Eat your heart out Carmen Reinhart and Ken Rogoff. Who says this time can’t be different?

In 1999, writing at the Fortune magazine the former value investor (now a political entrepreneur) Warren Buffett’s revealed his two most important variables for determining investment returns. The first is interest rates where I quoted him in January[1], the second is after tax profit.

Again the Warren Buffett of 1999[2] warning of the dotcom bubble

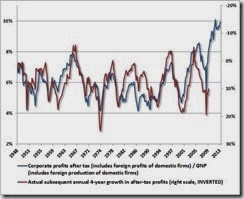

The second thing bearing on stock prices during this 17 years was after-tax corporate profits, which this chart [above] displays as a percentage of GDP. In effect, what this chart tells you is what portion of the GDP ended up every year with the shareholders of American business…When you begin to expect the growth of a component factor to forever outpace that of the aggregate, you get into certain mathematical problems. In my opinion, you have to be wildly optimistic to believe that corporate profits as a percent of GDP can, for any sustained period, hold much above 6%. One thing keeping the percentage down will be competition, which is alive and well…The inescapable fact is that the value of an asset, whatever its character, cannot over the long term grow faster than its earnings do.

Corporate profits after taxes are at a “this time is different” levels. Some have argued that Mr. Buffett has been wrong considering that revenues from today has been internationalized which justifies high valuations.

But fund manager Dr. John Hussman writes to dispute this and concludes[3]

Corporate after-tax profits as a share of GDP, GNP (or even net national product if one wishes to use that number) are steeply above historical norms, and the pre-tax profit share is also at record levels.

Mr. Buffett must also be scratching his head.

More of ‘this time is different’.

Skyrocketing Russell 2000 has a PE ratio of 81.61!!! Nasdaq composite is now just a breath away from the 2000 highs. Nasdaq’s PE has been at a pricey 21.04.

What has financed such elevated prices, aside from record bond financed buybacks? Well the answer is “this time is different” in the context of margin debt and net credit balance that has been on a record streak too.

Notes Doug Short[4],

There are too few peak/trough episodes in this overlay series to take the latest credit-balance trough as a definitive warning for U.S. equities.

And who has been buying record stocks with increasing leverage? It seems that US households have been in a ‘this time is different’ pile up mode. Household buying as represented by equity mutual funds and equity ETFs have been blazing hot[5]. The scale of buying has reached 2007 highs (right window), as institutional investors register net selling. Meanwhile foreign flows which posted net selling have been largely flippant.

And here is another ‘this time is different’ picture. Total equity market cap as % of GDP exhibits a breakaway run beyond the average market cap and beyond the one (if not two) standard deviation of the mean.

Of course the ‘this time is different’ series won’t be complete without record levels in household wealth based on record stocks.

Writes the Zero Hedge[6], (bold mine, italics original)

On the surface, the increase in household net worth to a record $80.7 trillion is good news. The problem is that with $2.5 trillion of the $3 trillion purely thanks to an increase in financial assets, which as has been made quite clear over the past several years, benefit only the 1%, what the lede should say is "another quarter down, another $3 trillion added to the net worth of America's richest." Put another way: of the $94.4 trillion in total assets (gross, not excluding $13.8 trillion in household liabilities), a record 71% or $66.9 trillion, is in financial products. And now you know why the Fed can not possibly allow any hiccups on the road to trickle down Fed balance sheet nirvana. If only for the 1%.

Very much like the Philippines, serial bubble blowing has been required to keep statistical mirage alive. Of course Wall Streets of the world loves this, while the mainstream agonizes with slow growth and reduced purchasing power.

But for as long the returns from the chronic speculative excesses funded by roaring expansion of credit expansion surpasses the burden of servicing debt then such game of musical chairs or might I say that the blowoff top may continue…until the Wile E. Coyote moment arrives.

Dr. John Hussman has a very pertinent view of calling for bubble tops[7].

The problem with bubbles is that they force one to decide whether to look like an idiot before the peak, or an idiot after the peak. There’s no calling the top, and most of the signals that have been most historically useful for that purpose have been blazing red since late-2011.

[1] See Will an ASEAN Black Swan Event Occur in 2014? January 13, 2014

[2] Warren Buffett Mr. Buffett on the Stock Market The most celebrated of investors says stocks can't possibly meet the public's expectations. November 22, 1999 Fortune/CNNMoney.com

[3] John P. Hussman Do Foreign Profits Explain Elevated Profit Margins? No. March 3, 2014

[4] Doug Short, NYSE Margin Debt Hits Another All-Time High March 3, 2014 Advisers Perspective

[5] Yardeni.com US Flow of Funds: Equities March 6, 2014

[6] Zero Hedge Record 71% Of Household Net Worth Is In Financial Assets March 6, 2014

[7] Dr. John Hussman A Textbook Pre-Crash Bubble November 11, 2013 Hussman Funds

No comments:

Post a Comment