accentuated as US banks have been reported to have been reducing their holdings of USTs.

And in the absence of US banks and foreign buying, USTs will become almost entirely a US Federal Reserve dynamic. The FED now owns 33% of the outstanding 10 year USTs, according to the Zero Hedge. Fed holdings of USTs will significantly affect the capital standards required for the banking and financial system

So it has been a Dr.Jekyll and Mr. Hyde when it comes to the bilateral relationship between China and the US, as geopolitics and financing appear to be worlds apart.

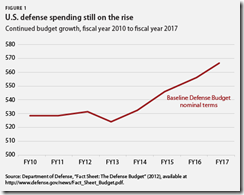

As I have been saying, the theatrics in arguing and posturing over uninhabited islands seem to be meant at justifying more military spending (through inflationism) by the incitation of nationalism.

And nationalism based rationalization of defense spending it has been. The Japanese government recently approved an increase to her military spending budget…

Japan will boost its military spending in coming years, buying early-warning planes, beach-assault vehicles and troop-carrying aircraft, while seeking closer ties with Asian partners to counter a more militarily assertive China.The planned 2.6 percent increase over five years, announced on Tuesday, reverses a decade of decline and marks the clearest sign since Prime Minister Shinzo Abe took office a year ago that he wants a bigger military role for Japan as tension flares with China over islands they both claim…The policies, including a five-year military buildup and a 10-year defense guideline, call for stronger air and maritime surveillance capabilities and improved ability to defend far-flung islands through such steps as setting up a marine unit, buying unarmed surveillance drones and putting a unit of E-2C early-warning aircraft on Okinawa island in the south.Japan will budget 23.97 trillion yen ($232.4 billion) over the coming five years for defense, up from 23.37 trillion yen from the previous five years.

Who will benefit? No other than the US military complex…

U.S. contractors would be major beneficiaries of Abe's increased spending. These include V22 Osprey maker Boeing Co, lead F-35 fighter-jet contractor Lockheed Martin Corp, missile-fabricator Raytheon Corp, and Northrop Grumman Corp, which builds the Global Hawk unarmed drone.Another corporate winner could be Britain's BAE Systems PLC, which through its American subsidiary, U.S. Combat Systems, is a major supplier of "amtrack" assault amphibious vehicles to the U.S. Marines.

You see, wars signify as good business, particularly for the politicians and their private sector allies. All that is needed is public approval. And to do this governments drum up nationalism by creating conflicts.

Of course governments also use wars as diversion from economic malaise.

The risk is that when the pantomine transmogrify into reality.

No comments:

Post a Comment