What an astounding risk OFF day.

The 2+% plunge in US stocks last night hit some Asian markets right smack on the chin.

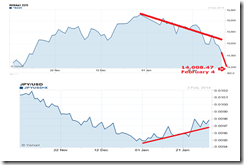

Japan’s Nikkei 225 plummeted a whopping 4.2% today!

The Nikkei 225’s ongoing meltdown (top window) which ironically commenced during the New Year, has been tightly correlated with the sharply rallying Japanese Yen vis-à-vis the US dollar.

And it has not just been the Nikkei, Hong Kong’s Hang Seng Index likewise got drubbed by 2.89%.

Given that China’s financial markets remain closed due to the week long New Year festivities, has the Hang Seng’s decline been an indicator to the sentiment of the Chinese financial markets once they open?

The Philippine Phisix also tumbled by 2.15% on heavy foreign selling (technistock.net)

Singapore’s stock market benchmark’s decline, as measured by the Strait Times Index (STI), hasn’t been as deep as those above…

...but today’s action highlights the confirmation of yesterday’s breakdown from key support levels (see above).

Although the STI is still about 5.9% away from a technical bear market.

And in addition, the weakening STI goes along with a sluggish Singapore Dollar which seems also nearing a breakdown from support levels.

Singapore’s bond markets seem also in distress. Yields of 10 year Singapore SGD denominated treasuries while down by about 12 bps from the recent highs has still been about 100 bps from the 2013 lows.

Could it be that the strains in Singapore’s financial markets have been symptoms of her significant exposure on ASEAN economies, with emphasize on Indonesia, as previously discussed?

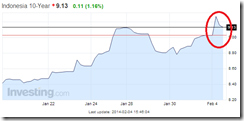

And speaking of Risk off and Indonesia, yields of the latter’s 10 year rupiah bonds soared today; currently priced at 9.13% (as of this writing) which backed off from a high of 9.27%. Nonetheless current yield stands at the 2011 levels.

Although the Indonesia’s equity bellwether the JCI which is still trading as of this writing has been down by less than 1%.

All this brings us back to the issue of foreign currency exchange reserves.

The mainstream assures us with confidence that forex reserves should shield markets or economies from such events.

Yet none of this panacea appears to be working. That’s because there seems hardly any correlation between stock market/economy and forex reserves.

Just look, Japan has $1.25 trillion in forex reserves. The Japanese government continued to amass forex reserves through her own bubble bust in 1990, the 1997 Asian crisis and the 2007-8 Global Crisis.

As a side note: Japan’s reserve accumulation may have peaked given the recent record streak of balance of trade deficits as well as record budget deficits.

Meanwhile, despite the current financial tremors, Singapore’s government continues to pileup on Forex reserves which is now at almost $350 billion (about 3x the Philippines).

Yet with all these accumulation, Singapore has not been immune from the Asian Crisis, US dot.com bust or from 2008 Global Crisis in terms of…

the stock market via the STI… where the STI fell dramatically into bear markets during the above stated episodes

...and or even as exhibited in the statistical economy which reveals of recessions during the above events.

Meanwhile Hong Kong has $311 billion of forex reserves.

And by the way, Indonesia’s government had record forex exchange reserves during the 2008 global crisis and continued to accumulate until the peak in 2011

In spite of all the evidences, the Panglossian consensus continue to holler in unison “forex reserves!”, “forex reserves!”, “forex reserves!”

Has this rabid denial been because "a pleasant illusion is better than a harsh reality?" (quote from Christian Nevell Bovee)

No comments:

Post a Comment