I have earlier pointed out that there has been increasing signs of deterioration in the market internals of global stock markets.

It's not just in market internals but potential headwinds against global stocks can be seen in bond markets, US dollar and commodity markets.

As for US stocks, the Gavekal Team writes (bold mine)

There are four developments in the fixed income markets that represent a clear and present danger for stocks.First, high yield spreads continue to widen, diverging from the upward movement in stocks prices. In the chart below we plot high yield spreads against the S&P 500 over the last ten years. Until today the equity market seemed unfazed by the widening in spreads.

My comment: if the ascent of stocks has been driven by debt, then widening the spreads means lesser debt fuel to sustain prospective advances.

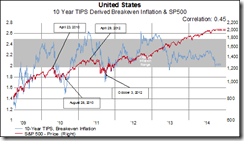

Second, inflation expectations derived by comparing 10-tear nominal US Treasuries against the 10-year TIPS show a recent big drop. This is likely due to the recent strength in the USD, but regardless of the reason, the drop in inflation expectations is undoing much of the reflationary work the Fed has tried to achieve. Should inflation expectations fall below 2%, the danger signal would intensify.

My comment: falling inflation expectations could be seen in the lens of a weakening economy and a hissing bubble.

Third, 10-year bonds around the global are taking another leg down.

My comment: During Risk OFF (asset deflation), government debt which have been perceived as "risk free" appeals as a safehaven bet.

Fourth, the spread between 30-year and 10-year US Treausry bonds is narrowing to new five year lows. The last time the long end of the yield curve was this flat was in the first few months of 2009.

My comment: a flattening of the yield curve means bond investors are lesser concerned with inflation, this also implies (again) increased perception of weakening growth. So this is consistent with falling inflation expectations and a potential downdraft in high yield credit markets. At the end of the day, market breadth, commodity and bond market actions have been indicating a prospective Risk OFF.

When the US sneezes, the world catches cold. So if US stocks will be pressured global stocks will most likely follow.

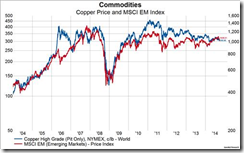

The Gavekal team also adds that plummeting copper prices are portentous for Emerging Market Stocks. (bold mine)

it appears copper prices are about to take another significant leg down. The price of copper has now decisively broken through the rising support line in what appears to be a continuation of the longer-term downtrend that started back in 2011. The metal price has yet to take out the low of 2.95 achieved in March, but based on recent history that day is not far off.Assuming copper prices do make a new low then, what would that mean for EM stocks? Based on the last two charts below depicting copper prices on the left axis and the MSCI EM price index on the right axis, we should expect another leg down in copper to coincide with more weakness in EM stocks. The third chart offers a shorter-term view of the relationship and from this perspective it appears that EM stocks have gotten ahead of themselves.

It's not just copper, diminishing global oil demand seems to fit into the picture…(from Yardeni.com)

This is the periphery to the core dynamics in motion. The periphery to core simply implies marginal changes at the fringe working its way to the center. Applied to bubbles, which is a market process induced by social policies, this means deflating bubbles will commence at the margins (here Emerging economies) and work their way or spread to the core (advanced economies or developed markets or DM).

The IMF recently delved with and warned of the risks of deepening Emerging Market slowdown. And EM, which has been expected to affect DM, will have a feedback loop to aggravate real economic conditions in the EM sphere. That’s unless internal growth in DM offsets the loss from the EM transmission.

June 2013’s Taper Tantrum which brought about sharp market volatilities exposed on Emerging Market fragilities. This is because EM markets have been supported by ample liquidity (carry trades) from the Fed’s easing programs. Since the EM bubbles seem to have been pricked last June, the slomo decay in the real economy has been taking place despite surging stocks.

Now with the Fed impliedly tightening via the closure of QE 3.0, the window for carry trades have been diminishing, and this has been what the BIS, IMF, and the OECD as well as the BSP has been warning about; the potentials for capital flight.

The Fed’s tightening combined with signs of weakening of real economic fundamentals have been converging to reflect on risk conditions.

So such EM to DM contagion process have now become evident in commodity prices, the US dollar and in the bond markets. But not with stocks yet.

With the EM-DM transition progressing and apparently escalating, a drastic change in risk conditions will eventually reflect on the global stock markets and the global economy.

2015 will be very interesting.

No comments:

Post a Comment