The popularly held mercantilist view is that weak currency equals strong exports.

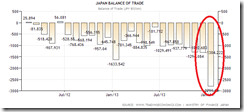

Well the above chart is just an awesome unmasking of the mercantilist myth.

Abenomics via the massive debasement of the yen has led, not to an increase in exports, but instead to a sharp decline. January exports retraced by about 15% (m-o-m). Japan’s exports have now reached pre-Abenomics level. Nonetheless Japan’s exports is still up about a measly 9.5% (y-o-y). After all the yen’s debasement, this has been what remains of export growth?

The steep drop in Japan’s exports seem to mirror China’s exports collapse in February.

I’ve read some excuses by the mainstream bubble worshiping zealots alleging that China’s export drop has been cyclical and due to a supposed “overinvoicing”. But even if there have been some truth to this, none of this explains the degree or scale of the drop. Why 18% and not 5 or below 10%? Why the huge drop?

And of course if we look at Japan’s top trading partners, it looks like neighboring China has been instrumental in providing substantial external trade.

Unfortunately, both countries have been playing with geopolitical fire, being engaged in a territorial squabble over some small islands called Senkaku.

And the sharp contraction in Japan’s export growth can likewise be seen in Japan’s exports to China.

I am in doubt if such has been about geopolitics.

That’s because Japan’s export to Australia has also been shrinking.

And guess the common denominator between Japan and Australia?

Well the answer is China. China represents Australia’s largest trading partner, where Japan comes only second and the US third.

What does all the above suggest? They imply two things; one China appears to be meaningfully slowing down and second there has also been a significant downshift in the global economy

Going back to Japan. The substantial export decline has only exploded…

…Japan’s trade deficits

as well as her current account deficits

This means that Japan will need foreigners to plug on these or that she will have to draw down from her dwindling domestic savings (18.6% 2012 from 24.6% 2007) or expatriate her externally located capital (NIIP) or…

…even borrow more to compound on her debt yoke. The above table from global finance reveals that Japan’s private and government debt load as of 2011 is at 512% (!!!) of GDP.

And don’t forget the above deficits will add to the ballooning government deficits.

The above conditions looks like the present emerging market dilemma (weak currency, weak current and trade accounts). Nonetheless given Japan’s policy direction, they seem to be headed that way via a Black Swan event.

But don’t worry be happy. Japan’s stock markets will likely ignore this because bad news has really been good news. All these for Japan’s Wall Street means more easing from the BoJ in order to expand “Abenomics”.

No comments:

Post a Comment