As I told you this isn’t your granddaddy’s stock market as the foundations of today's financial markets have been erected from credit steroids.

Proof? Japan’s Nikkei 225 catapulted by 3.3% today!

Why? Because the government, particularly the Bank of Japan, promised more free lunch money in the prospects of a faltering economy from the fading effects of Abenomics.

From the BBC.

Japan's central bank, Bank of Japan, has expanded two key lending programmes to try to boost economic growth.It has doubled the size of one facility to 7 trillion yen ($68bn; £41bn) and said banks can now borrow twice as much money at low rates as previously under the second programme.The central bank also extended the expiry of both schemes by one year.The move comes just a day after Japan reported disappointing growth numbers for the October-to-December quarter.Its gross domestic product rose by 1% on an annualised basis during the period, much lower than analyst forecasts of an expansion of close to 2.8%.The weaker than expected data had raised questions on whether Japan's recovery - triggered by a series of aggressive stimulus and policy moves over the past year - can be sustained.

Japan's government now seems deeply worried that the declining "high" impact from BoJ's earlier flooding of monetary steroids, will be aggravated by the coming consumption tax hike this April which is from 5% to 8%. So they throw in more of the monetary punch bowl.

Ironically the expected onrush to spend prior to a hike in consumption tax has hardly generated a "front loading effect" as Japanese consumers remain reluctant. This plus the unimpressive GDP announced a few hours back may have prompted for the BoJ action.

This shows how fragile Japan's financial conditions are, such that Japan too can serve as an aggravating factor to a global black swan event.

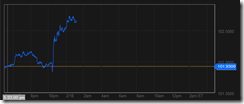

Look at how the USD-Yen responded to the announcement, USD-yen soared.

The rising Nikkei 225 (green line) has so far been tightly correlated with a falling yen (blue line) and vice versa.

So betting on the Nikkei can be seen as a proxy to betting against the yen or vice versa. Said differently, currency traders have now donned the jacket of stock market speculators and vice versa.

And you thought that stock markets has been about corporate fundamentals and the economy eh?

More on this possibly during the weekend.

No comments:

Post a Comment