The economic and financial conditions in China remains highly fragile and increasingly tense as more and more accounts of debt problems surface.

From Reuters:

Hundreds of people rushed to withdraw money from a branch of a small Chinese bank on Monday after rumors spread about its solvency, local media reported, reflecting growing anxiety among investors as regulators signal greater tolerance for credit defaults.The incident occurred at a branch of Jiangsu Sheyang Rural Commercial Bank in Yancheng in Jiangsu province, about 300 km (185 miles) north of Shanghai, the semi-official China News Service reported late on Monday.Bank chairman Zang Zhengzhi was quoted saying the bank would ensure payment to all the depositors. The report did not say how the rumor originated.Jiangsu Sheyang Rural Commercial Bank is subject to formal reserve requirements, loan-to-deposit ratios and other rules to ensure they keep sufficient cash on hand.Depositor sentiment in Yancheng was rattled in January, when some local rural cooperatives -- which are not subject to the supervision of the bank regulator -- ran out of cash and locked their doors.

UPDATED to ADD: A Reuters report notes that 15.8% of the US$1 trillion owed, via domestic bonds, by Chinese companies will be due this year. In addition, of the 2,600 companies recently surveyed credit metrics has been worsening "across a range of industries" with the software carrying the largest debt load with an average of 3.4 times more debt than equity.

And compounding the backdrop of China’s jittery financial conditions has been growing signs of an economic slowdown.

And compounding the backdrop of China’s jittery financial conditions has been growing signs of an economic slowdown.

From Wall Street Journal:

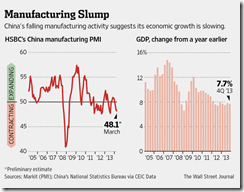

The latest sign of a sharp slowdown came from a measure of manufacturing activity. The preliminary HSBC Purchasing Managers' Index remained in contraction territory for the third straight month in March, HSBC said Monday. At 48.1, the PMI was the lowest in eight months. A reading above 50 shows expansion, while a reading below denotes contraction. Subindexes for output and new orders were down, while employment improved but was still in contraction territory.The preliminary PMI figure is based on 85% to 90% of total responses to HSBC's survey.

So we have a developing feedback mechanism between debt and the economy: debt problems have increasingly been affecting the economy, while at the same time, the intensifying economic slowdown amplifies on the debt problems

But don’t worry, be happy. China's stock markets sees that the Chinese government, will ride like a knight, to save the damsel in the distress.

From the same WSJ article:

China's leaders are beginning to ramp up spending to stem a deepening decline in economic growth as indicators of distress mount.In recent weeks, the government has quietly taken piecemeal measures to arrest the slowdown—from lining up new infrastructure spending to easing access to money.

Of course the question is how will all these be spending be funded? The likely answer is debt. So in essence, solve a debt problem with more debt.

The Shanghai index closed almost unchanged today following a 2-day ramp. Nonetheless yields of 10 year Chinese sovereign remains elevated at 4.52% as of this writing while the USD-yuan rose modestly +.11% today after yesterday’s broad rally on Asian currencies.

No comments:

Post a Comment