Contra my expectations of another Fed poker bluff, the US Federal Reserve has made good her ‘exit strategy’ by “tapering” on her buying of financial assets from $85 billion a month to $75 billion in January of 2014

Yet this represents a token symbolism as the Fed’s balance sheet will continue to expand substantially (chart from Prof David Howden)

One should realize that the bond vigilantes have began to make their presence felt even way before the taper talk. Yields of US 10 year notes have been rising since July 2012. Bernanke’s QE 3.0 has even failed to stem this rise.

The taper talk only accelerated this trend.

Yet part of the reason why the Fed could have tapered is that as noted in the June 2013, “markets are forcing them to realign their actions lest lose credibility. Thus any of such act, if there should be one, will be marginal or will signify as token symbolism.”

Another way to look at this is that Ben Bernanke could be doing a Pontius Pilate of washing his hands from a prospective bubble bust.

As I wrote at the start of this year, “Authorities of the FED will most likely evade the responsibility from the financial market bloodbath or meltdown that may ensue once interest rate substantially rises. And like Pontius Pilate, they will likely be washing their hands and leave tightening to the marketplace.

And as I previously noted, ASEAN markets have substantially been weakening as partly revealed by the developments in the currency markets.

Malaysia's ringgit, which has been the least affected so far, has also began to lose ground against the US dollar even prior to the taper.

Indonesia’s rupiah has been free falling against the USD.

The USD-Thai baht appear to be testing new highs.

The Philippine Peso continues to fall vis-à-vis the US Dollar as the stock market has entered the bear market zone for the third time since June.

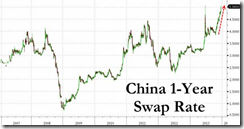

Media wants to blame taper for the region’s woes. But it has been more than just taper. There seems to be renewed tremors on China’s intractable and unsustainable debt markets.

(chart from zero hedge)

This fresh report from Marketwatch

Interest rates in China's money markets jumped Friday to levels last seen during a crippling cash crunch this summer, as banks continue to struggle to raise funds in the interbank market.The borrowing costs initially fell early Friday after the central bank said Thursday that it had "recently" injected cash to try to ease stress, but rates later rose higher. Traders said it remains difficult to borrow in the interbank market despite yesterday's central bank pledge to offer liquidity.

I have noted in the past that any rally from China’s supposed reforms will be suspect because of the clear and present danger posed by her fragile debt status.

From my post last November:

Yet the Chinese political economy and her financial markets will have to face vast immediate or short term challenges first. And the ultimate challenge is how to deal with her overleveraged economy.

China’s stock markets have reversed coursed, and is being drubbed as of this writing where the Shanghai index has slumped by 1.76%. This has not been the first time. The initial episode was in June this year.

The question is will the tremors morph into a debt implosion?

Bottom line: The Fed’s taper has been used as a convenient scapegoat on what has been truly a regional if not domestic dynamic.

Such rationalization is a sign of denial and the self-attribution bias.

And here is another prediction. Once US stock market bubble crumbles, expect the Fed to reverse course from tapering into massive expansion.

1 comment:

You write, “The Fed’s balance sheet will continue to expand substantially (chart from Prof David Howden”

I comment that such an analysis, fails to recognize, that Jesus Christ has pivoted the world out of inflationism and into destructionism, seen in Revelation 6:1-2, all for the purpose of terminating the banker regime and to introduce the beast regime.

The Creature from Jekyll Island was only for a 100 years, and God wants a more voracious monster to dominate mankind, its presented in Revelation 13:1-4, Daniel 2:25-45, and in Daniel 7:7.

The Fed's $3.2 trillion bond spree since 2009, has fueled fiat wealth, that is fiat asset bubbles galore, with these screaming Hot ETFs, FPX, FDN, RZV, RZG, PNQI, PJP, CSD, BJK, SOCL, PSCD, presented in combined ongoing Yahoo Finance chart, and seen in their Finviz Screener providing ample example. Liberalism was the age of investment choice, and greatly rewarded those who perceived it as such and “went all in” with the riskiest of investments.

Of note, the QEs, and thus the US Fed’s Balance Sheet, is based, first on the Distressed Investments, taken in under QE 1, like those traded in Fidelity’s FAGIX Mutual Fund, and then contain the Excess Reserves, containing US Treasury Bonds, TLT, and then the Debt Purchased, more TLT, and then Mortgage Backed Bonds, MBB, purchased under the most recent QE; these so called assets, consist of debt purchased, and are set to collapse, as is communicated by the ongoing combined Yahoo Finance Chart of FAGIX, and TLT, and MBB. The Fed’s balance sheet is comprised mostly of debt!!!

Soon it is going to implode!

You write “And as I previously noted, ASEAN markets have substantially been weakening as partly revealed by the developments in the currency markets”

I comment that this is seen in the ongoing Yahoo Finance Chart of THD, EPHE, IDX, and EWM. Debt deflation is occuring at the periphery.

Creditism, corporatism, and globalism are giving way to regionalism, Now with the means of economic destructionism, that is the Benchmark Interest Rate, ^TNX, rising from 2.88%, the dynamo of regionalism, will empower the beast regime, presented in Revelation 13;1-4, with its policies of regional governance diktat and schemes of totalitarian collectivism, to fully enforce debt servitude in the paradigm and age of authoritarianism.

In the age of authoritarianism, diktat money replaces liberalism’s fiat money; and fiat wealth, that is World Stocks, VT, and metrics of investment wealth such as M2 Money will be falling lower in value.

Under authoritarianism, the only form of sovereign wealth and sustainable wealth is diktat and the physical possession of gold bullion and silver bullion. Currently investors are long World Stocks, VT, and short the Gold, GLD, ETF, as is seen in the chart of VT:GLD, which is crushing gold. One should start to dollar cost average an investment in gold, and take possession of it.

And you write, “Expect the Fed to reverse course from tapering into massive expansion”.

I comment that this is historical Austrian Economics thinking. Under authoritarianism the banks, that is all the banks will be integrated into the government and become known as the government banks or govbanks for short; the excess reserves will not be released to spur inflation, nor will the Fed embark on any inflationary program.

Post a Comment